Auditing Problem Test Bank 1 ANS PDF

| Title | Auditing Problem Test Bank 1 ANS |

|---|---|

| Author | Richard Valdez |

| Course | BS Accountancy |

| Institution | Lyceum of the Philippines University |

| Pages | 8 |

| File Size | 92.9 KB |

| File Type | |

| Total Downloads | 298 |

| Total Views | 986 |

Summary

SOLUTION AUDITING PROBLEMS TEST BANK 1 PROBLEM 1 TANYING CORP. 1. B Sales P10,500 Freight) Sales returns and allowances Sales discounts Net sales P1,363,500 (11,700) (2,640) P1,349,160 2. C Inventory, Jan. 1 Purchases Purchase returns and allowances (P424,800 x Freight in (P16,575 P1,710) Cost of go...

Description

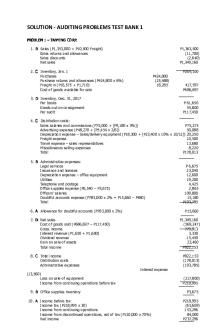

SOLUTION - AUDITING PROBLEMS TEST BANK 1 PROBLEM 1 – T TAN AN ANYING YING CORP CORP.. 1. B Sales (P1,353,000 + P10,500 Freight) Sales returns and allowances Sales discounts Net sales

P1,363,500 (11,700) (2,640) P1,349,160

2. C Inventory, Jan. 1 Purchases Purchase returns and allowances (P424,800 x 6%) Freight in (P16,575 + P1,710) Cost of goods available for sale

P269,100 P424,800 (25,488) 18,285

3. D Inventory, Dec. 31, 2017 Per books Goods out on consignment Per audit

417,597 P686,697

P 61,650 55,800 P117,450

4. C Distribution costs: Sales salaries and commissions (P75,000 + [P9,180 x 3%]) P75,275 Advertising expense (P48,270 + [P5,454 x 2/6]) 50,088 Depreciation expense – Sales/delivery equipment (P18,300 + [P23,400 x 10% x 10/12]) 20,250 Freight expense 10,500 Travel expense – sales representatives 13,680 Miscellaneous selling expenses 8,220 Total P178,013 5. B Administrative expenses: Legal services Insurance and licenses Depreciation expense – office equipment Utilities Telephone and postage Office supplies expense (P6,540 – P3,675) Officers’ salaries Doubtful accounts expense (P783,000 x 2% = P15,660 – P480) Total 6. A Allowance for doubtful accounts (P783,000 x 2%)

P 6,675 23,040 12,600 19,200 4,425 2,865 109,800 15,180 P193,785 P15,660

7. D Net sales Cost of goods sold (P686,697 – P117,450) Gross income Interest revenue (P1,650 + P1,680) Dividend revenue Gain on sale of assets Total income

P1,349,160 (569,247) 779,913 3,330 15,450 23,460 P822,153

8. C Total income Distribution costs Administrative expenses

P822,153 (178,013) (193,785) Interest expense

(13,560) Loss on sale of equipment Income from continuing operations before tax 9. B Office supplies inventory 10. A Income before tax Income tax (P218,995 x 30) Income from continuing operations Income from discontinued operations, net of tax (P120,000 x 70%) Net income

(217,800) P218,995 P3,675 P218,995 (65,669) 153,296 84,000 P237,296

Page 2 PROBLEM 2 – BUNCHING COMP COMPANY ANY

Per books AJE 1 2 3 a b c d e Per audit

AJES 1.

2.

Cash P963,200 (654,600) 360,000 ----------P668,600

Accounts Receivable P2,254,000 310,000 ------------P2,564,000

(11 – C)

(12 – B)

Inventory P6,050,000 ------130,000 (637,500) 217,500 275,000 P6,035,000

Accounts Payable P4,201,000 --372,400 (175,000) ----217,500 --P4,615,900

(13 – A)

(14 – B)

Sales Accounts receivable (P294,500 / 95%) Sales discounts (P310,000 x 5%) Cash

360,100 310,000

Cash (P372,400 – P12,400) Purchase discounts Accounts payable

360,000 12,400

15,500 654,600

372,400

3. a Accounts payable Purchases

175,000

b Inventory Cost of sales

130,000

c Cost of sales Inventory

637,500

d Purchases Accounts payable Inventory Cost of sales

217,500

e Inventory Cost of sales

175,000 130,000 637,500 217,500 217,500 217,500 275,000 275,000

f No adjusting entry 15. C Current ratio: Current assets: Cash Accounts receivable Inventory Current liabilities: Accounts payable Accrued expenses

P 668,600 2,564,000 6,035,000 P4,615,900 431,000

P9,267,600

5,046,900 1.84

Page 3 PROBLEM 3 – P PAKO AKO COMP COMPANY ANY 16. D Balance, Jan. 1 June 30 acquisition (P1,080,000 + P48,000) Sept. 30 sale Dec. 1 trade in: old machine new machine Balance, Dec. 31

P1,800,000 1,128,000 (150,000) (90,000) 270,000 P2,958,000

17. A Remainder of beginning balance (P1,800,000 – P150,000 – P90,000 = P1,560,000 x 10%) June 30 acquisition (P1,128,000 x 10% x 6/12) Sept. 30 sale (P150,000 x 10% x 9/12) Dec. 1 trade in: old machine (P90,000 x 10% x 11/12) new machine (P270,000 x 10% x 1/12) Depreciation expense for 2015

P156,000 56,400 11,250 8,250 2,250 P234,150

GENLUNA COPPERMINES, INC. 18. C Depletion rate per ton (P14,580,000 / 1,620,000) Copper ore mined in 2017 (15,000 x 6 months) Depletion for 2017 Depletion per books Overstatement of depletion expense

P9 x 90,000 P 810,000 1,215,000 P405,000

19. D Depreciable cost of machinery (P1,800,000 x 90%) Estimated copper ore reserve Depreciation rate per ton Copper ore mined in 2017 Depreciation expense for 2017 Depreciation per books Overstatement of depreciation expense

P1,620,000 1,620,000 P1 90,000 P 90,000 120,000 P 30,000

20. D January 1, 2014 Total cost of machine (P300,000 + P3,000 + P12,000) Residual value Depreciable cost Estimated useful life Annual depreciation

P315,000 (12,000) P303,000 10 years P30,300

Depreciable cost Depreciation, 2016 – 2014 (P30,300 x 3 years) Remaining depreciable cost, Jan. 1, 2017 Cost of new parts Total Remaining useful life (10 years – 3 years) Revised annual depreciation

P303,000 (90,000) P212,100 37,800 P249,900 7 years P35,700

PROBLEM 4 – HARLINGT HARLINGTON ON COMPAN COMPANY Y 21. A Net income before trading security adjustment Unrealized loss (P3,465,000 cost – P3,195,000 market value) Net income, as adjusted

P2,700,000 (270,000) P2,430,000

22. B Net income before trading security adjustment Unrealized gain (P3,465,000 cost – P3,564,000 market value) Net income, as adjusted

P2,700,000 99,000 P2,799,000

LABADA CO CO.. 23. D Ganda Co. Waston, Inc. (P135 x 1,800)

Carrying Value P1,710,000 243,000 P1,953,000

Market Value P1,759,500 229,500 P1,989,000

Unrealized gain (P1,989,000 – P1,953,000)

P36,000

24. C Net proceeds (P93 x 15,000 = P1,395,000 – P13,500) Carrying value Gain on sale

P1,381,500 (1,251,000) P 130,500

25. B Trading securities at fair value

P1,989,000

Page 4 PROBLEM 5 – SAMSON MFG. CO CO.. 26. C

Actual borrowing cost: Specific borrowing (P5 million x 10%) General borrowings: P25 million x 8% P15 million x 6% Total Capitalization rate (P2,900,000/P40 million)

P500,000 P2,000,000 900,000

2,900,000 P3,400,000 7.25%

Average expenditures – 2016

P7,250,000

Capitalizable interest – 2016: Specific borrowing (P5 million x 10%) General borrowings (P7,250,000 – P5,000,000 = P2,250,000 x 7.25%) Total 27. B

Average expenditures – 2017

P500,000 163,125 P663,125 P16,163,125

Capitalizable interest – 2017: Specific borrowing (P5 million 10% x 6/12) P250,000 General borrowings (P16,163,125 – P5,000,000 = P11,163,125 x 7.25% x 6/12) 404,663 Total P654,663 28. A

2014 interest expense (P3,400,000 – P663,125)

P2,736,875

29. D

2015 interest expense (P3,400,000 – P654,663)

P2,745,337

30. B

Accumulated expenditures before interest Interest capitalized in 2016 and 2017 (P663,125 + P654,663) Total cost of building

P19,500,000 1,317,788 P20,817,788

PROBLEM 6 Ye ar

Compensation Expense for P Period eriod

Calculation

Cumulative Compensation Expense

1

30,000 options x P5 fair value x

P 50,000

P 50,000

2

30,000 options x P5 fair value x

50,000

100,000

3

30,000 options x P5 fair value x

50,000

150,000

31. C

32.

C

33.

D

34.

D

35.

D

PROBLEM 7 – BRANDY CO CO.. 36. C

Ordinary shares issued and outstanding Ordinary shares subscribed Total Ordinary shares issued to acquire land Ordinary shares originally subscribed Par value/share Total par value Share premium (P2,850,000 – P450,000) Total subscription price

72,000 72,000 144,000 (24,000) 120,000 x P10 P1,200,000 2,400,000 P3,600,000

* P690,000 FV of land – P240,000 PV

37. D

Subscription of 12,000 preference shares @ P120/share Subscription of 60,000 preference shares @ P100/share Total Year-end balance of subscriptions receivable – preference Amount collected from subscribers

P1,440,000 6,000,000 7,440,000 (360,000) P7,080,000...

Similar Free PDFs

Auditing Problem Test Bank 1 ANS

- 8 Pages

Auditing Theory Test Bank

- 8 Pages

Auditing Theory Test Bank

- 31 Pages

Chapter 14 ans - Test bank

- 44 Pages

Chapter 13 ans - Test bank

- 40 Pages

Problem sheet 5 ans(1)

- 11 Pages

Auditing Problems Test Bank 2

- 15 Pages

Auditing Test Bank with answers

- 30 Pages

Problem sheet 3- ans

- 6 Pages

Test Bank-1 - Test Bank

- 3 Pages

203349718 Auditing problem reviewer

- 11 Pages

203349718-Auditing-problem-reviewer

- 10 Pages

Auditing Problem (Solution) II

- 9 Pages

161109620 CPAR Auditing Problem

- 12 Pages

Test bank chap 1 - Test Bank

- 29 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu