9706 past papers PDF

| Title | 9706 past papers |

|---|---|

| Course | A-Level Accounting |

| Institution | Monash University Malaysia |

| Pages | 28 |

| File Size | 197 KB |

| File Type | |

| Total Downloads | 39 |

| Total Views | 179 |

Summary

9706_m20_qp_32.pdf...

Description

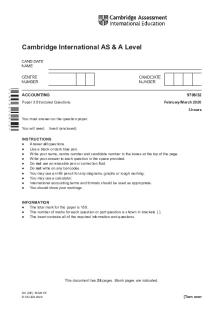

Cambridge International AS & A Level

* 1 9 2 3 4 1 4 8 1 2 *

ACCOUNTING

9706/32

Paper 3 Structured Questions

February/March 2020 3 hours

You must answer on the question paper. You will need:

Insert (enclosed)

INSTRUCTIONS ● Answer all questions. ● Use a black or dark blue pen. ● Write your name, centre number and candidate number in the boxes at the top of the page. ● Write your answer to each question in the space provided. ● Do not use an erasable pen or correction fluid. ● Do not write on any bar codes. ● You may use an HB pencil for any diagrams, graphs or rough working. ● You may use a calculator. ● International accounting terms and formats should be used as appropriate. ● You should show your workings.

INFORMATION ● The total mark for this paper is 150. ● The number of marks for each question or part question is shown in brackets [ ]. ● The insert contains all of the required information and questions.

This document has 28 pages. Blank pages are indicated.

DC (NF) 181291/5 © UCLES 2020

[Turn over

2 Section A : Financial Accounting Answer all questions. 1

Read Source A1 in the Insert. (a) Prepare the manufacturing account for the year ended 31 December 2019. ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ...................................................................................................................................................

© UCLES 2020

9706/32/F/M/20

3 Workings:

[8]

© UCLES 2020

9706/32/F/M/20

[Turn over

4 (b) Prepare the income statement for the year ended 31 December 2019. ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... Workings:

[7]

© UCLES 2020

9706/32/F/M/20

5 (c) Calculate the amount at which finished goods are included in inventory at 31 December 2019. ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ............................................................................................................................................. [2] (d) Explain, with the support of accounting concepts, the treatment of unrealised profit on finished goods in both the income statement and statement of financial position. ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ............................................................................................................................................. [5] (e) Advise the directors of T Limited whether or not they should continue basing the transfer price on the price paid to an outside supplier. Justify your answer. ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ............................................................................................................................................. [3] [Total: 25] © UCLES 2020

9706/32/F/M/20

[Turn over

6 2

Read Source A2 in the Insert. (a) Prepare the café trading account for the year ended 31 December 2019, showing clearly the closing café inventory. ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ............................................................................................................................................. [5] Additional information The club had prepared an income and expenditure account for the year ended 31 December 2019. The following items were shown in the income and expenditure account.

Subscriptions Administrative expenses Depreciation: furniture and fixtures

© UCLES 2020

$ 322 000 251 100 16 640

9706/32/F/M/20

7 (b) Prepare the receipts and payments account for the year ended 31 December 2019. ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... Workings:

[8] © UCLES 2020

9706/32/F/M/20

[Turn over

8 (c) State two differences between an income and expenditure account and a receipts and payments account. 1 ................................................................................................................................................ ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... 2 ................................................................................................................................................ ................................................................................................................................................... ................................................................................................................................................... ................................................................................................................................................... [2] Additional information The treasurer is aware that in early 2020, the club will receive two sums of donations from two wealthy members. One donor intends his donation to be used for maintaining the general running of the club in future years. The other donor intends his donation to be used for building a swimming pool in a few years’ time. (d) Explain the appropriate accounting treatment for the donation for: (i)

maintaining the general running of the club in future years ........................................................................................................................................... ........................................................................................................................................... ........................................................................................................................................... ........................................................................................................................................... ........................................................................................................................................... ........................................................................................................................................... ........................................................................................................................................... ..................................................................................................................................... [4]

© UCLES 2020

9706/32/F/M/20

9 (ii)

building a swimming pool in a few years’ time. ........................................................................................................................................... ........................................................................................................................................... ........................................................................................................................................... ........................................................................................................................................... ........................................................................................................................................... ..................................................................................................................................... [3]

Additional information In view of the large cash balance in the club, the committee is thinking of making a distribution to the existing members, just like paying a dividend to shareholders in a limited company. (e) Advise the committee whether or not the proposed distribution should be made. Just...

Similar Free PDFs

9706 past papers

- 28 Pages

Past exams papers 2

- 10 Pages

Past Papers Human Rights

- 14 Pages

AC100 - Past exam papers

- 15 Pages

Management Accounting Past Papers

- 38 Pages

CRIMINAL LAW PAST PAPERS

- 4 Pages

Topical past papers

- 27 Pages

Accounting 100 past papers

- 2 Pages

acca sbr past papers practice

- 49 Pages

Law-of-evidence - Past papers

- 5 Pages

Unit 1 chemistry past papers

- 12 Pages

Past Papers for Social Studies

- 25 Pages

CSS past papers for islamiat

- 25 Pages

N5 Biology all 2018 - past papers

- 48 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu