Tax3 - tax PDF

| Title | Tax3 - tax |

|---|---|

| Course | Taxation |

| Institution | Mindanao State University |

| Pages | 23 |

| File Size | 394 KB |

| File Type | |

| Total Downloads | 107 |

| Total Views | 386 |

Summary

INTRODUCTION TO BUSINESS TAXATIONNATURE OF BUSINESS TAX Relative consumption tax – Business tax on the consumption of goods or services and is imposable only when the seller is a business. Indirect tax – the tax is collected from the seller rather than from the buyer-consumer, Privilege tax – Busine...

Description

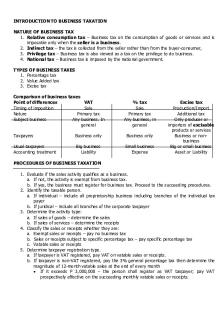

INTRODUCTION TO BUSINESS TAXATION NATURE OF BUSINESS TAX 1. Relative consumption tax – Business tax on the consumption of goods or services and is imposable only when the seller is a business. 2. Indirect tax – the tax is collected from the seller rather than from the buyer-consumer, 3. Privilege tax – Business tax is also viewed as a tax on the privilege to do business. 4. National tax – Business tax is imposed by the national government. TYPES OF BUSINESS TAXES 1. Percentage tax 2. Value Added tax 3. Excise tax Comparison of business taxes Point of differences VAT Timing of imposition Sale Nature Primary tax Subject business Any business. In general

% tax Sale Primary tax Any business, in general

Taxpayers

Business only

Business only

Usual taxpayers Accounting treatment

Big business Liability

Small business Expense

Excise tax Production/Import Additional tax Only producer or importers of excisable products or services Business or nonbusiness Big or small business Asset or Liability

PROCEDURES OF BUSINESS TAXATION 1. Evaluate if the sales activity qualifies as a business. a. If not, the activity is exempt from business tax. b. If yes, the business must register for business tax. Proceed to the succeeding procedures. 2. Identify the taxable person. a. If individual – include all proprietorship business including branches of the individual tax payer b. If juridical – include all branches of the corporate taxpayer 3. Determine the activity type: a. If sales of goods – determine the sales b. If sales of services – determine the receipts 4. Classify the sales or receipts whether they are: a. Exempt sales or receipts – pay no business tax b. Sales or receipts subject to specific percentage tax – pay specific percentage tax c. Vatable sales or receipts 5. Determine taxpayer registration type. a. If taxpayer is VAT registered, pay VAT on vatable sales or receipts. b. If taxpayer is non-VAT registered, pay the 3% general percentage tax then determine the magnitude of 12-month vatable sales at the end of every month If it exceeds P 3,000,000 – the person shall register as VAT taxpayer; pay VAT prospectively effective on the succeeding monthly vatable sales or receipts.

If it does not exceed P3,000,000 - the person shall continue paying the 3% general percentage tax on the vatable sales or receipts. 6. Determine if the goods or service offered is excisable. a. If yes, pay the applicable excise tax in addition to VAT and or percentage tax. b. If not, pay only VAT and or percentage tax.

Note: 1. Businesses normally register initially as non-VAT taxpayers, except when their projected operation is expected to exceed P3M annual VAT threshold. 2. For non-VAT registered taxpayer, the evaluation of the magnitude of vatable sales or receipts is done continuously every over a 12-month period. The taxpayer remains a non-VAT taxpayer for as long as its 12month rolling sales or receipts do not exceed the P3M annual VAT threshold. 3. Once the taxpayer becomes or registered as a VAT taxpayer, he remains as such paying VAT on vatable sales or receipts until the cancellation of his VAT registration.

WHAT IS A BUSINESS? Business refers to a habitual engagement in a commercial activity involving the sale of goods or services for a profit. Element of business: 1. Habitual engagement 2. Commercial activity HABITUAL ENGAGEMENT There must be regularity in transactions to construe the presence of a business. Isolated or casual sales are not regular activities; hence, these are presumed not made in the ordinary course of business. Habitual engagement is normally manifested by registration with the appropriate government agencies as a dealer or as a service provider in a particular trade or vocation but non-registration is not an excuse to business taxation. A casual sale transaction is not a business even if profit is derived from the transaction. On the other hand, the regular selling of goods or services for a profit is a business despite the absence of actual profit from such activity. Illustration 1 Mrs. Ellerton, a medical practitioner, sold his principal residence for P10M.

The sale of real properties by a non-realty dealer is a casual sale not made in the course of business; hence, it is exempt from the business tax. Illustration 2 Mang Merto, a realty dealer, purchased shares of stocks as investment and sold them at profit.

The acquisition and sale of stock investments by a realtor are not made in the course of the realty business and are not subject to business tax. If Merto were a security dealer, the transaction would be considered made in the course of business and hence, subject to business tax.

Illustration 3 Joshua is a proprietor regularly engaged in trading merchandise. During the month, he reported the following: Sales of merchandise Sale of personal car

P800,000 1,200,000

The 800.000 sales is subject to business tax. The P1,200,000 sales is outside the merchandising business. The same shall not be subjected to business tax since Joshua is not also a car dealer. Privilege stores Privilege stores (most commonly known as “tiangge”) are stalls or outlets not permanently fixed to the ground which are put up during special event such as festivals or fiestas (RR16-2013). To be considered a privilege store, the store should engage in a business activity for a cumulative period of not more than 15 days. Otherwise, they shall be considered regular taxpayers subject to business taxes and income tax. (Ibid) “Privilege store operators” shall not be considered habitually engaged in business considering their limited activity, they are exempt from business tax but is subject to income tax. Illustration 1 Mang Andro makes key chains and wood art for sale to tourists during the Panagbenga Festival. He rented a booth from the City of Baguio, the tiangge organizer, and recorded sales of P350,000 over the weeklong festivities.

Mang Andro is not considered habitually engaged in business. His P350,000 sales is not subject to business tax, but is subject to income tax. Illustration 2 Danes Bakeshops, an established business enterprise, also rented a booth from the organizer, City of Baguio, to sell its cakes and pastries during the Panagbenga Festival. Danes generated P400,000 sales during the event.

Danes Bakeshop is not a privilege store since it is an extablished and regularly operating business. The P400,000 sales on the event shall be subject to usual business tax. Exception to the regularity rule The sales of services by non-resident persons are presumed made in the course of business without regard as to whether the sale is regular or isolated. Our current tax law views the consumption tax on import of services a business tax. The sales of services by non-residents are subjected to the final withholding tax as previously discussed in Chapter 2. COMMERCIAL ACTIVITY Commercial activity means engagement in the sale of goods or services for a profit. The goods or services must be offered to the public with a motive to earn unrestricted amount of pecuniary gains. However the actual existence of a profit during the period is not a pre-condition to business taxation, even if the business operation results to a loss, business tax still applies.

The following are not businesses: 1. Government agencies and instrumentalities 2. Non-profit organization or association 3. Employment 4. Directorship in a corporation 5. Business for mere subsistence Government agencies and instrumentalities Agencies and instrumentalities provide essential public services. They may charge reasonable fees for services rendered but are not intended to profit but are merely costs reimbursement. Illustration The Professional Regulations Commission (PRC) collected P12,000,000 professional license fees during the month. It also earned additional P1,000,000 from rental income on its vacant premises. The P12M receipt is an income by PRC, a government agency, in rendering essential government services. This is not a commercial activity and is exempt from business tax. Leasing, on the other hand, is a commercial activity departing from the nature of government service; hence, it is subject to business tax. Non-profit or charitable organization A charitable or eleemosynary activity regularly pursued by an institution or organization is not a business because of the absence of the purpose to make profit. Illustration Union of Husbands Afraid of Wife (UHAW) is non-profit social welfare institution for the assistance of battered husbands. UHAW received P2,000,000 contributions from the public and generated P4,000,000 from the sales of the gift shops on its fund-raising drive.

The receipt of P2M contribution of donation is not subject to business tax since it is not commercial in nature. However, the selling of the gift shop is a commercial activity which is subject to business tax. The rule applies regardless of the disposition made of such fund-raising income. Employment The elements of an employer-employee relationship are discussed in detail in Chapter 10 of Income Taxation: Laws, principles and Applications by the same author. Employee benefits derived under employment is not subject to business tax but only to income tax. Illustration Jones is a job order employee contracted by the government to provide support services for office job for 6 months. Jones is paid P18,000 a month. Directorship in a corporation Although a director may not be an employee, director’s fees, per diems, and allowances are not derived in an economic or commercial activity or rendering of services to clients for a fee. Hence, these are not subject to business tax (RMC77-2008). Illustration 1

Mr. Agua is an independent director of Aga Corporation receiving director’s fees, per diems, and allowances totaling P15,000 per board meeting appearances. Mr. Agua is not subject to business tax.

Query: What if Mr. Agua is an employee of Aga Corporation? Mr. Agua’s director’s fees shall be part of his compensation income and is not likewise subject to business tax. Illustration 2 John, a certified public accountant, renders his services to clients for a fee. Is he subject to business tax? The excise of profession by regularly rendering services to clients for a fee is considered a business subject to business tax. Business principally for subsistence Business principally for subsistence or livelihood refers to business with gross sales or receipts not exceeding P100,000 per year. Marginal income earners – refer to individuals not deriving compensation income under an employeremployee relationship but who are self-employed deriving gross sales or receipts not exceeding P100,000 in any 12-month period. Examples of marginal income earners: a. Subsistential farmers or fishermen b. Small sari-sari stores c. Small carinderias or “turo-turos” d. Drivers or operators of a single unit tricycle, and e. Other similarly situated. The term marginal income earners do not include licensed professional consultants, artists, sales agents, brokers, including all others whose income have been subjected to withholding tax (RMC 72014). Although regular in operations, marginal income earners are exempt from business tax, but are subject to income tax (RR7-2012). These small businesses could not be considered commercial being merely for personal or family livelihood or subsistence. Examples of persons considered engaged in business: a. Consultants b. Sales agents of insurance or real estate including brokers c. Television or movie talents and artists d. Martial art instructors e. Cooking instructors BUSINESS TAXPAYERS The taxable person in business taxation includes any individual, trust, estate, partnership, corporation, joint venture, cooperative or association.

Rules: 1. Each person, natural or juridical, is a taxable person for purposes of business taxation 2. Husband and wife are separate taxpayers. 3. A parent company is a separate taxable person with its subsidiary company and each subsidiary company is a taxable person. 4. Home office and branch offices of the same business are one, not separate, taxable person. 5. Proprietorship is not a juridical entity. Its sales and receipts is subject to business tax to the individual proprietor. Multiple proprietorship business of the same individual are all taxable to that individual as the taxpayer.

Illustration 1 Mr. Ysmael, an accounting practitioner, has two other commercial businesses with the following receipts and sales: Mr. Ysmael’s practice P 1,200,000

Business 1 P 800,000

Business 2 P 700,000

Business 1, Business 2 and the accounting practice are not taxable persons being proprietorship businesses. The sales and receipts of these totaling P 2,700,000 shall be taxable to Mr. Ysmael as the taxable person. Illustration 2 DEF Corporation has its head office in Makati City and two branches in Manila City and Quezon City. The sales outlet has the following sales: Makati head office P2,000,000

Manila City branch P1,800,000

Quezon City branch P1,200,000

The branches are not taxable persons. The sales of the branch offices including the head office shall be taxable to DEF Corporation. The same shall be reported to the BIR RDO in the principal place of business – Makati City. Illustration 3 ABC Company has a branch in Manila City and a subsidiary, XTB Company, in Davao City. ABC Company and its branch are one entity while XTB Subsidiary is a separate entity. The transfer of goods by ABC Company to its Manila City branch is not subject to business tax. The intercompany sales made between ABC Company and its subsidiary, XTB Company, is subject to business tax. XTB Company’s transaction with the Manila branch is also a transaction with its parent, hence, taxable. Illustration 4 Dr. Jones owns a bakery registered as a proprietorship business. He also owns a clinic, also registered as a proprietorship business. His clinic occasionally purchases bread from his grocery. Dr. Jones’ children also bought breads from the bakery.

The sales between proprietorship businesses shall not be subject to business tax since the same does not involved another party. The sales made by the bakery to Dr. Jones’ children shall be subject to tax since they are different persons to Mr. Jones. Income tax exemption does not equate to business tax exemption If you still remember, the same concept of a taxable person in income taxation applies in business taxation but not income tax exemption does not necessarily mean business tax exemption.

Hence, the following persons who are exempt taxpayers from income tax are subject to business tax: 1. General professional partnership 2. Joint venture engaged in construction or oil exploration 3. Local water districts 4. Barangay micro-business enterprise TYPES OF BUSINESS TAXPAYES A taxable person shall register either as: 1. VAT taxpayer 2. Non-VAT taxpayers VAT-registered taxpayers pay 12% VAT while non-VAT registered taxpayers pay a 3% general percentage tax. BUSINESS ACTIVITIES The basis of business tax differs on the activities businesses are engaged in. Type of business activities: 1. Sales or exchange of goods or properties 2. Sales of exchange of services or lease of properties Sale of Goods or Properties Goods or Properties refers to all tangible and intangible objects which are capable of pecuniary estimation and shall include, among others: 1. Real properties held primarily for sale to customers, held for lease or is used in the ordinary course of trade or business; 2. The right or the privileges to use a patent, copyright, design or model, plan, properties or rights; 3. The right or privilege to use in the Philippines any industrial, commercial or scientific equipment; 4. The right or privilege to use motion picture films, films, tapes and discs; and 5. Radio, television, satellite transmission and cable television. Sale or Exchange of Services Sale or exchange of services shall mean the performance of all kind of services in the Philippines for others for a fee, remuneration or consideration, whether in kind or in cash, including those performed or rendered by the following: 1. Construction and service contractors 2. Stock, real estate, commercial, customs and immigration brokers

3. 4. 5. 6. 7.

Lessors of property, whether personal or real Persons engaged in warehousing services Lessors or distributors of cinematographic films Persons engaged in milling, processing, manufacturing or repacking goods Proprietors, operators, or keepers of hotels, motels, rest houses, pension houses, inns, resorts, theaters and movie houses 8. Proprietors or operators of restaurants, refreshment parlors, cafes and other eating places, including clubs and caterers. 9. Dealers in securities 10. Lending investors 11. Transportation contractors in their transport of passengers, goods or cargoes from one place in the Philippines to another place in the Philippines 12. Common carriers by air and sea relative to their transport of passengers, goods or cargoes for hire and other domestic common carries by land relative to their transport of goods or cargoes 13. Sales of electricity by generation, transmission and or distribution companies 14. Franchise grantees of electric utilities, telephone and telegraph, radio and or television broadcasting and all other franchise grantees 15. Non-life insurance including surety, indemnity and bonding companies 16. Similar services regardless of whether or not the performance thereof calls for the exercise or use of the physical or mental faculties 17. The lease of, use of, or the right or privilege to use any copyright, patent, design or model, plan, secret formula or process, goodwill, trademark, trade brand or other like property or right 18. The lease or the use of, or the right to use any industrial, commercial or scientific equipment; 19. The supply of any scientific, technical, industrial or commercial knowledge or information; 20. The supply of any assistance that is ancillary and subsidiary to and is furnished as a means enabling the application or enjoyment of any such property, or right or any such knowledge or information; 21. The supply of services by a non-resident person or his employee in connection with the use of property or right belonging to, or the installation or operation of any brand, machinery or other apparatus purchased from such non-resident person; 22. The supply technical advice, assistance or services rendered in connection with technical management or administration of any scientific, industrial or commercial undertaking, venture, project or scheme; 23. The lease of motion picture films, films, tapes and discs; and 24. The lease or the use of or the right to use radio, television, satellite transmission and cable television time. BASIS OF BUSINESS TAX PER TYPE OF ACTIVITY Sellers of goods or Sellers of services properties Basis of business tax Gross selling price Gross receipts Gross selling price Gross selling price refers to the total amount of money or its equivalent which the purchases pays or is obligated to pay to the seller in consideration of the sale, barter or exchange of goods or properties. The excise tax, if any, on such goods or properties shall form part of the gross selling price.

It includes sales made in cash, on credit and on installment basis and is analogous to the income taxation concept of ”gross sales” except only on the treatments of contingent discount. Allowable deduction from gross selling price: 1. Discounts determined and granted at the time of sale, which are expressly indicated in the invoice, the amount thereof forming part of the gross sales and are duly recorded in the books of accounts To be deductible, discounts must not be dependent upon the happening of a future event or contingency. 2. Sales returns and allowances for which a proper credit or refund was made during the month or quarter to the buyer on taxable sales. Illustration 1 A business taxpayer had the following transaction during the quarter...

Similar Free PDFs

Tax3 - tax

- 23 Pages

TAX - Tax

- 8 Pages

Tax Theory - tax rules

- 49 Pages

Tax-Remedies - Tax remedies

- 6 Pages

TAX- Chapter-1 - Tax

- 12 Pages

Quizzer TAX- Percentage-TAX

- 14 Pages

Quizzer TAX- Fringe- Benefit-TAX

- 8 Pages

Canada Tax Form - Tax Assignment

- 2 Pages

TAX 321 Chapter 17 - tax

- 13 Pages

TAX102 TAX 102 Estate Tax

- 17 Pages

6 - tax

- 14 Pages

tax amnesty

- 2 Pages

Analysis - TAX

- 4 Pages

Q1 tax

- 14 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu