Chapter 8 Capital Gains Reserve Examples PDF

| Title | Chapter 8 Capital Gains Reserve Examples |

|---|---|

| Author | Pranav Bhardwaj |

| Course | Business ethics |

| Institution | Humber College |

| Pages | 4 |

| File Size | 146 KB |

| File Type | |

| Total Downloads | 75 |

| Total Views | 182 |

Summary

Download Chapter 8 Capital Gains Reserve Examples PDF

Description

Format: $PROD_FMT\books\intfed.fmt Filename: G:\CCH\Composer\JOBs\INTFED\1855\1855_out.xml

Introduction to Federal Income Taxation in Canada

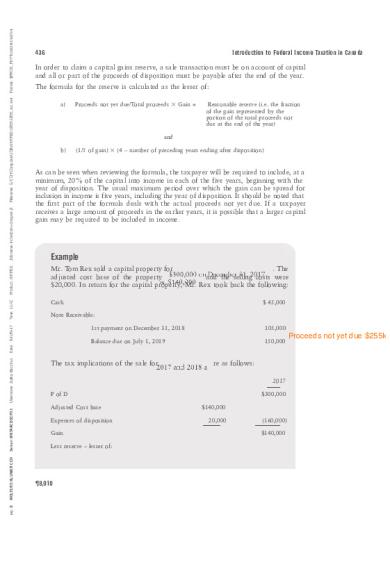

In order to claim a capital gains reserve, a sale transaction must be on account of capital and all or part of the proceeds of disposition must be payable after the end of the year. The formula for the reserve is calculated as the lesser of: a)

Proceeds not yet due/Total proceeds ⫻ Gain =

Reasonable reserve (i.e. the fraction of the gain represented by the portion of the total proceeds not due at the end of the year)

and b)

(1/5 of gain) ⫻ (4 – number of preceding years ending after disposition)

As can be seen when reviewing the formula, the taxpayer will be required to include, at a minimum, 20% of the capital into income in each of the five years, beginning with the year of disposition. The usual maximum period over which the gain can be spread for inclusion in income is five years, including the year of disposition. It should be noted that the first part of the formula deals with the actual proceeds not yet due. If a taxpayer receives a large amount of proceeds in the earlier years, it is possible that a larger capital gain may be required to be included in income.

Product: INTFED

Example Mr. Tom Rex sold a capital property for . The adjusted cost base of the property and the selling costs were $20,000. In return for the capital property, Mr. Rex took back the following:

Time: 11:42

Jobname: intfedcom+chapter_8

436

Cash Note Receivable:

Date: 9-JUN-17 Username: Zulika Bacchus Server: WKTAACDSCP01 WOLTERS KLUWER CCH eq: 8

$ 45,000

1st payment on December 31, 2018

105,000

Balance due on July 1, 2019

150,000

The tax implications of the sale for

re as follows: 2017

P of D Adjusted Cost base Expenses of disposition Gain Less reserve – lesser of:

¶8,010

$300,000 $140,000 20,000

(160,000) $140,000

Proceeds not yet due $255k

Format: $PROD_FMT\books\intfed.fmt Filename: G:\CCH\Composer\JOBs\INTFED\1855\1855_out.xml Jobname: intfedcom+chapter_8 Product: INTFED Time: 11:42 Date: 9-JUN-17 Username: Zulika Bacchus Server: WKTAACDSCP01 WOLTERS KLUWER CCH eq: 9

a) Proceeds not yet due * Gain Total proceeds Chapter 8 — Capital Gains: Business Related

a)

$255,000/$300,000 ⫻ $140,000 =

b)

(1/5 ⫻ $140,000) ⫻ (4-0) =

437

$119,000 112,000

Capital Gain

lesser

(112,000) $ 28,000

Taxable Capital Gain ( 1/2)

$14,000

2018 2017 Inclusion in income – 2017 reserve

$112,000

Less reserve – lesser of: a) b)

$150,000/$300,000 ⫻ $140,000 = (1/5 ⫻ $140,000) ⫻ (4-1) =

$70,000 84,000

(70,000)

Capital Gain

$42,000

Taxable Capital Gain ( 1/2)

$21,000

Mr. Rex will have to include 20% of the capital gain ($28,000) in 2017 and will pay tax on 1/2 of that capital gain ($14,000). In 2018, Mr. Rex receives a large cash payment, bringing his total cash received on the sale to 50% of the sales price. As a result, Mr. Rex is required to include a larger capital gain in 2018. When we review the 8, we can see that Mr. Rex will have included a total capital gains o ($28,000 in 2017 and $42,000 in 2018). This is equivalent t 00 capital gain and relates to the fact that 50% of the proceeds have been received.

The effect of this reserve system is to spread the capital gain realized on a disposition over a maximum of five years, including the year of the disposition. However, if the period of collection of the proceeds is less than five years, the system will spread the capital gain over the period of collection. The CRA’s interpretation of the applicability of the reserve provision has indicated that the reserve is based on amounts that are payable to the taxpayer after the end of the year. Where a demand note is accepted on a disposition, eligibility for a reserve can be improved by adding a condition that the note be payable, say, 10 days after demand. A demand made at the end of the year does not require payment until 10 days later with this condition.

Interpretation Bulletins: IT-236R4 Reserves — Disposition of Capital Property

Consistent with the treatment of other reserves, as discussed in Chapter 4, a reserve must be taken into income in the year following the deduction of a reserve. If eligible, a new reasonable reserve may be claimed.

ITA: 40(1)(a)(ii)

¶8,010

Format: $PROD_FMT\books\intfed.fmt Filename: G:\CCH\Composer\JOBs\INTFED\1855\1855_out.xml Jobname: intfedcom+chapter_8 Product: INTFED Time: 11:42 Date: 9-JUN-17 Username: Zulika Bacchus Server: WKTAACDSCP01 WOLTERS KLUWER CCH eq: 10

438

Introduction to Federal Income Taxation in Canada

The reserve is only used to defer capital gains. There is no reserve against recaptured depreciation. Also, the reserve cannot be claimed ●

by a non-resident,

●

where the purchaser is a controlled or controlling corporation,

●

if the purchaser is a partnership, where the vendor is a majority interest partner, or

●

in the year of death.

ITA: 40(2) Limitations, 72 Reserves, etc., for year of death

Example Problem 8-1 Ms. Gamma sold a capital property for $200,000 on December 31, 2017. Of that price, . The adjusted cost base of the property was $130,000 and the selling costs were $20,000. REQUIRED Determine the taxable capital gain for 2017 and 2018 using the capital gains reserve provision. SOLUTION 2017 Proceeds of disposition Adjusted Cost Base

$200,000 $130,000

Expenses of disposition

20,000

Gain

(150,000) $50,000

Less 2017 Reserve — lesser of: a) b)

$180,000/$200,000 ⫻ $50,000 =

$45,000

(1/5 ⫻ $50,000) ⫻ (4 - 0)

$40,000

Capital Gain included

(40,000) $10,000

Taxable Capital Gain ( /2 of capital gain) 1

$ 5,000 2018

Inclusion of 2017 reserve

$40,000

Less 2018 Reserve — lesser of: a) b)

¶8,010

/$200,000 ⫻ $50,000 (1/5 ⫻ $50,000) ⫻ (4 - 1)

Nil $30,000

Nil

ITA: 40(1)(a)

Format: $PROD_FMT\books\intfed.fmt Filename: G:\CCH\Composer\JOBs\INTFED\1855\1855_out.xml Jobname: intfedcom+chapter_8 Product: INTFED Time: 11:42 Date: 9-JUN-17 Username: Zulika Bacchus Server: WKTAACDSCP01 WOLTERS KLUWER CCH eq: 11

Chapter 8 — Capital Gains: Business Related

Capital Gain included

439

$40,000

Taxable Capital Gain ( /2 of capital gain) 1

$20,000

Ms. Gamma will be required to include a taxable capital gain of $5,000 in her 2017 tax return. All of the proceeds of disposition have been received in 2018. As a result, Ms. Gamma will include the remaining taxable capital gain of $20,000 in her 2018 tax return.

¶8,015 Adjusted Cost Base and Capital Cost The ‘‘adjusted cost base’’ of most capital property, as defined, is usually its cost plus or minus legislated adjustments. Cost is not defined for taxation purposes. The usual starting point is cost for accounting purposes which comprises laid-down cost, including the invoice cost, relevant sales, excise, and customs taxes, insurance, freight, and, perhaps, some start-up costs. Where the person is a GST/HST registrant and is eligible for an input tax credit, the GST/HST should be excluded from adjusted cost base, because the GST/ HST is not a cost if it is recovered by an input tax credit.

ITA: 54 Definitions, 53 Adjustments to cost base

There is an important exception to the above general rules in respect of depreciable property. In order to preserve the integrity of the capital cost allowance system, the adjusted cost base of depreciable property cannot be allowed to fluctuate as a result of the previously mentioned adjustments. Hence, the ‘‘adjusted cost base’’ of depreciable property is defined to be its capital cost, which in turn takes us back to cost for accounting purposes without adjustments.

ITA: 53 Adjustments to cost base, 54 Definitions

Subsection 53(1) (additions) and subsection 53(2) (reductions) set out a number of adjustments, some of which we have already examined. ●

●

●

The cost base of land is increased by interest and property taxes denied as an expense. Reasonable costs of surveying or valuing property in respect of its acquisition or disposition which are denied are added to the cost of the property. The cost of property is reduced by government assistance for capital property.

ITA: 18(2) Limit on certain interest and property tax, 53(1)(h) [Adjustments to cost base — Land] ITA: 18(1)(b) Capital outlay or loss, 53(1)(n) [Adjustments to cost base — Costs of surveying or valuing property] ITA: 53(2)(k) [Amounts to be deducted — Government assistance]

¶8,020 Non-arm’s Length Transfer of Depreciable Property If a depreciable property is transferred in a non-arm’s length transaction, then this has implications for the operation of the capital cost allowance system. Deeming proceeds of disposition and cost of acquisition to be the fair market value will affect potential recapture of capital cost allowance on disposition and the base on which capital cost allowance is computed on acquisition. ¶8,020...

Similar Free PDFs

Capital Gains Tax Act

- 20 Pages

Capital Gains Tax Notes

- 2 Pages

Capital Gains Tax

- 12 Pages

Capital gains - Lecture notes 5

- 10 Pages

Capital Gains Tax handouts May2020

- 22 Pages

Capital Gains Tax Summary Notes

- 7 Pages

Module 06 Capital Gains Taxation

- 14 Pages

Module 6 - Capital Gains Taxation

- 17 Pages

Capital gains tax schedule 2020

- 4 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu