102.05 Costing and Control of Manufacturing Overhead PDF

| Title | 102.05 Costing and Control of Manufacturing Overhead |

|---|---|

| Author | Dewana faheem |

| Course | Cost Accounting |

| Institution | International Islamic University Chittagong |

| Pages | 20 |

| File Size | 1 MB |

| File Type | |

| Total Downloads | 32 |

| Total Views | 140 |

Summary

Costing and Control of Manufacturing Overhead...

Description

Class note for CMA Professional Level –I 102 – Cost Accounting CMA Professional Level –I 102: Cost Accounting Class No. 06

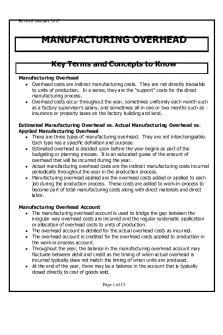

-Manufacturing Overhead Costs; -Actual Vs. Normal Costing of Manufacturing Overhead; -Production Capacity, -Predetermined Overhead Rates; -Departmental vs. Plant-wise Overhead Rates; -Separating Mixed Costs. -Scatter-graph; -High-low Method and Regression Analysis; -Accounting for Manufacturing Overhead; -Analysis and Disposition of Under-applied-and Over-applied Overhead. Manufacturing Overhead Costs Factory overhead or Production overhead or Indirect production cost

102.05 Costing and Control of Manufacturing Overhead

Manufacturing overhead involves a company’s factory operations. It includes the cost incurred in the factory other than the costs of direct materials and labor. Categories of Factory Overhead Costs: Manufacturing / Factory Overhead Cost

Variable Factory

Fixed Factory

Mixed Factory

Overhead Cost

Overhead Cost

Overhead Cost

Manufacturing /factory overhead include the following:

Indirect labor and indirect materials Power for the factory Rent on factory building Depreciation on factory building and factory equipments Maintenance of factory building and factory equipments Taxes and other for factory building, etc.

Page - 64 Saturday, March 22, 2014 Md.Monowar Hossain FCMA, CPA, ACS, ACA Audit Consultant (General Manager), Rupali Bank Ltd. eMail: [email protected]

Class note for CMA Professional Level –I 102 – Cost Accounting

Actual Vs. Normal Costing of Manufacturing Overhead

Actual costing: In actual costing all goods movements within a period are valued preliminary at the standard price. At the same time all price and exchange rate differences for the materials are collected in the material ledger. At the end of the period, an actual price is calculated for each material based on the actual costs of the particular period. Normal costing: Normal costing is a method of determining product costs used primarily for companies with more than one product. Direct materials and direct labor are added directly to WIP as the costs are incurred. Recall that 'incurred' is a term used in accrual basis accounting and generally refers to the point in which the costs are used. For manufacturing accounting purposes, incurred means when used in the production process.

Normal Vs. Actual Costing The main difference in actual and normal costing is how Manufacturing Overhead is included as part of product costs. • Actual costing = Actual Manufacturing Overhead costs are debited directly to WIP. • Normal costing = Actual Manufacturing Overhead costs are debited to Manufacturing Overhead expense. Based on a predetermined rate, Manufacturing Overhead is applied with a debit to WIP. • Only three primary amounts are debited to WIP in normal costing: Direct Material used, Direct Labor incurred, Manufacturing Overhead applied. • Only three primary amounts are debited to WIP in actual costing: Direct Material used, Direct Labor, Manufacturing Overhead incurred.

Page - 65 Saturday, March 22, 2014 Md.Monowar Hossain FCMA, CPA, ACS, ACA Audit Consultant (General Manager), Rupali Bank Ltd. eMail: [email protected]

Class note for CMA Professional Level –I 102 – Cost Accounting Production Capacity Volume of products that can be generated by a production plant or enterprise in a given period by using current resources. Types of production capacities: Theoretical or ideal productive capacity Practical or realistic productive capacity Normal or long-run productive capacity Expected or short-run productive capacity Idle capacity and excess capacity Capacity is a measure of production volume or some other activity base. •

Possible capacity measures are theoretical capacity, practical capacity, normaal capacity, and expected capacity. o Theoretical capacity is the maximum potential activity for a particular period assuming that everything works perfectly. o Practical capacity is the production the company could achieve taking regular operating interruptions into cons sideration. o Normal capacity is th he long-run average capacity considering cyclical fluctuations. o Expected capacity iss the anticipated activity level for the upcoming period based on the current budget. Manag gement often uses expected capacity in computing the predetermined overhead rate.

Predetermined Overrhead Rates

The formula for computing a predetermined overhead rate is:

The company in the preceding examp ple applies overhead costs to jobs on the basis of direct labor-hours. In other words, direct labor-hours is the allocation base. At the beginning of the year the comp pany estimated that it would incur Tk.320,000 in manufacturing overhead costs and would work 40,000 direct la abor-hours. The company’s predetermined overhead rate is: Tk. 320,000 = Tk. 8 per p direct labor hour 40,000 direct labor hours

Departmental vs. Plaant-wise Overhead Rates

Rates based on a department's dir ect and indirect overhead costs and some measure of the department's activity, such as the department's ma achine hours. Departmental rates are more accurate than plant-wide rates when a company manufactures divers se products requiring a variety of processes Page - 66 Saturday, March 22, 2014 Md.Monowar Hossain FCMA, CPA, ACS, ACA Audit Consultant (General Manager), Rupali Bank Ltd. eMail: [email protected]

Class note for CMA Professional Level –I 102 – Cost Accounting

Single predetermined overhead rate used in all departments of a company, rather than having a separate rate for each department. If the company's departments are homogeneous, the use of a single plant-wide rate may be adequate as a means of allocating overhead costs to production jobs

Costs are classified in terms of their behavior into three basic categories: variable costs, fixed costs, and semivariable costs. The classification is made with a specified range of activity, called a relevant range. The relevant range is the range over which volume is expected to fluctuate during the period of time being considered. VARIABLE COSTS : Variable costs are those costs that vary in total with changes in volume or level of activity. Examples of variable costs include the costs of direct materials, direct labour, sales commissions and gasoline expenses. The following factory overhead items fall in the variable cost category: Variable Factory Overhead Supplies Receiving costs Fuel and power Overtime premium Spoilage and defective work FIXED COSTS Fixed costs are costs that do not change in total regardless of the volume or level of activity. Examples include rent, property taxes, insurance and in the case of automobiles, the license fees and annual insurance premiums. The following factory overhead items fall in the fixed cost category: Fixed Factory Overhead Salaries of production supervisors Rent on warehouse and factory building Depreciation (by straight line) Salaries and indirect labour Property taxes Property insurance Patent amortization

ch 22, 2014 Md.Monowar Hossain FCMA, CPA, ACS, ACA Audit Consultant (General Manager), Rupali Bank Ltd. eMail: [email protected]

Class note for CMA Professional Level –I 102 – Cost Accounting Separating Mixed Costs. SEMIVARIABLE (OR MIXED) COSTS Semi-variable costs are costs that contain both a fixed element and a variable element. Salespersons’ compensation including salary and commission would be an example. Note that factory overhead, taken as a whole, would be an example of semi-variable costs. The following figure displays how each of these three types of costs varies with changes in volume or level of activity. Semi-variable costs

Variable costs Step Costs

y, Tk.

Fixed Costs Volume or level of activity x ANALYSIS OF SEMIVARIABLE COSTS (OR MIXED COSTS) For purposes of various types of cost analyses, semi-variable costs (or mixed costs) must be broken down into their fixed and variable elements. Since semi-variable costs contain both fixed and variable components, the analysis takes the following mathematical form, which is called a cost-volume formula: y = a + bx where y = the semi-variable cost to be broken up x = any given measure of activity such as production volume, sales volume or direct labour hours a = the fixed cost component b = the variable rate per unit of x

There are several methods available to separate a semi-variable expense into its variable and fixed components. They are 1. The high-low method 2. The scatter-graph method 3. The method of least squares (regression analysis) 4. Account Analysis 5. Engineering Analysis Page - 68 Saturday, March 22, 2014 Md.Monowar Hossain FCMA, CPA, ACS, ACA Audit Consultant (General Manager), Rupali Bank Ltd. eMail: [email protected]

Class note for CMA Professional Level –I 102 – Cost Accounting

Scatter-graph

A scatter diagram or scatter graph is used to plot two sets of data to see whether a connection or correlation can be established between them. A scatter plot or scatter graph is a type of mathematical diagram using Cartesian coordinates to display values for two variables for a set of data. The data is displayed as a collection of points, each having the value of one variable determining the position on the horizontal axis and the value of the other variable determining the position on the vertical axis.[2] This kind of plot is also called a scatter chart, scatter diagram and scatter graph. In this method, a semivariable expense is plotted on the vertical axis (or y axis) and activity measure is plotted on the horizontal axis (or x axis). Then, a regression line is fitted by visual inspection of the plotted x-y data. The method is best explained by the following example. Example: Since the regression line obtained by visual inspection strikes the factory overhead axis at the Tk.6 point, that amount represents the fixed cost component computed as Factory overhead at 23 hours of direct labor ………………… Tk. 25 Less: Fixed cost component ……………………………….. 6 Variable cost component………………………………………. Tk.19 Therefore, the variable rate per hour is Tk. 19 / 23 hours = Tk. 0.8261 per DLH. In summary, based on the scatter graph method, we obtain Where

y = Tk. 6 + Tk. 0.8261x

y = estimated factory overhead x = DLH

x

x

x

x

x x x

x x x

x

x x 4

8

12 16 Direct labor hours (DLH)

20

24

X

The Scatter graph Method The scatter-graph method is relatively easy to use and simple to understand. However, it should be used with extreme caution, because it does not provide for an objective test for assuring that the regression line drawn is the most accurate fit for the underlying observations. High-low Method and Regression Analysis The High Low Method The high-low method, as the name indicates, uses two extreme data points to determine the values of a (the fixed cost portion) and b (the variable rate) in the equation y = a + bx. The extreme data points are the highest representative x-y pair and the lowest representative x-y pair. The activity level x, rather than the mixed cost item y, governs their selection. Page - 69 Saturday, March 22, 2014 Md.Monowar Hossain FCMA, CPA, ACS, ACA Audit Consultant (General Manager), Rupali Bank Ltd. eMail: [email protected]

Class note for CMA Professional Level –I 102 – Cost Accounting The high-low method is explained, step by step, as follows: Step 1

Select the highest pair and the lowest pair

Step 2

Compute the variable rate, b, using the formula: Variable rate= Difference in cost y Difference in activity x

Step 3

Compute the fixed cost portion as: Fixed cost portion = Total semi-variable cost – Variable cost

Example: Flexible Manufacturing Company decided to relate total factory overhead costs to direct labor hours (DLH) to develop a cost-volume formula in the form of y = a + bx. Twelve monthly observations are collected. They are given in following Table: Table (000’Tk.) Month Direct Labor Hours x Factory Overhead y January 9 hours Tk.15 February 19 20 March 11 14 April 14 16 May 23 25 June 12 20 July 12 20 August 22 23 September 7 14 October 13 22 November 15 18 December 17 18 Total 174 hours Tk. 225 The high-low points selected from the monthly observations are x y High 23 hours Tk.25 (May pair) Low 7 14 (September pair) Difference 16 hours Tk. 11 Thus Variable rate b = Difference in y = Tk. 11 = Tk. 0.6875 per DLH Difference in x 16 hours The fixed cost portion is computed as: Total cost (y) – variable cost (bx) High Low Factory overhead (y) Tk. 25 Tk. 14 Variable expense (Tk.0.6875/DLH) (15.8125) ( 4.8125) Tk. 9.1875 Tk.9.1875 Therefore, the cost-volume formula for factory overhead is Tk. 9.1875 fixed, plus Tk. 0.6875 per DLH. Or more formally, y = Tk. 9.1875 + Tk. 0.6875x where

y = estimated factory overhead

x = DLH Note that the reason for using a new symbol gives an estimated value of y.

y (read as y-bar ) is that the cost-volume formula just obtained

Page - 70 Saturday, March 22, 2014 Md.Monowar Hossain FCMA, CPA, ACS, ACA Audit Consultant (General Manager), Rupali Bank Ltd. eMail: [email protected]

Class note for CMA Professional Level –I 102 – Cost Accounting The high-low method is simple and easy to use. It has the disadvantage, however, of using two extreme data points, which may not be representative of normal conditions. The method may yield unreliable estimates of a and b in our formula. In such a case, it would be wise to drop them and choose two other points that are more representative of normal situations. THE METHOD OF LEAST SQUARES : To explain the least-squares method, we define the error as the difference between the observed value and the estimated value of some semi-variable cost and denote it with u. Symbolically, u= y - y where y = observed value of a semi-variable expense y’ = estimated value based on y’ = a + bx The least-squares criterion requires that the line of best fit be such that the sum of the squares of the errors (or the vertical distance in Fig 3 from the observed data points to the line) is a minimum i.e. Minimum: u ² = (y – y ) ² Using differential calculus we obtain the following equations called normal equations: y = na + b x xy = ax + b x ² y

y = a + bx

x y and

y

Solving the equations for b, a and r² yields:

b=

r

n xy − ( x)( y)

2

[n

=

[n

n x2 − ( x) 2

xy − ( x )(

x 2 − ( x) 2

] [n

y)

]

2

y 2 − ( y ) 2

]

a = y − bx EXAMPLE: To illustrate the computations of b and a, we will once again refer to the data in the Table above. All the sums required are computed and shown below. Direct Labor Factory Hours x Overhead y XY x² Y² 9 Tk.15 135 81 225 19 20 380 361 400 11 14 154 121 196 14 16 224 196 256 23 25 575 529 625 12 20 240 144 400 Page - 71 Saturday, March 22, 2014 Md.Monowar Hossain FCMA, CPA, ACS, ACA Audit Consultant (General Manager), Rupali Bank Ltd. eMail: [email protected]

Class note for CMA Professional Level –I 102 – Cost Accounting 12 22 7 13 15 17 174

20 240 23 506 14 98 22 286 18 270 18 306 Tk.225 3,414

144 484 49 169 225 289 2,792

400 529 196 484 324 324 4,359

From the table above: x =174 y =225 xy =3414 x ² =2792 x = x/n = 174/12 = 14.5 y = y/n = 225/12 = 18.75 y ² = 4359 Substituting these values into the formula for b first: b = nx y — (x)( y) = (12)(3,414) — (174)(225) nx ² — (x) ² (12)(2,792) — (174) ²

= 1,818 3,228

= 0.5632

y — b x = 18.75 - (0.5632)(14.5) = 18.75 - 8.1664 = 10.5836 Our final regression equation is: y = 10.5836 + 0.5632x where y = estimated factory overhead a =

x = DLH

[n xy − ( x)( y) ]

2

2

r =

[n x − ( x) ] [n y − ( y) ] 2

=

2

3,305,124 (3228)[(52,308 − 50,625) ]

2

=

(1,818) 2

= 2

3,305,124 (3228)(1,683)

[

(3228) (12)(4359) − (225) 2 =

3,305,124

]

= 0.6084 = 60.84%

5,432,724

This means that about 60.84% of the total variation in total factory overhead is explained by DLH and the remaining 39.16% is still unexplained. A relatively low r² indicates that there is a lot of room for improvement

y

in our cost function ( = 10.5836 + 0 .5632x). Machine hours or a combination direct labor hours and machine hours might improve r². OVERHEAD COSTING FORMULAS Predetermined absorption rate Direct material cost % rate

Direct labor cost % rate

estimated or budgeted overhead for the period estimated or budgeted units of base for the period budgeted overhead budgeted direct material costs budgeted overhead budgeted direct labor cost

x 100

x 100

Page - 72 Saturday, March 22, 2014 Md.Monowar Hossain FCMA, CPA, ACS, ACA Audit Consultant (General Manager), Rupali Bank Ltd. eMail: [email protected]

Class note for CMA Professional Level –I 102 – Cost Accounting

Prime cost % rate

Direct labor hour rate

Machine hour rate

budgeted overhead prime cost

X 100

budgeted overhead budgeted direct labor hours budgeted overhead budgeted machine hours

Cost unit rate

budgeted overhead budgeted output

Reapportionment of service department expenses over production department :1) Direct redistribution method: • Service department costs are divided over production department. • Ignore service rended by one dept. to another 2) Step method of secondary distribution (or) Non reciprocal method: • Service department which serves largest number of service department is divided first and go on. 3) Reciprocal service method: i) Simultaneous equation method (or) Algebraic method • Equation is formed between service departments and is solved to find the amount due. ii) Repeated distribution method: • Service department cost separated repeatedly till figure of service dept. is exhausted or too small. iii) Trial and Error method: • Cost of service department is apportioned among them repeatedly till the amount is negligible and the total is divided among production department. Treatment of Over/Under absorption of overheads:i) If under absorbed and over absorbed overheads are of small value then it should be transferred to costing profit and loss a/c ii) If under and over absorption occurs due to wrong estimates then cost of product manufactured should be adjusted accordingly. iii) If the same accrued due to same abnormal reasons the same should be transferred to costing profit & loss a/c Apportionment of overhead expenses ----------------------– Basis a) Stores service expenses …………………………………… Value of materials consumed b) Factory rent ………………………………………………….. Floor area c) Municipal rent, rates and taxes ……………………………. floor area d) Insurance on Building and machinery…………………….. Insurable value e) Welfare department expenses ……………………………. Number of employees f) Supervision …………………………………………………… Number of employees g) Amenities to employee’s …………………………………… Number of employees h) Employees liability for insurance …………………………. ...

Similar Free PDFs

2b. Manufacturing Overhead CR

- 15 Pages

Job Costing and Contract Costing

- 38 Pages

2.Manufacturing of bricks

- 5 Pages

Types of Manufacturing System

- 6 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu