Company Law Lecture Notes PDF

| Title | Company Law Lecture Notes |

|---|---|

| Author | Afrina Hazwani |

| Course | Company Law |

| Institution | Universiti Malaya |

| Pages | 60 |

| File Size | 825.6 KB |

| File Type | |

| Total Downloads | 107 |

| Total Views | 151 |

Summary

Download Company Law Lecture Notes PDF

Description

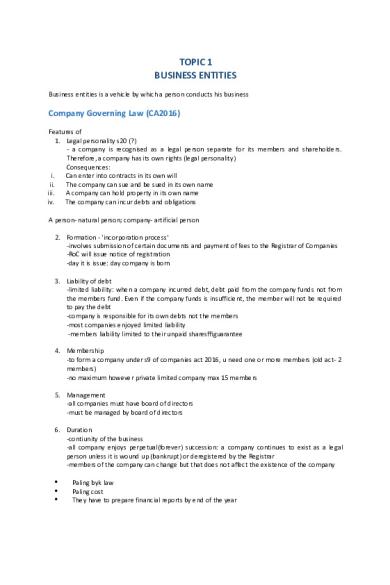

TOPIC 1 BUSINESS ENTITIES Business entities is a vehicle by which a person conducts his business

Company Governing Law (CA2016) Features of 1. Legal personality s20 (?) - a company is recognised as a legal person separate for its members and shareholders. Therefore, a company has its own rights (legal personality) Consequences: i. Can enter into contracts in its own will ii. The company can sue and be sued in its own name iii. A company can hold property in its own name iv. The company can incur debts and obligations A person- natural person; company- artificial person 2. Formation - 'incorporation process' -involves submission of certain documents and payment of fees to the Registrar of Companies -RoC will issue notice of registration -day it is issue: day company is born 3. Liability of debt -limited liability: when a company incurred debt, debt paid from the company funds not from the members fund. Even if the company funds is insufficient, the member will not be required to pay the debt -company is responsible for its own debts not the members -most companies enjoyed limited liability -members liability limited to their unpaid shares/guarantee 4. Membership -to form a company under s9 of companies act 2016, u need one or more members (old act- 2 members) -no maximum however private limited company max 15 members 5. Management -all companies must have board of directors -must be managed by board of directors 6. Duration -contiunity of the business -all company enjoys perpetual(forever) succession: a company continues to exist as a legal person unless it is wound up (bankrupt) or deregistered by the Registrar -members of the company can change but that does not affect the existence of the company

Paling byk law Paling cost They have to prepare financial reports by end of the year

Need the most time, money and resources bcs forming of a company involves the general public

Limited Liability Partnership (LLPA 2012) 1. Legal personality -s3 LLPA: recognised as a legal person -same consequences as company -LLP and company share the same feature 2. Liability -just like company, LLP enjoys limited liability -from LLP funds not partners funds - s21 3. Formation -similar to a company -LLP is formed thru an application process involves submission of certain documents and payment of feed to the Registrar of LLP -it is simpler (less documentation involves) 4. Membership -to form LLP under the act, must have minimum of 2 partners so 2 or more person can form LLP -no maximum partners imposed 5. Management -the LLP managed by the partners -all partners have the rights to participate in the partnership 6. Duration -LLP like a company has perpetual succession which means the death or retiring of a partner will not affects the existence of the LLP -unless it wound up or deregistered LLP does not issue shares to the public. Partners inject funds into the LLP.

Reporting obligation is much lesser

Partnership (Partnership Act 1961) -s3(1): a partnership is a rship that succeeds btw persons carrying on business in common with a view to profit 1. A relationship btw persons -a partnership has to be more than 1 person (at least 2 to form the partnership) 2. Carrying on business in common -all partners must be carrying on the same business 3. With a view to profit -the motive is for profit -cannot form a partnership to carry out a charity -not for purposes of doing research

-must be for trading, profit purposes Features: 1. Legal personality Does not have Not recognised by law as a legal person Therefore, a partnership does not have the capacity to enter into contracts in its own name A partnership cannot sue and be sued in its name A partnership cannot own property or land in its name The partnerships does not incur its own debts This means a partnership can only enter into contracts through the partners. The partner will enter into the ctt for the partnerships. If nak sue the partnership, sue the partner. And if the partnerships nak sue, must through the partners If partnership has the debt, the partners are responsible to pay the debt *under procedural law can sue under partnerships name, but substaintively cannot* 2. Formation There is no formal procedure to form a partnership Usually is form by way of oral or written agreement The business must be registered with the Registration of Business act 19 30 days of commencement of partnership 3. Liability Does not enjoy the concept of limited liability All partners are jointly liable for all debts incurred by the partnership (s11 PA1961) Exceptions s12,13,14,19 4. Membership Min:2 Conventional partnership (normal sort of business- selling cakes etc) max:20 - s47(2) of PA Professional partnerships (related to a profession and there is an act of parliament governing that profession- legal firms, architects, accountants) max: unlimited 5. Management Rest on the partners All partners has the rights to participate in the management of the partnership 6. Duration Does not enjoy perpetual succession PA: if a partner leaves a partnership, or retires, that partnership dissolves However, can have an agmt that if a partner leaves or retires it wont dissolves the partnership Whatever is said in PA, can have an agmt Death of a partner or a partner become bankrupt then partnership is dissolves (to avoid, have a partnership agmt) Partnership will continue until dissolves by consent of partners

Sole Proprietorship -no specific act of parliament

-no governing law 1. Legal personality No takde The sole proprietor and the business are the same If nak sue, or kena sue the sole proprietor Debts responsibility of the sole proprietor 2. Formation Don’t have Can be done at home, only using laptop However, the business must be registered with Registration of Business Act 1956 within 30 days 3. Liability Sole proprietor has unlimited liability on the debts of the sole proprietorship 4. Membership Usually 1 5. Management Solely by the sole proprietor 6. Duration As long the sole proprietor wants to (at his own will)

Classifications of Companies S2(1) Company Act A company is described as …. -in msia a company will be recognised as a company if it's incorporated under the 2016 act or 1965 act

LIABILITY OF ITS MEMBERS (liability) IDENTITY (status) 1.

Company limited by shares - 1. s10(2)

Company limited by 2. guarantee - s10(3) 3. Unlimited company - s10(4)

Private company

2.

Exempt private company

Public company

Public listed

Public nonlisted

LIABILITY OF ITS MEMBERS 1. Company limited by shares S10(2) - A company is limited by shares if the liability of its members is limited to the amount, if any, unpaid on shares held by the members. -shares may be fully paid out shares or partly paid out shares -fully: u have to pay the shares in full -partly: can pay partly and the rest pay later -it is common to issue fully paid out shares -only the person who has unpaid shares need to pay debt of the company but only up to the amount unpaid Liability of members 192. (2) The liability of a member of a company is limited to— (a) in the case of a company limited by shares, any amount unpaid on a share held by the member;

2. Company limited by guarantee S10(3) - A company is limited by guarantee if the liability of its members is limited to such amount as the members undertake to contribute in the event of its being wound up. -a company limited by guarantee has no shares capital -normally incorporated for non profit or trading purposes -businesses that promotes education (school), science and research, clubs and societies, religious societies (churches, buddhist society)

-the liability of its members is limited to the amount they guaranteed to contribute to the company's fund (balance of the amount) -company gets fund from the first few members Company Limited by guarantee 45. (1) No company other than a company limited by guarantee shall be formed with the following objects: (a) providing recreation or amusement; (b) promoting commerce and industry; (c) promoting art; (d) promoting science; (e) promoting religion; (f) promoting charity; (g) promoting pension or superannuation schemes; or (h) promoting any other object useful for the community or country. (2) A company limited by guarantee shall— (a) apply its profits or other income in achieving or promoting its objects; (b) prohibit the payment of any dividend to its members; and (c) require all the assets that would otherwise be available to its members generally be transferred on its winding up either— (i) to another body with objects similar to its own; or (ii) to another body the objects of which are the promotion of charity and anything incidental or conducive to such objects. (4) A company limited by guarantee shall not hold land unless a licence has been obtained from the Minister. Liability of members 192. (2) The liability of a member of a company is limited to— (b) in the case of a company limited by guarantee, any amount which the member has undertaken to contribute to the company in the event of it being wound up;

3. Unlimited company S10(4) - A company is an unlimited company if there is no limit on the liability of its members. -there is no limit on members liability to pay the company's debt -must have shares capital (similar with limited by shares) -member of the company are fully liable for the debt of the company -if fund is insufficient, members are responsible to pay for the debts of the company -enjoys separate legal personalities however all members are responsible for the debts of the company

IDENTITY (status) 1. Private company FEATURES:

S42 & 43 1. It is a company limited by shares - s42(1) 2. It has not more than 50 shareholders/members - s42(1) 3. It restricts the transfer of shares (shares among members are not freely transferrable to other ppl. There are rules) - s42(2) 4. It shall not offer to the public any shares or deventours of the company - s43(1)(a) 5. It does not issue shares with the view to offer the shares to the public. If company is issuing new shares, it cannot be to the public - s43(1)(b) 6. It shall not invite the public to deposit money to the company - s43(1)(c)

2. Public company S2(1) defined as a public company is a company other than a private company.

Public – s42

Private – s42

Exempt Private Company – s2(1) May be a company limited by May be a company limited by May be either company shares, limit by guarantee or shares or an unlimited limited by shares or unlimited company. company. unlimited company. No limits of number of Maximum of 50 shareholders s. No more than 20 shareholders. 42(1). members. It may not restrict the transfer It restricts the transfer of its All members must be of its shares. shares. S.42(2). individual. It may offer shares to the Not offer to the public any share None of the members public. of debenture s.43(1)(a). may hold shares on behalf of a company. It may allot any shares or It shall not allot any shares or debentures with the intention debentures with the intention to offer such securities to the to offer such securities to the public. public s.43(1)(b). It may invite the public to It shall not invite public to ` deposit money into the deposit money into the company. company.

RELATED COMPANIES Section 7 S 7(a): related where one company is the holding company of the other or parent company A Bhd (parent)-----> B Bhd = related companies S 7(b): if one company is the subsidiary of the other company D Bhd Q Bhd and R Bhd = both Q and R are related bcs ada same holding company • Can also be known as sister companies S7: A corporation is deemed to be related to each other if— (a) it is the holding company of another corporation; (b) it is a subsidiary of another corporation; or (c) it is a subsidiary of the holding company of another corporation.

Section 4 S is the subsidiary of H if: 1. H controls the board of director of S S 4(1)(a)(i) S 4(2): holding company is deemed to control board of directors of subsidiary if the holding company has the power to appoint/remove all or majority of the board directors in the subsidiary companies. 2. H control more than half of the voting power in S S 4(1)(a)(ii) The more capital the H company put in S company more power the H company have Focuses more on voting power Can also apply to company limited by guarantee 3. H owns/hold more than half of S's issues share capital S 4(1)(a)(iii) Can only be applicable to companies limited by shares 4. S is the sub of another corporation (X) which is the subsidiary of H. S 4(1)(b) S is the subsidiary of X and H

Section 5 Ultimate Holding Company (UH) 1. S is the subsidiary of UH 2. UH is not the subsidiary of another company

Section 6

Wholly-owned subsidiary (WOS) WOS is WOS of holding companies if 1. there are no members in WOS other than H 2. WOS is the wholly owned subsidiary of H H Bhd ---> WOS Bhd 100%

1. Subsidiaries of A B [s4(1)(a)(i)], D [s4(1)(b)], J [4(1)(b)], C s4(1)(a)(iii), etc 2. Holding companies A, B, D, C, F, G 3. Ultimate holding company A, F 4. Wholly owned subsidiary E, I 5. Related Companies A, B, D, J, C, E, G, I

TOPIC 2 INCORPORATION OF A COMPANY Application of ROC (s14) A person who desires to form a company must apply for incorporation from the Registrar.

1. PARTICULARS: s14(3) 1. 2. 3. 4. 5. 6. 7.

The name of the proposed company Status of the proposed company (ie. public or private) Nature of business of the proposed company Address of the registered office of the proposed company Details of members, directors and company's secretary of the proposed company Company limited by shares- details of class of shares and number of shares taken by members Company limited by guarantee- details of the amount that each members agreed to undertake to contribute in the event of wound up 8. Any other information as the Registrar may require

2. STATEMENTS: s14(4) An application for incorporation shall be accompanied by a statement made by each promoter or director Promoter= a person who takes steps to form a company Statements must contain: 1. They(promoters/directors) consent to act as a promoter or director of the company 2. The promoters and directors must confirm they are not disqualified from acting as a director or promoter

3. PRESCRIBED FEES: s15 If the Registrar of the companies is satisfied with the particulars and statements, then the Registrar will ask for payment of the fees. Once all procedure has been complied with, 3 thing will happen: 1. The Registrar will enter the particulars of the company in the company register (a large database) 2. The Registrar will assign the registration number to the company as the company registration number 3. The Registrar will issue a notice of registration to the company

S18: on the date the registrar issues the notice of registration, the company has been duly incorporated S19: the notice of registration is conclusive evidence that the company is registered and in existence S16: ROC has the power to refuse registration of the company S25-30: name of the company

EFFECTS OF INCORPORATION

Once a company is incorporated, the company acquires its own legal personality. This is the foundational basis of company law. Upon incorporation, it becomes a legal person separate from its members and directors. Because company is a legal person, there are certain things a company can do: a. Can enter into contracts in its own name b. Can sue and be sued in its own name c. Can own property and hold property d. Company has perpetual succession e. Can incur its own debt

The following are effects of incorporation a company –

every person whose name was stated as a member in the application for incorporation shall be a member of the company - s.18(2) if the company has share capital, the member shall also be known as a shareholder - s.18(3) a company is a body corporate and has legal personality separate from that of its members a company continues its existence until it is removed from the register - s20(a) a company is capable of exercising all the functions of a body corporate and has full capacity to carry on or undertake any business - s21 a company can sue or be sued - s21(a) a company can acquire, own, hold, develop or dispose of any property, and - s21(b) a company can do any act which it may do to enter into transactions. - s21(c)

Legal Personality Salomon v Salomon; HOL First establishes a principle where a company having legal personality Mr Solomon was a boot manufacturer and ran a business making boots and was a sole proprietor. The business was very successful that Mr Solomon decided to incorporate a company. He then form a company and was called Solomon & Co Ltd The company issued 20,007 shares. Mr Solomon held 20,001 shares while the remainder 6 was held by his wife and children. Mr Solomon was appointed as the managing director of this company and made all the decisions Mr Solomon has the last say and full control of the company Mr Solomon gave a secured loan (debentures) of 10,000 pounds to the company. Secured loan= when u loan the money, the borrower gave the security The security of the loan was the assets of the company He sold his sole proprietorship business to the company Unfortunately, the business did not do well after a while and the company face financial difficulties. The company wound up. The company unable to pay its debts. A person (liquidator) will be appointed to pay off the company's debts as far as possible before it can be completely shut down Priority of debts: highest priority is employees who has not been paid salaries The creditors were very unhappy because their debts cannot be paid as the company assets are not sufficient Creditors decided to raise the arguments to the liquidator. Argument: 1. this company is fully controlled by one man where he owns 95% of the shares and controls all the decisions of the company. The company and Mr Solomon are the same person. Mr Solomon should be liable to pay the debts 2. Mr Solomon is a secured creditor. The unsecured creditors said it was unfair for Mr Solomon to have security but they don’t have any and it was unfair for Mr Solomon's debts ranked higher than theirs. High court: Mr Solomon lost. They found Mr Solomon and the company are the same. CoA: Company was a trustee for Mr Solomon. Mr Solomon should be responsible for the debts of the company. HoL: Reversed both HC and CoA. The company and its members are 2 separate legal entities. Where the company has a debt, that debt is to be paid from the company’s funds not from the members' funds. Members could not be made personally liable for the debts of the company. A member can give a loan to the company and can be a secured loan to the company. It's fair. Lord McNaughten: The company is at law a different person altogether from its members and though it may be that after incorporation a business precisely the same as it was before, the same persons are managers, and the same hands receive the profits, the company is not in law the agent of the members or trustee for them. Nor are the members liable, in any shape or form except in the manner prescribe by the Companies Act. Metaphor: The Veil of Incorporation The creditors can only look to the company for the repayment of their debts. They can't look behind the veil which are the directors and its members. Once the veil is lifted, the company and its members will be looked as one legal entity

Lee v Lee's Air Farming Ltd

The company carried out a business called aerial top dressing where you have farm land and drop fertilisers using airplane. This company had 2 shareholders which are Mr Lee and hi...

Similar Free PDFs

Company law lecture notes

- 9 Pages

COMPANY LAW -LECTURE NOTES

- 48 Pages

Company Law Lecture Notes

- 56 Pages

Company Law Lecture Notes

- 60 Pages

Company law Full Notes

- 43 Pages

Company Law Notes

- 32 Pages

Company law notes

- 52 Pages

Company law notes

- 23 Pages

Company Law Condensed Notes

- 103 Pages

Company Law - Notes - LLB

- 218 Pages

Company Law - Notes - LLB

- 218 Pages

COMPANY LAW NOTES

- 8 Pages

Company Law Notes

- 19 Pages

Company law

- 55 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu