FAR - Juan is a resident citizen, erming purely business income for taxable yearGross PDF

| Title | FAR - Juan is a resident citizen, erming purely business income for taxable yearGross |

|---|---|

| Course | Science, Technology and Society |

| Institution | Laguna State Polytechnic University |

| Pages | 10 |

| File Size | 193.9 KB |

| File Type | |

| Total Downloads | 194 |

| Total Views | 324 |

Summary

FINANCIAL ACCOUNTING & REPORTINGFAR_Earnings Per Share FAR 740-OnlineLECTURE NOTESKey definitions Ordinary share - Also known as a common share or common stock. An equity instrument that is subordinate to all other classes of equity shares.Potential ordinary share - A financial instrument or oth...

Description

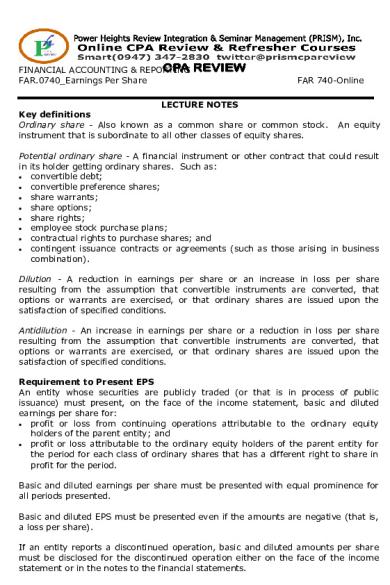

FINANCIAL ACCOUNTING & REPORTING FAR.0740_Earnings Per Share

FAR 740-Online

LECTURE NOTES Key definitions Ordinary share - Also known as a common share or common stock. instrument that is subordinate to all other classes of equity shares.

An equity

Potential ordinary share - A financial instrument or other contract that could result in its holder getting ordinary shares. Such as: convertible debt; convertible preference shares; share warrants; share options; share rights; employee stock purchase plans; contractual rights to purchase shares; and contingent issuance contracts or agreements (such as those arising in business combination). Dilution - A reduction in earnings per share or an increase in loss per share resulting from the assumption that convertible instruments are converted, that options or warrants are exercised, or that ordinary shares are issued upon the satisfaction of specified conditions. Antidilution - An increase in earnings per share or a reduction in loss per share resulting from the assumption that convertible instruments are converted, that options or warrants are exercised, or that ordinary shares are issued upon the satisfaction of specified conditions. Requirement to Present EPS An entity whose securities are publicly traded (or that is in process of public issuance) must present, on the face of the income statement, basic and diluted earnings per share for: profit or loss from continuing operations attributable to the ordinary equity holders of the parent entity; and profit or loss attributable to the ordinary equity holders of the parent entity for the period for each class of ordinary shares that has a different right to share in profit for the period. Basic and diluted earnings per share must be presented with equal prominence for all periods presented. Basic and diluted EPS must be presented even if the amounts are negative (that is, a loss per share). If an entity reports a discontinued operation, basic and diluted amounts per share must be disclosed for the discontinued operation either on the face of the income statement or in the notes to the financial statements.

Page 1 of 10

www.facebook.com/prismcpareview

FAR

PRISM CPA REVIEW

Basic EPS Basic EPS is calculated by dividing profit or loss attributable to ordinary equity holders of the parent entity (the numerator) by the weighted average number of ordinary shares outstanding (the denominator) during the period. The earnings numerators (profit or loss from continuing operations and net profit or loss) used for the calculation should be after deducting all expenses including taxes, minority interests, and preference dividends. The denominator is calculated by adjusting the shares in issue at the beginning of the period by the number of shares bought back or issued during the period, multiplied by a time-weighting factor. Contingently issuable shares are included in the basic EPS denominator if the contingency has been met. Diluted EPS Diluted EPS is calculated by adjusting the earnings and number of shares for the effects of dilutive options and other dilutive potential ordinary shares. The effects of anti-dilutive potential ordinary shares are ignored in calculating diluted EPS. Rights issue If a rights issue is offered to all existing shareholders, the number of ordinary shares to be used in calculating basic and diluted earnings per share for all periods before the rights issue is the number of ordinary shares outstanding before the issue, multiplied by the following factor: FV per share immediately before the exercise of rights Theoretical ex-rights fair value per share The theoretical ex-rights fair value per share is calculated by adding the aggregate market value of the shares immediately before the exercise of the rights to the proceeds from the exercise of the rights, and dividing by the number of shares outstanding after the exercise of the rights. Guidance on Calculating Dilution Convertible securities The numerator should be adjusted for the after-tax effects of dividends and interest charged in relation to dilutive potential ordinary shares and for any other changes in income that would result from the conversion of the potential ordinary shares. Options and warrants In calculating diluted EPS, assume the exercise of outstanding dilutive options and warrants. The assumed proceeds from exercise should be regarded as having been used to repurchase ordinary shares at the average market price during the period. The difference between the number of ordinary shares assumed issued on exercise and the number of ordinary shares assumed repurchased shall be treated as an issue of ordinary shares for no consideration. Contingently issuable shares Contingently issuable ordinary shares are treated as outstanding and included in the calculation of both basic and diluted EPS if the conditions have been met. If the

Page 2 of 10

www.facebook.com/prismcpareview

FAR

PRISM CPA REVIEW

conditions have not been met, the number of contingently issuable shares included in the diluted EPS calculation is based on the number of shares that would be issuable if the end of the period were the end of the contingency period. Restatement is not permitted if the conditions are not met when the contingency period expires. Contracts that may be settled in ordinary shares or cash Presume that the contract will be settled in ordinary shares, and include the resulting potential ordinary shares in diluted EPS if the effect is dilutive. Retrospective Adjustments The calculation of basic and diluted EPS for all periods presented is adjusted retrospectively when the number of ordinary or potential ordinary shares outstanding increases as a result of a capitalization, bonus issue, or share split, or decreases as a result of a reverse share split. If such changes occur after the balance sheet date but before the financial statements are authorized for issue, the per share calculations for those and any prior period financial statements presented are based on the new number of shares. Disclosure is required. Basic and diluted EPS are also adjusted for the effects of errors and adjustments resulting from changes in accounting policies, accounted for retrospectively. Diluted EPS for prior periods should not be adjusted for changes in the assumptions used or for the conversion of potential ordinary shares into ordinary shares outstanding. - done REVIEW QUESTONS REVIEW QUESTION: PROBLEMS 1. Strauch Co. has one class of ordinary shares outstanding and no other securities that are potentially convertible into ordinary shares. During 2015, 100,000 ordinary shares were outstanding. In 2016, the following distributions of additional ordinary shares occurred: On April 1 – Sold 20,000 treasury shares July 1 - 2-for-1 share split Profit was P410,000 in 2016 and P350,000 in 2015. What amounts should Strauch report as basic earnings per share in its 2016 and 2015 comparative income statements, respectively? a. P1.78; P3.50 b. P1.78; P1.75 c. P2.34; P1.75 d. P2.34; P3.50 2. Lapasan Company had the following capital during 2015 and 2016: Preference share capital, P100 par, 10% cumulative, 100,000 shares Ordinary share capital, P100 par, 400,000 shares

P10,000,000 40,000,000

Lapasan reported profit of P8,000,000 for the year ended December 31, 2016. Lapasan paid no preference share dividends during 2015 and paid P1,500,000

Page 3 of 10

www.facebook.com/prismcpareview

FAR

PRISM CPA REVIEW

preference share dividends during 2016. On January 31, 2017, prior to the date that the financial statements are authorized for issue, Lapasan distributed 10% ordinary share dividend. In its 2016 statement of profit or loss, what amount should Lapasan report as basic earnings per share? a. P17.50 b. P15.91 c. P16.25 d. P14.77 3. Entity B’s profit available for ordinary shareholders’ for the year ended December 31, 2015 and 2016 were P2,100,000 and P3,500,000, respectively. The ordinary shares in issue on January 1, 2016 were 800,000. Entity B offered existing shareholders’ a rights issue of one for five shares at a price of P6 per share to be exercised on April 1, 2016. The market value of Entity B’s shares on that date was P10 per share. What amounts should Entity B report as basic earnings per share in its 2016 and 2015 comparative income statements, respectively? a. P7.80; P2.63 b. P3.75; P2.45 c. P7.80; P2.45 d. P3.75; P2.63 4. West Co. had earnings per share of P15.00 for 2016 before considering the effects of any convertible securities. No conversion or exercise of convertible securities occurred during 2016. However, possible conversion of convertible bonds, not considered ordinary share equivalents, would have reduced earnings per share by P0.75. The effect of possible exercise of share options would have increased earnings per share by P0.10. What amount should West report as diluted earnings per share for 2016? a. P14.25 b. P14.35 c. P15.00 d. P15.10 5. Faith Co. had 200,000 ordinary shares, 20,000 convertible preference shares, and 1,000,000 of 10% convertible bonds outstanding during 2016. The preference share is convertible into 40,000 ordinary shares. During 2016, Faith paid dividends of P1.20 per share on ordinary shares and P4.00 per share on preference shares. Each P1,000 bond is convertible into 45 ordinary shares if converted before 2018 and 40 shares if converted after 2018. The profit for 2016 was P800,000 and the income tax rate was 30%. Diluted earnings per share for 2016 is a. P2.77 b. P3.05

c. P2.81

6. Kai Company provides the following data for the entire year: Profit Ordinary share capital, P100 par, 400,000 shares Options and warrants outstanding during the entire year: Option shares 40,000 Exercise price 200 Average market price 250 Ending market price 400

d. P3.08

P10,000,000 40,000,000

Page 4 of 10

www.facebook.com/prismcpareview

FAR

PRISM CPA REVIEW

Diluted earnings per share should be a. P25.00 b. P24.51

c. P22.72

d. P23.81

Use the following information for the next two questions. The information below pertains to Prancer Company. Profit for the year 8% convertible bonds issued at par (P1,000 per bond). Each bond is convertible into 40 ordinary shares 6% convertible cumulative preference shares, P100 par value. Each share is convertible into 3 ordinary shares Ordinary shares, P10 par value Share options (granted in a prior year) to purchase 50,000 ordinary shares at P20 per share Tax rate Average market price of ordinary shares

P1,200,000 2,000,000 3,000,000 6,000,000 500,000 40% P25 per share

There were no changes during the year in the no. of ordinary shares, preference shares, or convertible bonds outstanding. There is no treasury share. 7. Compute basic earnings per share. a. P2.00 b. P1.70

c. P1.82

d. P1.07

8. Compute diluted earnings per share. a. P1.70 b. P1.62

c. P1.66

d. P1.26

9. The income statement of Pastel Company shows a net loss of P10,000,000 for the year ended December 31, 2016. The company had share as follows: Ordinary share capital, P100 par, 400,000 shares Preference share capital, P100 par 10% cumulative, 100,000 shares convertible into 100,000 ordinary shares The basic loss per share should be a. P27.50 b. P25.00

c. P22.00

P40,000,000 10,000,000

d. P22.50

Use the following information for the next two questions. Edmund Halvor of the controller’s office of East Aurora Corporation was given the assignment of determining the basic and diluted earnings per share values for the year ending December 31, 2016. Additional information: a. The company is authorized to issue 8,000,000, P10 par value ordinary shares. As of December 31, 2015, 3,000,000 shares had been issued and were outstanding. b. The per share market prices of the ordinary shares on selected dates were as follows: Price per Share July 1, 2015 P20.00 January 1, 2016 21.00 April 1, 2016 25.00 July 1, 2016 11.00 August 1, 2016 10.50

Page 5 of 10

www.facebook.com/prismcpareview

FAR...

Similar Free PDFs

Practice EXAM for FAR

- 18 Pages

Song a far your

- 26 Pages

Qld regional profiles resident

- 55 Pages

3M IS income statement 2016

- 1 Pages

FAR summary 1 - far

- 41 Pages

A business plan for Kopinoy

- 118 Pages

A Passion for Business Essay

- 2 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu