Directors duties PDF

| Title | Directors duties |

|---|---|

| Author | Megan adams |

| Course | Company & Partnership Law |

| Institution | University of Limerick |

| Pages | 4 |

| File Size | 88.8 KB |

| File Type | |

| Total Downloads | 80 |

| Total Views | 307 |

Summary

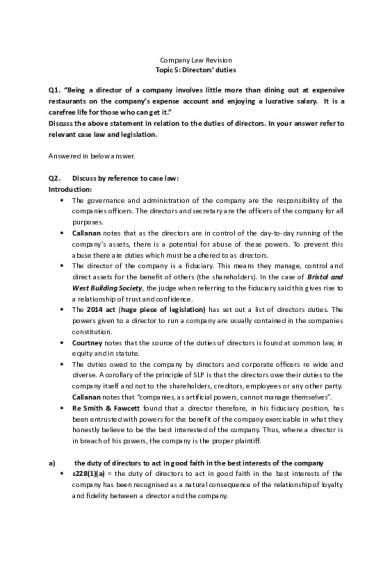

Company Law Revision Topic 5: Directors’ dutiesQ1. “Being a director of a company involves little more than dining out at expensive restaurants on the company’s expense account and enjoying a lucrative salary. It is a carefree life for those who can get it.” Discuss the above statement in relation t...

Description

Company Law Revision Topic 5: Directors’ duties Q1. “Being a director of a company involves little more than dining out at expensive restaurants on the company’s expense account and enjoying a lucrative salary. It is a carefree life for those who can get it.” Discuss the above statement in relation to the duties of directors. In your answer refer to relevant case law and legislation. Answered in below answer. Q2. Discuss by reference to case law: Introduction: The governance and administration of the company are the responsibility of the companies officers. The directors and secretary are the officers of the company for all purposes. Callanan notes that as the directors are in control of the day-to-day running of the company’s assets, there is a potential for abuse of these powers. To prevent this abuse there are duties which must be adhered to as directors. The director of the company is a fiduciary. This means they manage, control and direct assets for the benefit of others (the shareholders). In the case of Bristol and West Building Society, the judge when referring to the fiduciary said this gives rise to a relationship of trust and confidence. The 2014 act (huge piece of legislation) has set out a list of directors duties. The powers given to a director to run a company are usually contained in the companies constitution. Courtney notes that the source of the duties of directors is found at common law, in equity and in statute. The duties owed to the company by directors and corporate officers re wide and diverse. A corollary of the principle of SLP is that the directors owe their duties to the company itself and not to the shareholders, creditors, employees or any other party. Callanan notes that “companies, as artificial powers, cannot manage themselves”. Re Smith & Fawcett found that a director therefore, in his fiduciary position, has been entrusted with powers for the benefit of the company exercisable in what they honestly believe to be the best interested of the company. Thus, where a director is in breach of his powers, the company is the proper plaintiff. a)

the duty of directors to act in good faith in the best interests of the company s228(1)(a) = the duty of directors to act in good faith in the best interests of the company has been recognised as a natural consequence of the relationship of loyalty and fidelity between a director and the company.

Courtney states that the rationale for directors being in a fiduciary relationship to the company, is that, inter alia, meaning they are agents of the company and the relationship of the agent and principal will give rise to fiduciary duties. Percival v Wright – ruled that the directors duties are owed to the company and not to the shareholders. Held that no fiduciary duty was owed to the shareholders and that the directors held the power to negotiate the sale of the company. Callanan is critical of the ruling, noting “if similar circumstances arose today the director’s actions woulf likely fall foul of the insider dealing provisions of the 1990 Act”. However, McCann rationalises the court’s approach stating “it is the company as a distinct legal entity which appointed the directors, and it is therefore, to this company only that the directors owe their fiduciary duty”. Dawson International v Coats Paton plc – Lord Cullen stated that directors have but one master: the company. Re W & M Roith Ltd – the director of the company entered into an agreement with the company that upon his death his wife would receive a widow’s pension for life. The court found that the agreement was for the benefit of the widow and no consideration n had been given to the interest of the company. So for this reason the agreement was not binding on the company. Regentcrest plc v Cohen – the director failed to enforce a claim for 1.5 million. His reason for not enforcing the claim was to prevent 2 directors being involved in litigation. The court expected that the directors were acting in good faith, despite the fact we may think not pursuing this could be in ill faith the court ruled otherwise. Those who claim that a director has acted in bad faith, they must provide evidence of this fact (known as the burden of proof). This is difficult as directors don’t have to give a reason for their decisions. Re North Dublin City Milling Co Ltd – judge said “I think that law is wise in refusing to compel directors to disclose their reasons, the law allows the directors to hold their tongues. Madoff Securities Int Ltd v Raven – makes the point that if a director makes a decision and it’s not unanimous that doesn’t mean they’ve acted in bad faith, assumptions cannot be made. Courtney states a fiduciary must act in a manner which is legally becoming of his office and which places the interest of the subject ahead of his own. However, Courtney notes that there are exemptions and clarifications to the general principal that directors duties are only owed to the “company”. This is evident in the case of Brunninghausen v Glavanics – the judge refused to follow Percival v Wright and found that the directors did owe a duty to the company’s shareholders where there are negotiations for a takeover or an acquisition of the company’s undertaking which would require the loyally promote the joint interests of the shareholders.

b) the duty of directors not to use the company’s property for personal gain and to avoid conflicts of interest 228(1)(d) – the director may not use the company’s property, information or opportunities for their own or anyone else’s benefit unless this was permitted in an AGM or the constitution of the co. Industrial Development v Cooley - the director of the construction company declared ill health and resigned from his position but he had actually taken a position with the gas board. Failed to get the contract for the construction co. so he took it in his personal capacity. Co. sued him for the profit he had made but he argued the information about the contract came to him in his personal capacity. Judge ruled that he was acting in only one capacity at the time and that was as a director of the construction co. so it was his duty to relay any information he received. So he was in breach of his fiduciary duty. Peso Silver Mines Ltd v Cropper – (NB case) – this case the defendant was the director of the co. and they had declined an opportunity. The director joined with the other 2 directors and made an acquisition. The co he worked for weren’t happy and brought proceedings against him for the profit he had made. The principal developed = the court held that where a board of directors rejects an opportunity individual directors are free to take up the opportunity and retain any profits as a result. O’Donnell v Shanahan – the decision here stated the directors were in breach of their fiduciary duties by taking advantage of an opportunity without informing the co and getting its consent. This section of the 2014 act has a strict test. c) the duty of directors to use due skill, care and diligence in the performance of their functions 228(1)(g) – duty for directors to be proactive and to maintain a sufficient knowledge and understanding of the co’s business to enable them to properly discharge their duties. This was evident in the case of Re Tralee Beef Lamb Ltd. Re City Equitable Fire Ins Co. judge ruled that the duties of the directors inter se may differ and in particular the duties of a non-executive director may not be co-extensive with those of an executive director. Re D’Jan of London Ltd – the director was well educated and experienced and claimed he had certain skills so he trusted an insurance broker to complete a blank application for insurance. The court found he was in breach of his duty to be diligent and it was negligent not to read a document he had signed. Dorchester Finance Ltd v Stebbing – the 3 defendants were all directors and then there were 2 non-exec directors and each of them had an accountancy qualification or extensive accountancy experience. But no board meetings were ever held and the non-exec directors used to leave the managing of the co’s affairs to Stebbing, they’d leave blank checks for him to complete. The co issued proceedings against all of the

directors and the court held if the directors had exercised their skills the loss in question would not have arisen so the 3 directors were liable. Courtney states that a director must exercise his powers in good faith, or bona fide. A director’s intention is the deciding factor of this and can be determined by looking at the circumstance’s surrounding the director’s actions, in particular the substanbtial purpose behind the exercise, which was outlined in Smith (Howard) Ltd v Ampol Petroleum Ltd.

Conclusion: With respect to Lord Cullen’s statement to the contrary, the reality of the n=modern company law is that there appears to be an increasing number of exceptions and clarifications to the traditional principle that director’s duties are solely to the company....

Similar Free PDFs

Directors duties

- 4 Pages

Directors Duties

- 26 Pages

SU9B - Directors\' Duties 2

- 17 Pages

CH15 Directors duties remedies

- 19 Pages

Directors\' Duties PQ Structure

- 18 Pages

Directors Duties – s174

- 4 Pages

Directors duties week 4

- 6 Pages

CH15 Directors duties

- 35 Pages

Directors\' Duties Problem Essay

- 8 Pages

Directors duties final mine.

- 32 Pages

Exam Prep - Directors Duties

- 11 Pages

Notes on Directors Duties

- 7 Pages

Company Law-directors duties

- 12 Pages

Directors Duties- Cheat Sheet

- 5 Pages

Directors\' duties - exam question

- 22 Pages

CH15 Directors Duties

- 36 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu