Notes on Pledge Mortgage Chattel Mortgage and Antichresis DOC

| Title | Notes on Pledge Mortgage Chattel Mortgage and Antichresis |

|---|---|

| Author | Janet Grace Fabrero |

| Pages | 22 |

| File Size | 471 KB |

| File Type | DOC |

| Total Downloads | 94 |

| Total Views | 170 |

Summary

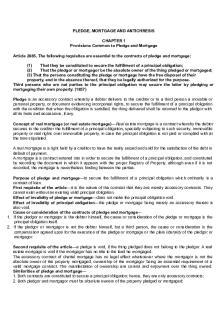

1 Notes on the Law on Pledge, Real Mortgage & Chattel Mortgage Common Provisions on Pledge and Mortgage 1. Essential Requisites common to both Pledge and Mortgage: a. They are constituted to secure fulfillment of the principal obligation. b. The pledgor or mortgagor is the absolute owner of the ...

Description

Notes on the Law on Pledge, Real Mortgage & Chattel Mortgage Common Provisions on Pledge and Mortgage 1. Essential Requisites common to both Pledge and Mortgage: a. They are constituted to secure fulfllment of the principal obligation. b. The pledgor or mortgagor is the absolute owner of the thing pledge or mortgage. c. The person constituting the pledge or mortgage have free disposal of the their property and in the absence thereof, that may be legally authorized for the purpose (Art. 2085); and d. The when the principal obligation becomes due, the things in which the pledge or mortgage consists may be alienated for the payment of the creditor. (Art. 2087) Note: a. Third persons who are not parties to the principal obligation may secure the latter by pledging or mortgaging their own property (Art. 2085). b. Any kind of obligation whether pure or conditional, including natural, voidable and unenforceable obligations may be secured by a contract of pledge and mortgage. (Art. 2091, 2052). 2. Meaning of PACTUM COMMISSORIUM It is a stipulation authorizing the creditor to appropriate the things given by way of pledge and mortgage or to dispose of them. It is declared null and void by law. (Art 2088). Reason : The amount of the loan is ordinarily much less than the value of the security. Note: The appropriation must be automatic without need of further act on the part of the debtor. Hence, the prohibition does not apply to: a. Subsequent voluntary act of the debtor of making cession of the property or; b. A promise to assign or sell said property in payment of the debt. 3. Rules on the indivisibility of Pledge and Mortgage: a. A pledge or mortgage is indivisible, even though the debt may be divided among the successors in interest of the debtor or of the creditor; b. Therefore, the debtor's heirs who has paid of the debt cannot ask for the proportionate extinguishments of the pledge or mortgage as long as the debt is not completely satisfed; c. Neither can the creditor's heirs who received his share of the debt return the pledge or cancel the mortgage, to the prejudice of the other heirs who have not been paid; d. The above rules, however, do not apply where there being in several things given in mortgage or pledge, each of them guarantees only a determinate portion of the credit. In this case, the debtor shall have a right to the extinguishments of the pledge or mortgage as the portion of the debt for each thing is especially answerable is satisfed. Examples: a. A borrowed from B P 10,000 and to guarantee payment, A pledge his diamond ring worth P 4,000 and a pair of earnings worth P 6,000. if A pays P 4,000, he cannot ask for the return of the ring because both the ring and the earnings are given to secure payment of the entire obligation of P 10,000. The same is true if A dies leaving W and X as heirs and W pays P4,000 to B. If the creditors are B and C, and A pays B P4, 000, B cannot return the ring to the prejudice of C who has not received his share. However, if it is agreed that the ring was given to secure the payment of P4,000 and the earnings, the balance of P6,000 and A (or his heir W) pays P 4,000, A (or W) can demand the return of the ring. b. A and V are jointly liable to C in the sum of P9,000 secured by A's ring worth P 5,000 and B's watch worth P4,000. If A pays P5,000 he cannot demand the 1...

Similar Free PDFs

Pledge, Mortgage AND Antichresis

- 17 Pages

Mortgage-and-pledge cases

- 4 Pages

Module 8 pledge-and-mortgage

- 15 Pages

Mortgage

- 18 Pages

Kinds OF Mortgage

- 8 Pages

Mortgage Seminar

- 5 Pages

W6 - Nationwide Mortgage Offer

- 2 Pages

Subprime mortgage crisis - Wikipedia

- 46 Pages

Notes on Antichresis

- 3 Pages

Other Mortgage Math Student-2

- 7 Pages

DEED OF REAL ESTATE MORTGAGE

- 3 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu