Define Auditing PDF

| Title | Define Auditing |

|---|---|

| Course | BSA |

| Institution | Batangas State University |

| Pages | 3 |

| File Size | 43.6 KB |

| File Type | |

| Total Downloads | 83 |

| Total Views | 138 |

Summary

What is Auditing?...

Description

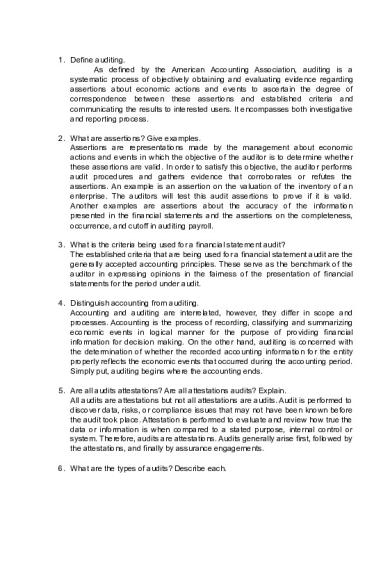

1. Define auditing. As defined by the American Accounting Association, auditing is a systematic process of objectively obtaining and evaluating evidence regarding assertions about economic actions and events to ascertain the degree of correspondence between these assertions and established criteria and communicating the results to interested users. It encompasses both investigative and reporting process. 2. What are assertions? Give examples. Assertions are representations made by the management about economic actions and events in which the objective of the auditor is to determine whether these assertions are valid. In order to satisfy this objective, the auditor performs audit procedures and gathers evidence that corroborates or refutes the assertions. An example is an assertion on the valuation of the inventory of an enterprise. The auditors will test this audit assertions to prove if it is valid. Another examples are assertions about the accuracy of the information presented in the financial statements and the assertions on the completeness, occurrence, and cutoff in auditing payroll. 3. What is the criteria being used for a financial statement audit? The established criteria that are being used for a financial statement audit are the generally accepted accounting principles. These serve as the benchmark of the auditor in expressing opinions in the fairness of the presentation of financial statements for the period under audit. 4. Distinguish accounting from auditing. Accounting and auditing are interrelated, however, they differ in scope and processes. Accounting is the process of recording, classifying and summarizing economic events in logical manner for the purpose of providing financial information for decision making. On the other hand, auditing is concerned with the determination of whether the recorded accounting information for the entity properly reflects the economic events that occurred during the accounting period. Simply put, auditing begins where the accounting ends. 5. Are all audits attestations? Are all attestations audits? Explain. All audits are attestations but not all attestations are audits. Audit is performed to discover data, risks, or compliance issues that may not have been known before the audit took place. Attestation is performed to evaluate and review how true the data or information is when compared to a stated purpose, internal control or system. Therefore, audits are attestations. Audits generally arise first, followed by the attestations, and finally by assurance engagements. 6. What are the types of audits? Describe each.

Audits can be classified according to the nature of assertion being audited or the type of the auditor performing the engagement. According to the nature of assertion: a. Financial statement audits refers to the gathering of evidence on the assertions embodied in the financial statements of an entity and using the evidence to determine whether the assertions adhere to generally accepted accounting principles (GAAP) or another comprehensive and authoritative financial reporting framework. b. Operational audit is a future-oriented, systematic, and independent evaluation or organizational activities. c. Compliance audit is used to determine whether a person or entity has adhered to laws and regulations. According to the auditor performing the engagement: a. External audits are performed by CPAs who are independent of the organizations whose assertions are being audited. b. An internal audit is an independent appraisal function established within an organization to examine and evaluate its activities as a service to the organization. c. Government audit involves the determination of whether government funds are being handled properly and in compliance with existing laws and whether the government programs of a particular agency are being conducted efficiently and economically. This is further classified into three main divisions which are compliance audit which involves the examination, audit and settlement in accordance with laws and regulations, the financial audit which is the audit of the accounting and financial system and controls to ensure reliability of recorded financial data, and the performance audit which encompasses the management and the program results audits. 7. What is the objective of a financial statement audit? The objective of an audit of financial statements is to enhance the credibility of such financial statements as the auditor expresses his opinion regarding its fairness. Such financial statements shall be presented in conformity with the GAAP. 8. What is information risk? Information risk refers to the risk that the information is misstated or misleading. This may be attributed to several factors such as the remoteness of information users from the information provider, potential bias and motives of information provider, voluminous data and complex exchange transactions. 9. What is an audit report?

The audit report is a written report which states the reasonable assurance provided by the auditor regarding the fairness of the audited financial statements. It is presented in a uniform format with suitable title to avoid confusion on the interpretation of the content and to differentiate it from other reports. 10.Describe the limitations of an audit. An audit cannot provide an absolute guarantee regarding the exactness and accuracy of assertions in the financial statements. It is only undertaken to enhance the degree of confidence of the intended users towards the audited financial statements. This is because of the inherent limitations of an audit arising from the nature of financial reporting and audit processes, and the need for the audit to be connected within a reasonable period of time at a reasonable cost. It is also necessarily limited by its scope and objective....

Similar Free PDFs

Define Auditing

- 3 Pages

Define the term homeostasis

- 1 Pages

Auditing

- 31 Pages

Auditing

- 9 Pages

Auditing

- 10 Pages

Define good news message

- 3 Pages

Auditing

- 1 Pages

Question 4.4 define stigma

- 2 Pages

Define Anarchy - Google Docs

- 2 Pages

TestBank Auditing

- 56 Pages

Auditing Problems

- 28 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu