Comprehensive Exercises ON Equity Investmentquestionaire PDF

| Title | Comprehensive Exercises ON Equity Investmentquestionaire |

|---|---|

| Course | BS Accountancy |

| Institution | Lyceum of the Philippines University |

| Pages | 3 |

| File Size | 91.6 KB |

| File Type | |

| Total Downloads | 67 |

| Total Views | 291 |

Summary

COMPREHENSIVE EXERCISES ON EQUITY INVESTMENTProblem 1 Equity Securities of another company where no control nor significant influence exists. The company elected to report gains and losses in the profit and lossP 100,Equity Securities of another company where no control nor significant influence exi...

Description

COMPREHENSIVE EXERCISES ON EQUITY INVESTMENT

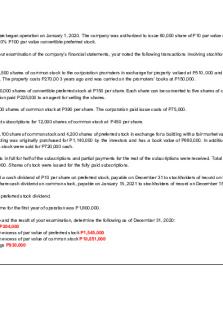

Problem 1 Equity Securities of another company where no control nor significant influence exists. The company elected to report gains and losses in the profit and loss Equity Securities of another company where no control nor significant influence exists. The company elected to report gains and losses in the other comprehensive income/loss 20% Equity securities of another company quoted in an active market 51% Equity securities of another company quoted in an active market Equity securities of the company quoted in an active market reacquired with the intention of reissuance in the latter period for short term profit Debt security of another company quoted in an active market. Business model of the company has an objective to hold debt securities for short term profits Debt security of another company quoted in an active market. Business model of the company has an objective of collecting contractual cash flows from the bonds which are primarily in the form of interest and principal Real Property held for sale in the normal course of business Real Property held for speculation purposes Real Property held as a current factory site Real Property of a manufacturing business being leased out to another party under operating lease Land held for undetermined future purpose Land held to be used as a future plant site Real Estate being developed as an investment property Given the list of securities and other assets that may qualify as investment.

1. 2. 3. 4. 5. 6.

P 100,000 150,000 500,000 1,400,000 500,000 100,000 500,000 500,000 700,000 1,000,000 900,000 800,000 400,000 300,000

How much from the list above is to be considered as financial asset at fair value through profits or loss? a. P 0 b. P 100,000 c. P 200,000 d. P 500,000 How much from the list above is to be considered as financial asset at fair value though OCI? a. P 150,000 b. P 180,000 c. P 200,000 d. P 350,000 How much from the list above is to be categorized as investment at amortized cost? a. P 0 b. P 500,000 c. P 600,000 d. P 750,000 How much from the list above is to be categorized as investment in associate? a. P 0 b. P 500,000 c. P 600,000 d. P 700,000 How much from the list above is to be categorized as investment in subsidiary? a. P 0 b. P 1,000,000 c. P 1,200,000 d. P 1,400,000 How much from the list above is to be categorized as investment property? a. P 2,400,000 b. P 2,700,000 c. P 2,800,000 d. P 3,100,000

Problem 2 Benshoppe Inc. had the following portfolio of financial assets as of December 31, 2014. All the financial assets were acquired in 2014: Financial Assets Aye Corporation stock, 20,000 shares Bee Inc. Stocks, 40,000 shares Cee Co 10%, P2M bonds Dee Corp. Stocks, 50,000 shares

Cost P 590,000 1,100,000 1,973,000 2,400,000

Additional Notes: a.

Aye Corporation shares were acquired with the intention of generating short term profits from the shares’ price fluctuation. The company paid P 29.50 per share, which included the P .50 per share broker’s fees and commissions. The shares were acquired on February 20, 2014. A P 2 per share cash dividends were received on March 30. These dividends were declared by Aye Corporation. On January 20, 2014 to stockholders as of record date March 1, 2014.

b.

c.

d.

e.

The company paid P 27.50 per shares, including P 0.50 per share broker’s fee on the acquisition of Bee, Inc. on March 1, 2014. These shares were acquired for trading purposes. A P 3 per share dividend were received from the said shares on May 3, 2014. These dividends were declared on April 1 to stockholders’ as of record date April 20. Cee Co. bonds which pay semiannual interest every June 30 and December 31, were acquired on October 1, 2014 at P 1,973,000, when the prevailing intertest rate on similar instruments was 12%. The bonds shall mature on December 31, 2016. The company has a business model of holding debt securities for short term profits. Dee Corporation stocks were acquired P 48 per share, inclusive of a P 3 per share broker’s fees and commission s on June 30, 2014. Dee Corporation has a total of P 200,000 shares outstanding on the same date. The company received P 5 dividends per share from Dee Corporation on December 20, 2014. The following were deemed relevant at year end, and no entries had been made yet by the company to reflect any of the following information:

Net Income, 2014 Fair Value

Aye Corporation P 1,200,000

Bee, Incorporation P 1,500,000

Cee Corporation P 2,000,000

Dee Corporation P 2,240,000

P 35/share

P 25/ share

11%

P 51/share

7.

What is the unrealized holding gains/loss to be reported in the 2014 statement of comprehensive income? a. P 1,948 b. P 51,948 c. P 121,948 d. P 122,750 8. What is the carrying value of investment that should be presented as current assets? a. P 3,665,750 b. P 3,543,000 c. P 3,664,948 d. P 2,765,250 9. What is the carrying value of investment that should be presented as non-current assets? a. P 2,280,000 b. P 2,150,000 c. P 2,430,000 d. P 2,550,000 10. What is the total amount that should be recognized in the income statement in relation the investment? a. P 261,948 b. p 541,948 c. P 571,948 d. P 542,750 11. Assuming the company’s business model regarding debt securities has an objective of collecting contractual cash flows, what is the carrying value of investment that should be presented as non-current? a. P 4,394,948 b. P 4,362,390 c. P 4,395,750 d. P 4,360,690 12. Assuming the company’s business model regarding debt securities has an objective of collecting contractual cash flows, how much in total should be presented in the income statement in relation to the investments? a. P 461,948 b. P 525,750 c. P 537,690 d. P 507,690 Problem 3 Mariah Corporation has the following non-trading equity securities on December 31, 2018: Securities ABC ordinary shares DEF ordinary shares GHI preference shares Additional Notes: a. b. c. d.

No. of Shares 9,000 30,000 2,400

Costs P 441,000 1,080,000 360,000

Fair Value, 12.31.18 P 46 per share P 35 per share P 154 per share

The above securities were all bought in 2018. On the initial recognition, Mariah made an irrevocable election to present gain/loss on the said securities to other comprehensive income. On April 1, 2019, the company sold all of the ABC ordinary shares for P 65 per share. On May 1, 2019, the company purchased 4,200 ordinary shares of JKL Corp. at P 75 per share. The company incurred broker’s fees amounting to P 10,400. The following additional information in 2019 were deemed relevant: Investment ABC ordinary shares DEF ordinary shares GHI preference shares JKL ordinary shares

Dividend declared 12.31.19 P 2 per share P 1.50 per share P 1.00 per share P 0.75 per share

Reported Net Income P 900,000 P 1,300,000 P 750,000 P 450,000

Fair Values per share,12.31.19 P 62 per share P 38 per share P 145 per share P 77 per share

13. What is the realized gain on sale of ABC ordinary shares in 2019, under PAS 39? a. P 144,000 b. P 171,000 c. P 190,000 d. P 0 14. What is the realized gain on sale of ABC ordinary shares in 2019, under PFRS 9? b. P 144,000 b. P 171,000 c. P 190,000 d. P 0 15. What is the unrealized holding gain/loss to be reported in the stockholders’ equity portion in the 2019 statement of financial position under PAS 39? a. P 76,800 b. P 56,400 c. P 46,000 d. P 66,400

16. Assuming that the company elected to report gains/loss in the profit or losses instead, what is the unrealized holding gain or loss to be reported in the 2019 statement of comprehensive income? a. P 76,800 b. P 56,400 c. P 46,000 d. P 66,400

17. Assuming that the JKL shares represents 20% interest in the JKL’s outstanding shares, what is the carrying value of investment in JKL shares? a. P 412,250 b. P 382,250 c. P 371,850 d. P 401,850 So, we will use Associate now: Problem 4 On January 4, 2014, Isuzu Corp. paid P 2,592,000 for 40,000 shares of Suzuki Inc. ordinary shares. The book value of Suzuki’s assets was P 6,400,000 on the date of acquisition. The investment represents a 30% interest in the net assets of Suzuki Inc. and gave Isuzu the ability to exercise significant influence over Suzuki. Isuzu received dividends of P 6 per share on December 4, 2014, and Suzuki reported net income of P 1,280,000 for one year ended, December 31, 2014. The market value of Suzuki’s shares at December 31, 2014 was P 64 per share with the cost to sell at minimal amount. You also ascertained the following information: On January 4, 2014, the fair value of Suzuki’s depreciable assets, with an average remaining life of 8 years, exceeded their book value by P 640,000. The remainder of the excess of the cost of the Investment over the book value of net assets purchased was attributed to an unidentifiable asset. 18. What amount of investment is attributable to goodwill? a. P 480,000 b. P 192,000 c. P 672,000 d. P 288,000 19. What amount of investment income to be reported by Suzuki’s income statement for the year ended, December 31, 2014? a. P 240,000 b. P 216,000 c. P 360,000 d. P 384,000 20. What is the carrying value of the Investment in Suzuki’s ordinary shares on December 31, 2014? a. P 2,560,000 b. P 2,712,000 c. P 2,592,000 d. P 2,736,000 21. What total/net amount should be reported in Suzuki’s income statement for the year ended December 31, 2014? a. P 240,000 b. P 208,000 c. P 60,000 d. P 180,000 22. Assuming that the company had no significant influence over Suzuki despite of the proportionate ownership, what total/net amount should be reported in Suzuki’s income statement for the year ended December 31, 2014? a. P 240,000 b. P 208,000 c. P 60,000 d. P 180,000 23. In relation to item no. 59 above, what is the net carrying value of the investment at December 31, 2014? a. P 2,592,000 b. P 2,712,000 c. P 2,560,000 d. P 2,472,000...

Similar Free PDFs

prelims on shareholder\'s equity

- 30 Pages

Exercises on Mill\'s Methods

- 2 Pages

Exercises on Belt Drives

- 5 Pages

Maxims of Equity Equity Law

- 5 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu