Corporation theories and application PDF

| Title | Corporation theories and application |

|---|---|

| Course | Corp Law & Policy Seminar |

| Institution | Michigan State University |

| Pages | 34 |

| File Size | 280.9 KB |

| File Type | |

| Total Downloads | 15 |

| Total Views | 144 |

Summary

practical questions and applications...

Description

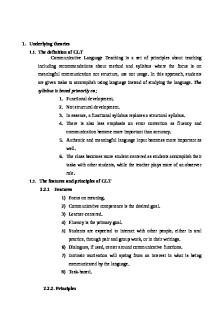

CHAPTER 5

5-1. The corporation is the most common form of business ownership. Answer: False LG: 1/LL: 1 Page: 142 5-2. The three major forms of business ownership in the U.S. are sole proprietorships, partnerships, and corporations. Answer: True LG: 1/LL: 1 Page: 142 5-4. Once a business is established, it's almost impossible to change from one form of business ownership to another. Answer: False LG: 1/LL: 1 Page: 142 5-5. A comparison of the three major forms of business ownership shows that sole proprietorships are usually the most difficult type of business to establish. Answer: False LG: 1/LL: 1 Page: 143 5-6. The first step in starting a sole proprietorship is to fill out a proprietorship charter application form and file it with the state government. Answer: False LG: 1/LL: 1 Page: 143 5-8. The profits of a sole proprietorship are taxed as the personal income of the owner. Answer: True LG: 1/LL: 1 Page: 143

5-10. A major advantage of sole proprietorships is that an owner has limited liability for the debts of his or her business. Answer: False LG: 1/LL: 1 Page: 143 5-12. The debts of a business operated as a sole proprietorship are considered to be the personal debts of the owner of the business. Answer: True LG: 1/LL: 1 Page: 143-144

5-13. A drawback of sole proprietorships is that they usually have limited access to additional financial resources. Answer: True LG: 1/LL: 1 Page: 144

5-14. An advantage of forming a sole proprietorship is that it allows the owner to have more time for leisure activities. Answer: False LG: 1/LL: 1 Page: 144 5-15. Jim wants to start a business. He is attracted by the idea of being his own boss, and wants to get started with a minimum of expense and hassle. He is very confident in his abilities, so he is not particularly worried about financial risks. All of these factors suggest that Jim would favor starting his business as a sole proprietorship. Answer: True LG: 1/LL: 2 Page: 143 Rationale: People who want to be their own boss often prefer to operate their business, at least initially, as a sole proprietorship. Another advantage of the sole proprietorship is that it is a relatively easy and inexpensive form of business to set up. One drawback of a sole proprietorship is that the owner has unlimited liability. However, Jim is not worried about risk, so this would not appear to be a major problem for him. 5-16. If a sole proprietorship fails, the owner may lose whatever was invested in the business, but the owner's personal assets are not at risk. Answer: False LG: 1/LL: 2 Page: 143-144 Rationale: Sole proprietors have unlimited liability for the debts of their business. This means that if their business gets into financial trouble they can lose their personal assets. 5-19. A general partner can take an active role in the management of the business. Answer: True LG: 2/LL: 1 Page: 145 5-20. All of the partners in a general partnership have limited liability for the debts of their firm. Answer: False LG: 2/LL: 1 Page: 145 5-21. In a general partnership, all owners share in both management of the business and in the assumption of liability for the firm's debts. Answer: True LG: 2/LL: 1 Page: 145

5-24. A limited partner is an owner who takes no management responsibility and has no liability for losses beyond the amount invested. Answer: True LG: 2/LL: 1 Page: 145

5-27. According to the Uniform Partnership Act, the three key elements of any general partnership are (1) shares of stock to represent ownership, (2) limited liability, and (3) ease of ownership transfer. Answer: False LG: 2/LL: 1 Page: 145 5-28. A recent study showed that partnerships are more likely to fail than sole proprietorships. Answer: False LG: 2/LL: 1 Page: 146 5-29. A major objective of limited liability partnerships (LLPs) is to limit each partner's personal liability to the consequences of their own acts and those of people under their supervision. Answer: True LG: 2/LL: 1 Page: 145 5-32. In order to protect all parties and minimize misunderstandings among partners, all terms of the partnership should be spelled out in writing. Answer: True LG: 2/LL: 1 Page: 147 5-33. One advantage of a partnership is that there is a simple process for partners to terminate their business. Answer: False LG: 2/LL: 1 Page: 147 5-34. Compared to sole proprietorships, an advantage of partnerships is their ability to obtain more financial resources. Answer: True LG: 2/LL: 1 Page: 145 5-36. Compared to sole proprietorships, partnerships offer the advantage of shared management and pooled knowledge. Answer: True LG: 2/LL: 1 Page: 145-146 5-37. A limited partnership refers to a partnership set up for a temporary purpose, such as a real estate development project. Answer: False LG: 2/LL: 1 Page: 145 5-38. Ted and Mark have been partners in a dry cleaning business for the past three years. They would like their brother Todd to join them. Unfortunately, partnership law states that only two partners can participate in a partnership. Answer: False LG: 2/LL: 2 Page: 145 Rationale: A partnership consists of two or more owners.

5-40. Sharon Pebble and Gilbert Stone have just formed a business partnership. Under their arrangement, Sharon will actively manage the company and assume unlimited liability for the firm's debts. Gilbert will invest several thousand dollars of his money and will share in the profits, but will not actively manage the firm and will not have liability for losses beyond his initial investment. Sharon and Gilbert have formed a limited partnership. Answer: True LG: 2/LL: 2 Page: 145 Rationale: A limited partnership consists of at least one general partner, who has unlimited liability, and at least one limited partner, who can lose only what he or she has invested. The limited partner cannot actively manage the partnership. 5-41. Alphonzo has agreed to become a partner in his brother's new clothing store and has provided 30 percent of the startup capital for Remora’s Clothiers. Since he provided 30 percent of the money to start the firm, he is legally entitled to 30 percent of any the profits the firm earns during its first year of operations. Answer: False LG: 2/LL: 2 Page: 146-147 Rationale: The division of profits in a partnership is negotiable and is not necessarily tied to the amount of the initial investment. 5-42. Ron and Jon want to go into business together. They do not want to bring in other partners, but they both want to avoid unlimited liability for any debts incurred by their new company. Ron and Jon can achieve their aims by organizing the firm as a limited partnership. Answer: False LG: 2/LL: 2 Page: 145 Rationale: All partnerships, including limited partnerships, must include at least one general partner. The general partners in a limited partnership must accept unlimited liability. Thus, if Ron and Jon form a limited partnership they will either have to bring in another person to be the general partner, or one of them will have to be the general partner and accept unlimited liability. 5-44. Connie is a general partner in a retail cookie store. Her personal assets are protected from the debts of the business. Answer: False LG: 2/LL: 2 Page: 145 Rationale: As a general partner, Connie assumes unlimited liability for the debts of her business. 5-45. A conventional corporation is a state-chartered legal entity, with authority to act and have liability separate from its owners. Answer: True LG: 3/LL: 1 Page: 149

5-48. A corporation can raise financial capital by selling shares of stock to interested investors. Answer: True LG: 3/LL: 1 Page: 150 5-49. Stockholders in a corporation must accept unlimited liability for the corporation’s debts. Answer: False LG: 3/LL: 1 Page: 149 5-51. When one of the owners of a corporation dies, the corporation legally ceases to exist. Answer: False LG: 3/LL: 1 Page: 150 5-52. Corporations are easy to start and easy to terminate. Answer: False LG: 3/LL: 1 Page: 151 5-53. A disadvantage of corporations is that they generally require extensive paperwork. Answer: True LG: 3/LL: 1 Page: 151 5-56.

The stockholders in a corporation elect a board of directors to oversee the company’s major policy issues. Answer: True LG: 3/LL: 1

Page: 150-151

5-57. Stockholders in a corporation have limited liability for the debts of the corporation. Answer: True LG: 3/LL: 1 Page: 149 5-58. One advantage of corporations is that the initial cost of setting them up is usually lower than for other forms of ownership. Answer: False LG: 3/LL: 1 Page: 151 5-61. One reason Individuals incorporate is to obtain the advantage of limited liability. Answer: True LG: 3/LL: 1

Page: 152

5-62. One advantage of an S Corporation is that the profits of the business are taxed as regular personal income of the owners, thus avoiding the problem of double taxation. Answer: True LG: 3/LL: 1

Page: 152-153

5.63.

Any corporation can qualify to be classified as an S corporation as long as it fills out and files the proper paperwork with the appropriate state agency on an annual basis. Answer: False LG: 3/LL: 1

Page: 153

5-65. The advantages of limited liability companies are not available to providers of personal services like doctors and lawyers. Answer: False LG: 3/LL: 1 Page: 153 5-68. A limited liability company is similar to an S corporation, but without the special eligibility requirements. Answer: True LG: 3/LL: 1 Page: 153 5-69. Limited liability companies have both flexibility in tax treatment of earnings and limited liability protection for owners. Answer: True LG: 3/LL: 1 Page: 153 5.71.Like stockholders of a C corporation, owners of a limited liability company (LLC) are free to sell their ownership without the approval of other members. Answer: False LG: 3/LL 1

Page: 154

5-72. Owners of limited liability companies (LLCs) must pay self-employment taxes on any profits they earn. Answer: True

LG: 3/LL: 1

Page: 154

5-74. Dr. Wright is interested in incorporating as an individual. While this is legally possible, there are really no advantages to doing so. Answer: False LG: 3/LL: 2 Page: 152 Rationale: Many individuals choose to incorporate to obtain limited liability. In some cases, they may also receive tax savings by doing so. 5-75. Nutty Dough is a small chain of donut shops that is currently owned and operated by a group of seven partners. The owners think that their chain has the potential for rapid growth, but several of the partners are concerned about the growing financial risks that will accompany this growth. One way the partners could deal with this problem would be to incorporate their business. Answer: True LG: 3/LL: 2 Page: 150 Rationale: Because they can issue shares of stock and bonds, and often find it easier to obtain loans from financial institutions, corporations usually have easier access to financial resources than unincorporated businesses. Another

advantage of corporations is that they provide their owners (stockholders) with the protection of limited liability. 5.76. When Erica Wayne decided to start a business she chose to form it as a corporation. This choice ensures that, as the founder and incorporator of the company, Erica will remain in control of the firm’s operations as long as she wants, no matter how large or complex the business becomes. Answer: False LG: 3/LL: 2 Page: 151 Rationale: One potential drawback of incorporation is the possibility of conflict between the entrepreneurs who originally start a business and the stockholders and board of directors who may eventually gain control. The text cites the cases of Rod Canion of Compaq and Steve Jobs of Apple Computer as examples of entrepreneurs who were forced out of the very companies they founded.

5-77. Mojo Motors is a rather small conventional corporation with only 212 stockholders. Eleven of the stockholders are citizens of Mexico who live in Mexico City, and eight more are citizens of Canada who live in Toronto. Mojo Motors should organize as an S corporation in order to save on taxes. Answer: False LG: 3/LL: 2 Page: 153 Rationale: Mojo Motors does not satisfy the requirements for an S corporation--it has more than 75 stockholders, some of whom are not U.S. citizens or permanent residents of the United States. 5-78. The partners at Edgar's Microbrewery would like to switch to an S corporation. Unfortunately, their lawyer has told them that they do not meet some of the requirements necessary to qualify as an S corporation. An alternative form of business that would give them similar advantages is a limited liability company. Answer: True LG: 3/LL: 2 Page: 153 Rationale: Limited liability companies offer many of the same advantages as S corporations, including limited liability and the possibility of taxation like a partnership, without the special eligibility requirements required to qualify for S corporation status. 5-79. The owners of the new Chillout Ice Cream Company have chosen to organize their business as a limited liability company. One drawback of this form of ownership is that the owners will pay higher taxes on their earnings than a regular corporation if their company grows rapidly. Answer: False LG: 3/LL: 2 Page: 153 Rationale: In terms of taxes, a limited liability company offers the best of all worlds, allowing the owners to choose to be taxed as a partnership or a corporation depending on which tax rates would benefit them the most.

5-81. In a merger, two firms combine to form one company. Answer: True LG: 4/LL: 1 Page: 156 5-83. An acquisition is when one company buys the property and obligations of another company. Answer: True LG: 4/LL: 1 Page: 156 5-86. In a conglomerate merger, firms in the same industry merge to expand their share of the market. Answer: False LG: 4/LL: 1 Page: 157 5-88. A merger between two businesses in different stages of related businesses is known as a vertical merger. Answer: True LG: 4/LL: 1 Page: 156 5-91. When a group of investors take a firm private, they obtain all of the stock for themselves. Answer: True LG: 4/LL: 1 Page: 157 5-94. In the past, the Beirderg’s Markets and Bronew’s Groceries have been fierce competitors in the grocery market. However, they recently issued a joint announcement stating their decision to merge. The announcement justified the proposed merger by claiming that the resulting firm would have more financial resources, which would enable it to expand services and broaden offerings to consumers. This proposed merger is an example of a horizontal merger. Answer: True LG: 4/LL: 2 Page: 157 Rationale: A merger between two firms in the same industry, such as two grocery store chains, is a horizontal merger. 5-96. A major objective of a leveraged buyout is to enable investors to gain control of a company by issuing new shares of ownership, thus minimizing the use of debt. Answer: False LG: 4/LL: 2 Page: 157 Rationale: Leveraged buyouts involve financing the acquisition of an organization through the use of debt financing. 5-97. Jane Gramm is leading a group of stockholders who want to take the Bigbux Corporation private. If Jane's group succeeds, Bigbux's stock will no longer be available to investors on the open market. Answer: True LG: 4/LL: 2 Page: 157

Rationale: Taking a firm private involves gaining control of a firm's stock so that it is no longer available to investors on the open market. 5-98. The workers at Scrappy’s Metal Fabrication, Inc., have learned that the firm is about to close down. They have devised a plan to use debt financing to buy the company's stock from current shareholders with the intention of keeping the company in business, thus saving their jobs. This strategy is called a leveraged buyout. Answer: True LG: 4/LL: 2 Page: 157 Rationale: A leveraged buyout involves the use of debt financing to buy the stock of a company. This is what the workers are attempting to do in this example. 5-100. A franchise agreement is an arrangement where a franchisor sells the rights to a business name and to sell a product or service within a given territory to a franchisee. Answer: True LG: 5/LL: 1 Page: 158 5-101. A franchise may be organized as a sole proprietorship, partnership, or corporation. Answer: True LG: 5/LL: 1 Page: 158 5-105. In a franchise arrangement, ownership of all of the individual stores or outlets remains in the hands of the franchisor. Answer: False LG: 5/LL: 1 Page: 159 5-106. One of the major advantages of a franchise system is the franchisee often gets instant recognition from consumers. Answer: True LG: 5/LL: 1 Page: 159 5-107. Franchisees must follow more rules, regulations, and procedures than if they operated independently owned businesses. Answer: True LG: 5/LL: 1 Page: 160 5-108. The “coattail effect” refers to the burden of corporate rules and regulations on franchisees. Answer: False LG: 5/LL: 1 Page: 160 5-111. The franchisee often must pay the franchisor a share of profits or a percentage commission on sales known as a royalty. Answer: True LG: 5/LL: 1 Page: 160

5-116. Franchising in global markets has demonstrated that high operating costs are counterbalanced by high profit opportunities. Answer: True LG: 5/LL: 1 Page: 164 5-121. Les is a franchisee in the Far Horizons Travel Agency franchise. As a franchisee, Les is guaranteed the right to retain all of his franchise's profits. Answer: False LG: 5/LL: 2 Page: 160 Rationale: Franchisees usually pay a royalty to the franchisor. This royalty is sometimes expressed as a share of the franchisee's profits. 5-122. Leanne is a franchisee in a restaurant chain. Thanks mainly to her hard work and people skills, her individual outlet is doing quite well. However, she has noticed that several other franchisees in the same chain have let their businesses deteriorate, especially in terms of the quality of the food they offer. Leanne should be very concerned about this trend, since it eventually could affect her own business. Answer: True LG: 5/LL: 2 Page: 160 Rationale: The actions of less successful franchisees can hurt the success of others in the same franchise. This is known as the coattail effect. 5-125. A cooperative consists of people with similar needs who pool their resources for mutual gain. Answer: True LG: 6/LL: 1 Page: 165 5-126. It is not unusual for members of cooperatives to work for and help manage their cooperative. Answer: True LG: 6/LL: 1 Page: 165 5-127. Farm cooperatives were originally established to help farmers increase their economic power by acting as a group rather than as individuals. Answer: True LG: 6/LL: 1 Page: 165 5-133. The ___________ is the most common form of business ownership. A) partnership. B) corporation. C) joint venture. D) sole proprietorship. Answer: D LG: 1/LL: 1 Page: 142

5-134. A ___________ is a business organization that is owned, and usually managed, by one person. A) closed corporation. B) subchapter S corporation. C) sole proprietorship. D) limited partnership. Answer: C LG: 1/LL: 1 Page: 142 5-135. ____________ comprise about 20% of all businesses but account for about 87% of all business receipts. A) Corporations B) Partnerships C) Sole proprietorships D) Limited liability companies Answer: A LG: 1/LL: 1 Page: 142 5-142. Any debts or damages incurred by a firm organized as a sole proprietorship are: A) the sole responsibility of the owner. B) limited to the amount the owner has invested in the firm. C) paid for out of a reserve contingency fund that sole proprietors are required by law to set up. D) normally covered by liability insurance. Answer: A LG: 1/LL: 1 Page: 143-144 5-143. An entrepreneur who wishes to start a business with little delay or hassle, and who wants to be his or her own boss, should organize the business as a: A) sole proprietorship. B) cooperative. C) C corporation. D) general partnership. Answer: A LG: 1/LL: 2 Page: 143 Rationale: Two advantages of sole proprietorships are ease of starting (and ending) and being your own boss.

CHAPTER 6 TRUE/FALSE 6-1.Entrepreneurship involves accepting the risk of starting and running a business. Answer: True LG: 1/LL: 1 Page: 174

6-2.Entre...

Similar Free PDFs

Corporation theories and application

- 34 Pages

Partnership and corporation reviewer

- 10 Pages

Corporation

- 37 Pages

Corporation - ....

- 27 Pages

Kfc-corporation kfc-corporation

- 18 Pages

Hot and cold application

- 5 Pages

Elasticity and Its Application

- 3 Pages

Macroeconomics and it\'s application

- 18 Pages

Basic Definitions and Theories

- 4 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu