Tax Calculation Example Print PDF

| Title | Tax Calculation Example Print |

|---|---|

| Author | Sonia Rukhsar |

| Course | Taxation |

| Institution | Nottingham Trent University |

| Pages | 4 |

| File Size | 122.8 KB |

| File Type | |

| Total Downloads | 73 |

| Total Views | 144 |

Summary

Income Tax Notes - with worked example ...

Description

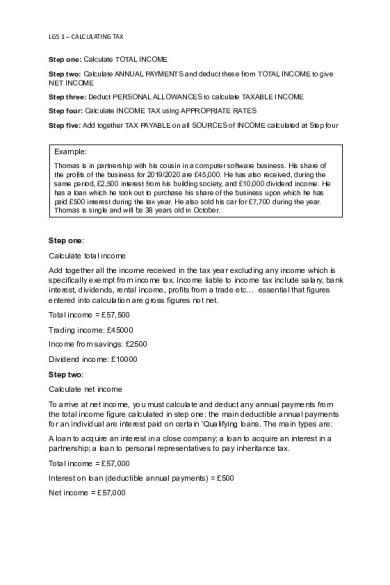

LGS 1 – CALCULATING TAX Step one: Calculate TOTAL INCOME Step two: Calculate ANNUAL PAYMENTS and deduct these from TOTAL INCOME to give NET INCOME Step three: Deduct PERSONAL ALLOWANCES to calculate TAXABLE INCOME Step four: Calculate INCOME TAX using APPROPRIATE RATES Step five: Add together TAX PAYABLE on all SOURCES of INCOME calculated at Step four

Example: Thomas is in partnership with his cousin in a computer software business. His share of the profits of the business for 2019/2020 are £45,000. He has also received, during the same period, £2,500 interest from his building society, and £10,000 dividend income. He has a loan which he took out to purchase his share of the business upon which he has paid £500 interest during the tax year. He also sold his car for £7,700 during the year. Thomas is single and will be 38 years old in October.

Step one: Calculate total income Add together all the income received in the tax year excluding any income which is specifically exempt from income tax. Income liable to income tax include salary, bank interest, dividends, rental income, profits from a trade etc… essential that figures entered into calculation are gross figures not net. Total income = £57,500 Trading income: £45000 Income from savings: £2500 Dividend income: £10000 Step two: Calculate net income To arrive at net income, you must calculate and deduct any annual payments from the total income figure calculated in step one: the main deductible annual payments for an individual are interest paid on certain ‘Qualifying loans. The main types are: A loan to acquire an interest in a close company; a loan to acquire an interest in a partnership; a loan to personal representatives to pay inheritance tax. Total income = £57,000 Interest on loan (deductible annual payments) = £500 Net income = £57,000

LGS 1 – CALCULATING TAX

Step three: Calculate taxable income Number of allowances and reliefs from tax available to individuals. Personal allowance Everyone is entitled to a personal allowance - £12,500 – this can be set off against income of any kind. Individuals with net income over £100,000 will have their personal allowance withdrawn by £1 for every £2 of net income over £100,000. An individual with income of £125,000 or above will not receive personal allowance. Marriage allowance Where spouse can transfer a maximum of £1250 of their personal allowance to their spouse because they have insufficient funds to set it off against. Personal savings allowance Either the first £1000 (basic rate taxpayer) or £500 (higher rate tax payer) of savings income will be tax free. Tax Rate Basic Rate Taxpayer Higher Rate Taxpayer Additional Rate Taxpayer

Income Band £0-37,500 £37,501-£150,000 £150,000+

PSA £1,000 £500 No PSA

Dividend allowance All taxpayers can receive up to £2,000 of dividend income free of tax in the 2019/20 tax year. Net income = £57,000 Less personal allowance = £12,500 Taxable income = £44,500 Step four Calculate income tax How much tax is actually taxable? First split the taxable income between nonsavings, savings and dividend income. This is because slightly different rates of tax apply to each type of income. Income tax applied in the following order: non-savings, savings, dividend. Rates for NON-SAVINGS income are: £0 - £37,500

20%

Basic Rate

£37,501 - £150,000

40%

Higher Rate

LGS 1 – CALCULATING TAX £150,000 +

45%

Additional Rate

Taxable income: £44,500 Savings income: £2,500 Dividend income: £10,000 NON-SAVINGS INCOME: £32,000 RATE APPLIED: £32,000 * 20% = £6,400

SAVINGS INCOME: interest received by an individual on bank or building society deposits. [£0 - £5,000

0%

Starting Rate*]

Up to £37,500

20%

Basic Rate

£37,501 - £150,000

40%

Higher Rate

£150,000 +

45%

Additional Rate

SAVINGS INCOME: £2,500 RATE APPLIED: Higher rate tax payer as taxable income was £44,500 at step three therefore allowed £500 of personal savings allowance. Taxable savings income: £2000 RATE APPLIED: £2000 * 20% = £400 income tax Dividend: Up to £37,500

7.5%

Basic Rate

£37,501 - £150,000

32.5%

Higher Rate

£150,000 +

38.1%

Additional Rate

Dividend income received: £10,000 Dividend allowance: £2000 TAXABLE DIVIDEND INCOME: £8000

LGS 1 – CALCULATING TAX

Refer to word document (only £1000 left in the basic rate band) RATE APPLIED: £1000 * 7.5% = £75 £7000 * 32.5% = £2,275 = £2,350

Step five Tax bill = Non-savings income - £6,400 Savings income – £400 Dividend income – £2,350 TOTAL = £9,150...

Similar Free PDFs

Tax Calculation Example Print

- 4 Pages

- 4 Pages

- 4 Pages

TAX - Tax

- 8 Pages

Print OC

- 45 Pages

SPI Calculation

- 2 Pages

Print Ieu

- 14 Pages

Apheresis Calculation

- 3 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu