Written Case Analysis - Enron Scandal PDF

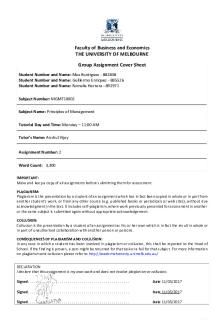

| Title | Written Case Analysis - Enron Scandal |

|---|---|

| Author | Rona Marie De Castro |

| Course | Managerial Economics |

| Institution | Ateneo de Davao University |

| Pages | 2 |

| File Size | 91 KB |

| File Type | |

| Total Downloads | 56 |

| Total Views | 190 |

Summary

Written Case Analysis on Enron Scandal through Managerial Economics perspective...

Description

Written Case Analysis on the ENRON Scandal In today’s economy, time-tested standards are being upheld to ensure justice in the economy and the industries that drive it. Firms that violate these standards ought to face adequate consequences. Statement of the Problem Enron, natural gas pipeline company, engaged in an unregulated business practice and applied revolutionary business models used in financial services industry as suggested by their then consultant and Chief Operating Officer, Jeff Skilling. With his leadership, the company embarked on aggressive expansion and based the share price and rewards given to employees on unearned revenue, consequently causing their financial statements to be off-balanced (Applied Corporate Governance, 2016). Prudence and integrity in management compromised the company’s steady growth. Objectives This written case analysis aims to identify and deliberate possible alternative courses of actions in the Enron Scandal and propose a reliable recommendation. Facts of the Case The company’s off-balanced statement of financial position confused analysts which the company disregarded in the pursuit of their continued “global progress”. Fastow, Enron’s Former Chief Financial Officer, authorized the reporting of inaccurate revenues derived from transactions Enron undertook as third-party insurer. Sales were purposely miscomputed by including sales of partner companies to inflate their company’s reported revenue which the served as the basis for their share price. Enron also committed fraud towards the public and employees by rewarding their employees based on inaccurate revenue values. All these instances, when revealed to the public, rapidly caused their share price to decrease and posted a $586-million loss (Francis, 2010). Alternative Courses of Action Although the Enron Scandal is far in the past, the following set of alternative courses of action may be applied to avoid the unfortunate circumstances Enron went through. The first alternative course of action would be careful scrutinizing of the members of the Board of Directors. Having people who share the same objectives with the company and prioritize it over selfish goals would ensure integrity and prudence in the company’s governance. Second, the stakeholders, internal and external, must always examine the policies and subsequent changes in policies of the company. They must be given the right to demand justifications of such applied standards. Last, but certainly not least, Securities and Exchange Commission, tasked in the facilitating of partnerships and corporations must closely monitor firms under their supervision and make sure that the rules and regulations that they uphold must strictly be followed. Any odd significant transactions must be reviewed by a team of experts from the agency.

Recommendation To directly cut-off the root cause of this dilemma, the suggestion of deliberating the Board and their intention of leading is strongly proposed. With a competent and prudent set of leaders who practices integrity and accountability in their management. The success and steady growth of a company like Enron is ensured. Previous issues with management would be avoided with such leadership and management. Conclusion Upon watching and further reading on the Enron Scandal, one may realize that the problematic case rooted from lack of careful deliberation of crucial business decisions of the management which as seen in the movie was caused by dominance of greed for personal wealth. To be in a management position, one must ensure that decisions made must be justifiable. The selfishness of the manager in the case caused great losses especially to the frontliners of Enron who trusted the company.

References Applied Corporate Governance. (2016, February). Enron Case study. Retrieved from Applied Corporate Governance: https://www.applied-corporate-governance.com/casestudy/enron-case-study/ Francis, A. (2010, September). Case Study: The Enron Accounting Scandal. Retrieved from MBA Knowledge Base: https://www.mbaknol.com/management-case-studies/casestudy-the-enron-accounting-scandal/...

Similar Free PDFs

Enron-Scandal - enron scandal

- 19 Pages

Enron-Scandal

- 2 Pages

Enron scandal - brief summary

- 2 Pages

Case Study - Westpac scandal

- 14 Pages

Satyam Scandal A case study

- 11 Pages

Enron case study

- 4 Pages

Case 1.1: Enron

- 4 Pages

Play Analysis School for Scandal

- 4 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu