W7 - General Deductions PDF

| Title | W7 - General Deductions |

|---|---|

| Author | ridhwaan maudarun |

| Course | Taxation Law |

| Institution | Western Sydney University |

| Pages | 5 |

| File Size | 146.8 KB |

| File Type | |

| Total Downloads | 41 |

| Total Views | 142 |

Summary

Download W7 - General Deductions PDF

Description

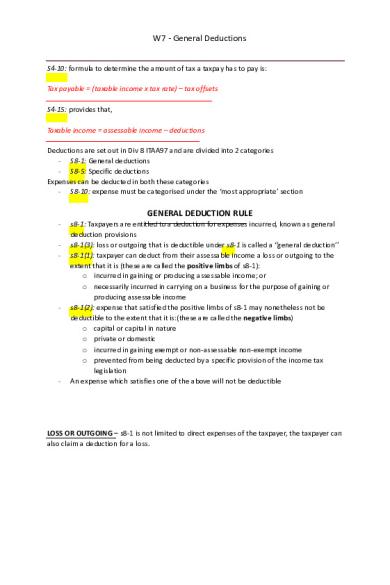

W7 - General Deductions S4-10: formula to determine the amount of tax a taxpay has to pay is: Tax payable = (taxable income x tax rate) – tax offsets S4-15: provides that, Taxable income = assessable income – deductions Deductions are set out in Div 8 ITAA97 and are divided into 2 categories - S8-1: General deductions - S8-5: Specific deductions Expenses can be deducted in both these categories - S8-10: expense must be categorised under the ‘most appropriate’ section

GENERAL DEDUCTION RULE -

-

-

s8-1: Taxpayers are entitled to a deduction for expenses incurred, known as general deduction provisions s8-1(3): loss or outgoing that is deductible under s8-1 is called a ‘’general deduction’’ s8-1(1): taxpayer can deduct from their assessable income a loss or outgoing to the extent that it is (these are called the positive limbs of s8-1): o incurred in gaining or producing assessable income; or o necessarily incurred in carrying on a business for the purpose of gaining or producing assessable income s8-1(2): expense that satisfied the positive limbs of s8-1 may nonetheless not be deductible to the extent that it is:(these are called the negative limbs) o capital or capital in nature o private or domestic o incurred in gaining exempt or non-assessable non-exempt income o prevented from being deducted by a specific provision of the income tax legislation An expense which satisfies one of the above will not be deductible

LOSS OR OUTGOING – s8-1 is not limited to direct expenses of the taxpayer, the taxpayer can also claim a deduction for a loss.

-

-

Example (Loss): Sarah undertook a profit-making land development scheme, she purchased the land for $1million, spent $1million on development of the land and sold the land for $1.5million; Sarah has a net loss of $500,000 which is deductible if all other requirements are satisfied. Example (Outgoing): Sarah paid her office phone bill of $220, the payment is an outgoing which is deductible under s8-1 if all of the other requirements are satisfied.

THE NEXUS TEST – POSITIVE LIMBS OF S8-1 - A loss to be deemed deductible under s8-1 must meet he nexus requirement - Under s8-1(1) the loss or outgoing must be; o Incurred in gaining or producing assessable income; or Requires a direct connection between the expense and the production of assessable income o Necessarily incurred in carrying on a business to gain or produce assessable income Requires a connection between the expense and the carrying on of a business to produce assessable income - Where the expense is partially connected to the business, we must apportion. EXPENSES Involving alleged or actual wrongdoing by taxpayer: Expenses arising due to alleged or actual wrongdoings by the taxpayers satisfy the positive limbs of s8-1 as the expenses related to the taxpayers conduct - Expenses resulting from the taxpayers alleged or actual wrongdoing can satisfy the 2nd positive limb, despite the ‘’necessarily incurred’’ criteria To reduce future expenditure: Deducibility of expenses incurred in improving business efficiency will result in a reduction of future expenditure. - Such expenses increase taxable income (by reducing deductions) and not assessable income - Expenses that improve the business overall and reduce future expense which is not directly incurred in gaining or producing assessable income satisfies the second limb of s8-1 Related to the production of assessable income in future years: Expenses incurred to gain or produce income in future years may satisfy the positive limbs, in certain circumstances; Steele v DCT Related to the production of assessable income in prior years: In order to satisfy positive limb; you must establish whether the expense was caused by the taxpayer’s prior income produce activities; if expenses have been caused by the taxpayers previous income producing activities then they are deductible

2

NON-DEDUCTIBLE EXPENSES – THE NEGATIVE LIMBS Expense that satisfies the possible limbs may not be deductible if it satisfied any one of the elements of s8-1(2) CAPITAL OR CAPITAL IN NATURE - s8-1(2)(a): a loss or outgoing that is capital or capital in nature will not be deductible under s8-1 - Expenses that aren’t capital or capital in nature are reffered to as ‘’revenue expense’’ o An expense that relates to the taxpayer’s income-producing process will be a revenue expense o Expense relating to taxpayers income-producing structure will be a capital expense Sun Newspapers Ltd & Associated Newspapers Ltd v FCT – Taxpayer tried to claim a deduction for the payment over a payment of 3 years, however no provision in the income legislation allowed it – Taxpayer instead of claiming the deduction over 3 years claimed an immediate deduction on the basis that the expense would safeguard and increase the taxpayer’s revenue (assessable income) - Commissioner agreed that the payment benefited the business as a whole – therefore capital in nature - Payment was a non-deductible capital expense as the taxpayer acquired a non-wasting capital benefit as the purpose of the payment to the rival was to shut down their business so he could continue his for 3 years - Dixon J concluded that the actions of the taxpayer were to strengthen /preserve the taxpayers business structure and as such it was deemed capital in nature The 3 factors in the above case were considered: 1. Character of the advantage sought: Consideration as to whether the expense results in a long last or temporary benefit for the taxpayer o Lasting benefit = capital expense o Temporary expense = less likely to be a capital expense 2. Manner in which the benefit is to be used, relied upon or enjoyed: Whether the benefit received by the taxpayer is used in a constant way or rather a benefit that is relied upon or enjoyed in a shorter-term sense o Benefit received once will be a capital expense whereas a benefit received short term, recurrently for a short term period is a revenue expense 3. Means adopted to obtain the benefit: Looks at how the benefit was acquired either through recurrent payments or a one-off payment o A recurrent payment is less likely to be a capital expense while a lump sum will be a capital expense

3

Capital Expense Example: Dominic owns a pizza-making business. He incurs an expense of $3,000 to purchase an oven which he uses to make pizzas and approximately $100 in monthly electricity expenses. Applying Dixon J’s 3 factors to the two expenses: Character of the advantage sought: - The pizza oven will provide Dominic with a long-lasting benefit and is therefore more likely to be a capital expense - The monthly electricity expenditure is for a short-term, on-month benefit and is therefore more likely to be a revenue expense Manner in which the benefit is to be used or enjoyed - The pizza oven will provide Dominic with a benefit that he can rely on once and for all and is therefore more likely to be a capital expense - The electricity is a recurring benefit and is therefore more likely to be a revenue expense Means adopted to obtain the benefit - Dominic paid for the pizza oven in one lump sum payment of $3,000, which indicates that the expense is more likely to be capital - The electricity bills are recurrent monthly expenses, which are more likely not to be capital In summary, the payment for the pizza oven is capital expense and the electricity payments aren’t: Acquisition of pizza oven = means of production (to produce pizza) which relates to his income-producing structure Electricity payments are for the use of that means of production, which relates to Dominic’s income-producing activities or process PRIVATE OR DOMESTIC - S8-1(2)(b) – Loss our outgoings of a private or domestic nature will not be deductible under s8-1. - This is due to expenses being private or domestic in nature will unlikely attribute to gaining or producing assessable income and thus wont satisfy any positive limbs of s8-1. INCURRED IN GAINING OR PRODUCING EXEMPT OR NON-ASSESSABLE NON-EXEMPT INCOME - S8-1(2)C) – expenses aren’t deductible under s8-1 as the income to which the expense relates to is not subject to tax in Australia

4

DENIED DEDUCTIONS: An expense is not deductible under s8-1 if the tax legislation states the expense is not deductible for tax purposes See page 383 for breakdown of denied transactions ENTERTAINMENT EXPENSES: These are generally not deductible - s32-10(1) entertainment is defined as by way of food, drink or recreation or accommodation or travel - Business lunches will constitute entertainment, but meals on business travel overnight are not considered to be entertainment - The employee providing the lunch can claim the deduction however the opposing party (firm attending) cannot claim the deduction as they merely attended REIMBURSED EXPENDITURE: Reimbursement cannot be deducted as the taxpayer is at the same economic position as before the expense, s51AH ITAA36 In order to claim a deduction for tax purposes, for most expenses taxpayers should obtain a document from the supplier containing the following information: - Name or business of supplier - Amount of the expense - Nature of the goods and services - Date expense incurred; and - Date of document

Pg 396 – 432: Individual deductions

5...

Similar Free PDFs

W7 - General Deductions

- 5 Pages

General Deductions Summary Notes

- 11 Pages

LAWS2200 Property Law w7

- 13 Pages

Allowable Deductions

- 4 Pages

Tax deductions - nothin follows

- 31 Pages

Deductions - Chapter summary

- 11 Pages

Deductions - TAXATION REVIEWER

- 31 Pages

Lab 7 (W7) assessment

- 1 Pages

W7 - Lecture notes 7

- 7 Pages

W7-8 Dwuw ZL

- 18 Pages

W7 polyarchy summary Dahl

- 5 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu