Tutorial Solutions - Chapter 8 (IM-6e)Tutorial Solutions of Accounting Management system PDF

| Title | Tutorial Solutions - Chapter 8 (IM-6e)Tutorial Solutions of Accounting Management system |

|---|---|

| Course | FINANCIAL MANAGEMENT |

| Institution | Federation University Australia |

| Pages | 8 |

| File Size | 329.8 KB |

| File Type | |

| Total Downloads | 28 |

| Total Views | 123 |

Summary

Accounting management tutorial questions and solutions for 2021 exam and mid term tests, are very useful....

Description

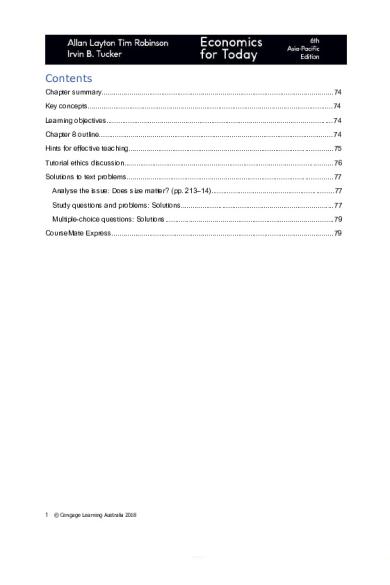

Contents Chapter summary..................................................................................................................... 74 Key concepts............................................................................................................................ 74 Learning objectives.................................................................................................................. 74 Chapter 8 outline...................................................................................................................... 74 Hints for effective teaching....................................................................................................... 75 Tutorial ethics discussion......................................................................................................... 76 Solutions to text problems........................................................................................................ 77 Analyse the issue: Does size matter? (pp. 213–14)..............................................................77 Study questions and problems: Solutions.............................................................................77 Multiple-choice questions: Solutions.....................................................................................79 CourseMate Express................................................................................................................ 79

1 © Cengage Learning Australia 2018

Economics for Today Instructor’s Manual

Chapter 8 Monopoly Chapter summary This chapter examines the market structure of monopoly. The characteristics of a monopoly are that it is a single seller, the product produced is unique and there are barriers to entry. Barriers to entry may include ownership of a vital resource, legal barriers or economies of scale. The latter barrier also leads to what is known as a natural monopoly. Being a single seller of a product with no close substitutes means that the monopoly is a price maker. That is, it sets the price in the market by producing an output level that maximises its profits thereby effectively determining market supply, this in turn sets the market price. The monopolist faces the market demand curve. Therefore, the monopolist’s marginal revenue curve lies below the market demand curve it faces. The profit-maximising output is still where marginal revenue (MR) equals marginal cost (MC). Long-run economic profits are expected for a monopolist because of the strong barriers to entry, which limit others from entering and competing in the market. Monopolies may price discriminate in order to increase their profits if they are able to do so. Price discrimination means the firm is charging different prices to different people where those price differences are not a reflection of cost differences. A comparison with perfect competition is also made in order to look at the disadvantages of a monopoly and advantages of perfect competition. The chapter concludes with an analysis of the pros and cons of monopoly.

Key concepts

Monopoly Natural monopoly

Price maker

Price discrimination Arbitrage

Learning objectives After completing this chapter, students should be able to: Understand the characteristics of the monopoly market structure.

Explore the price and output decisions for a monopolist. Learn how monopolists can engage in a practice known as price discrimination.

Understand the case against and for monopoly by comparing monopoly and perfect competition.

Chapter 8 outline Introduction The monopoly market structure Single seller Unique product Barriers to entry Ownership of a vital resource Legal barriers 2 © Cengage Learning Australia 2015

Chapter 8: Monopoly

Global perspective: Tesla: swapping one barrier for another? Economies of scale Exhibit 8.1: Minimising costs in a natural monopoly Price and output decisions for a monopolist Marginal revenue, total revenue and price elasticity of demand Exhibit 8.2: Demand, marginal revenue and total revenue Monopoly in the short run Exhibit 8.3: Profit maximisation and loss minimisation for a monopolist Monopoly in the long run Price discrimination Conditions for price discrimination Exhibit 8.4: Price discrimination Economics and ethics You’re the economist: What do publishers, car makers, developers and flat-pack furniture deliverers have in common? Comparing monopoly and perfect competition: The case against and for monopoly The monopolist as a resource misallocator Exhibit 8.5: Comparing a perfectly competitive firm and a monopolist Perfect competition means more output for less Exhibit 8.6: The impact of monopolising an industry The case against and for monopoly Analyse the issue: Does size matter? Key concepts Summary Study questions and problems Answer to ‘You’re the economist’ Multiple-choice questions CourseMate Express

Hints for effective teaching 1

Ask your students to give some examples of monopoly markets. In the past, some examples included local telephone services, local cable TV and utilities companies. But note that times have changed and that competition is the main driving force towards efficiency and productivity. Note also that monopolies can be found at the local level (e.g. the only service station or hotel in small town).

2

Point out that many real-world monopolies are natural monopolies, which are governmentowned or government-regulated. Ask students to explain this, and then discuss economies of scale.

3

Students may have had some difficulty with P = D = MR = AR in perfect competition, but they can struggle, too, with having separate D and MR curves in monopoly. Take them through an example, such as in Exhibit 8.2, so that they can see why the demand curve is downward-sloping and why the marginal revenue curve will, therefore, be below the demand curve. Once this is established, then, using a diagram, you can add the MC curve and identify the point where MR = MC. Remind students that this is the profit-maximising output rule –

3

© Cengage Learning Australia 2018

Economics for Today Instructor’s Manual

4

5

6

7

for all market structures. However, in perfect competition, it would end here, since we would have profit-maximising output (where MR = MC) and price (as P = MR). For monopoly, we have the profit-maximising output by going down to the horizontal axis to find the quantity at the point where MR = MC, but then we need to see what P relates to this Q by going up to the demand curve. This means that the monopolist will maximise profit by charging a price above marginal cost. Following on from profit maximisation, it is then possible to add the ATC curve to see whether the monopolist will be making a profit or loss. This is important; students often expect that, because it is a price taker, the monopoly will never make a loss. Remind them again of what the demand curve is telling them. Even though it is the market demand curve as well as the monopoly demand curve, it is necessary to lower the price to sell more. Have students think of some examples of price discrimination. These could include doctors’ services, movie theatres, flights and university fees, since students are likely to have experienced price discrimination in these cases. Stress the negative social outcomes associated with monopolised markets. It would also be useful to compare the negativity in light of perfect competitive markets. However, keep an open mind and explore some of the positives associated with monopoly, especially natural monopolies. Point out that the ACCC is charged with combating the growth of monopoly power. Moreover, this is a most effective way to combat monopoly power. In the text, the discussion in ‘Analyse the issue: Does size matter?’ would be a good one to examine. You could use an example of airports, which could be seen as a natural monopoly achieving economies of scale (it is hardly practical to have multiple airports in a relatively small city), but which attract attention from the ACCC for use of their monopoly power in providing and charging for various services, including parking. Do a search on the ACCC site (http://www.accc.gov.au) for its annual report on airport performance. The ACCC will permit a monopoly if the social benefits outweigh its social costs.

Tutorial ethics discussion 1 2

The goal of price discrimination is to increase further the profits of a monopolist. Does this mean that price discrimination is essentially unfair and unethical? Monopolies could behave like a perfectly competitive industry. They could, for example, set S = D rather than MR = MC and thereby increase quantity and decrease prices. Should the government force monopolies to behave like perfectly competitive industries?

4 © Cengage Learning Australia 2015

Chapter 8: Monopoly

Solutions to text problems Analyse the issue Does size matter? (pp. 213–14) 1

In order to become competitive internationally, firms must do more than just reduce their input cost levels; they need to reduce their prices to the world price. This is possible with economies of scale, which can be achieved through mergers with other firms producing similar products or services.

2

Mergers were approved because the ACCC determined that these mergers did not significantly reduce competition in the Australian market. These mergers, it is believed, will improve the welfare of the public. That is, the social benefit was greater than the social cost. Use the ACCC website (http://www.accc.gov.au) to find instances of where mergers have or have not been approved and why or why not.

Study questions and problems: Solutions (pp. 215–16) 1

2

a The fact that there is only one casino in the city indicates that it has monopoly power within the city because it is the only provider of gambling activities and the product is unique. In Australia, casinos need licenses issued by the relevant state or territory government. b The government of New South Wales owns the Sydney Harbour Bridge and gives a permit for one company to organise bridge climbing. Hence, the product/service is unique, with only one supplier/seller. c The supplier of the NBN operates as a natural monopoly in which average costs decline continuously as output increases in the long run. There is a large set-up cost related to the NBN, which is why there is only one NBN. A key argument in favour of monopoly is the possibility of price discrimination. A monopoly situation enables price discrimination under certain conditions. Price discrimination increases the economic welfare of some segments of society. For example, as the textbook points out, ‘price discrimination means that lower prices are available to the needy when they use public transport, visit the hairdresser or use doctors’ and lawyers’ services’. In other words, some buyers are prevented from being excluded from consuming some products or services. Furthermore, since a monopolist produces less at a higher price, it can be argued that such a system reduces waste. In some cases, a monopoly situation is also good for the environment, which in turn increases human welfare.

3

There are three conditions for price discrimination. First, the market can be divided into segments. Second, each market segment differs with respect to the price customers are willing to pay and the PED for the product. Third, it is not possible to buy a product purchased in the low-price market segment and resell it in the high-price market segment.

4

In the inelastic range of the demand curve, MR is negative while MC is positive. Because the monopolist will profit maximise by setting MR equal to MC and since MC is always positive, then MR must be positive. That is, it will always operate where demand is elastic.

5 Price ($)

5

Quantity demanded

Total revenue ($)

Marginal revenue ($)

Price elasticity of demand

© Cengage Learning Australia 2018

Economics for Today Instructor’s Manual

5.00

0

0

– elastic

4.50

4

18

4.50 elastic

4.00

8

32

3.50 elastic

3.50

12

42

2.50 elastic

3.00

16

48

1.50 elastic

2.50

20

50

2.00

24

48

–.50 inelastic

1.50

28

42

–1.50 inelastic

1.00

32

32

–2.50 inelastic

0.50

36

18

–3.50 inelastic

0.00

40

0

–4.50 inelastic

.50 unit elastic

This graph below is similar to what was shown in Exhibit 5.5. Figure 8A-1

6

Output will be 5, where MR = MC (see Figure 8A-1) so price will be $2.50 (see the table in question 5 above or figure for P when Q = 5), and this gives us profit of $12.50 (see the table or figure). The price elasticity of demand is unit-elastic. If MC > 0, the price will be above $2.50 and output will be less than 5 (see the table or figure).

7

The fixed cost of producing software, such as operating systems, is very high, but the marginal cost of producing another copy of the system is zero. If I were to load an updated version Windows to my PC, it might cost me money to buy it, but it costs Microsoft nothing to produce an extra copy.

8

See Figure 8A-2. Before the takeover, the price of lawn mowing is Pc and the output is Qc. Since Pc = MC, the allocation of resources to the perfectly competitive mowing service is efficient. After the takeover, the price rises to Pm, and the quantity supplied falls to Qm. To profit maximise, the monopolist equates MR and MC, with P > MC. As a result, resources are under-allocated to a monopolistic lawn-mowing business. Because there are no barriers to entry, the monopoly would not survive.

6 © Cengage Learning Australia 2015

Chapter 8: Monopoly

7

© Cengage Learning Australia 2018

Economics for Today Instructor’s Manual

Figure 8A-2

9

The reason why this occurs is that the firm that sells the clothing and shoes intends to compete in all segments of the market by selling at a single price. Hence, no market segment is left out. It can also reduce certain administrative costs (e.g. advertisements, printing different price labels, etc.) by charging a single price. Thus, this strategy is quite attractive to consumers and increases the profits of the seller (larger quantity sold). There is, in effect, price discrimination, where some sizes (e.g. large sizes) earn less profit than other (e.g. smaller) sizes. However, the quantity sold increases, which increases profits for the firm.

Multiple-choice questions: Solutions (pp. 217–18) 1 2

d: price at which marginal revenue equals marginal cost b: $25 per unit

3

b: 200 units per day

4 5

a: earns positive economic profit d: none of the above statements is true

6

e: both a and b above are correct

7 8

c: will shut down if its demand curve lies wholly below the average total cost curve d: arbitrage

9

c: manufacturers of cars in Korea sell their cars at higher prices in Australia than in Korea (all else being equal).

CourseMate Express Go to http://login.cengagebrain.com/ to link to CourseMate Express, the online study tool for Economics for Today.

8 © Cengage Learning Australia 2015...

Similar Free PDFs

Chapter 8 - Tutorial Solutions

- 9 Pages

Week 8 Tutorial Solutions

- 5 Pages

Tutorial 8 Solutions

- 13 Pages

Tutorial 8 Solutions

- 8 Pages

Tutorial 8 Suggested Solutions

- 7 Pages

Week 8 Solutions tutorial

- 11 Pages

Chapter 2 - Tutorial Solutions

- 6 Pages

Chapter 5 - Tutorial Solutions

- 9 Pages

Chapter 8 solutions

- 59 Pages

Chapter 8 Solutions Cengel

- 97 Pages

Tutorial Solutions

- 74 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu