Definition of IRR and NPV PDF

| Title | Definition of IRR and NPV |

|---|---|

| Author | 钰琪 谭 |

| Course | Property Resources and Management |

| Institution | University of Melbourne |

| Pages | 5 |

| File Size | 117.5 KB |

| File Type | |

| Total Downloads | 114 |

| Total Views | 432 |

Summary

Definition of IRR and NPV1- IRR refers to internal rate of return. This is the real annualized return to the investor over the entire investment period and takes account of not only the investor’s initial outlay, but also the net annual incomes and the capital gain from the resale at the end of the ...

Description

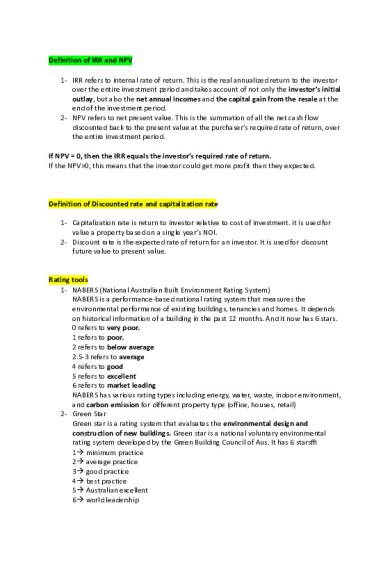

Definition of IRR and NPV 1- IRR refers to internal rate of return. This is the real annualized return to the investor over the entire investment period and takes account of not only the investor’s initial outlay, but also the net annual incomes and the capital gain from the resale at the end of the investment period. 2- NPV refers to net present value. This is the summation of all the net cash flow discounted back to the present value at the purchaser’s required rate of return, over the entire investment period. If NPV = 0, then the IRR equals the investor’s required rate of return. If the NPV>0, this means that the investor could get more profit than they expected.

Definition of Discounted rate and capitalization rate 1- Capitalization rate is return to investor relative to cost of investment. it is used for value a property based on a single year’s NOI. 2- Discount rate is the expected rate of return for an investor. It is used for discount future value to present value.

Rating tools 1- NABERS (National Australian Built Environment Rating System) NABERS is a performance-based national rating system that measures the environmental performance of existing buildings, tenancies and homes. It depends on historical information of a building in the past 12 months. And it now has 6 stars. 0 refers to very poor. 1 refers to poor. 2 refers to below average 2.5-3 refers to average 4 refers to good 5 refers to excellent 6 refers to market leading NABERS has various rating types including energy, water, waste, indoor environment, and carbon emission for different property type (office, houses, retail) 2- Green Star Green star is a rating system that evaluates the environmental design and construction of new buildings. Green star is a national voluntary environmental rating system developed by the Green Building Council of Aus. It has 6 stars: 1 minimum practice 2 average practice 3 good practice 4 best practice 5 Australian excellent 6 world leadership

Half star rating is not available. Green star has various rating types including design and as built, interiors, and communities for various property types (office, shopping center, education) Green star is not suitable for existing buildings. and NABERS is not suitable for new building.

Define sustainability from a PM perspective Sustainability means carrying out practices to make the building perform sustainably in economic dimension, social dimension and environmental dimension. For economic dimension, sustainability means durable returns to the investor, low operating costs, and building endure through having quality investments. Save costs For social dimension, sustainability means contributing to neighborhood by providing and managing social facilities. For environmental dimension, sustainability means making sure energy efficiency and low carbon emission by managing resource consumption in the building. The importance of sustainability to property management

Discuss the pros and cons of adopting more sustainable practices in their AUS portfolio Pros: more sustainable practices could promote the building’s performance in economic dimension, social dimension and environmental dimension. For example, the rental and capital value will grow, the communities could benefit from social services, and the building is more ` Cons: more sustainable practices might produce more capital expenditure and more depreciation in the future. Besides, these has a circle of blame that: landlord pays for capital improvements to save energy, however, tenant saves costs because of lower energy bills. So investors think there is no market for sustainable buildings. Explain term ‘retail premises’ as defined in the Retail Leases Act 2003. ‘Retail premises’ means: premises, not including any are intended for use as a residence, predominantly used for the sale or hire of goods by retail or the retail provision of services. Difference between lease and license A license gives a licensee a right to occupy the land but not exclusive possession – a licensee has no ability to exclude others. A existing license cannot be enforced against a purchaser. A lease can be enforced against a purchaser, but a license cannot. A license creates contractual rights but does not give the license an interest in the land.

Lease and license are appropriate in what circumstances? Café on the street with chairs and tables at the front license Retail stores on the ground floor of an apartment building, enclosed by walls. lease Leases go with the property when property sold, license doesn’t. Discuss 4 essential elements of a lease and the consequence for the owner if one element is missed from a lease To continue a lease, an agreement must identify 4 essential elements: parties (landlord, tenant), premises (clearly defined), rent (method of payment), and term (commencement date and duration, fixed or determinable date) The lease might be invalid and cannot be enforced under the law.

Key elements that an asset management plan should contain. What is the plan’s purpose and the main points to include in it. 1- Competition & SWOT analysis Who’s our competitor? Who’s in the market place? Player? How can we overcome competition? 2- Lease expiry profile WALE 3- Financial modeling of assets Market, property, suite, lease, opex, capex Fund allocation 4- Asset positioning Where are we in the market 5- Risks Regular inspections of property & premises for compliance and risks Emergency procedures & warden training Contractors – inductions/ work method statements/ risk assessment Environmental / asset liability/ asbestos Business continuity plans 6- Market analysis Market condition Main players Potential tenant identification Marketing strategies 7- Hold/sell recommendation

Describe 6 of most important elements of asset manager in managing office building. 1- Asset plan Asset manager should develop an asset plan

2- Tenant retention strategy Asset manager should have tight relationship with tenants 3- Leasing strategy Agent selection, marketing, lease proposals 4- Operations Highly understand the operation of the building 5- Risk management Regular inspection/ emergency procedures/ contractors/ environmental/ business continuity plan 6- Sustainability Design and carry out sustainability practices Property manager acts as agent or representative to owner.

What are the benefits of a Bank Guarantee over PG or SD? -

To tenant: the tenant does not have to give the landlord / bank the money, but bank will require security - To landlord: in contrast to the tenant, the provider of bank guarantee is less likely to become insolvent (破产的) ========================== Define FM and CREM and how they have different perspective on property or buildings used by organizations. CREM is corporate real estate management. CRE is the physical infrastructure that supports an organization whose primary business is not real estate which incidentally holds real estate to support its corporate mission. CREM is management of CRE to meet business needs. According to European Committee for Standardization, FM is the integration of processes within an organization to maintain and develop the agreed services which support and improve the effectiveness of its primary activities. CREM concentrates on portfolios of CREs, strategic real estate, strategic business focus. It mainly responses to corporate strategies. FM concentrates on a single property or a facility, building performance. It mainly responses to the building and the users.

How FM and CREM evolved over the last 3 decades. -

CREM 1) Before 1990s, CREM started to become a professional discipline. The job of CREM is selecting the sites to expand corporate offices. most of them are provided in-house.

2) During 1990s, CRE was considered as an organizational resource. CREM functions are out-sourcing. 3) After 2000, CREM complies to corporate strategies. CREMers need to understand the business and try to meet the need of business. -

FM 1) 1970s, the contents of FM mainly are cleaning, lifts, fire alarms, and they are inhouse. 2) 1980s, FM started to move to contract services. And the contracts also contain soft services. 3) 1990s, FM is outsourcing. There has a change of procurement of method. Specification of FM comes out. 4) 2000s, a range of other obligations come into FM. FM is not just provide services, but also manage services.

Effective interest rate - Effective interest rate is the real interest rate paid whenever the interest calculation does not coincide with the timing of the cash flow....

Similar Free PDFs

Definition of IRR and NPV

- 5 Pages

Exercise 2 (IRR & NPV)

- 8 Pages

NPV and IRR Return Measures

- 3 Pages

IRR vs NPV vs discounted payback

- 5 Pages

WACC AND NPV - WACC and NPV

- 7 Pages

Definition of Law and classification

- 15 Pages

Meaning and Definition of Retailing

- 38 Pages

Multiple and no IRR

- 2 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu