AOS 2 Accounting Revision Notes PDF

| Title | AOS 2 Accounting Revision Notes |

|---|---|

| Course | Accounting |

| Institution | Victorian Certificate of Education |

| Pages | 7 |

| File Size | 90.7 KB |

| File Type | |

| Total Downloads | 66 |

| Total Views | 192 |

Summary

Accounting Unit 4 AOS 2 Revision Notes

2021 Accounting 3/4...

Description

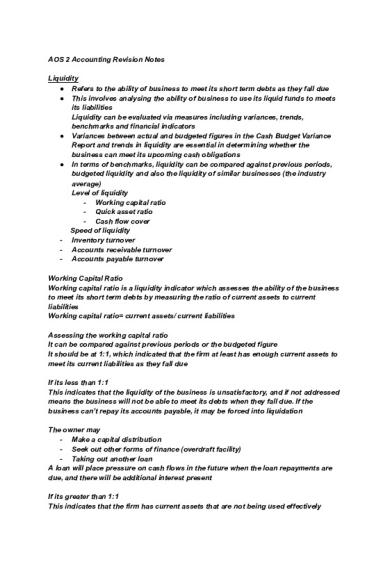

AOS 2 Accounting Revision Notes Liquidity ● Refers to the ability of business to meet its short term debts as they fall due ● This involves analysing the ability of business to use its liquid funds to meets its liabilities Liquidity can be evaluated via measures including variances, trends, benchmarks and financial indicators ● Variances between actual and budgeted figures in the Cash Budget Variance Report and trends in liquidity are essential in determining whether the business can meet its upcoming cash obligations ● In terms of benchmarks, liquidity can be compared against previous periods, budgeted liquidity and also the liquidity of similar businesses (the industry average) Level of liquidity - Working capital ratio - Quick asset ratio - Cash flow cover Speed of liquidity - Inventory turnover - Accounts receivable turnover - Accounts payable turnover Working Capital Ratio Working capital ratio is a liquidity indicator which assesses the ability of the business to meet its short term debts by measuring the ratio of current assets to current liabilities Working capital ratio= current assets/ current liabilities Assessing the working capital ratio It can be compared against previous periods or the budgeted figure It should be at 1:1, which indicated that the firm at least has enough current assets to meet its current liabilities as they fall due If its less than 1:1 This indicates that the liquidity of the business is unsatisfactory, and if not addressed means the business will not be able to meet its debts when they fall due. If the business can’t repay its accounts payable, it may be forced into liquidation The owner may - Make a capital distribution - Seek out other forms of finance (overdraft facility) - Taking out another loan A loan will place pressure on cash flows in the future when the loan repayments are due, and there will be additional interest present If its greater than 1:1 This indicates that the firm has current assets that are not being used effectively

●

Cash: there is not much advantage to keeping lots of cash on hand (as it will not earn much interest). The business may be better off using excess cash to pay off debts , expand operation or make other investments ● Inventory: having excess inventory takes up space in the business. Additionally, inventory is susceptible to damage, losses and obsolescence which could result in inventory-write downs ● Accounts receivable: if the business has too much accounts receivable, this may indicate that debts are becoming older, increasing the likelihood that they will need to be written off as a bad debt In response to this the owner can - Use excess cash - Order inventory just in timer(wait before ordering) - Use strategies to reduce accounts receivable Bank overdraft Its unlikely that overdrafts will be called in for repayment unless they are over the limit Overdraft is another source of funds the business may use to repay debts, which should be taken into account when assessing liquidity through the WCR Quick Asset Ratio( QAR) The WRC assumes that all the current assets of the business can be liquidated (converted to cash) straight away if required However this is not the case for two current assets ● Inventory: receiving cash from inventory depends on sales, which the business is not directly in control of. Its not guaranteed that the business can suddenly sell all its inventory ● Prepaid expenses: after purchasing a prepaid expense, it’s unlikely the business will be able to receive a refund The quick asset ratio is a liquidity indicator that assesses the firm’s ability to meet immediate short- term debts by measuring the ratio of quick assets to quick liabilities Quick asset ratio= current assets-(inventory +prepaid expenses)/ current liabilities Assessing the quick asset ratio The QAR should be at least 1:1, as this indicated the firm will be able to meet its immediate debts as they fall due If not, this will indicate that a lot of the current assets of the business are inventory and prepaid expenses , presenting issues for liquidity The business should take measures to increase the QAR through increasing quick assets like account and Bank, or reducing quick liabilities such as accrued expenses or accounts payable. Cash Flow Cover Both the WCR and QAR of the business rely on static figures from the balance sheet to try and measure liquidity

The cash flow cover is a liquidity indicator that measures the number of times net cahs flows from operating activities is able to cover the current liabilities of the business This is a relevant indicator as it provides real information regarding the cash flows of the business. In particular, the CFC is useful in budgeting the growth or decline of business Cash flow cover= net cash flows from operating activities/average current liabilities Note: the CFC is not a static indicator, if the business has a low CFC, it will need a lot of contributions from the owner, increase its reliance on external finance or sell non-current assets The speed of liquidity The WCR, QAR and CFC ofthe business only measures the level of liquidity ●

A business can survive with an unsatisfactory level of liquidity if it can sell its inventory (and collect cash from costumers) before that cash is required ● Hence, business can survive with a low WCR Assessingliquidity must consider the ● Inventory turnover ● Accounts receivable turnover ● Accounts payable turnover Inventory Turnover ● Inventory turnover is a financial indicator which measures the average number of days it takes the business to convert inventory to sales ● Inventory turnover = average inventory x 365/ cost of goods sold ● The ITO shouldn’t be too fast or too slow Slow ITO ● If the ITO is slow, it is taking the business too long to generate sales from inventory, and the business will have less cash to meet its debts. This will reduce the speed of liquidity ● The ITO can also affect profitability, as the business will be earning less sales revenues, and the unsold inventory may need to be written down To address a slow ITO, the business may ● Attempt to increase sales (by investing in advertising or adjusting the inventory mix) ● Decrease the amount of inventory held by the business (by ordering just in time or replacing slow-moving lines of inventory) Fast ITO ● If the ITO is too fast,then the selling price may be too low(meaning the business is losing potential revenue) or the business may have too little inventory on hand (resulting in more frequent deliveries and greater delivery expenses) ● To address a fast ITO, the owner should look at the specific inventory card to determine which lines are slow-moving and which lines are fast moving

Key point: when talking about inventory turnover (and other similar indicators),alwasy be clear about what exactly indicates improved speed of liquidity. For example, in the case of ITO,a reduced number of days required to convert inventory into sales indicates improved liquidity. Other strategies ● Bulk buying inventory to reduce delivery costs ● Changing the selling price of inventory ● Decreasing the level of inventory on hand(and ordering just-in-time) ● Rearranging the position of inventory in the business (such as placing fast-moving items at the front, or placing items together) ● Offering discounts to encourage sales Comparing ITO Compared against ● Previous figures ● Industry average for similar business ● Budgeted ITO ● The nature of the item (cheaper items will generally sell faster than more expensive items- a high ITO may not be as concerning for expensive items such as cars) Accounts receivable turnover (ARTO) Fast ARTO ● A fast ARTO is a good as it means the business is receiving cash from debtors very quickly- usually not an issue Slow ARTO ● It is waiting too long to receive cash from debtors ● The business may face difficulty meeting its short-term debts ● Cahs will be tied up in debts,so the chance of a doubtful debt is more likely To improve ARTO, the business could ● Offer discounts to encourage early settlement ● Invoice customers promptly ● Undertake Credit checks before providing credit to costumers ● Give frequent reminders of the amounts owing ● Hire a debt collection agency Comparing ARTO ● Previous figures ● Industry average for similar business ● Budgeted ARTO Unlike ITO,ARTO can also be compared against ● The credit terms of the business (as this indicated when credit customers must repay the business) ● If the ARTO is much higher than the credit terms, then this indicates that on average, most accounts receivable accounts aren’t repaying the business in time Ethical considerations

●

The business should consider what strategies they are using to encourage accounts receivable to repay them early (particularly if they are late of if they are a problem customer) ● For an example, threating a customer of they don’t repay the business is unethical Accounts payable turnover ● Is a financial indicator that measures the average number of days it takes the business to pay its creditors ● Accounts payable turnover (APTO)= average accounts payable x 365/ net credit purchase (plus GST) Slow APTO ● Lose its credit facilities ● Incur costs of deferral (that is,costs for late repayment) ● Miss out on potential discounts ● Heighten the risk of the business facing potential legal action Fast APTO ● The main benefit the business may receive from repaying accounts payable is taking advantage of a discount and staying on good terms with their supplier ● Repaying accounts payable too quickly may mean the business does not have cash to repay other debts or purchase other assets ● In order to repay accounts payable quickly,it may have to use bank overdraft, which may be detrimental to the business as a whole Ethical considerations ● The business should consider whether it is ethical to purchase from a particular supplier or not. In particular,they should consider: who they are buying from, what they are buying (and how it is produced), when they are paying them Relationship between APTO, ITO and ARTO ● The ITO of the business indicates how long it takes the business to sell inventory, after it is purchased ● The ARTO indicates how long after the sale that cash is received ● The APTO indicates how quickly the business can use that cash to repay its credit suppliers ● Ideally, the ITO and ARTO of the business should be as fast as possible and the APTO should be as close as possible to the credit terms (so the business can hold cash onger to be used for other payments) Profitability Analysing: refers to the process of examining financial reports to identify changes or differences in performance Interpreting: refers to examining the relationship between items in the financial reports of the business to explain changes or differences in perfromance There are four key measures used to assess performance ● Profitability: the ability of the business to earn profit,compared against a base such as sales, assets or owner’s equity

● ● ●

Liquidity: the ability of the business to meet its short-term debts as they fall due Efficiency: the ability of the business to manage its assets and liabilities Stability: the ability of the business to meet its debts and continue its operations in the long-term

Assessing profitability ● The profitability of a business is dependent on the firm’s ability to earn revenue and minimise or control expenses Tools for assessing profitability ● Trends: trends in profit over reporting periods can help identify if the business is effectively maximising revenue and minimising expenses ● Variances: variances between actual and budgeted figures in the income statement variance report can help identify areas where performance has been substandard Benchmarks ● Provide a standard against which actual performance can be measured Can be compared against ● Past performance: which allows for the business to prepare a horizontal analysis and identify trends the business can be determined whether profitability has improved or worsened ● Budgeted performance: this allows the business to prepare a variance report to assess if profitability met or did not meet its expectations ● Industry average: comparing to similar firms operating under similar conditions Profitability indicators ● Are measures that express the elements of profit in relation to some other aspect of the performance of the business These are the indicators ● Return on Owner’s Investment (ROI) ● Return on Assets (ROA) ● Asset turnover (ROA) ● Net Profit Margin (NPM) ● Gross Profit Margin (GPM)

Return on Owner’s Investment (ROI) ● Is a profitability indicator that assesses how effectively the business has used the owner’s capital to earn a profit ● Return on owner’s investment (ROI)= net profit/average capital x 100 Debt Ratio ● Stability refers to the ability of the business to meet its debts and continue operations in the long term ● The debt ratio: is a stability indicator that measures the percentage of the firm’s assets that are funded by liabilities, thereby showing the extent the business relies on debts compared to capital to purchase assets ● Debt ratio: total liabilities/ total assets x 100

The debt ratio and risk ● A high debt ratio indicates that the firm relies largely on borrowed funds (such as loans) to purchase assets ● If these borrowed funds are put to profitable use, this means the owner will be earning profit using someone else's money (rather than their own capital),resulting in a high ROI ● however ,a high debt ratio will result in more loan repayments and interest expense payments ( decreasing net profit margins),resulting in greater pressure on cahs flows,which impacts the stability...

Similar Free PDFs

AOS 2 Accounting Revision Notes

- 7 Pages

AOS 2 notes

- 16 Pages

Accounting Notes - Revision

- 30 Pages

UNIT 2 AOS 2 - Psyc summary notes

- 13 Pages

AOS 3 notes

- 10 Pages

Revision - Lecture notes 2-10

- 38 Pages

Business Law 2 Revision Notes

- 32 Pages

Revision Notes

- 58 Pages

Revision Notes

- 20 Pages

Revision Notes

- 32 Pages

America AOS 2 key knowledge

- 13 Pages

Revision Notes

- 16 Pages

Revision Notes

- 35 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu