22012 1 AA standards flowchart Rebranded NZ Jan 2021 PDF

| Title | 22012 1 AA standards flowchart Rebranded NZ Jan 2021 |

|---|---|

| Course | Accounting Auditing |

| Institution | University of Utah |

| Pages | 3 |

| File Size | 272.6 KB |

| File Type | |

| Total Downloads | 62 |

| Total Views | 149 |

Summary

none...

Description

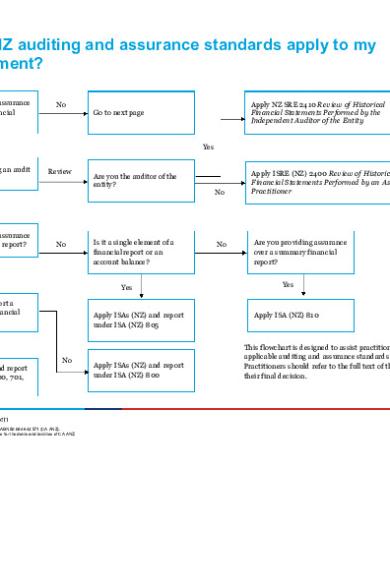

Which NZ auditing and assurance standards apply to my engagement? Are you providing assurance over historical financial information?

Go to next page

Yes Are you performing an audit or a review?

Apply NZ SRE 2410 Review of Historical Financial Statements Performed by the Independent Auditor of the Entity

No

Yes Review

Are you the auditor of the entity? No

Apply ISRE (NZ) 2400 Review of Historical Financial Statements Performed by an Assurance Practitioner

Audit

Are you providing assurance over a full financial report?

No

Is it a single element of a financial report or an account balance?

No

Are you providing assurance over a summary financial report?

Yes Yes Is the financial report a general purpose financial report?

Apply ISAs (NZ) and report under ISA (NZ) 805

Yes No Apply ISAs (NZ) and report under ISAs (NZ) 700, 701, 705, 706 and 720

© Chartered Accountants Australia and New Zealand ABN 50 084 642 571 (CA ANZ). Formed in Australia. Members of CA ANZ are not liable for the debts and liabilities of CA ANZ.

Apply ISAs (NZ) and report under ISA (NZ) 800

Yes

Apply ISA (NZ) 810

This flowchart is designed to assist practitioners in determining the applicable auditing and assurance standards for an engagement. Practitioners should refer to the full text of the standards to make their final decision.

Which NZ auditing and assurance standards apply to my engagement? ISAE (NZ) 3000 is the overarching standard for assurance engagements in relation to information other than historical financial information. Other standards provide guidance on specific types of engagements but practitioners must also comply with ISAE (NZ) 3000 when applying these standards. Note that all these standards provide guidance on both reasonable assurance and limited assurance engagements. Are you providing:

Specific standard applicable to the engagement in addition to ISAE (NZ) 3000

Assurance over the entity’s compliance with the terms of a contract, law or regulation?

SAE 3100 Compliance Engagements

Assurance over internal controls?

SAE 3150 Assurance Engagements on Controls

Assurance over the internal controls of a service organisation?

ISAE (NZ) 3402 Assurance Reports on Controls at a Service Organisation

Assurance in relation to greenhouse gas emissions?

ISAE (NZ) 3410 Assurance Engagements on Greenhouse Gas Statements

Assurance over the compilation of pro-forma financial information?

ISAE (NZ) 3420 Assurance Engagements to Report on The Compilation of Pro Forma Financial Information included in a Prospectus

For all other engagements in relation to assurance over non-historical financial information, ISAE (NZ) 3000 is the only applicable standard.

© Chartered Accountants Australia and New Zealand ABN 50 084 642 571 (CA ANZ). Formed in Australia. Members of CA ANZ are not liable for the debts and liabilities of CA ANZ.

Copyright © 2021 Chartered Accountants Australia and New Zealand ABN 50 084 642 571.

Disclaimer This Guide has been prepared for use by members of Chartered Accountants Australia and New Zealand (CA ANZ) in New Zealand only. It is not intended for use by any person who is not a CA ANZ member and/or does not have appropriate expertise in the subject matter. This Guide is intended to provide general information and is not intended to provide or substitute legal or professional advice on a specific matter. Laws, practices and regulations may have changed since publication of this Guide. Users should make their own inquiries as to the currency of relevant laws, practices and regulations. No warranty is given as to the correctness of the information contained in this Guide, or of its suitability for use by you. To the fullest extent permitted by law, CA ANZ is not liable for any statement or opinion, or for any error or omission contained in this Guide and disclaims all warranties with regard to the information contained in it, including, without limitation, all implied warranties of merchantability and fitness for a particular purpose. CA ANZ is not liable for any direct, indirect, special or consequential losses or damages of any kind, or loss of profit, loss or corruption of data, business interruption or indirect costs, arising out of or in connection with the use of this guide or the information contained in it, whether such loss or damage arises in contract, negligence, tort, under statute, or otherwise.

© Chartered Accountants Australia and New Zealand ABN 50 084 642 571 (CA ANZ). Formed in Australia. Members of CA ANZ are not liable for the debts and liabilities of CA ANZ....

Similar Free PDFs

Isca-jan-2021 - audit

- 31 Pages

ACC106 JAN 2021

- 7 Pages

MKT202 JAN 2021 TOA

- 5 Pages

TEST 1 - 16 JAN 2021 (AIS 160)

- 4 Pages

JAN 25 2021 - Charles Roth

- 2 Pages

English Standard Jan 2021 compressed

- 82 Pages

ACC203 Revision 2021 Jan Sem

- 23 Pages

BTM496 AA Outline Winter 2021

- 8 Pages

HRM201 Study Guide JAN 2021

- 176 Pages

RPA AA - RPA AA

- 7 Pages

Guia AA 1 Excel

- 33 Pages

Flowchart-acco - flowchart

- 1 Pages

Formulario C1 22012 4 113213

- 3 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu