Marketing principles week6 2020 PDF

| Title | Marketing principles week6 2020 |

|---|---|

| Course | Marketing Principles |

| Institution | Royal Melbourne Institute of Technology |

| Pages | 10 |

| File Size | 645.3 KB |

| File Type | |

| Total Downloads | 6 |

| Total Views | 143 |

Summary

marketing principles week 6 lecture notes 2020...

Description

Marketing principles week6

-

Price: (one of the most important elements determining a firm market share and profitability) o is the amount of money charged for a product or service. (narrow definition) o sum of all the values that customers give up in order to gain the benefits of having or using a product or service.(broad definition)

-

Why pricing is important? o Price is the only element in the marketing mix that produces revenue; all other elements represent costs. o It is one of the most flexible marketing mix elements –can be changed quickly o It is a key strategic tool for creating and capturing customer value o Prices have a direct impact the bottom line. o Part of the overall value proposition -key role in creating customer value and building customer relationships.

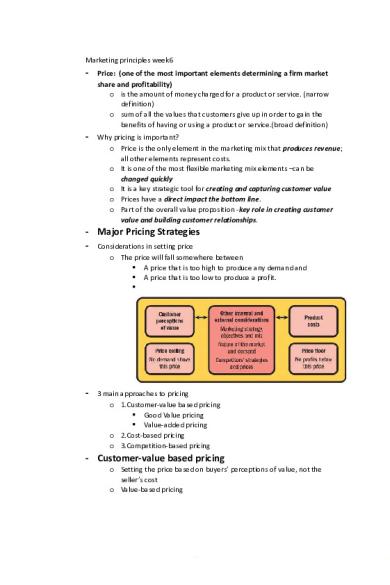

- Major Pricing Strategies - Considerations in setting price o The price will fall somewhere between A price that is too high to produce any demand and A price that is too low to produce a profit.

-

3 main approaches to pricing o 1.Customer-value based pricing Good Value pricing Value-added pricing o 2.Cost-based pricing o 3.Competition-based pricing

- Customer-value based pricing o Setting the price based on buyers’ perceptions of value, not the seller’s cost o Value-based pricing

o Cost-based pricing

-

-

2 approaches to customer-value pricing o 1. Good-value pricing o Offering just the right combination of quality and good service at a fair price. Introducing less expensive versions of established brand Redesigning existing brands to offer more quality(or same quality for less) Every-day-low-price (EDLP) vs High-low pricing o 2. Value-added pricing Rather than cutting prices to match competitors’ prices, marketers adopting this strategy attach value-added featuresand services to differentiatetheir offerings, and this supports higher prices.

-

Cost based pricing o

Setting prices based on the costs of producing, distributing and selling product, plus a fair rate of return. o The key is to manage the spread between costs and prices -how much the company makes for the customer value it delivers Companies with lower costs can set lower prices that result in smaller margins but greater sales and profits (low cost producer). Other companies intentionally pay higher costs so that they can add value and claim higher prices and margins (differentiator). o Cost-based pricing includes: Types of costs Cost-plus pricing Breakeven pricing

o Types of Costs Fixed costs (overhead)Costs that do not vary with production or sales level. Variable costsCosts that vary directly with the level of production. Total costsThe sum of the fixed costs and variable costs for any given level of production

-

Cost-plus pricing (markup pricing) is the simplest method of pricing o Add a standard markup to the cost of the product.Typically used by Professional services. o Not the best approach to pricing -ignores consumer demand and competitor pricing o Used because Sellers are more confident about the costs than the demand Links the price to cost –simplifying pricing When all companies in a market do this, it standardises the price (when costs are similar –less price competition) Sellers earn a fair return on investment o Eg

o

-

Breakeven pricing (target return pricing) o setting the price to break even on the costs of making and marketing a product, or to make the desired profit.

o

-

Competition-based pricing o Setting prices based on competitor’s strategies, costs, prices and market offerings. o Consumers make their judgments of product value by comparing the prices that competitors charge for similar products o Two approaches: High price -high margin Low price -low margin o The goal of competition-based pricing is notto match or beat competitors’ prices, ratherto set prices according to the relative value created versus competitors. o If a company creates greater value for customers, higher prices are justified.

-

Other internal and external considerations in pricing o Marketing Strategy, objectives & mix Pricing plays a role in achieving company objectives at many levels: Attract new customers or to profitably retain existing customers. Deter new competitors from entering the market to stabilise the market. Retain the loyalty of resellers or avoid government intervention. Reduced to temporarily create excitement for a brand or to help the sales of other products in the line. Price positioning strategies

o Organisational Considerations Companies handle pricing in a variety of ways

o The Market and the Demand Pricing can differ based on the types of market There are four types of markets: 1. Pure competition o Sellers cannot charge more than the going price because buyers can obtain as much as they need at that price o There are a large number of buyers and sellers for undifferentiated(commodity) products. 2. Monopolistic competition o A range of prices occurs because sellers can differentiate their offers. o Product offerings are differentiated by design, quality, brand image and product features. 3. Oligopolistic competition o Sellers are highly sensitive to each other’s pricing and marketing strategies. o Market can be dominated by a small number of large suppliers. (like the 4 banks) 4. Pure monopoly o Pricing is handled differently, depending on whether it is a government monopoly or a regulated monopoly. o Essentially, one supplier can determine price without regard for competition

-

Analysing the price-demand relationship

o The demand curve is a graph showing the relationship between price and volume sold. As price rises, quantity sold falls. o Price elasticity: A measure of the sensitivity of demand to changes in price. Elastic demand: When demand changes greatly with a small change in price Inelastic demand: When demand hardly changes with a small change in price

-

The economy o Economic factors such as boom or recession, inflation and interest rates affect pricing decisions because they affect consumer spending, consumer perceptions of the product’s price and value, and the company’s costs.

-

Other external factors o Government o Industry protection and regulation o Public policy o Social Concerns o Equity and access o Service of uneconomic markets Eg disadvantaged, special needs, remote communities

-

New-product pricing strategies o When companies bring out a new product can choose between 2 broad strategies to set the prices: o Market-skimming pricing Setting a high initial price for a new product to skim maximum revenue from the segments willing to pay the high price; the company makes fewer but more profitable sales. Market-skimming pricing makes sense only under certain conditions. the product’s quality and image supports its higher price enough buyers want the product at that price

the costs of producing a smaller volume cannot be so high that it cancels out the advantage of charging more. competitors should not be able to enter the market easily and undercut the high price typically used in shopping and speciality goods o Market-penetration pricing Setting a low price for a new product in order to attract a large number of buyers and a large market share. The high sales volume results in falling costs, allowing the companies to cut their prices even further. Market-penetration pricing makes sense under the following conditions. The market must be highly price sensitive so that a low price produces more market growth. production and distribution costs must fall as sales volume increases the low price must help keep out the competition, and the company adopting penetration pricing must maintain its low-price position –otherwise, the price advantage may be only temporary Purchase intervals are short typically used in convenience goods

-

Product-mix pricing strategies o Product-line pricingSetting prices across an entire product line Management must decide on the price steps to set between the various products in a line. Take into account cost differences between the products Account for differences in customer perceptions of the value of different features o Optional-product pricingPricing optional or accessory products sold with the main product (different kinds of kettle) o Captive-product pricingPricing products that must be used with the main product (razor, catridge and printer) (2 things or 3, etc) o By-product pricingPricing low-value by-products to get rid of them or to make money on them and the main products(tit tar from wooden chair in parks sold) o Product-bundle pricingPricing bundles of products sold together (iph, earph, in a bundle)

-

Price Adjustment Strategies o Discount and allowance pricingReducing prices to reward intermediaries for responses such as volume purchases, paying early or promoting the product.

o •Segmented pricingAdjusting prices to allow for differences in customers, products or locations.The company sells a product or service at two or more prices, even though the difference in price is not based on differences in costs Customer-segment pricing:customers pay different prices for the same product (like going to zoos, child can get for free, adults and concession diff price) Product-form pricing: different forms of the product are priced differently, but not based on costs (diff price for diff ipads) Location-based pricing: different prices for specific locations, not based on costs (going to concert) Time-based pricing: different prices for time of day, time of year etc. (PTV myki money fair 2 hr, train travel, myki eetc Revenue management (aka yield management): prices routinely set hour by hour depending on availability, demand and competitor price changes o •Psychological pricingAdjusting prices for psychological effect. (reference prices)

o •Promotional pricingTemporarily reducing prices to increase shortterm sales. o Promotional pricing can be an effective means of generating sales. However, it can be damaging if taken as a steady diet. o Includes: Discounts: off reduction from normal price to increase sales Rebates: cash back Special-event Pricing: season based Low-interest Finance / Free Maintenance: intended to reduce consumer price o Promotional pricing should not be used too frequentlyPromotional pricing is easily copied o Cause brand position and value erosion o •Geographical pricingAdjusting prices to account for the geographic location of customers. FOB-origin pricingFree on Board –title passes from seller to buyer •Uniform-delivered pricingSame price for all delivery -internet •Zone pricingBetween FOB-origin pricing and uniformdelivered pricing. The company sets up two or more zones •Basing-point pricingCharging from a point no matter where it originated. Certain cities are designated as basing points. All goods shipped from a given basis point are charged the same amount. •Freight-absorption pricingSeller absorbs all or part of the freight o •Dynamic / online pricingAdjusting prices continually to meet the characteristics and needs of individual customers and situations. Initiating price changes

When initiating prices changes (whether cuts or increases), marketers must consider… o Buyer reactions o Competitor reactions Price changes: Responding to price changes

-

Public policy and pricing

o

Public policy: Within channel levels Prohibited practices (within channels) o Price fixing: talking to competitors to fix prices o Predatory pricing: selling below cost with the intention of punishing a competitor or putting the competitor out of business Prohibited practices (across channels) o Price discrimination: offering different prices or trading terms to different customers o Resale price maintenance: Manufacturers cannot require retailers to charge specified prices o Deceptive pricing: stating or advertising prices that are not available to the customer...

Similar Free PDFs

Marketing principles week6 2020

- 10 Pages

PRINCIPLES MARKETING

- 36 Pages

Week6

- 1 Pages

Principles of Marketing LT3

- 4 Pages

Uniqlo - Marketing principles

- 18 Pages

Marketing Principles - Lecture notes

- 121 Pages

Principles of Marketing LT1

- 3 Pages

Principles of Marketing LT2

- 3 Pages

Principles of Marketing

- 25 Pages

Principles of Marketing Notes

- 45 Pages

Principles of marketing CH09

- 49 Pages

Marketing Principles Revision

- 37 Pages

Principles of marketing (vinamilk)

- 17 Pages

Principles of marketing CH14

- 52 Pages

Principles of Marketing

- 2 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu