FIN6406 Chapter 1 Practice HW PDF

| Title | FIN6406 Chapter 1 Practice HW |

|---|---|

| Author | Anonymous User |

| Course | Business Finance |

| Institution | Florida Gulf Coast University |

| Pages | 11 |

| File Size | 296.9 KB |

| File Type | |

| Total Downloads | 2 |

| Total Views | 155 |

Summary

practice HW for FIN 6406 finance class...

Description

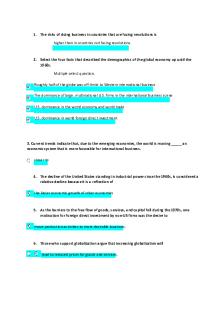

Which one of these best fits the description of an agency cost? Multiple Choice The costs of increasing the dividend payment per share The benefits received from reducing production costs per unit The payment of corporate income taxes The payment required for an outside audit of the firm The payment of interest on a firm's debts Which one of these accounts is included in net working capital? Multiple Choice Copyright Manufacturing equipment Common stock Long-term debt

Inventory Financial managers primarily create firm value by: Multiple Choice maximizing current dividends. investing in assets that generate cash in excess of their cost. lowering the earnings per share. increasing the firm's market share. maximizing current sales. The process of planning and managing a firm's long-term assets is called: Multiple Choice working capital management. cash management. cost accounting management.

capital budgeting. capital structure management. A business owned by a single individual is called a: sole proprietorship

A business formed by two or more individuals who each have unlimited personal liability for all of the firm's debts is called a: Multiple Choice corporation. sole proprietorship. general partnership. limited partnership. limited liability company. A business created as a distinct legal entity is called a: Multiple Choice corporation.

sole proprietorship. general partnership. limited partnership. unlimited liability company. The primary goal of financial management is to: Multiple Choice maximize current dividends per share of the existing stock. maximize the current value per share of the existing stock. avoid financial distress. minimize operational costs and maximize firm efficiency. maintain steady growth in both sales and net earnings. One intent of the Sarbanes Oxley Act of 2002 is to: Multiple Choice

prevent minority investors from making demands on corporations. protect corporate directors from frivolous lawsuits. guarantee the repayment of all future personal loans to corporate officers and directors. protect investors from corporate abuses. require all public corporations to "go dark" within the next twenty years. Which one of the following statements concerning a sole proprietorship is correct? Multiple Choice A sole proprietorship is difficult to form. The business profits are taxed twice at the federal level. The business profits are taxed separately from the personal income of the owner.

The owner may be forced to sell his/her personal assets to pay company debts. A sole proprietorship has an unlimited life. Which one of the following statements concerning a sole proprietorship is correct? Multiple Choice A sole proprietorship is difficult to form. The business profits are taxed twice at the federal level. The business profits are taxed separately from the personal income of the owner. The owner may be forced to sell his/her personal assets to pay company debts. A sole proprietorship has an unlimited life. A partnership: Multiple Choice is taxed the same as a corporation. terminates at the death of any limited partner.

creates an unlimited liability for all general partners for the partnership's debts. has the same ability as a corporation to raise capital. allows for easy transfer of interest from one general partner to another. One advantage of a partnership is the: Multiple Choice personal liability for all of the firm's debts. limited life of the entity. limited liability protection for all of the partners. relatively low formation cost. ease of transferring full ownership. One disadvantage of the corporate form of business ownership is the: Multiple Choice

limited liability protection provided for all owners. firm's ability to raise cash. unlimited life of the firm. difficulties encountered when changing ownership. double taxation of profits. Which one of the following business types is best suited to raising large amounts of capital? Multiple Choice Sole proprietorship Limited liability company Corporation General partnership

Limited partnership Accounting profits and cash flows are generally: Multiple Choice the same since they reflect current laws and accounting standards. the same since accounting profits reflect the timing of cash flows. different because of GAAP rules regarding the recognition of income. different because cash inflows must occur before revenue recognition. the same due to the requirements of GAAP. The decisions made by financial managers should all be ones which increase the: Multiple Choice size of the firm. growth rate of the firm.

marketability of the managers. market value of the existing owners' equity. firm's current sales. Which one of the following actions by a financial manager creates an agency problem? Multiple Choice Borrowing money when doing so creates value for the firm Lowering selling prices that will result in increased firm value Agreeing to expand the company at the expense of stockholders' value Agreeing to pay management bonuses based on the market value of the firm's stock Refusing to spend current cash on an unprofitable project The basic regulatory framework for the public trading of securities in the United States was provided by the: Multiple Choice

New York Stock Exchange when it was founded. Securities Exchange Act of 1934. Federal Reserve Bank. Securities Act of 1933 and the Securities Exchange Act of 1934. Sarbanes-Oxley Act in 2002....

Similar Free PDFs

FIN6406 Chapter 1 Practice HW

- 11 Pages

HW 1 - Quiz Practice

- 7 Pages

Chapter 1 HW Document - HW 1

- 6 Pages

Chapter 1 HW - Answers

- 3 Pages

Chapter Three HW 1

- 2 Pages

Chapter 1 HW Answers

- 4 Pages

Chapter 1 HW Answers

- 5 Pages

HW Chapter 11 part 1

- 19 Pages

Hw 1 - quest hw

- 9 Pages

HW Chapter 9 part 1

- 11 Pages

Mos chapter 1 practice

- 44 Pages

Chapter 1 - quiz practice

- 5 Pages

Chapter 1 practice material

- 7 Pages

Chapter 1 Extra Practice

- 3 Pages

Chapter 1 Practice Questions

- 37 Pages

Chapter 1 Practice

- 6 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu