Audit and Concepts: Audit Final Review Sheets PDF

| Title | Audit and Concepts: Audit Final Review Sheets |

|---|---|

| Course | Internal Audit |

| Institution | St. John's University |

| Pages | 11 |

| File Size | 297.4 KB |

| File Type | |

| Total Downloads | 38 |

| Total Views | 166 |

Summary

Dr. Trainor- Audit and Concepts- Provides extensive review sheet for final exam containing explanations and charts for topics on final. From Ch 16 on with heavy emphasis on assertions and tests used during an audit....

Description

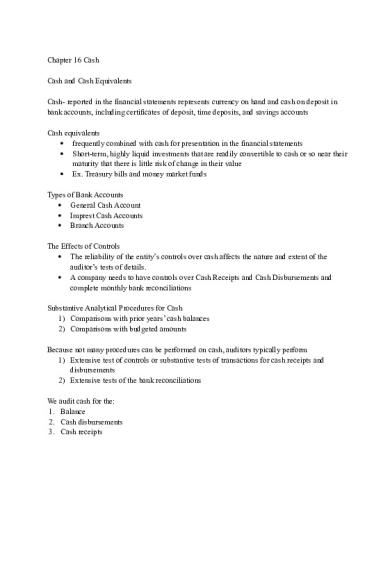

Chapter 16 Cash Cash and Cash Equivalents Cash- reported in the financial statements represents currency on hand and cash on deposit in bank accounts, including certificates of deposit, time deposits, and savings accounts Cash equivalents frequently combined with cash for presentation in the financial statements Short-term, highly liquid investments that are readily convertible to cash or so near their maturity that there is little risk of change in their value Ex. Treasury bills and money market funds Types of Bank Accounts General Cash Account Imprest Cash Accounts Branch Accounts The Effects of Controls The reliability of the entity’s controls over cash affects the nature and extent of the auditor’s tests of details. A company needs to have controls over Cash Receipts and Cash Disbursements and complete monthly bank reconciliations Substantive Analytical Procedures for Cash 1) Comparisons with prior years’ cash balances 2) Comparisons with budgeted amounts Because not many procedures can be performed on cash, auditors typically perform 1) Extensive test of controls or substantive tests of transactions for cash receipts and disbursements 2) Extensive tests of the bank reconciliations We audit cash for the: 1. Balance 2. Cash disbursements 3. Cash receipts

Assertions OccurrenceCash receipts- vouching cash entries from receipts to remittance advices, deposit slips and bank statement Cash disbursements- vouch sample entries from disbursements to canceled checks, voucher packet and bank statement CompletenessReceipts- trace remittance advices to cash receipts journal and if necessary deposit slips Disbursements- trace a sample of cancelled checks to cash disbursements journal AuthorizationReceipts- examine the signature on deposit slips and check endorsements for proper authorizations Disbursements- examine cancelled checks for authorized signature and proper endorsement AccuracyReceipts- sample of daily deposits, foot the remittance advice and entries on the deposit slip and agree to the cash receipts journal and bank statements Disbursement- sample of voucher packets agree amounts in PO, receiving report, invoice, cancelled check, and disbursement journal CutoffReceipts- compare dates of receipts in receipts journal to the dates the cash was deposited in bank Disbursements- compare dates of checks with dates the checks cleared in bank ClassificationReceipts- examine remittance advices for proper account classification Disbursements- examine cancelled checks for proper account classification Balance related assertions

Revenue Cycle- ends in cash receipts Expenditure Cycle- ends in cash disbursements To audit a cash account, the auditor should obtain these items - Copy of Bank Reconciliation- prior month - Standard Bank Confirmation - Cutoff Bank Statement- A cutoff bank statement normally covers the 7- to 10-day period after the date on which the bank account is reconciled. For reconciliation purposes, any item should have cleared the entity’s bank account during the 7- to 10-day period Mailed by bank, a statement with transactions listed from within the first 10-15 business days Used to validate the adjustments (bank fees) and that deposits in transit and outstanding checks have cleared Tests of the Bank Reconciliation The auditor typically uses the following audit procedures to test the bank reconciliation: 1. Verify the mathematical accuracy and agree the balance per the books to the general ledger. 2. Agree the bank balance on the reconciliation with the balance shown on the standard bank confirmation. 3. Trace the deposits in transit on the bank reconciliation to the cutoff bank statement. 4. Compare the outstanding checks on the bank reconciliation with the canceled checks contained in the cutoff bank statement for proper payee, amount, and endorsement. 5. Agree any charges included on the bank statement to the bank reconciliation. 6. Agree the adjusted book balance to the cash account lead schedule. Fraud-Related Audit Procedures Extended Bank Reconciliation Procedures- In some instances, the year-end bank reconciliation can be used to cover cash defalcations—aka hiding deposits in transit - Purpose: to identify fraud that may have been consistent or in trend over the past months Proof of Cash is basically a bank reconciliation amplified - Takes two bank reconciliations, two adjoining month reconciliations, to reconcile the change - Disbursements and receipts are the only two items that can change the balance of cash between two periods - Audit cash disbursements and receipts

Tests for Kiting- Interbank transfer schedule - Kiting- (double counting)- counting money in two different accounts - Kiting and know how to identify it (LOOK IN NOTES) Remittance Advice- part of the invoice, lower portion with perforated paper. - Includes an account number, the cost, where to send the money - Send this advice and check to the bank - Bank takes the money and deposit into account and provide a log to the company - The company takes the log and remittance advice to record the accounts payable Auditing a Payroll or Branch Imprest Account - The audit of any imprest cash account such as payroll or a branch account follows the same basic audit steps discussed under the audit of the general cash account. Auditing Petty Cash- a type of imprest account - Usually not material - Potential for defalcation - Seldom perform substantive tests - Document controls. Disclosure Issues for Cash 1. Accounting policy for defining cash and cash equivalents 2. Any restrictions on cash such as a sinking fund requirement for funds allocated by the entity’s board of directors for special purposes 3. Contractual obligations to maintain compensating balances 4. Cash balances restricted by foreign exchange controls 5. Letters of Credit Inventory Types of Documents and Records 1. Production Schedule – Based on the expected demand for the entity’s products. 2. Receiving Report – Records the receipt of goods from vendors. 3. Materials Requisition – Used to track materials during the production process. 4. Inventory Master File – Contains all the important information related to the entity’s inventory, including the perpetual inventory records. 5. Production Data Information – Contains information about the transfer of goods and related cost accumulation at each stage of production.

6. Cost Accumulation and Variance Report – Material, labor, and overhead costs are charged to inventory as part of the manufacturing process. The variance report compares actual costs to standard or budgeted costs. 7. Inventory Status Report – Shows the type and amount of products on hand. 8. Shipping Order – Used to remove goods from the perpetual inventory records. Functions of the Inventory Management Process Inventory management- Authorization of production activity and maintenance of inventory at appropriate levels; issuance of purchase requisitions to the purchasing department Raw materials stores- Custody of raw materials and issuance of raw materials to manufacturing departments Manufacturing- Production of goods Finished goods stores- Custody of finished goods and issuance of goods to the shipping department Cost accounting- Maintenance of the costs of manufacturing and inventory in cost records General ledger- Proper accumulation, classification, and summarization of inventory and related costs in the general ledger Segregation of Duties: The inventory management function should be segregated from the cost-accounting function. The inventory stores function should be segregated from the cost-accounting function. The cost-accounting function should be segregated from the general ledger function. The responsibility for supervising physical inventory should be separated from the inventory management and inventory stores functions. Possible Errors or Fraud: If the individual responsible for inventory management also has access to the cost-accounting records, production and inventory costs can be manipulated. This may lead to an over- or understatement of inventory and net income. If one individual is responsible for both controlling and accounting for inventory, unauthorized shipments can be made or theft of goods can be covered up.

If one individual is responsible for the inventory records and also for the general ledger, it is possible for that individual to conceal unauthorized shipments. This can result in the theft of goods, leading to an overstatement of inventory. If the individual responsible for production management or inventory stores functions is also responsible for the physical inventory, it is possible that inventory records to the physical inventory, resulting in an overstatement of inventory.

Inherent Risk Assessment - The auditor should consider industry-related factors and operating and engagement characteristics when assessing the possibility of a material misstatement. - If industry competition is intense, there may be problems with the proper valuation of inventory. Technology changes in certain industries may also promote material misstatement due to obsolescence. - Products that are small and of high value are more susceptible to theft. The auditor must be alert to related-party transactions for acquiring raw materials and selling finished products. Prior-year misstatements are good indicators of potential misstatements in the current year. Control Risk Assessment Major steps in setting the control risk in the inventory management process. - Understand and document the inventory management process based on a reliance strategy.

- Plan and perform tests of controls on inventory transactions. - Set and document the control risk for the inventory management process.

Important Assertions related to inventory:

-

-

Existence – observe the counts, observe the inventory observation Management checks the AIS inventory master list, randomly selects inventory items and assigns someone random who understands inventory checks that they are on the floor Quantity is not listed so that it is a blind count The auditor goes along with the inventory counter to observe the count Completeness- can also be tested by doing the same process above ^^^^ Valuation- about obsolescence and spoilage. Obsolescence deals with inventory turnover

Test of Controls to test Assertions Occurrence- Observe and evaluate proper segregation of duties. Review and test procedures for transfer of inventory. Review and test procedures for issuing materials to manufacturing departments. Review and test entity procedures for account for numerical sequence of materials requisitions. Observe the physical safeguards over inventory. - The auditor’s main concern is that all recorded inventory transactions actually occurred. The auditor should also be concerned that goods may be stolen. Review and observation are the main tests of controls used by the auditor to test the control procedures. Completeness- Review and test entity's procedures for consignment goods - The primary control procedure for completeness relates to recording inventory that has been received. Controls are closely related to the purchasing process. Authorization- Review authorized production schedules. Review and test procedures for developing inventory levels and procedures used to control them - The auditor’s concern with authorization in the inventory system is with unauthorized purchase or production activity that may lead to excess levels of certain types of finished goods. Accuracy- Review and test procedures for taking physical inventory. Review and test procedures used to develop standard costs. Review and test cost accumulation and variance reports. Review

and test procedures for identifying obsolete, slow-moving, and excess quantities. Review the reconciliation of perpetual inventory to general ledger control account. - Inventory transactions that are not properly recorded result in misstatements that directly affect the amounts reported in the financial statements. Inventory purchases must be recorded at the correct price and actual quantity received. Inventory shipped must be properly recorded in cost of goods sold and the related revenue recognized. Cutoff- Review and test procedures for processing inventory included on receiving reports into the perpetual records. Review and test procedures for removing inventory from perpetual records based on shipments of goods - Inventory transactions recorded in the improper period could affect a number of accounts, including inventory, purchases, and cost of goods sold. Classification- Review the procedures and forms used to classify inventory. - The entity must have control procedures to ensure that inventory is properly classified as raw materials, work in process, or finished goods. By knowing which manufacturing department holds the inventory, the auditor is able to classify it by type. Assertions about Classes of Transactions and Events: Occurrence. Inventory transactions and events are valid. Completeness. All inventory transactions and events have been recorded. Authorization. All inventory transactions and events are properly authorized. Accuracy. Inventory transactions have been properly computed and recorded. Cutoff. Inventory receipts and shipments are recorded in the correct accounting period. Classification. Inventory is recorded in the proper accounts. Assertions about Account Balances at the Period End: Existence. Inventory recorded on the books and records actually exists. Rights and obligations. The entity has the legal right to the recorded inventory. Completeness. All inventory is recorded. Valuation and allocation. Inventory is properly recorded in accordance with GAAP (e.g., lower of cost or market). Assertions about Presentation and Disclosure: Occurrence and rights and obligations. All disclosed events, transactions, and other matters relating to inventory have occurred and pertain to the entity. Completeness. All disclosures relating to inventory that should have been included in the financial statements have been included. Classification and understandability. Financial information relating to inventory is appropriately presented and described, and disclosures are clearly expressed.

Accuracy and valuation. Financial and other information relating to inventory are disclosed fairly and in appropriate amounts. Substantive Analytical Procedures: Compare raw material, finished goods, and total inventory turnover to previous years' and industry averages. Compare days outstanding in inventory to previous years' and industry average. Compare gross profit percentage by product line with previous years' and industry data. Compare actual cost of goods sold to budgeted amounts. Compare current-year standard costs with prior years' after considering current conditions. Compare actual manufacturing overhead costs with budgeted or standard overhead costs. Possible Misstatement Detected: Obsolete, slow-moving, or excess inventory Obsolete, slow-moving, or excess inventory Unrecorded or fictitious inventory Over- or understated inventory Over- or understated inventory Inclusion or exclusion of overhead costs Auditing Standard Costs: 1. Materials- Test the quantity and type of materials included in the product and the price of the materials 2. Labor- Gather evidence about the type and amount of labor needed for production and the labor rate 3. Overhead- Review the entity’s method of overhead allocation for reasonableness, compliance with GAAP, and consistency Observing Physical Inventory During the observation of the physical inventory count, the auditor should do the following: 1. Ensure that no production is scheduled. If production is scheduled proper controls must be established for movement between departments in order to prevent double counting. 2. Ensure that there is no movement of goods during the inventory count. 3. Make sure that the entity’s count teams are following the inventory count instructions. 4. Ensure that inventory tags are issued sequentially to individual departments. 5. Perform test counts and record a sample of counts in the working papers. 6. Obtain tag control information for testing the entity’s inventory compilation. 7. Obtain cutoff information, including the number of the last shipping and receiving documents issued. 8. Observe the condition of the inventory for items that may be obsolete, slow moving, or carried in excess quantities. 9. Inquire about goods held on consignment for others or held on a “bill-and-hold” basis.

Substantive Tests of Transactions Occurrence. Vouch a sample of inventory additions to receiving reports and purchase requisitions. Completeness. Trace a sample of receiving reports to the inventory records. Authorization. Test a sample of inventory shipments to ensure there is an approved shipping ticket and customer sales. Accuracy. Recompute the mathematical accuracy of a sample of inventory transactions. Audit standard costs or other methods used to price inventory. Cutoff. Trace a sample of time cards before and after period end to the appropriate weekly inventory report. Classification. Examine a sample of inventory checks for proper classification into expense accounts. Test of Details of Account Balances Existence. Observe count of physical inventory. Rights and obligations. Verify that inventory held on consignment for others or "bill-and-hold" goods are not included in inventory. Completeness. Trace test counts and tag control information to the inventory compilation. Valuation and allocation. Obtain a copy of the inventory compilation and agree totals to general ledger. Test mathematical accuracy of extensions and foot the inventory compilation. Inquire of management concerning obsolete, slow-moving, or excess inventory. Review book-to-physical adjustment for possible misstatements. Tests of Details of Disclosures Occurrence and rights and obligations. Inquire of management and review any loan agreements and board of directors' minutes for any indication that inventory has been pledged or assigned. Inquire of management about issues related to warranty obligations. Completeness. Complete financial reporting checklist to ensure that all financial statement disclosures related to inventory are made. Classification and understandability. Review inventory compilation for proper classification among raw materials, work in process, and finished goods. Read footnotes to ensure that required disclosures are understandable. Accuracy and valuation. Determine if the cost method is accurately disclosed. Inquire of management about issues related to LIFO liquidations. Read footnotes and other information to ensure that the information is accurate and properly presented at the appropriate amounts. Possible causes of book-to-physical differences: 1. Inventory cutoff errors. 2. Unreported scrap or spoilage. 3. Pilferage or theft.

Examples of Disclosure Items: 1. Cost method (FIFO, LIFO, retail method). 2. Components of inventory. 3. Long-term purchase contracts. 4. Consigned inventory. 5. Purchases from related parties. 6. LIFO liquidations. 7. Pledged or assigned inventory. 8. Disclosure of unusual losses from write-downs or losses on long-term purchase commitments. 9. Warranty obligations.

Evaluating the Audit Findings – Inventory At the conclusion of testing, the auditor should aggregate all identified misstatements. The likely misstatement is compared to the tolerable misstatement allocated to the inventory account. Likely misstatement < Tolerable misstatement: The auditor may accept the inventory account as fairly presented. Likely misstatement > Tolerable misstatement: The auditor must conclude the inventory is not fairly presented. Consignment Sales- Inventory held by another party (different from seller) to sell the inventory. Inventory is not on the books of the Consigner Types of inventory

-

Finished goods- products ready to sell Product cost= Priced in terms of direct labor, direct materials, overhead Raw materials- probably dealing with a manufacturer

Inventory Tag- contains a barcode and a unique number- identifier. The numbers are sequenced for a control to check if everything...

Similar Free PDFs

AUDIT

- 19 Pages

Audit Working Papers - Audit

- 6 Pages

audit final report

- 23 Pages

Audit

- 1 Pages

Audit

- 25 Pages

Review of FS - Audit Theory

- 84 Pages

Makalah Audit - bab Audit Persediaan

- 15 Pages

AUDIT AND ASSURANCE

- 16 Pages

audit and assurance

- 15 Pages

Advanced Audit and Assurance

- 7 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu