Finding an Unknown Number of Periods PDF

| Title | Finding an Unknown Number of Periods |

|---|---|

| Course | Business Finance |

| Institution | University of Maryland Global Campus |

| Pages | 3 |

| File Size | 224.8 KB |

| File Type | |

| Total Downloads | 78 |

| Total Views | 163 |

Summary

Finding an Unknown Number of Periods tutorial...

Description

Finding an Unknown Number of Periods

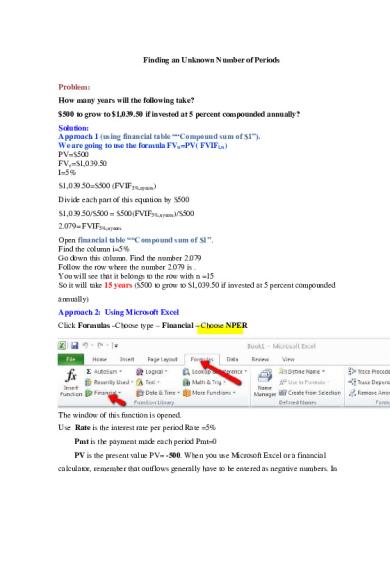

Problem: How many years will the following take? $500 to grow to $1,039.50 if invested at 5 percent compounded annually? Solution: Approach 1 (using financial table ““Compound sum of $1”). We are going to use the formula FVn=PV( FVIFi,n) PV=$500 FVv=$1,039.50 I=5% $1,039.50=$500 (FVIF5%,nyears) Divide each part of this equation by $500 $1,039.50/$500 = $500(FVIF5%,nyears)/$500 2.079= FVIF5%,nyears Open financial table ““Compound sum of $1”. Find the column i=5% Go down this column. Find the number 2.079 Follow the row where the number 2.079 is . You will see that it belongs to the row with n =15 So it will take 15 years ($500 to grow to $1,039.50 if invested at 5 percent compounded annually) Approach 2: Using Microsoft Excel Click Formulas –Choose type – Financial – Choose NPER

The window of this function is opened. Use Rate is the interest rate per period Rate =5% Pmt is the payment made each period Pmt=0 PV is the present value PV= -500. When you use Microsoft Excel or a financial calculator, remember that outflows generally have to be entered as negative numbers. In

general, each problem in Time Value of Money will have at least one cash outflow (as a negative value), and at least one cash inflow (as a positive value). This is comparable to depositing money in the bank at some point in time (an outflow), and withdrawing money from the bank at another time (an inflow). DO NOT USE $ OR COMMA WHEN ENTERING THE VALUE FV is the future value FV= 1039.50 Type 0 (the payment is made at the end of the period)

Get the result 15 years

For the Financial calculator use Use Rate =5 Pmt is the payment made each period Pmt=0 PV is the present value PV= -500 When you use Microsoft Excel or a financial calculator, remember that outflows generally have to be entered as negative numbers. In general, each problem in Time Value of Money will have at least one cash outflow (as a negative value), and at least one cash inflow (as a positive value). This is comparable to depositing money in the bank at some point in time (an outflow), and withdrawing money from the bank at another time (an inflow). FV is the future value FV= 1,039.50 CPT Interest Get the result N = 15 years...

Similar Free PDFs

Finding the Foci of an Ellipse

- 3 Pages

Limitation periods

- 1 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu