Topic 2 Notes - Corporations Law B PDF

| Title | Topic 2 Notes - Corporations Law B |

|---|---|

| Course | Corporations Law (Governance and Control) |

| Institution | University of South Australia |

| Pages | 5 |

| File Size | 300.4 KB |

| File Type | |

| Total Downloads | 65 |

| Total Views | 122 |

Summary

Lecture and reading notes for topic 2...

Description

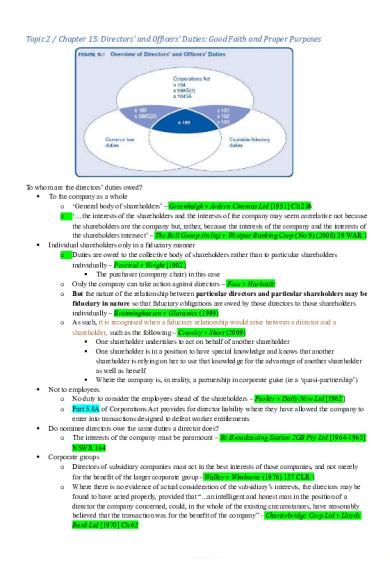

Topic 2 / Chapter 15: Directors’ and Officers’ Duties: Good Faith and Proper Purposes

To whom are the directors’ duties owed? To the company as a whole o ‘General body of shareholders’ – Greenhalgh v Ardern Cinemas Ltd [1951] Ch 286 o ‘…the interests of the shareholders and the interests of the company may seem correlative not because the shareholders are the company but, rather, because the interests of the company and the interests of the shareholders intersect’ – The Bell Group (in liq) v Westpac Banking Corp (No 9) (2008) 39 WAR 1 Individual shareholders only in a fiduciary manner o Duties are owed to the collective body of shareholders rather than to particular shareholders individually – Percival v Wright [1902] The purchaser (company chair) in this case o Only the company can take action against directors – Foss v Harbottle o But the nature of the relationship between particular directors and particular shareholders may be fiduciary in nature so that fiduciary obligations are owed by those directors to those shareholders individually – Brunninghausen v Glavanics (1999) o As such, it is recognised when a fiduciary relationship would arise between a director and a shareholder, such as the following – Crawley v Short (2009) One shareholder undertakes to act on behalf of another shareholder One shareholder is in a position to have special knowledge and knows that another shareholder is relying on her to use that knowledge for the advantage of another shareholder as well as herself Where the company is, in reality, a partnership in corporate guise (ie a ‘quasi-partnership’) Not to employees o No duty to consider the employees ahead of the shareholders – Parker v Daily New Ltd [1962] o Part 5.8A of Corporations Act provides for director liability where they have allowed the company to enter into transactions designed to defeat worker entitlements Do nominee directors owe the same duties a director does? o The interests of the company must be paramount – Re Broadcasting Station 2GB Pty Ltd [1964-1965] NSWR 164 Corporate groups o Directors of subsidiary companies must act in the best interests of those companies, and not merely for the benefit of the larger corporate group - Walker v Wimborne (1976) 137 CLR 1 o Where there is no evidence of actual consideration of the subsidiary’s interests, the directors may be found to have acted properly, provided that “...an intelligent and honest man in the position of a director the company concerned, could, in the whole of the existing circumstances, have reasonably believed that the transaction was for the benefit of the company” - Charterbridge Corp Ltd v Lloyds Bank Ltd [1970] Ch 62

S 187 - Directors of wholly owned subsidiaries may act in the best interests of the holding company, provided that The subsidiary’s constitution expressly authorises the directors to act in the interests of the holding company; The director acts in good faith; The director in fact acts in the best interests of the holding company; and The subsidiary remains solvent Creditors o Company must take account of the interests of its shareholders and its creditors – Walker v Wimborne (1976) 137 CLR 1 o The directors’ duty to a company as a whole extends in an insolvency context to not prejudicing the interests of creditors – Kinsela v Russell Kinsela Pty Ltd (1986) 4 NSWLR 722 o It did not mean that creditors had an independently enforceable duty against directors – Spies v R (2000) 201 CLR 603 ‘…the creditors are entitled to have their interests considered within (and not in addition to) the confines of the duty of the directors to act in the interests of the company’ – Westpac Banking Corp v The Bell Group Ltd (No 3) (2012) 89 ACSR 1 o

Risk taking “Directors’ duties must achieve a balance between keeping directors accountable to the interests of the company while allowing them discretion to make decisions which inevitable involve a degree of risk” – Austin & Ramsay Some argue that by increasing the duties of directors, directors have become more risk averse – Neil Young Managerialist vs Contractarian theories o Managerialist: emphasise the power that is exercised by corporate officers; the use of strong director’s duties are used as a countervailing force o Contractarian: emphasise that the corporation is merely a “nexus of contracts” and that voluntary contractual rules can be used to align the interests of directors and members (without the need for enhanced legal duties) Assumes that markets are efficient Sufficient to rely upon the power of the competitive market to discipline poor corporate governance (as reflected in low stock prices) under the so-called market for corporate control and the managerial labour market Acceptable for companies to contract out or duties of care Implications of a directors’ fiduciary duty Where a fiduciary relationship arises, equity sets a high standard of loyalty for the directors 4 key obligations o To act in good faith in the interests of the company (also a statutory duty under s 181) Aka the shareholder primacy rule A difference between the duty to act in good faith and the duty to act for a proper purpose is that the former is based on a subjective analysis while the latter is concerned with an objective analysis – Westpac Banking Corp v Bell Group Ltd (No 3) [2012] 89 ACSR 1 It should not be assumed that the honest director will necessarily be able to avoid liability simply by believing that what they were doing was for the benefit of the company – Hutton v West Cork Railway Co (1883) 23 Ch D 654 Courts will look to objective evidence that the directors actually held the belief that they were trying to benefit the company o To act for a proper purpose (also a statutory duty under s 181) Any use of power by directors that is not undertaken for the benefit of the company is an improper use of that power and therefore a breach of fiduciary duty– Mills v Mills (1938) 60 CLR 150

The Court will undertake a two-step process to decide whether a director has used a power for an improper purpose – Howard Smith Ltd v Ampol Petroleum Ltd [1974] AC 821 Determining what the purpose of the power is (that is, why does the power exist?) Deciding (as a matter of fact) what purpose the director had for exercising the power, and whether that purpose is within the range of permissible powers The following should be considered when applying this test – Permanent Building Society (in liq) v Wheeler (1994) 14 ACSR 109 Fiduciary powers granted to directors are to be exercised for the purpose for which they were given, not collateral purposes It must be shown that the substantial purpose of directors was improper or collateral to their duties as a director. The issue is not whether business decisions were good or bad; it is whether directors have acted in breach of their fiduciary duties Honest or altruistic behaviour does not prevent a finding of improper conduct. Whether acts were performed for the benefit of the company is to be objectively determined (that is, a proper purpose being a purpose to benefit the company). o However, evidence as to the subjective intentions / beliefs is relevant The court must determine whether, but for the improper or collateral purpose, the directors would have performed the act in dispute Mixed purposes Where there are a range of possible purposes, the Court will look at what motivated the exercise of power using the ’but for’ test – Mills v Mills o Would the power still have been exercised if the improper purpose did not exist? Share issues The power to issue shares may not be used to manipulate control of the company’s voting rights – Whitehouse v Carlton Hotel Pty Ltd (1987) 70 ALR 251 The directors of a company cannot ordinarily exercise a fiduciary power to allot shares for the purpose of defeating the voting power of existing shareholders by creating a new majority – Ngurli Ltd v McCann (1953) 90 CLR 425 Proper uses of the power of share allotment include: o To raise capital – Ngurli Ltd.v McCann o To foster business connections, so long as it relates to a purpose of benefitting the company as a whole (distinguished to maintaining control of the company in the hands of the directors / friends) – Harlowe’s Nominees v Woodside (Lake Entrance) Oil Co (1968) 121 CLR 483 o For an employee share scheme o As consideration for the purchase of an asset – Winthrop Investments Ltd v Winns Ltd (No 2) (1979) 4 ACLR 1 Improper purposes may include: o To entrench the existing board of directors – Whitehouse v Carlton o To fight off a hostile takeover bidder – Howard Smith o To discriminate against particular shareholders or classes of shareholders – Mills v Mills o To reconfigure the majority shareholders in the company – Howard Smith o To issue shares as part of a remuneration scheme which the director knows he or she is not entitled to - Groeneveld Australia Pty Ltd v Wouter Nolten (No 3) (2010) 80 ACSR 562 [2010] VSC 533 To avoid conflicts of interest (ie duty of loyalty) Duty not to make secret profits

o o

Breach of statutory duty to act in good faith and for a proper purpose S 181 is a civil penalty provision o S 181 breached only when a director ‘engages in conduct, knowing that it is not in the interests of the company’ – ASIC v Maxwell (2006) 59 ACSR 372 o Acting negligently in failing to protect the company’s interests is not proof of breach of s 181. Some positive knowledge is required (this is objectively assessed) – ASIC v Sydney investment House Equities Pty Ltd (2008) 69 ACSR 1 S 184(1) is a criminal offence (reckless or intentionally dishonest) Civil remedies at general law Only the company can seek remedies (not ASIC) – ASIC v Adler (2002) 41 ACSR 72 Remedies o Equitable compensation o Rescission of the contract o An account of profits o Constructive trust o Injunction Statutory remedies for breach of ss 181-183 ASIC can seek o Declaration order o Pecuniary penalty under s 1317G (civil penalty order) Requires a declaration of a contravention under s 1317E o Disqualification order under s 206C Requires a declaration of a contravention under s 1317E o Compensation under s 1317H o Enforcement of the criminal penalties, where the conduct is recklessly or intentionally dishonest – s 184(1) Company can only seek o Compensation under s 1317H Defences Defences to disclosure o Only for breaches of duty under general law o There must be sufficient disclosure to excuse the bad faith. If disclosed appropriately, this may be a defence – Groenveld Australia Pty Ltd v Wouter Nolten (No 3) (2010) 80 ACSR 562 ‘I have an interest’ is not enough; must be sufficient / full disclosure o Must obtain fully informed consent - Duncan v Independent Commission Against Corruption [2016] NSWCA 143 Relief from liability – ss 1317S and 1318 o Only applies to civil matters and requires that The person has acted honestly Having regard to all the circumstances of the case, including those connected to the person’s appointment, the person ought to be excused from liability

o

Indemnification S 199A(1): A company or a related body corporate must not exempt a person (whether directly or through an interposed entity) from a liability to the company incurred as an officer or auditor of the company” S 199A(2): A company or a related body corporate must not indemnify a person …against (a) a liability owed to the company or a related body corporate; (b) a liability for a pecuniary penalty order under section 1317G or a compensation order under section 961M, 1317H, 1317HA or 1317HB; (c) a liability that is owed to someone other than the company or a related body corporate and did not arise out of conduct in good faith. The subsection does not apply to a liability for legal costs S 199A (3): A company or related body corporate must not indemnify a person (whether by agreement or by making a payment and whether directly or through an interposed entity) against legal costs incurred in defending an action for a liability incurred as an officer or auditor of the company if the costs are incurred: (a) in defending or resisting proceedings in which the person is found to have a liability for which they could not be indemnified under subsection (2); or (b) in defending or resisting criminal proceedings in which the person is found guilty; or (c) in defending or resisting proceedings brought by ASIC or a liquidator for a court order if the grounds for making the order are found by the court to have been established; or (d) in connection with proceedings for relief to the person under this Act in which the Court denies the relief. Paragraph (c) does not apply to costs incurred in responding to actions taken by ASIC or a liquidator as part of an investigation before commencing proceedings for the court order.

o

Insurance S 199B prohibits the company paying for an officer’s insurance coverage in respect of liability for wilful breach of duty or a contravention of ss 182 & 183

Criminal actions against directors All provisions in the Corporations Act 2001 (Cth) are criminal (unless the specific provision states otherwise) – s 1311 No requirement that prosecution prove that the defendant derived any benefit from their breach of duty, just that they had breached said duty – R v Wilkie (2008) 220 FLR 2230 Penalties to breaches o Subject to Schedule 3, the standard criminal penalty is five penalty units ($1,050) – s 1311(5) A penalty unit is $210 as at July 2017 – s 4AA Crimes Act 1914 (Cth) o Max criminal penalties for individual offenders are set at 2000 penalty units ($420,000) and/or 5 years imprisonment – Sch 3 o Corporate offenders face fines x5 that of an individual (max $2.1 million), in lieu of a term of imprisonment – s 1312 o Penalty notices may be issued by ASIC – s 1313 o Criminal prosecution may be commenced by ASIC and/or DPP – s 1315 o Prosecutions must be commenced within 5 years of the contravention – s 1315 Double jeopardy rule – Adler v DPP (2004) 51 ACSR 1 o The court found that the criminal charges were not an abuse of process because (despite the punitive nature of civil penalties), obtaining civil penalty orders was not a ‘prosecution’ of Adler...

Similar Free PDFs

Topic 9 Notes - Corporations Law A

- 10 Pages

Corporations Law Lecture Notes

- 66 Pages

Corporations Notes

- 4 Pages

Corporations law W3 S9

- 11 Pages

Corporations notes

- 3 Pages

Consumer 2 Topic 1 - law notes

- 4 Pages

Notes for Topic 2 Land Law

- 17 Pages

Land Law 2 Topic 9

- 11 Pages

Constitutional Law Essay Topic 2

- 3 Pages

Property Law B Table Notes

- 31 Pages

Topic 2 psych notes

- 18 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu