Ac F 311 Deferred tax practice question solution PDF

| Title | Ac F 311 Deferred tax practice question solution |

|---|---|

| Course | Financial Accounting |

| Institution | Lancaster University |

| Pages | 5 |

| File Size | 113 KB |

| File Type | |

| Total Downloads | 43 |

| Total Views | 140 |

Summary

Ac F 311 Deferred tax practice question solution...

Description

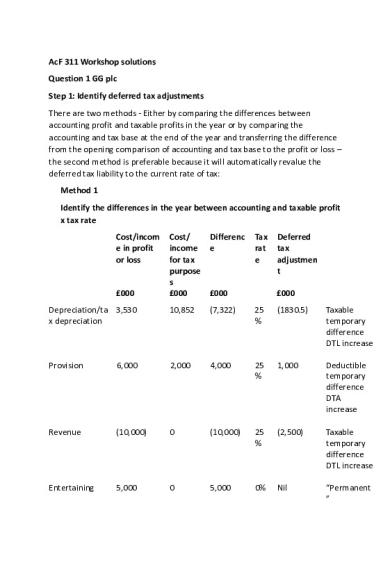

AcF 311 Workshop solutions Question 1 GG plc Step 1: Identify deferred tax adjustments There are two methods - Either by comparing the differences between accounting profit and taxable profits in the year or by comparing the accounting and tax base at the end of the year and transferring the difference from the opening comparison of accounting and tax base to the profit or loss – the second method is preferable because it will automatically revalue the deferred tax liability to the current rate of tax: Method 1 Identify the differences in the year between accounting and taxable profit x tax rate Differenc e

Tax rat e

Deferred tax adjustmen t

Cost/ income for tax purpose s £000

£000

Depreciation/ta 3,530 x depreciation

10,852

(7,322)

25 %

(1830.5)

Taxable temporary difference DTL increase

Provision

6,000

2,000

4,000

25 %

1,000

Deductible temporary difference DTA increase

Revenue

(10,000)

0

(10,000)

25 %

(2,500)

Taxable temporary difference DTL increase

Entertaining

5,000

0

5,000

0%

Nil

“Permanent ”

Cost/incom e in profit or loss

£000

£000

£000 Opening balance at 1 April 20X8

(1,741.0)

Increase during the year: £1830.5m + £2,500m

(4,330.5)

Decrease (or increase in deferred tax asset) - provision

1,000

Closing balance at 31 March 2019

(5,071.5)

Journal Dr Current tax charge 4330.5 – 1000 Cr Deferred tax liability

£000 3,330.5 3,330.5

Being increase in deferred tax liability for the year 31.3.20X9

OR Method 2 Identify the changes in the accounting and tax base at the year end PPE is an asset The tax base of an asset is the amount that will be deductible for tax purposes against any taxable economic benefit that will flow to an entity when it recovers the carrying amount

Accounting base

£000 21,777

Carrying amount (CA) of PPE at 1.4.20X8 Add: additions in the year

27,200

Less: depreciation charged in the year

(3,530)

Carrying amount (CA) of PPE at 31.3.20X9

45,447

Tax base

£000 14,813

At 1.4.20X8 Add: additions in the year

27,200

Less: tax depreciation in the year

(10,852)

At 31.3.20X9

31,161

Accounting Tax base Difference base PPE = an asset £m £m £m Carrying 21,777 14,813 6,964 x 25% amount at 1.4.20X8 Movement to PorL

X 25% DTA or DTL £m (1,741.0)

Carrying amount at 31.3.20X9

(3,571.5) DTL

45,447

31,161

14,286 x 25%

(1,830.5)

This is a deferred tax liability because the tax base is lower than the accounting base – which means that the company has claimed tax relief quicker than it has charged depreciation – in the future therefore the tax liability will be bigger and hence the need to smooth out the impact of the tax rules with an adjustment each year until the timing difference reverses. Provision = a liability

The tax base of a liability is its carrying amount, less any amount that will be deductible for tax purposes with respect to that liability in future periods The tax base of the provision = £6,000 less £4,000 which will be deductible in the future = £2000 The provision was established in the year so there is no brought forward balance

Carrying amount at 1.4.20X8

Carrying amount at 31.3.20X9

Accounting Tax base base 0 0

6000

Difference 0

X 25% DTA or DTL 0

Movement to PorL

1,000

2,000

1,000 DTA

4,000 x 25%

This is a deferred tax asset because the tax liability will be lower in the future

Rental income = a receivable (asset)

Carrying amount at 1 April 20X8

Carrying amount at 31 March 20X9

Accounting Tax base base 0 0

10,000

Difference 0

X 25% DTA or DTL 0

Movement to PorL

(2,500)

0

(2,500) DTL

10,000

The tax base is zero because the definition of the tax base of an asset = the amount that will be deductible in the future – and none of this will be deductible in the future i.e.it will increase not reduce the tax liability -

Entertaining

Accounting Tax base base 0 0

Difference 0

X 25% DTA or DTL 0

No impact on the tax liability in the future - the timing difference is assumed to be there when the cost was recognised and is covered by the initial recognition exemption

Deferred tax liability

£’000

Opening balance at 1 April 20X8

(1,741.0)

Movement to Profit or loss

(3,330.5)

Closing balance at 31 March 20X9 3,571.5 + 2500 – 1000

(5,071.5)

Journal Dr Current tax charge Cr Deferred tax liability

£000 3,330.5 3,330.5

Being increase in deferred tax liability for the year 31.3.20X9...

Similar Free PDFs

Deferred Tax Worksheet

- 2 Pages

Deferred TAX Extra Questions

- 8 Pages

Deferred tax Investment Property

- 9 Pages

How to Calculate Deferred Tax

- 3 Pages

Mini Case 3 Deferred Tax A211

- 4 Pages

AC 311 Exam 1 Study Guide

- 7 Pages

Ac test 1 question paper

- 21 Pages

Question paper for Income Tax

- 3 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu