Lernzettel Finance: International Capital Market Financing PDF

| Title | Lernzettel Finance: International Capital Market Financing |

|---|---|

| Author | Andre Schroeder |

| Course | International Finance & Accounting |

| Institution | FOM Hochschule |

| Pages | 6 |

| File Size | 190.7 KB |

| File Type | |

| Total Downloads | 93 |

| Total Views | 156 |

Summary

Sommersemester...

Description

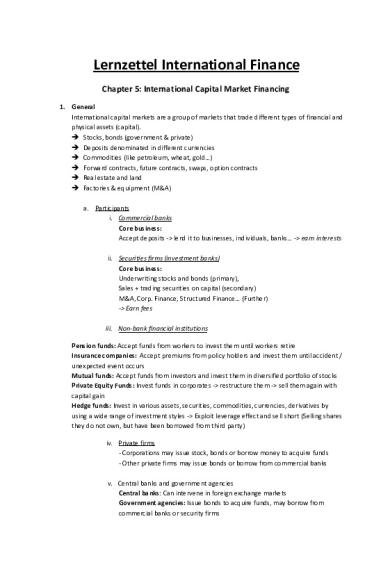

Lernzettel International Finance Chapter 5: International Capital Market Financing 1. General International capital markets are a group of markets that trade different types of financial and physical assets (capital). Stocks, bonds (government & private) Deposits denominated in different currencies Commodities (like petroleum, wheat, gold…) Forward contracts, future contracts, swaps, option contracts Real estate and land Factories & equipment (M&A) a. Participants i. Commercial banks Core business: Accept deposits -> lend it to businesses, individuals, banks… -> earn interests ii. Securities firms (investment banks) Core business: Underwriting stocks and bonds (primary), Sales + trading securities on capital (secondary) M&A, Corp. Finance, Structured Finance… (Further) -> Earn fees iii. Non-bank financial institutions Pension funds: Accept funds from workers to invest them until workers retire Insurance companies: Accept premiums from policy holders and invest them until accident / unexpected event occurs Mutual funds: Accept funds from investors and invest them in diversified portfolio of stocks Private Equity Funds: Invest funds in corporates -> restructure them -> sell them again with capital gain Hedge funds: Invest in various assets, securities, commodities, currencies, derivatives by using a wide range of investment styles -> Exploit leverage effect and sell short (Selling shares they do not own, but have been borrowed from third party) iv. Private firms - Corporations may issue stock, bonds or borrow money to acquire funds - Other private firms may issue bonds or borrow from commercial banks v. Central banks and government agencies Central banks: Can intervene in foreign exchange markets Government agencies: Issue bonds to acquire funds, may borrow from commercial banks or security firms

b. Classification of Capital Market Products Debt Capital Markets: Specify that the issuer must repay a fixed amount regardless of economic conditions (e.g. bonds and deposits) Equity Capital Markets: Specify ownership of variable profits or returns, which vary according to economic conditions 2. Debt Financing a. Features - Time restriction (has to be paid back) - Interest payments and amortization is required - No transfer of voting rights to investors - Priority handling in case of bankruptcy - Two groups of debt(depending on credit check / rating) - Investment Grade & Non-Investment Grade - Based on risk creditors charge higher margins to compensate risk b. Rating - Rating classifies creditworthiness of debt issuer (risk management) - Credit story and future cash flows are rated - Additionally intensive management discussions are taken into account - Ratings are regularly updated c. Loans - most common form of financing - flexible in terms of maturity, interest and repayment - can be customized to needs of company - Adequate guarantees are essential for granting of long-term loans - big loans are often provided by a group of lenders (syndicated) and administered by one or several commercial banks (Arrangers) i. Advantages -> Cost-effective form of financing -> Customized and flexible -> no rating required ii. Disadvantages -> Possible dependence on few creditors -> Maturity often requires refinancing -> Extensive collateral and covenants iii. Covenants Clauses in credit agreements, which give certain rights in certain situations to lenders. Breaches may lead to increasing interest payments or partial / total repayments of the loan.

Pari Passu Clause: borrower confirms that the receivables of the lender are ranked with the same position of priority Negative Pledge Clause: Borrower commits to restrictions to not provide any further collateral to existing and future loans to prevent other creditors from being preferred. Asset Disposal Clause: Borrower is subject to restrictions applying to the free determination of asset/property disposals Information Covenants: Borrower commits to provide proper information about economic and financial situation on fixed due dates to lender. Additionally providing lender with business plan for upcoming financial year. Financial Covenants: Enforce minimum requirements based on financial ratios Minimum Net Worth Clause = Equity / Total Assets Gearing = Total Debt / Equity Ratio Loan-to-Value Ratio = Loans / fair Value of properties Interest Cover Ratio = EBITDA / Net Interest expenses Debt Service Cover Ratio = EBITDA / Debt service d. Corporate Bonds Listed debt security sold by corporations to raise money from mainly institutional investors. Commits issuer to a bullet repayment of nominal value at the repayment date (maturity Date) and to continuous payment of interest (Coupon). i. Main features: - kinds of coupon payments: fixed, variable, none… - Repayment modalities: Bullet payment, annuity… - Collateral: Secured or unsecured - Bondholders priority at default: Senior or Junior - Different covenants - Maturity: Usually 10 years or less - Issued by Investment grade companies (Otherwise High-Yield/Junk Bonds) ii. Value: - Issue value > nominal value = Above par / at premium -> Agio - Issue value < nominal value = Below par / at discount -> Disagio iii. Advantages: -> Flexible terms possible -> Diversification of investor base -> Access to other capital market instruments after successful placement -> Loss covenants than loans

iv. Disadvantages: -> Rating required -> Regular investor “road shows” -> Mandatory reporting requirements -> Higher transaction costs than loans -> Forecasts required -> Intensive preparation -> High minimum volumes required (~ 100 Mio.€) e. Promissory Note Bonds (Schuldscheindarlehen) Long-term loan with bond character, granted by big large companies, insurance companies… Mostly no amortization within first 5 years, then annual amortization i. Features - Borrower must have excellent creditworthiness (rating not required) - Interest payments: between loan and corporate bonds - Volumes: 20m-100m€ - Maturity: Medium to long term (4-7 years) - Not listed, but available for sale - very fungible market between banks and insurance companies ii. Advantages / Disadvantages + Diversification of financing + No credit rating necessary + lower size than bonds - limited liquidity - big minimum size (20m€) f.

Medium Term Note – Euro MTN Listed bond under a program to cover medium to long term financing needs of a company i. Features - Papers are issued in name of a bank, which guarantees quality of MTN - Similar design to bonds with shorter terms - Possibility of smaller tranches - MTN program allows going forward to flexibly issue bonds in various currencies and with varying maturities on (euro) bond market ii. Advantages / Disadvantages + diversification of debt structure and investors + cost-effective instrument + High flexibility with individual tranches and maturities + issued notes mostly listed at exchange - Rating required - investment grade necessary

3. Mezzanine Financing (Hybrid Financing) Hybrid or mixed financing. Cannot be clearly assigned to Equity or Debt financing. a. Hybrid Bonds Mixture of debt and equity i. Features - starts with fixed interest rate - interest rate may change over very long tenor in line with bond conditions - Interest payments can be suspended if no dividends are paid and no shares are bought back - Bonds shall be serviced only after all other obligations and only before the shareholders in case of insolvency (Junior / Subordinated bond) b. Convertibel bond A bond that can be converted into a predetermined number of shares (Equity) at a predetermined share price at certain times or at maturity i. Forms Mandatory convertible: Requires conversion or redemption feature. On or before contractual conversion date, holder must convert mandatory into the underlying common stock Contingent Convertible Bonds: CoCos are hybrid capital securities that absorb losses when equity of issuing corporate falls below certain level 4. Equity Financing...

Similar Free PDFs

Capital Market

- 27 Pages

Capital Market

- 2 Pages

International Finance

- 28 Pages

Quiz Capital Market Research

- 12 Pages

TA - Capital Market Research

- 9 Pages

Capital market theory

- 4 Pages

Market Leader -Accounting Finance

- 97 Pages

Working Capital Finance

- 60 Pages

P03 Working Capital Finance

- 45 Pages

International Corporate Finance

- 2 Pages

BUS 330 International Finance

- 5 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu