Manufacturing Overhead Accounting- Actual and Applied PDF

| Title | Manufacturing Overhead Accounting- Actual and Applied |

|---|---|

| Course | Accountancy |

| Institution | Adamson University |

| Pages | 2 |

| File Size | 72.8 KB |

| File Type | |

| Total Downloads | 106 |

| Total Views | 132 |

Summary

I want to share this to you guys because I know that sharing is caring. Keep up the good work guys! Good luck....

Description

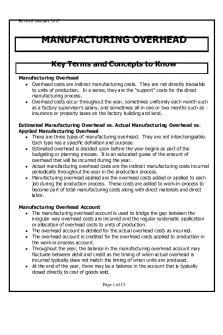

Manufacturing Overhead Accounting- Actual and Applied ADAPTED: Pedro P. Guerrero, Cost Accounting – Principles and Procedural Applications – 2014 – 2015 Edition MULTIPLE CHOICE: 1. Costs that are not conveniently identified with particular orders or units of products. a. Manufacturing overhead b. Direct labor c. Direct materials d. Manufacturing costs Answer: A. Manufacturing overhead 2. What costing system is used to avoid any delay in the costing of jobs as experienced in actual costing? a. Process costing b. Job order costing c. Historical costing d. Normal costing Answer: D. NORMAL COSTING 3. What costing system is used to allocate overhead with the use of a predetermined overhead rate determined at the beginning of the year based on budgets. a. Normal costing b. Actual costing c. Job order costing d. Process costing Answer: A. NORMAL COSTING 4. A credit balance in manufacturing overhead control account is: a. Over applied overhead b. Under applied overhead c. Idle capacity variance d. Spending variance Answer: A. Over applied overhead 5. A debit balance in the manufacturing overhead control account is: a. Over applied overhead b. Under applied c. Idle capacity variance d. Spending variance Answer: B. Under applied 6. Over applied manufacturing overhead would result if: a. Manufacturing overhead costs incurred were less than costs charged to production. b. Manufacturing overhead costs incurred were unreasonably large in relation to units produced.

c. Manufacturing overhead costs incurred were greater than costs charged to production d. The plant were operating at less than normal capacity. Answer: A. Manufacturing overhead costs incurred were less than costs charged to production 7. When the amount of over applied manufacturing overhead is significant, the entry close Over Applied Manufacturing Overhead will most likely require: a. A debit to Cost of Goods Sold b. Debits to Cost of Goods Sold, Finished Goods Inventory, and Work in Process Inventory c. A credit to Cost of Goods Sold d. Credits to Cost of Goods Sold, Finished Goods Inventory, and Work in Process Inventory Answer: D. Credits to Cost of Goods Sold, Finished Goods Inventory, and Work in Process Inventory 8. The most common treatment of the under applied overhead at the end of the year would be to: a. Carry it as a deferred charge on the balance sheet b. Report it as a miscellaneous expense on the income statement c. Debit it to Cost of Goods Sold d. Prorate between Work in Process Inventory and Finished Goods Inventory Answer: C. Debit it to Cost of Goods Sold 9. All of the following phrases are used as alternate terminology for manufacturing overhead except: a. Manufacturing expense b. Indirect manufacturing cost c. Factory expense d. Other expense Answer: D. Other expense 10. What does a favorable variance represent? a. The actual overhead costs were less than the costs applied to production. b. The actual overhead costs were more than the costs applied to production. c. The spending variance is more than the volume variance. d. The spending variance is less than the volume variance. Answer: A. The actual overhead costs were less than the costs applied to production....

Similar Free PDFs

2b. Manufacturing Overhead CR

- 15 Pages

Flexible Budgets and Overhead Analysis

- 120 Pages

Manufacturing Accounts and examples

- 17 Pages

Overhead Analysis

- 6 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu