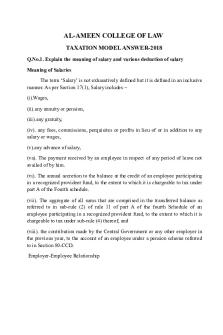

Taxation lecture notes for Finals PDF

| Title | Taxation lecture notes for Finals |

|---|---|

| Course | Tax Law |

| Institution | University of San Carlos |

| Pages | 26 |

| File Size | 2.2 MB |

| File Type | |

| Total Downloads | 85 |

| Total Views | 708 |

Summary

TAXATION II FINALS ATTY. KIM ARANAS EH 4021LOCAL TAXATIONGENERAL PRINCIPLES, LIMITATION, TAXING POWERDefinition: Basically it is a revenue raising power exercise by the local government unit in order to raise revenue enough to defray necessary expenses and the manner of levying and imposition of th...

Description

LOCAL TAXATION GENERAL PRINCIPLES , L IMITATION , T AXING POWER

Definition: Basically it is a revenue raising power exercise by the local government unit in order to raise revenue enough to defray necessary expenses and the manner of levying and imposition of the local taxes is done through the enactment or passage of what we call as an ordinance. The law is binding as far as the local government unit is concerned. The revenue that it is being raised thru the ordinance is basically the local taxes.

1. Internal Source of Local FUnd: a. Local taxes- Local taxes levied or imposed by the LGU b. Real Property Taxes- which is being collected by the Government c. Non tax revenues- These are the regulatory fees. Revenues from regulatory fees collected by the LGU or the exercise of its police power or in rendering service to the public. (Garbage collection fee, Toll fee) 2. External Source of Local Fund a. Internal Revenue Allotment (IRA) received from the National Government b. National Aid- given in times of calamities, disaster 3. Borrowings of the Local Government Unit

Fundamental Principles- Local Taxation (PIE-CUP-UP) –Must memorize 1. Levied for PUBLIC Purpose 2. The revenues collected under the code shall inure solely to the benefit of, and subject to disposition by, the LGU Levying the tax or other imposition unless otherwise specifically provided therein (The one who impose should be the one to dispose) 3. Equitable and based as much as possible on the taxpayers ability to pay 4. Not contrary to law, public policy, national economic policy, or in restraint of trade 5. Uniform in each local sub-unit 6. Collecting local taxes and other impositions shall not be let to any private person (BIR can delegate the collection to AABs but for local taxes, it cannot be delegated) 7. Not unjust, excessive, oppressive, or confiscatory 8. Each LGU shall, as far as practicable, evolve a progressive system of taxation.(not mandatory but directory as far as the LGUs are concerned.) Limits the power of the LGU in collecting local taxes. If it violates any of the fundamental principles then this would be a ground for the illegality of the imposition tax by the LGU

The power of the LGUs to collect tax is merely delegated. Delegated by this foundation of local taxing power directly granted under Section 5, Article X of the 1987 Constitution which states that “Each local government unit shall have the power to create its own sources of revenues and to levy taxes, fees and charges subject to such guidelines and limitations as the Congress may provide, consistent with the Constitutional basic policy of local autonomy. Such taxes, fees, and charges Limitations shall accrue exclusively to the local governments.” That Fundamental Principles provision is not self executory that’s why Sec. 129 of RA 7160 (sec. 130, LGC) executed the particular provision and under Sec 129 it Public hearing provides the fiscal power of the local government units. Nature of Local Taxing Power requirements Who can exercise the power of taxation? Principle of pre-emption 1. Not inherent but direct of exclusionary rule 1. Provinces grant Common limitations on 2. Cities 2. LimitedLGUs taxing Power (Sec. 3. Municipalities 3. Legislative 133, LGC) 4. Barangays 4. Territorial Take note a region is not a local territory jurisdiction. 5. Accrual of Tax LGC, Sec. 132 You have to remember that each of this local territorial 1. Sangguniang jurisdiction has its own executive and legislative branch. Panlalawigan It may be the governor, mayor or the barangay captain. 2.

Scope: 1) Local Taxation-pertains to local taxes, levies, charges as enumerated under RA 7160. For provinces (Sec 135), Municipalities (147) and so on as enumerated in the LGC 2) Real Property Taxation- It’s a local tax because collected by LGU but imposed in a nationwide scale. The rates are the same. In local taxation there is only a ceiling, in RPT it’s the same nationwide.

3. 4.

SAngguniang Panglungsod Sangguniang Pambayan Barangay Council

Local Taxation power is not inherent but granted under the Constitution. Principle of pre-emption rule simply tells us that the LGU can only subject tax only when the national gov’t did not subject it.

Sources of Local Fund

TAXATION II FINALS ATTY. KIM ARANAS EH 402 Amores, Aveztrus, Cabading, Calzado, Dela Peña, Dungog, Flores,Maceda, Nazario, Roloma, Sios-e, Tan

1

Territorial meaning to say it may only be exercised within ON THE GRANT TAX EXEMPTIONS OR TAX RELIEFS: its territorial jurisdiction. A. TAX EXEMPTIONS OR TAX RELIEFS MAY BE Accrual of tax- the local gov’t unit does not remit a share GRANTED IN CASES OF: to the national gov’t. NATURAL CALAMITIES CIVIL DISTURBANCE GENERAL FAILURE OF CROPS, OR POWERS OF THE SANGGUNIAN ADVERSE ECONOMIC CONDITIONS SUCH AS SUBSTANTIAL DECREASE IN PRICES OF AGRICULTURAL OR AGRI-BASED PRODUCTS B. THE GRANT OF EXEMPTIONS OR RELIEF SHALL BE THROUGH AN ORDINANCE. C. ANY EXEMPTION OR RELIEF GRANTED TO A TYPE OR KIND OF BUSINESS SHALL APPLY TO ALL BUSINESSES SIMILARLY SITUATED. D. ANY EXEMPTION OR RELIEF GRANTED SHALL TAKE EFFECT ONLY DURING THE NEXT CALENDAR YEAR FOR A PERIOD NOT EXCEEDING TWELVE (12) MONTHS AS MAY BE PROVIDED IN THE ORDINANCE. ABOLITION OF TAX EXEMPTION BEFORE THE LGC UNLESS OTHERWISE PROVIDED IN THOS CODE, TAX EXEMPTIONS OR INCENTIVES GRANTED TO, OR PRESENTLY ENJOYED BY ALL PERSONS, WHETHER NATURAL OR JURIDICAL, INCLUDING GOVERNMENT OWNED OR CONTROLLED CORPORATIONS EXCEPT: 1. LOCAL WATER DISTRICTS 2. COOPERATIVES DULY REGISTERED UNDER R.A. 6938 3. NON STOCK AND NON PROFIT HOSIPITALS 4. EDUCATIONAL INSTITUTIONS, ARE HEREBY WITHDRAWN UPON THE EFFECTIVITY OF THIS CODE. The power to grant tax exemption- The one who can impose the tax, is also the one that can grant the tax Take note, the imposition of fines only pertain to local exemption. taxes imposed thru an ordinance. For RPT, there is a The exemption should apply to all entities similarly separate set of provisions for RPT. situated. Not to a specific entity. May a Barangay imprison an entity for non-payment of tax? No. It can only impose a fine. IN THE CASE OF SHARED REVENUES, THE EXEMPTION OR To Adjust Local Tax Rates (Sec. 191, LGC) RELIEF SHALL ONLY EXTEND TO THE LOCAL GOVERNMENT UNIT GRANTING SUCH EXEMPTION OR RELIEF. ADJUSTMENT SHOULD BE MADE NOT OFTENER THAN ONCE EVERY FIVE (5) BUT IN NO CASE SHALLE THE ON THE GRANT OF TAX INCENTIVES: ADJUSTMENT EXCEED TEN PERCENT (10%) OF THE RATES THE TAX INCENTIVES SHALL BE GRANTED ONLY TO FIXED UNDER THE LOCAL GOVERNMENT CODE NEW INVESTMENTS IN THE LOCALITY AND THE ORDINANCE SHALL PRESCRIBE THE TERMS AND Can the LGU go higher than the ceiling or the maximum CONDITIONS THEREFOR. rate? Yes, because of the provision under Sec. 191 of the LGC but it is not unlimited. THE GRANT OF TAX INCENTIVE SHALL BE FOR A o SEC. 191. Authority of Local Government Units DEFINITE PERIOD NOT EXCEEDING ONE (1) to Adjust Rates of Tax ordinances. - Local CALENDAR YEAR. government units shall have the authority to THE GRANT OF TAX INCENTIVES SHALL BE BY adjust the tax rates as prescribed herein not ORDINANCE PASSED PERIOD TO THE FIRST (1ST ) oftener than once every five (5) years, but in no DAY OF JANUARY OF ANY YEAR. case shall such adjustment exceed ten percent ANY TAX INCENTIVE GRANTED TO A TYPE OR KIND (10%) of the rates fixed under this Code. OF BUSINESS SHALL APLY TO ALL BUSINES SIMILARLY SITUATED. GUIDE OF SANGGUNIANS IN GRANTING OF TAX Power to Prescribe Penalties for Tax violations and Limitations Thereon *Sec. 516, LGC) 1) The sanggunian of a local government unit is authorized to prescribe fines or other penalties for violation of tax ordinances o a. In no case shall fines be less than P1,000 nor more than P5,000 o b. Nor shall imprisonment be less than one (1) month nor more than six (6) months. 2) Such fine or other penalty or both shall be imposed at the discretion of the court. 3) The sanggunian barangay may prescribe a fine not less than P100 nor more tha P1,000.

EXEMPTIONS, TAX RELIEFS AND TAX INCENTIVES (ART. 282[B], RULES AND REGULATIONS IMPLEMENTING THE LOCAL GOVERNMENT CODE OF 1991]

These shared revenues pertain to local taxes wherein the proceeds are being shared by several divisions of local

TAXATION II FINALS ATTY. KIM ARANAS EH 402 2 Amores, Aveztrus, Cabading, Calzado, Dela Peña, Dungog, Flores,Maceda, Nazario, Roloma, Sios-e, Tan

territorial jurisdiction. Example: Local tax on extraction of sands, stones and other quarrying resources in public lands. The province generally imposes 10% on the FMV. The proceeds thereof is being shared by the province, municipality and barangays where the extraction is located. 30%-province, 30%-municipality, 40%-Barangay On the grant of Tax incentive is different from tax exemption. This is given for the primary purpose of encouraging new investments. So the tax incentive is granted only to new investments. Again this is only for local taxes, not for RPT. Educational institutions should also be non-stock, not profit. PEZA registered entities still pay local taxes although it is only one. 5%of gross income-2% goes to the BIR;3% to the LGU. IMPOSITION OF LOCAL T AXES

As to publication on posting it will be done 10 days after the final proposal for 3 consecutive weeks. If there’s no newspaper of general circulation in the locality, then it has to be posted in 2 conspicuous places. Doctrine of preemption or exclusion: the national government elects to tax a particular period; it impliedly holds from the local government the delegated power to tax the same field. The local taxing power is limited, unlike the power of taxation that may be exercised by the congress or national legislature which is plenary and supreme, the local taxation power is limited in the sense that it’s subject not only to the constitutional limitations but it’s also subject to fundamental principles of local taxation. COMMON LIMITATIONS List of taxes that may not anymore be imposed by local taxing authority primarily because 1) it’s a tax already imposed by the national internal revenue code; 2) it’s a tax or duties and charges which are already imposed by the tariff and customs code or 3) prohibited by public policy.

SEC. 133. Common Limitations on the Taxing Powers of Local Government Units. - Unless otherwise provided herein, the exercise of the taxing powers of provinces, cities, municipalities, and barangays shall not extend to the levy of the following: They can’t impose income tax because it’s already being imposed by the national government through the NIRC. -impose thru passage of local tax ordinance Kinds: 1) Tax ordinance specifically enumerated in LGC (RA 7160) 2) Not yet imposed by the national government or not specifically enumerated in RA 716 0 taking int o consideration the pre-emption rule. Requisites: 1)Filing of a proposal who is a member of the Sanggunian 2) After 10 days there must be a publication or posting shall be for 3 consecutive weeks. If it’s posting then it must be posted to 2 conspicuous places. 3) There has to be notification to Treasurer, the entities to be subjected to the tax 4) Public Hearing. 5) There has to be a forum in the Sanggunian 6) It has to be approved by the local chief executive. As a rule for the province the local chief executive is given 15 day, for cities the local chief executive is given 10 days to enact the ordinance. If it is not enacted, then it is deemed passed. The local chief executive may veto it but the sanggunian may override the veto by the vote of 2/3 of all the members of the sanggunian. Doctrine of Pre-emption or Exclusion - If the national government elects to tax a particular area it impliedly withholds from the Local government the local delegated power to tax the same field. Stated otherwise, If it is not taxed by the national government then the local government can tax. But not all the local government can do that. Only a specific division; Province and Barangay cannot do it. RECAP:

(a) Income tax, except when levied on banks and other financial institutions; These banks and other financial institutions, if we based on it benefits- received theory, it also requires a high degree of security as far as the local government is concerned. (b) Documentary stamp tax; Already covered by the NIRC (c) Taxes on estates, inheritance, gifts, legacies and other acquisitions mortis causa, except as otherwise provided herein; Already provided by the NIRC. “except as otherwise provided herein;” means “Except those subject to taxes on transfer or real property by provinces and cities” o For provinces, the province can collect a local tax called tax on transfers of ownership of real property. Estate tax, inheritance, gifts and legacies are all transferred but because it’s primarily covered by NIRC, the local government unit cannot anymore levy except these tax mentioned that transfers of ownership of real property. (d) Customs duties, registration fees of vessel and wharfage on wharves, tonnage dues, and all other kinds of customs fees, charges and dues except wharfage on wharves constructed and maintained by the local government unit concerned; The exception if the wharfs are being constructed and maintained

TAXATION II FINALS ATTY. KIM ARANAS EH 402 Amores, Aveztrus, Cabading, Calzado, Dela Peña, Dungog, Flores,Maceda, Nazario, Roloma, Sios-e, Tan

3

subject to OPT or 12% VAT as the case may be. “except as provided in this Code;” - tricycle operators. (e) Taxes, fees and charges and other impositions upon goods carried into or out of, or passing through, the territorial Because the LGU can regulate the operators of the jurisdictions of local government units in the guise of tricycle, then the LGU can collect taxes on gross receipts. charges for wharfage, tolls for bridges or otherwise, or other taxes, fees or charges in any form whatsoever upon such (k) Taxes on premiums paid by way of reinsurance or goods or merchandise; retrocession; These is within the ambit or jurisdiction of the bureau of Reinsurance - insurer seeks another insurer Retrocession - reinsurer seeks another insurer customs. Otherwise, if the local government will also The premiums can no longer be collected because it’s collect, it will amount to double taxation. already the second level of your insurance and it’s (f) Taxes, fees or charges on agricultural and aquatic covered under the insurance code. products when sold by marginal farmers or fishermen; Small operation is primarily described as for subsistence (l) Taxes, fees or charges for the registration of motor vehicles and for the issuance of all kinds of licenses or purposes only. It’s not primarily for commercial or sale. permits for the driving thereof, except tricycles; In letter (j) the exception is to the tricycle (g) Taxes on business enterprises certified to by the Board of In letter (l) - these are already under the mandate of the Investments as pioneer or non-pioneer for a period of six (6) and four (4) years, respectively from the date of registration; LTO They are duly registered under EO 226 or the Investments Code. It’s primarily exempt because they (m) Taxes, fees, or other charges on Philippine products enjoy the fiscal executive of income tax holiday. actually exported, except as otherwise provided herein; o Income tax holiday is where in the enterprise It’s not consumed here in Philippines this is with registered is not subject to any taxes, including consonance to the cross-border destination principle. “except as otherwise provided herein;” - still the business local taxes If pioneer enterprise – 6 years tax that is being imposed on those engaged in export If non-pioneer enterprise – 4 years business. What is being subject to local is the business Same provision under Special Economic Zone Act (SEZ) itself and not the goods or products being exported. wherein there is also the fiscal executive of income tax holiday (n) Taxes, fees, or charges, on Countryside and Barangay Pioneer enterprise - first to establish such kind of Business Enterprises and cooperatives duly registered under business in the Philippines R.A. No. 6810 and Republic Act Numbered Sixty-nine hundred thirty-eight (R.A. No. 6938) otherwise known as the (h) Excise taxes on articles enumerated under the National "Cooperatives Code of the Philippines" respectively; and Provided in Special laws Internal Revenue Code, as amended, and taxes, fees or charges on petroleum products; Articles enumerated in NIRC - tobacco, alcohol, (o) Taxes, fees or charges of any kind on the National automobiles and non-essential goods and jewelries. Government, its agencies and instrumentalities, and local government units. These are expressly listed under NIRC. You can’t transfer money from your own pockets o If a particular item is not enumerated in NIRC, the local government can still collect excess tax. Petroleum products - generic exception with no REVENUE RAISING POWERS qualification from local taxation. 1. General or common revenue raising powers - all LGU can exercise this power Petron Corporation vs. Mayor Tobias M. Tiangco, et.al. i. Reasonable Fees and charges for Services Petron questioned the imposition of excise tax by the rendered - consideration for the services rendered LGU and the CPA said that the local government is by local government units (Sec. 153) prohibited from imposing such excise tax because the Parking fees, garbage collection, going product is classified as petroleum products. to city hall and ask for business permit (i) Percentage or value-added tax (VAT) on sales, barters or ii. Public utilities charges must be owned, operated exchanges or similar transactions on goods or services and maintained by the LGUs within their jurisdiction except as otherwise provided herein; (Sec. 154) Already collected by the national government. Water facilities, terminal, markets “except as otherwise provided herein;” - you have the iii. Toll fees or charges must be funded and business taxes which may be collected by cities and constructed by the LGUs (Sec. 155) municipalities. Municipal roads or barangay roads Except: (j) Taxes on the gross receipts of transportation contractors i. Officers and enlisted men of and persons engaged in the transportation of passengers or the Armed Forces of the freight by hire and common carriers by air, land or water, Philippines (AFP) and except as provided in this Code; members of the Philippine For transportation contractors and transporting National Police (PNP) on passengers, specifically common carriers it’s already mission, subject to carriers under Other Percentage Tax. Others, like contractors which carries goods, they may be

TAXATION II FINALS ATTY. KIM ARANAS EH 402 4 Amores, Aveztrus, Cabading, Calzado, Dela Peña, Dungog, Flores,Maceda, Nazario, Roloma, Sios-e, Tan

ii.

Post office personnel in the act of delivering mail iii. Physically-handicapped, and iv. Disabled citizens who are sixty-five (65) years or older.

Not violation of constitution of freedom of the press because this is a tax on business of printing and publication. It would be a different story if you didn’t collect a business tax in other types of businesses and you just imposed it to somebody who is into printing and publication because in that sense you’re singling out that business who’s into press or publication.

May be suspended by the Sanggunian for general welfare purposes. No further conditions, so long as the 3. Franchise Tax (Sec. 137) welfare requires it. The barangay may collect toll fees and charges provided Tax rate: it was funded and constructed by the barangay. o On going business - not exceeding 50%of 1% of the gross annual receipts for the preceding 2. Specific revenue raising powers - applicable only to particular calendar year division or unit of LGU o Newly started business - not exceed 1/20 of 1% of the capital investment You are subjected to franchise tax when you’re enjoying A....

Similar Free PDFs

Taxation lecture notes for Finals

- 26 Pages

Income Taxation- Finals Quizzes

- 11 Pages

income taxation finals

- 9 Pages

Notes for Finals (Compile)

- 21 Pages

Taxation - Lecture notes 1

- 29 Pages

Guevarra - Taxation Law 1 (Finals)

- 34 Pages

Art Appreciation Notes for finals

- 17 Pages

Taxation 8 - Lecture notes 8

- 2 Pages

Taxation-Reviewer 1 lecture notes

- 12 Pages

Taxation notes

- 54 Pages

Ethics Cheatsheet FOR Finals

- 86 Pages

ORAL Anatomy Lecture Finals

- 20 Pages

Reviewer for ITC (Finals)

- 50 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu