Installment Sales PDF

| Title | Installment Sales |

|---|---|

| Author | Hana Dee |

| Course | Accounting |

| Institution | De La Salle University |

| Pages | 7 |

| File Size | 154.8 KB |

| File Type | |

| Total Downloads | 35 |

| Total Views | 148 |

Summary

accounting for installment sales using IFRS16 and the previous standards...

Description

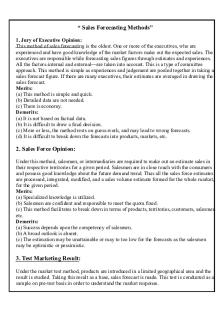

Installment Sales An installment sales contract is a special type of credit arrangement which provides for a series of payments over a period of months or years; widely used in real estate, home appliances, and cars. Since in credit, it is customary to provide interest on the unpaid balance. Likewise, the seller must protect himself from the greater risk of non-collection through a contract enabling repossession of the property if the buyer fails to pay. To minimize loss, a down payment can cover the decline in the value of the property upon sale. Methods of recognition 1. Cost recovery method - collections are first treated as cost recovery; recognize profit once collections exceed cost; collection, regardless of whether it’s principal or interest, will be part of cost; too conservative but best for products not permitting repossession 2. Gross profit realization - collections are first treated as realization of gross profit (opposite of cost recovery); lacks conservatism 3. Installment method - collections are treated as partly cost and realization of gross profit in proportion to their rates upon sale; frequently used in practice and is acceptable for income tax purposes If silent, choose installment method because the collectivity of the note is not reasonably assured. All are prescribed by the standards. Illustration: Sales = 1,000,000 Y1 = 300,000 Y2 = 400,000 Y3 = 300,000 GP rate - 40% Y1 1. Cost Recovery Profit Cost Revenue 2. GP Realization Profit Cost 3. Installment Profit Cost

300,000 300,000 300,000

120,000 (300 x .4) 180,000

Y2 100,000 300,000 400,000

Y3 300,000 300,000

100,000 300,000

300,000

160,000 240,000

120,000 180,000

Accounting procedures for installment sales 1. Separate account designations for sales, receivable, and cost of sales (just affix the word “installment”). 2. Installment receivable and deferred gross profit accounts should be maintained separately according to year of sale. 3. Journalize gross profit deferral, either at date of sale or end of period. The latter is preferred. 4. Realized gross profit must be periodically recognized in proportion to current collections (less interest). Installment Contracts Receivable • Current asset, regardless of the length of time required for its collection • Aggregated in the balance sheet, but individually accounted for per year in the notes to financial statements Installment Contracts Receivable Beginning Installment sales Collections Repossessions Write off Ending Deferred Gross Profit • aka Unrealized Gross Profit • Under the installment method, SP - COGS; decreased periodically for the amount recognized as revenue (based on GPR on date of sale) • Contra asset of Installment Contract Receivable; can also be classified as noncurrent liability Deferred Gross Profit Beginning Realized Gross Profit Repossessions Write off Ending Formulas: Installment receivable x Gross profit rate (GPR) = Deferred gross profit (DGP) Collections (during the year) x GPR (also in the year of sale) = Realized gross profit (RGP) Note: If silent, we assume that the given amount of DGP is an unadjusted (beginning) balance and the given amount of ICR is the ending balance.

Composition of collections 1. Down payment (cash) Basis of down payment: If fair value of trade in is mentioned first, then subtract that from the list price before computing down payment. If problem states that down payment is required, then compute down payment from list price. 2. Fair value of trade in (if any) 3. Amortization of installments (principal only) Trade Ins Accepting a merchandise trade in as part of the down payment. Example: Acceptance by a car dealer of a used car as partial payment for a new car. Trade in Allowance: a reduction in the price of a new item when an old item is given as part of the deal. Under/overallowance is netted against installment sales to get the adjusted sales. FV of Trade in Less: Trade in Allowance = Gain (loss) on trade in — under (over) allowance Installment sales Gain (loss) on Trade in = Adjusted installment sales Less: Cost of sales = Gross profit Doc F’s Combined Formula Installment sales FV of Trade in Less: Trade in allowance = Adjusted installment sales Less: Cost of sales = Gross profit Down payment (FV of trade in) Down payment (cash) Collections for the year = Total collections x GP Rate = RGP of Trade in Note! Use adjusted installment sales to compute for gross profit rate. If repossessed item/trade in merchandise is sold, account for it in the usual manner (either as installment or regular sale).

Different approaches on getting gross profit rate IS - Prior Year DGP, beginning RGP ÷ ICR, beginning ÷ Collections = GPR = GPR

IS - Current Year DGP of Installment Sales ÷ Installment Sales = GPR

Repossessions Seller may repossess property when buyer defaults on installment contract and no further collections can be made. Procedure: 1) Record repossessed merchandise as inventory at its fair value at date of repossession. 2) Cancel uncollected ICR balance of the defaulted contract. 3) Write-off balance of the DGP relating to the defaulted contract. 4) Recognize resulting gain or loss on repossession. Fair/appraised value of repossessed item (ESP - Reconditioning cost - Normal profit) Less: Unrecovered/uncollected cost (ICR - DGP or ICR x cost ratio) = Gain (Loss on Repossession) FV of repossessed item Estimated selling price after reconditioning cost Less: Reconditioning cost Estimated selling price before reconditioning cost Less: Normal profit = 1FV of repossessed item

Example: Estimated selling price Reconditioning cost Normal profit = FV of repossessed item Cost to sell (if given) = NRV of repossessed item

115 (10) (5) 100 (10) 90

Sales COS (100+10) = Gross profit

115 (110) 5

Est selling price before RC Reconditioning cost Est selling price after RC

105 10 115

X (X) X

Notes -

on repossession: If silent, given ESP is after reconditioning cost. If given amount is appraised value, it’s already the fair value. If given amount is wholesale value, deduct the reconditioning cost but not normal profit. If profit margin is silent, do not deduct anything. Normal profit margin = based on SP after reconditioning cost.

Schools of thought regarding recognition of gain on repossession: 1. Fully recognize the gain immediately (what we follow) - It is as if the current asset was remeasured at fair value, like in trading securities. 2. Defer the recognition of gain. Conservatism dictates that you must not overstate your assets or income. Once the repossessed asset is sold to another third party, you then recognize the gain. Maceda Law A public policy to protect buyers of real estate on installment payments against onerous and oppressive conditions. What happens to buyers who are unable to pay further? 1. Buyer paid at least 2 years of installment a. Pay without interest the balance within grace period of 1 month for every year of installment payment. Grace period to be exercised once every five years. b. When no payment – cancelled; buyer entitled to 50% of what he has paid + 5% for every year but not exceeding 90% of payments done 2. Buyer paid less than 2 years installment a. Grade period is not less than 60 days from due date b. Cancellation if failure to pay within grace period c. 30 days’ notice before final cancellation

Beginning inventory Purchases Repossessed inventory Trade in inventory = Total goods available for sale (TGAS) Less: Ending inventory (new purchases, unsold repossessed & traded in, reconditioning cost) = Cost of sales – Total Less: Cost of sales - Regular = Cost of sales – Installment (current year) If silent, assume repossession and trade in are included in ending inventory. Do not include repossessed and traded in merchandise if they are sold. RGP - 20XA (Collections for the year x GP rate for 20XA) RGP - 20XB (Collections for the year x GP rate for 20XB) = Total RGP - Installment

Income statement RGP - Regular sales (Sales – COS) RGP - Installment sales (Total) = Total RGP Gain (Less: Loss) on repossession Less: Operating expenses Interest income = Net income *Present items related to installment sales in a separate column if the amount is significant in relation to total sales revenue. Journal entries Cash Installment Contracts Receivable, 200X Installment Sales To record installment sales Cost of Installment Sales Merchandise Inventory To record cost of sales - perpetual Cost of Installment Sales Shipments on Installment Sales To record cost of sales - periodic Cash Installment Contracts Receivable, 200X Installment Contracts Receivable, 200Y Interest Income To record collections

Deferred Gross Profit, 200X Loss on Write off Installment Contracts Receivable, 200X To record write off Repossessed Inventory @ FV Deferred Gross Profit, 200X Loss on Repossession Installment Contracts Receivable, 200X Gain on Repossession To record repossession

Traded-In Inventory (@ FV) Over Allowance on Trade In Installment Contracts Receivable, 200Y Installment Sales To record installment sales with trade in

Adjusting entries Installment Sales Cost of Installment Sales Deferred Gross Profit, 200Y To set up deferred gross profit on 200Y Deferred Gross Profit, 200X Deferred Gross Profit, 200Y Realized Gross Profit To record realized gross profit Realized Gross Profit Income Summary To close RGP...

Similar Free PDFs

Installment Sales

- 7 Pages

Installment Sales

- 36 Pages

QA Installment Sales

- 3 Pages

Lesson 8 Installment Sales

- 13 Pages

Chapter 9 - Installment Sales

- 21 Pages

Chapter 6 - Installment Sales

- 37 Pages

425662626 Installment Sales Punzalan

- 33 Pages

Sales

- 4 Pages

AFAR CONSIGNMENT INSTALLMENT

- 3 Pages

Sales

- 2 Pages

Sales

- 14 Pages

Sales

- 40 Pages

CHAPTER 7 Installment Liquidation

- 20 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu