Chapter 15 partnership formation operation changes PDF

| Title | Chapter 15 partnership formation operation changes |

|---|---|

| Author | Reyline Rivero |

| Course | Accountancy business |

| Institution | Divine Word University |

| Pages | 22 |

| File Size | 297.5 KB |

| File Type | |

| Total Downloads | 633 |

| Total Views | 769 |

Summary

Chapter 15 Test Bank PARTNERSHIPS FORMATION, OPERATIONS, AND CHANGES IN OWNERSHIP INTERESTS Multiple Choice Questions LO1 1. Under the Uniform Partnership Act, loans made a partner to the partnership are treated as a. advances to the partnership for which interest shall be paid from the date of the ...

Description

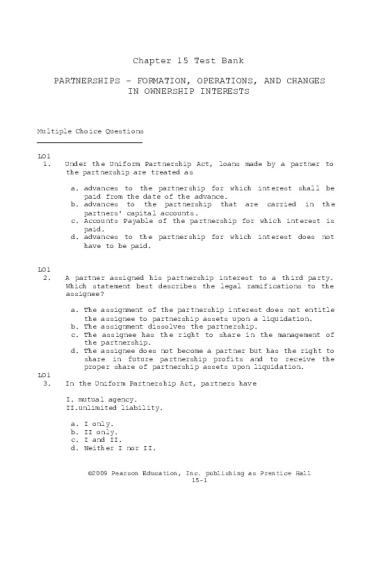

Chapter 15 Test Bank PARTNERSHIPS – FORMATION, OPERATIONS, AND CHANGES IN OWNERSHIP INTERESTS

Multiple Choice Questions

LO1 1.

Under the Uniform Partnership Act, loans made by a partner to the partnership are treated as a. advances to the partnership for which interest shall be paid from the date of the advance. b. advances to the partnership that are carried in the partners' capital accounts. c. Accounts Payable of the partnership for which interest is paid. d. advances to the partnership for which interest does not have to be paid.

LO1 2.

A partner assigned his partnership interest to a third party. Which statement best describes the legal ramifications to the assignee? a. The assignment of the partnership interest does not entitle the assignee to partnership assets upon a liquidation. b. The assignment dissolves the partnership. c. The assignee has the right to share in the management of the partnership. d. The assignee does not become a partner but has the right to share in future partnership profits and to receive the proper share of partnership assets upon liquidation.

LO1 3.

In the Uniform Partnership Act, partners have I. mutual agency. II.unlimited liability. a. b. c. d.

I only. II only. I and II. Neither I nor II.

©2009 Pearson Education, Inc. publishing as Prentice Hall 15-1

LO1 4.

Partnerships a. are required to prepare annual reports. b. are required to file income tax returns but do not pay Federal taxes. c. are required to file income tax returns and pay Federal income taxes. d. are not required to file income tax returns or pay Federal income taxes.

LO2 5.

Langley invests his delivery van in a computer repair partnership with McCurdy. What amount should the van be credited to Langley’s partnership capital? a. b. c. d.

The tax basis. The fair value at the date of contribution. Langley’s original cost. The assessed valuation for property tax purposes.

©2009 Pearson Education, Inc. publishing as Prentice Hall 15-2

Use the following information for questions 6, 7 and 8. A summary balance sheet for the McCune, Nall, and Oakley partnership appears below. McCune, Nall, and Oakley share profits and losses in a ratio of 2:3:5, respectively. Assets Cash Inventory Marketable securities Land Building-net Total assets

$

50,000 62,500 100,000 50,000 250,000 512,500

$

Equities McCune, capital Nall, capital Oakely, capital Total equities

$

212,500 200,000 100,000 512,500

$

The partners agree to admit Pavic for a one-fifth interest. The fair market value of partnership land is appraised at $100,000 and the fair market value of inventory is $87,500. The assets are to be revalued prior to the admission of Pavic and there is $15,000 of goodwill that attaches to the old partnership. LO2 6.

By how much will the capital accounts of McCune, Nall, and Oakley increase, respectively, due to the revaluation of the assets and the recognition of goodwill? a. b. c. d.

LO2 7.

The capital accounts will increase by $25,000 each. The capital accounts will increase by $30,000 each. $18,000, $27,000, and $45,000. $20,000, $25,000, and $30,000.

How much interest? a. b. c. d.

cash

must

Pavic

invest

to

acquire

a

one-fifth

$117,500. $120,500. $146,875. $150,625.

©2009 Pearson Education, Inc. publishing as Prentice Hall 15-3

LO2 8.

What will the profit and loss sharing ratios be after Pavic’s investment? a. b. c. d.

1:2:4:2. 2:3:5:2. 3:4:6:2. 4:6:10:5.

Use the following information for questions 9, 10 and 11. Albion and Blaze share profits and losses equally. Albion and Blaze receive salary allowances of $20,000 and $30,000, respectively, and both partners receive 10% interest on their average capital balances. Average capital balances are calculated at the beginning of each month balance regardless of when additional capital contributions or permanent withdrawals are made subsequently within the month. Partners’ drawings are not used in determining the average capital balances. Total net income for 2006 is $120,000.

January 1 capital balances Yearly drawings ($1,500 a month) Permanent withdrawals of capital: June 3 May 2 Additional investments of capital: July 3 October 2

LO3 9.

(

$

Blaze 120,000 18,000

12,000 ) (

15,000 )

40,000 50,000

What is the weighted-average capital for Albion and Blaze in 2006? a. b. c. d.

LO3 10.

Albion 100,000 18,000

$

$100,000 $105,333 $110,667 $126,667

and and and and

$120,000. $126,667. $119,583. $105,333.

If the average capital for Albion and Blaze from the above information is $112,000 and $119,000, respectively, what will be the total amount of profit allocated after the salary and interest distributions are completed? a. b. c. d.

$70,000. $73,100. $75,000. $80,000. ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-4

LO3 11.

If the average capital balances for Albion and Blaze are $100,000 and $120,000, what will the final profit allocations for Albion and Blaze in 2006? a. b. c. d.

$50,000 $54,000 $70,000 $75,000

and and and and

$70,000. $66,000. $50,000. $45,000.

Use the following information for questions 12 and 13. Bloom and Carnes share profits and losses in a ratio of 2:3, respectively. Bloom and Carnes receive salary allowances of $10,000 and $20,000, also respectively, and both partners receive 10% interest based upon the balance in their capital accounts on January 1. Partners’ drawings are not used in determining the average capital balances. Total net income for 2006 is $60,000. If net income after deducting the interest and salary allocations is greater than $20,000, Carnes receives a bonus of 5% of the original amount of net income.

January 1 capital balances Yearly drawings ($1,500 a month) LO3 12.

Bloom 200,000 18,000

$

Carnes 300,000 18,000

What are the total amounts for the allocation of interest, salary, and bonus, and, how much over-allocation is present? a. b. c. d.

LO3 13.

$

$60,000 $80,000 $83,000 $83,000

and and and and

$0. $20,000. $0. $23,000.

If the partnership experiences a net loss of $20,000 for the year, what will be the final amount of profit or (loss) closed to each partner’s capital account? a. b. c. d.

($30,000) to Bloom and $10,000 to Carnes. ($10,000) to Bloom and ($10,000) to Carnes. ($8,000) to Bloom and ($12,000) to Carnes. $10,000 to Bloom and ($30,000) to Carnes.

©2009 Pearson Education, Inc. publishing as Prentice Hall 15-5

LO3 14.

The XYZ partnership provides a 10% bonus to Partner Y that is based upon partnership income, after deduction of the bonus. If the partnership's income is $121,000, how much is Partner Y's bonus allocation? a. b. c. d.

LO3 15.

Drawings a. b. c. d.

LO4 16.

$11,000. $11,450. $11,650. $12,100.

are advances to a partnership. are loans to a partnership. are a function of interest on partnership average capital. *are the same nature as withdrawals.

If the partnership agreement provides a formula for the computation of a bonus to the partners, the bonus would be computed a. next to last, because the final allocation is distribution of the profit residual. b. before income tax allocations are made. c. after the salary and interest allocations are made. d. in any manner agreed to by the partners.

©2009 Pearson Education, Inc. publishing as Prentice Hall 15-6

the

Use the following information for questions 17, 18 and 19. Davis has decided to retire from the partnership of Davis, Eiser, and Foreman. The partnership will pay Davis $200,000. Goodwill is to be recorded in the transaction as implied by the excess payment to Davis. A summary balance sheet for the Davis, Eiser, and Foreman partnership appears below. Davis, Eiser, and Foreman share profits and losses in a ratio of 1:1:3, respectively.

Assets Cash Inventory Marketable securities Land Building-net Total assets Equities Davis, capital Eiser, capital Foreman, capital Total equities LO5 17.

$

160,000 140,000 300,000 600,000

$40,000. $120,000. $160,000. $200,000.

What partnership capital will Eiser have after Davis retires? a. b. c. d.

LO5 19.

$

75,000 82,000 38,000 150,000 255,000 600,000

What goodwill will be recorded? a. b. c. d.

LO5 18.

$

$100,000. $140,000. $180,000. $220,000.

What partnership capital will Foreman have after Davis retires? a. b. c. d.

$240,000. $300,000. $360,000. $420,000. ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-7

LO6 20.

In a limited partnership, a general partner a. b. c. d.

is excluded from management. is not entitled to a bonus at the end of the year. has limited liability for partnership debit. has unlimited liability for partnership debit.

©2009 Pearson Education, Inc. publishing as Prentice Hall 15-8

LO2 Exercise 1 Cesar and Damon share partnership profits and losses at 60% and 40%, respectively. The partners agree to admit Egan into the partnership for a 50% interest in capital and earnings. Capital accounts immediately before the admission of Egan are: Cesar (60%) Damon (40%) Total

$ $

300,000 300,000 600,000

Required: 1. Prepare the journal entry(s) for the admission of Egan to the partnership assuming Egan invested $400,000 for the ownership interest. Egan paid the money directly to Cesar and to Damon for 50% of each of their respective capital interests. The partnership records goodwill. 2. Prepare the journal entry(s) for the admission of Egan to the partnership assuming Egan invested $500,000 for the ownership interest. Egan paid the money to the partnership for a 50% interest in capital and earnings. The partnership records goodwill. 3. Prepare the journal entry(s) for the admission of Egan to the partnership assuming Egan invested $700,000 for the ownership interest. Egan paid the money to the partnership for a 50% interest in capital and earnings. The partnership records goodwill. LO3 Exercise 2 On February 1, 2005, Flores, Gilroy, and Hansen began a partnership in which Flores and Hansen contributed cash of $25,000; Gilroy contribute property with a fair value of $50,000 and a tax basis $40,000. Gilroy receives a 5% bonus of partnership income. Flores and Hansen receive salaries of $10,000 each. The partnership agreement of Flores, Gilroy, and Hansen provides all partners to receive a 5% interest on capital and that profits and losses be divided of the remaining income be distributed to Flores, Gilroy, and Hansen by a 1:3:1 ratio. Required: Prepare a schedule to distribute $25,000 of partnership net income to the partners. ©2009 Pearson Education, Inc. publishing as Prentice Hall 15-9

LO3 Exercise 3 The profit and loss sharing agreement for the Quade, Reid, and Scott partnership provides for a $15,000 salary allowance to Reid. Residual profits and losses are allocated 5:3:2 to Quade, Reid, and Scott, respectively. In 2006, the partnership recorded $120,000 of net income that was properly allocated to the partner's capital accounts. On January 25, 2007, after the books were closed for 2006, Quade discovered that office equipment, purchased for $12,000 on December 29, 2006, was recorded as office expense by the company bookkeeper. Required: Prepare the necessary correcting entry(s) for the partnership. LO3 Exercise 4 Evans, Fitch, and Gault operate a partnership with a complex profit and loss sharing agreement. The average capital balance for each partner on December 31, 2006 is $300,000 for Evans, $250,000 for Fitch, and $325,000 for Gault. An 8% interest allocation is provided to each partner. Evans and Fitch receive salary allocations of $10,000 and $15,000, respectively. If partnership net income is above $25,000, after the salary allocations are considered (but before the interest allocations are considered), Gault will receive a bonus of 10% of the original amount of net income. All residual income is allocated in the ratios of 2:3:5 to Evans, Fitch, and Gault, respectively. Required: 1.

Prepare a schedule to allocate income to the partners assuming that partnership net income is $250,000.

2.

Prepare a journal entry to distribute the partnership's income to the partners (assume that an Income Summary account is used by the partnership).

©2009 Pearson Education, Inc. publishing as Prentice Hall 15-10

LO3 Exercise 5 Required: Using the information from Exercise 4 above: 1. Prepare a schedule to allocate income or loss to the partners assuming that the partnership incurs a net loss of $36,000. 2. Prepare a journal entry to distribute the partnership's loss to the partners (assume that an Income Summary account is used by the partnership). LO3 Exercise 6 Grech, Harris, and Ivers have a retail partnership business selling personal computers. The partners are allowed an interest allocation of 8% on their average capital. Capital account balances on the first day of each month are used in determining weighted average capital, regardless of additional partner investment or withdrawal transactions during any given month. Drawings are disregarded in computing average capital, but temporary withdrawals of capital that are debited to the capital account are used in the average calculation. Partner capital activity for the year was: Capital accounts Jan 1 balance Feb 2 investment Mar 6 investment Apr 20 withdrawal Jul 3 withdrawal and investment Sep 29 investment Nov 5 investment Required:

Grech 200,000 50,000 10,000

$

$

Harris 300,000

$

20,000 (

(

7,000 ) 5,000

Ivers 250,000

10,000 4,000

10,000 ) 5,000 5,000

Calculate weighted average capital for each partner, and determine the amount of interest that each partner will be allocated.

©2009 Pearson Education, Inc. publishing as Prentice Hall 15-11

LO3 Exercise 7 The profit and loss sharing agreement for the Sealy, Teske, and Ubank partnership provides that each partner receive a bonus of 5% on the original amount of partnership net income if net income is above $25,000. Sealy and Teske receive a salary allowance of $7,500 and $10,500, respectively. Ubank has an average capital balance of $260,000, and receives a 10% interest allocation on the amount by which his average capital account balance exceeds $200,000. Residual profits and losses are allocated to Sealy, Teske, and Ubank in their respective ratios of 7:5:8. Required: Prepare a schedule to allocate $88,000 of partnership net income to the partners.

LO5 Exercise 8 A summary balance sheet for the partnership of Ivory, Jacoby and Kato on December 31, 2006 is shown below. Partners Ivory, Jacoby and Kato allocate profit and loss in their respective ratios of 9:6:10. Assets Cash Inventory Marketable securities Land Building-net Total assets Equities Ivory, capital Jacoby, capital Kato, capital Total equities

$

$

$

$

50,000 75,000 120,000 80,000 400,000 725,000

425,000 225,000 75,000 725,000

The partners agree to admit Lange for a one-tenth interest. The fair market value for partnership land is $180,000, and the fair market value of the inventory is $150,000.

©2009 Pearson Education, Inc. publishing as Prentice Hall 15-12

Required: 1. Record the entry to revalue the partnership assets prior to the admission of Lange. 2. Calculate how much Lange will have to invest to acquire a 10% interest. 3. If Lange paid $200,000 to the partnership in exchange for a 10% interest, what would be the bonus that is allocated to each partner's capital account?

LO5 Exercise 9 A summary balance sheet for the Vail, Wacker Yang partnership on December 31, 2006 is shown below. Partners Vail, Wacker, and Yang allocate profit and loss in their respective ratios of 4:5:7. The partnership agreed to pay partner Yang $227,500 for his partnership interest upon his retirement from the partnership on January 1, 2007. Any payments exceeding Yang’s capital balance are treated as a bonus from partners Vail and Wacker. Assets Cash Inventory Marketable securities Land Building-net Total assets Equities Vail, capital Wacker, capital Yang, capital Total equities

$

$

$

$

75,000 87,500 60,000 90,000 150,000 462,500

212,500 112,500 137,500 462,500

Required: Prepare the journal entry to reflect Yang’s retirement from the partnership.

©2009 Pearson Education, Inc. publishing as Prentice Hall 15-13

LO5 Exercise 10 A summary balance sheet for the Almond, Brandt, and Clack partnership on December 31, 2006 is shown below. Partners Almond, Brandt, and Clack allocate profit and loss in their respective ratios of 2:1:1. The partnership agreed to pay partner Brandt $135,000 for his partnership interest upon his retirement from the partnership on January 1, 2007. The partnership financials on January 1, 2007 are: Assets Cash Inventory Marketable securities Land Building-net Total assets Equities Almond, capital Brandt, capital Clack, capital Total equities

$

$

$

$

75,000 85,000 60,000 90,000 150,000 420,000

210,000 105,000 105,000 420,000

Required: Prepare the journal entry to reflect Brandt’s retirement from the partnership: 1. Assuming a bonus to Brandt. 2. Assuming a revaluation of total partnership capital based on excess payment. 3. Assuming goodwill to excess payment is recorded.

©2009 Pearson Education, Inc. publishing as Prentice Hall 15-14

SOLUTIONS Multiple Choice Questions 1.

a

2.

d

3.

c

4.

b

5.

b

6.

c

The assets will be valued upward by $90,000 which, allocated on a 2:3:5 basis, yields $18,000 to McCune, $27,000 to Nall, and $45,000 to Oakely.

7.

d

After the revaluation, the assets will be recorded at $602,500. If Pavic is admitted for a one-fifth interest, the $602,500 represents 80% of the total implied capital. Dividing $602,500 by 80% gives a total capitalization of $753,150 for which $150,625 is required from Pavic for a 20% interest.

8.

d

Each of the original partners has given up 20% of their interest to Pavic. Their profit and loss sharing ratios will therefore be 80% of what they were before the admission of Pavic. McCune Nall Oakely Pavic

20% x 80% = 30% x 80% = 50% x 80% = =

16% 24% 40% 20%

Expressed as: 4:6:10:5 9.

c

Albion: [($100,000 x 6) + ($88,000 x 1) + ($128,000 x 5)]/12 = $110,667 Blaze:

10.

b

[($120,000 x 5) + ($105,000 x 5) + ($155,000 x 2)]/12 = $119,583

Capital: ($112,000 + $119,000)x(10%) = $23,100 Salary: ($20,000 + $30,000) = $50,000 Total: $23,100 + $50,000 = $73,100

©2009 Pearson Education, Inc. publishing...

Similar Free PDFs

Partnership Formation and Operation

- 36 Pages

Partnership Formation Activity

- 24 Pages

Partnership Formation Reviewer

- 17 Pages

Partnership Formation Notes

- 3 Pages

Partnership Formation Problems

- 129 Pages

AFAR Partnership Formation

- 128 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu