CH18Taxes PDF

| Title | CH18Taxes |

|---|---|

| Author | Anonymous User |

| Course | Financial Accounting 2 |

| Institution | British Columbia Institute of Technology |

| Pages | 5 |

| File Size | 198.7 KB |

| File Type | |

| Total Downloads | 49 |

| Total Views | 138 |

Summary

Taxes...

Description

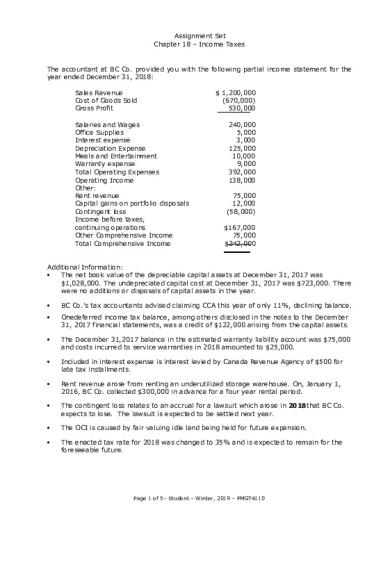

Assignment Set Chapter 18 – Income Taxes

The accountant at BC Co. provided you with the following partial income statement for the year ended December 31, 2018: Sales Revenue Cost of Goods Sold Gross Profit Salaries and Wages Office Supplies Interest expense Depreciation Expense Meals and Entertainment Warranty expense Total Operating Expenses Operating Income Other: Rent revenue Capital gains on portfolio disposals Contingent loss Income before taxes, continuing operations Other Comprehensive Income Total Comprehensive Income

$ 1,200,000 (670,000) 530,000 240,000 5,000 3,000 125,000 10,000 9,000 392,000 138,000 75,000 12,000 (58,000) $167,000 75,000 $242,000

Additional Information: The net book value of the depreciable capital assets at December 31, 2017 was $1,028,000. The undepreciated capital cost at December 31, 2017 was $723,000. There were no additions or disposals of capital assets in the year.

BC Co.’s tax accountants advised claiming CCA this year of only 11%, declining balance.

Onedeferred income tax balance, among others disclosed in the notes to the December 31, 2017 financial statements, was a credit of $122,000 arising from the capital assets.

The December 31,2017 balance in the estimated warranty liability account was $75,000 and costs incurred to service warranties in 2018 amounted to $25,000.

Included in interest expense is interest levied by Canada Revenue Agency of $500 for late tax installments.

Rent revenue arose from renting an underutilized storage warehouse. On, January 1, 2016, BC Co. collected $300,000 in advance for a four year rental period.

The contingent loss relates to an accrual for a lawsuit which arose in 2018that BC Co. expects to lose. The lawsuit is expected to be settled next year.

The OCI is caused by fair valuing idle land being held for future expansion.

The enacted tax rate for 2018 was changed to 35% and is expected to remain for the foreseeable future.

Page 1 of 5– Student – Winter, 2019 – FMGT4110

Assignment Set Chapter 18 – Income Taxes

In 2017 BC Co. suffered a substantial non-capital tax loss of $420,000. Taxable incomes for the years 2012-2016 follows and the tax rate for all of these years was 38%. 2012 $67,000

2013 $47,000

2014 $58,000

2015 $64,000

2016 $76,000

In evaluating the treatment of any tax loss carry-forward (LCF) at the end of 2017, management evaluated a high level of uncertainty and volatility in generating sufficient future taxable incomes and did not recognize any benefit of the loss carry-forward at that time. However, innovative marketing and new, differentiated products changed this assessment and, at the end of 2018, the full benefit of any available LCF at that time was recognized.

Round any amounts to the nearest dollar.

Page 2 of 5– Student – Winter, 2019 – FMGT4110

Assignment Set Chapter 18 – Income Taxes Required #1: Prepare, with supporting calculations, required entries to record the tax provision for continuing operations for the year ended December 31, 2018.

2018 Tax reconciliation and calculation:

Income from continuing operations, before tax Permanent Differences: Non-Deductible Interest Penalty Non-Deductible Portion of Meals & Entertainment Deductible Portion of Capital Gains Temporary Differences: Depreciation CCA Warranty Expense Actual Warranty Costs Contingent Loss Rent Revenue Taxable Income before LCF LCF to Apply [420,000 – (58,000+64,000+76,000)= 222,000] Taxable Income

Page 3 of 5– Student – Winter, 2019 – FMGT4110

167,000

500 5,000 (6,000) 166,500 125,000 (79,530) 9,000 (25,000) 58,000 (75,000) 178,970 178,970 $0

Assignment Set Chapter 18 – Income Taxes

Deferred Tax Analysis: Account

Tax Basis

GAAP

Temp. Diff.

643,470

903,000

259,530

0

59,000

59,000

Rent

0

75,000

75,000

Contingent Loss LCF

0

58,000

58,000

43,030

0

43,030

Capital Assets Warranty

@35% @40% Deferred Deferred Ending Beginning A?/L? A?/L?

90,836 DTL 20,650 DTA 26,250 DTA 20,300 DTA 15,061 DTA

122,000 DTL 30,000 DTA 60,000 DTA 0

Adjust.

31,164 DTL 9,350 DTA 33,750 DTA 20,300 DTA 15,061 DTA

0

Tax entries: Description Income tax expense – current Income tax payable

Debit 0

Credit 0

DTL - Assets DTA – Contingent Loss DTA - LCF DTA - Warranty DTA - Rent Deferred Income Tax – Benefit

31,164 20,300 15,061

Deferred Tax Expense - OCI Deferred Tax Liability

13,125

9,350 33,750 23,425

13,125

Required #2: Prepare, in good form, the Statement of Comprehensive Income for 2018 beginning with “income from continuing operations” (before tax).

Income from Continuing Operations (before tax) Provision for Income Taxes: Current Deferred Benefit Net Income Other Comprehensive Income, net of tax 13,125 Comprehensive Income

167,000 0 23,425

Required #3:

Page 4 of 5– Student – Winter, 2019 – FMGT4110

23,425 190,425 61,875 $252,300

Assignment Set Chapter 18 – Income Taxes

Prepare, in good form, the Statement of Comprehensive Income for 2018 beginning with “income from continuing operations” (before tax) assuming that BC Co. had recognized the full benefit if any loss carry-forward at the end of 2017 and provide all tax entries required for 2018.

Analysis: Account

LCF

Tax Basis

GAAP

Temp. Diff.

Deferred Ending A?/L?

Deferred Beginning A?/L?

Adjust.

43,030

0

43,030

15,061 DTA

88,800 DTA

73,739 DTA

Tax entries: Description Income tax expense – current Income tax payable DTL - Assets DTA – Contingent Loss DTA - LCF DTA - Warranty DTA - Rent Deferred Income Tax Expense Deferred Tax Expense - OCI Deferred Tax Liability Presentation: Income from Continuing Operations (before tax) Provision for Income Taxes: Current Deferred Net Income Other Comprehensive Income, net of tax 13,125 Comprehensive Income

Debit 0

Credit 0

31,164 20,300 73,739 9,350 33,750 65,375 13,125 13,125

167,000 0 65,375

Page 5 of 5– Student – Winter, 2019 – FMGT4110

65,375 101,625 61,875 $163,500...

Similar Free PDFs

CH18Taxes

- 5 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu