404354636 prinnciple of acccounting test with ans docx PDF

| Title | 404354636 prinnciple of acccounting test with ans docx |

|---|---|

| Author | Thành Chiến |

| Course | Finance for Manager |

| Institution | Đại học Kinh tế Quốc dân |

| Pages | 21 |

| File Size | 351 KB |

| File Type | |

| Total Downloads | 33 |

| Total Views | 139 |

Summary

most a na...

Description

1.The income statement and balance sheet columns of Beer and Nuts Company’s worksheet reflect the following totals:

Totals

Income Statement Dr. Cr. $75,000 $51,000

Balance Sheet Dr. Cr. $60,000 $84,000

The net income (or loss) for the period is a. $51,000 income. b. $24,000 income. c. $24,000 loss. d. not determinable. 2.

The income statement and balance sheet columns of Beer and Nuts Company’s worksheet reflect the following totals:

Totals

Income Statement Dr. Cr. $75,000 $48,000

Balance Sheet Dr. Cr. $60,000 $87,000

To enter the net income (or loss) for the period into the above worksheet requires an entry to the a. income statement debit column and the balance sheet credit column. b. income statement credit column and the balance sheet debit column. c. income statement debit column and the income statement credit column. d. balance sheet debit column and the balance sheet credit column. 3.The income statement for the month of June, 2016 of Snap Shot, Inc. contains the following information: Revenues Expenses: Salaries and Wages Expense Rent Expense Advertising Expense Supplies Expense Insurance Expense Total expenses Net income The entry to close the revenue account includes a a. debit to Income Summary for $2,000. b. credit to Income Summary for $2,000. c. debit to Income Summary for $7,300. d. credit to Income Summary for $7,300.

$7,300 $3,000 1,300 700 200 100 5,300 $2,000

4.

The income statement for the month of June, 2016 of Snap Shot, Inc. contains the following information: Revenues Expenses: Salaries and Wages Expense Rent Expense Advertising Expense Supplies Expense Insurance Expense Total expenses Net income

$7,300 $3,000 1,300 700 200 100 5,300 $2,000

The entry to close the expense accounts includes a a. debit to Income Summary for $2,000. b. credit to Rent Expense for $1,300. c. credit to Income Summary for $5,300. d. debit to Salaries and Wages Expense for $3,000. 5.

The income statement for the month of June, 2016 of Snap Shot, Inc. contains the following information: Revenues Expenses: Salaries and Wages Expense Rent Expense Advertising Expense Supplies Expense Insurance Expense Total expenses Net income

$7,300 $3,000 1,300 700 200 100 5,300 $2,000

After the revenue and expense accounts have been closed, the balance in Income Summary will be a. a debit balance of $7,300. b. a debit balance of $2,000. c. a credit balance of $2,000. d. a credit balance of $7,300. 6.

The income statement for the month of June, 2016 of Snap Shot, Inc. contains the following information: Revenues Expenses: Salaries and Wages Expense Rent Expense Advertising Expense Supplies Expense Insurance Expense Total expenses Net income The entry to close Income Summary to Owner’s, Capital

$7,300 $3,000 1,300 700 200 100 5,300 $2,000

includes a. a debit to Revenues for $7,300. b. credits to Expenses totalling $5,300. c. a credit to Income Summary for $2,000 d. a credit to Owner’s Capital for $2,000. 7.

The income statement for the month of June, 2016 of Snap Shot, Inc. contains the following information: Revenues Expenses: Salries and Wages Expense Rent Expense Advertising Expense Supplies Expense Insurance Expense Total expenses Net income

$7,300 $3,000 1,300 700 200 100 5,300 $2,000

At June 1, 2016, Snap Shot reported owner’s equity of $36,000. The company had no owner drawings during June. At June 30, 2016, the company will report owner’s equity of a. $30,700. b. $36,000.3 c. $38,000. d. $43,300. 8.

The income statement for the year 2016 of Bugati Co. contains the following information: Revenues Expenses: Salaries and Wages Expense Rent Expense Advertising Expense Supplies Expense Utilities Expense Insurance Expense Total expenses Net income (loss) The entry to close the revenue account includes a a. debit to Income Summary for $6,500. b. credit to Income Summary for $6,500. c. debit to Revenues for $73,000. d. credit to Revenues for $73,000.

$73,000 $43,000 12,000 11,000 6,000 3,500 4,000 79,500 $ (6,500)

9.The following information is for Central Avenue Real Estate: Central Avenue Real Estate Balance Sheet December 31, 2016 Cash $ 25,000 Prepaid Insurance 40,000 Accounts Receivable 50,000 Inventory 80,000 Land Held for Investment 75,000 Land 120,000 Building $110,000 Less Accumulated Depreciation (20,000) 90,000 Trademark 70,000 Total Assets $550,000

Accounts Payable Salaries and Wages Payable Mortgage Payable Total Liabilities

Owner’s Capital Total Liabilities and Owner’s Equity

$ 60,000 25,000 85,000 170,000

380,000

$550,000

The total dollar amount of assets to be classified as current assets is a. $115,000. b. $195,000. c. $200,000. d. $270,000. 10.The following information is for Central Avenue Real Estate: Central Avenue Real Estate Balance Sheet December 31, 2016 Cash $ 25,000 Prepaid Insurance 40,000 Accounts Receivable 50,000 Inventory 80,000 Land Held for Investment 75,000 Land 120,000 Building $110,000 Less Accumulated Depreciation (20,000) 90,000 Trademark 70,000 Total Assets $550,000

Accounts Payable Salaries and Wages Payable Mortgage Payable Total Liabilities

Owner’s Capital Total Liabilities and Owner’s Equity

$ 60,000 25,000 85,000 170,000

380,000

$550,000

The total dollar amount of assets to be classified as property, plant, and equipment is a. $210,000. b. $230,000. c. $285,000. d. $315,000.

11.The following information is for Central Avenue Real Estate: Central Avenue Real Estate Balance Sheet December 31, 2016 Cash $ 25,000 Prepaid Insurance 40,000 Accounts Receivable 50,000 Inventory 80,000 Land Held for Investment 75,000 Land 120,000 Building $110,000 Less Accumulated Depreciation (20,000) 90,000 Trademark 70,000 Total Assets $550,000

Accounts Payable Salaries and Wages Payable Mortgage Payable Total Liabilities

Owner’s Capital Total Liabilities and Owner’s Equity

$ 60,000 25,000 85,000 170,000

380,000

$550,000

The total dollar amount of assets to be classified as investments is a. $0. b. $80,000. c. $75,000. d. $175,000. 12.The following information is for Central Avenue Real Estate: Central Avenue Real Estate Balance Sheet December 31, 2016 Cash $ 25,000 Prepaid Insurance 40,000 Accounts Receivable 50,000 Inventory 80,000 Land Held for Investment 75,000 Land 120,000 Building $110,000 Less Accumulated Depreciation (20,000) 90,000 Trademark 70,000 Total Assets $550,000

Accounts Payable Salaries and Wages Payable Mortgage Payable Total Liabilities

Owner’s Capital Total Liabilities and Owner’s Equity

The total dollar amount of liabilities to be classified as current liabilities is a. $25,000. b. $60,000. c. $85,000. d. $170,000.

$ 60,000 25,000 85,000 170,000

380,000

$550,000

13.The following information is for Qwik Auto Supplies: Qwik Auto Supplies Balance Sheet December 31, 2016 Cash $ 45,000 Prepaid Insurance 80,000 Accounts Receivable 110,000 Inventory 140,000 Land Held for Investment 185,000 Land 250,000 Building $200,000 Less Accumulated Depreciation (50,000) 150,000 Trademark 140,000 Total Assets $1,100,000

Accounts Payable $ 140,000 Salaries and Wages Payable 60,000 Mortgage Payable 150,000 Total Liabilities 350,000

Owner’s Capital Total Liabilities and Owner’s Equity

750,000

$1,100,000

The total dollar amount of assets to be classified as current assets is a. $125,000. b. $235,000. c. $375,000. d. $560,000. 14.The following information is for Qwik Auto Supplies: Qwik Auto Supplies Balance Sheet December 31, 2016 Cash $ 45,000 Prepaid Insurance 80,000 Accounts Receivable 110,000 Inventory 140,000 Land Held for Investment 185,000 Land 250,000 Building $200,000 Less Accumulated Depreciation (50,000) 150,000 Trademark 140,000 Total Assets $1,100,000

Accounts Payable $ 140,000 Salaries and Wages Payable 60,000 Mortgage Payable 150,000 Total Liabilities 350,000

Owner’s Capital Total Liabilities and Owner’s Equity

750,000

$1,100,000

The total dollar amount of assets to be classified as property, plant, and equipment is a. $400,000. b. $450,000. c. $585,000. d. $635,000.

15.The following information is for Qwik Auto Supplies: Qwik Auto Supplies Balance Sheet December 31, 2016 Cash $ 45,000 Prepaid Insurance 80,000 Accounts Receivable 110,000 Inventory 140,000 Land Held for Investment 185,000 Land 250,000 Building $200,000 Less Accumulated Depreciation (50,000) 150,000 Trademark 140,000 Total Assets $1,100,000

Accounts Payable $ 140,000 Salaries and Wages Payable 60,000 Mortgage Payable 150,000 Total Liabilities 350,000

Owner’s Capital Total Liabilities and Owner’s Equity

750,000

$1,100,000

The total dollar amount of assets to be classified as investments is a. $0. b. $585,000. c. $185,000. d. $725,000.

16.The following information is for Qwik Auto Supplies: Qwik Auto Supplies Balance Sheet December 31, 2016 Cash $ 45,000 Prepaid Insurance 80,000 Accounts Receivable 110,000 Inventory 140,000 Land Held for Investment 185,000 Land 250,000 Building $200,000 Less Accumulated Depreciation (50,000) 150,000 Trademark 140,000 Total Assets $1,100,000

Accounts Payable $ 140,000 Salaries and Wages Payable 60,000 Mortgage Payable 150,000 Total Liabilities 350,000

Owner’s Capital Total Liabilities and Owner’s Equity

The total dollar amount of liabilities to be classified as current liabilities is a. $60,000. b. $140,000. c. $200,000. d. $350,000.

750,000

$1,100,000

17.The following items are taken from the financial statements of the Freight Service for the year ending December 31, 2016: Accounts payable Accounts receivable Accumulated depreciation – equipment Advertising expense Cash Owner’s capital (1/1/16) Owner’s drawings Depreciation expense Insurance expense Note payable, due 6/30/17 Prepaid insurance (12-month policy) Rent expense Salaries and wages expense Service revenue Supplies Supplies expense Equipment

$ 19,000 13,000 26,000 21,200 15,000 104,000 11,000 12,000 3,800 72,000 7,200 16,000 32,000 135,000 5,000 6,000 210,000

What is the company’s net income for the year ending December 31, 2016? a. $14,000 b. $33,000 c. $44,000 d. $135,000 18.The following items are taken from the financial statements of the Freight Service for the year ending December 31, 2016: Accounts payable Accounts receivable Accumulated depreciation – equipment Advertising expense Cash Owner’s capital (1/1/16) Owner’s drawings Depreciation expense Insurance expense Note payable, due 6/30/17 Prepaid insurance (12-month policy)

$ 19,000 13,000 26,000 21,200 15,000 104,000 11,000 12,000 3,800 72,000 7,200

What is the company’s net income for the year ending December 31, 2016? a. $14,000 b. $33,000 c. $44,000 d. $135,000

19.

Rent expense Salaries and wages expense Service revenue Supplies Supplies expense Equipment

16,000 32,000 135,000 5,000 6,000 210,000

What is the balance that would be reported for owner’s equity at December 31, 2016? a. $159,000 b. $148,000 c. $137,000 d. $104,000 20.The following items are taken from the financial statements of the Freight Service for the year ending December 31, 2016: Accounts payable Accounts receivable Accumulated depreciation – equipment Advertising expense Cash Owner’s capital (1/1/16) Owner’s drawings Depreciation expense Insurance expense Note payable, due 6/30/17 Prepaid insurance (12-month policy) Rent expense Salaries and wages expense Service revenue Supplies Supplies expense Equipment

$ 19,000 13,000 26,000 21,200 15,000 104,000 11,000 12,000 3,800 72,000 7,200 16,000 32,000 135,000 5,000 6,000 210,000

What are total current assets at December 31, 2016? a. $28,000 b. $35,200 c. $40,200 d. $46,200

21.The following items are taken from the financial statements of the Freight Service for the year ending December 31, 2016: Accounts payable Accounts receivable Accumulated depreciation – equipment Advertising expense Cash Owner’s capital (1/1/16) Owner’s drawings

$ 19,000 13,000 26,000 21,200 15,000 104,000 11,000

Depreciation expense Equipment Insurance expense Note payable, due 6/30/17 Prepaid insurance (12-month policy) Rent expense Salaries and wages expense Service revenue Supplies Supplies expense

12,000 210,000 3,800 72,000 7,200 16,000 32,000 135,000 5,000 6,000

What is the book value of the equipment at December 31, 2016? a. $172,000 b. $184,000 c. $210,000 d. $236,000 22.The following items are taken from the financial statements of the Freight Service for the year ending December 31, 2016: Accounts payable Accounts receivable Accumulated depreciation – equipment Advertising expense Cash Owner’s capital (1/1/16) Owner’s drawings Depreciation expense Insurance expense Note payable, due 6/30/17 Prepaid insurance (12-month policy) Rent expense Salaries and wages expense Service revenue Supplies Supplies expense Equipment What are total current liabilities at December 31, 2016? a. $19,000 b. $72,000 c. $91,000 d. $102,000

$ 19,000 13,000 26,000 21,200 15,000 104,000 11,000 12,000 3,800 72,000 7,200 16,000 32,000 135,000 5,000 6,000 210,000

23.The following items are taken from the financial statements of the Freight Service for the year ending December 31, 2016: Accounts payable Accounts receivable Accumulated depreciation – equipment Advertising expense Cash Owner’s capital (1/1/16) Owner’s drawings Depreciation expense Insurance expense Note payable, due 6/30/17 Prepaid insurance (12-month policy) Rent expense Salaries and wages expense Service revenue Supplies Supplies expense Equipment

$ 19,000 13,000 26,000 21,200 15,000 104,000 11,000 12,000 3,800 72,000 7,200 16,000 32,000 135,000 5,000 6,000 210,000

What are total long-term liabilities at December 31, 2016? a. $0 b. $72,000 c. $91,000 d. $93,000 24.The following items are taken from the financial statements of the Freight Service for the year ending December 31, 2016: Accounts payable Accounts receivable Accumulated depreciation – equipment Advertising expense Cash Owner’s capital (1/1/16) Owner’s drawings Depreciation expense Equipment Insurance expense Note payable, due 6/30/17 Prepaid insurance (12-month policy) Rent expense Salaries and wages expense Service revenue Supplies Supplies expense

$ 19,000 13,000 26,000 21,200 15,000 104,000 11,000 12,000 210,000 3,800 72,000 7,200 16,000 32,000 135,000 5,000 6,000

What is total liabilities and owner’s equity at December 31, 2016? a. $184,000 b. $228,000 c. $195,000 d. $239,000 25.The sub-classifications for assets on the company’s classified balance sheet would include all of the following except a. Current Assets. b. Property, Plant, and Equipment. c. Intangible Assets. d. Long-term Assets. 26.The following items are taken from the financial statements of the Freight Service for the year ending December 31, 2016: Accounts payable Accounts receivable Accumulated depreciation – equipment Advertising expense Cash Owner’s capital (1/1/16) Owner’s drawings Depreciation expense Insurance expense Note payable, due 6/30/17 Prepaid insurance (12-month policy) Rent expense Salaries and wages expense Service revenue Supplies Supplies expense Equipment

$ 19,000 13,000 26,000 21,200 15,000 104,000 11,000 12,000 3,800 72,000 7,200 16,000 32,000 135,000 5,000 6,000 210,000

The current assets should be listed on Freight Service’s balance sheet in the following order: a. cash, accounts receivable, prepaid insurance, equipment. b. cash, prepaid insurance, supplies, accounts receivable. c. cash, accounts receivable, prepaid insurance, supplies. d. equipment, supplies, prepaid insurance, accounts receivable, cash.

27.The following is selected information from Monty Corporation for the fiscal year ending October 31, 2016. Cash received from customers Revenue recognized Cash paid for expenses Cash paid for computers on November 1, 2015 that will be used for 3 years (annual depreciation is $15,000) Expenses incurred, including interest, but excluding any depreciation Proceeds from a bank loan, part of which was used to pay for the computers

$300,000 378,000 180,000 45,000 230,000 100,000

Based on the accrual basis of accounting, what is Monty Corporation’s net income for the year ending October 31, 2016? a. $75,000. b. $105,000. c. $133,000. d. $148,000. 28.

Toole Company had the following transactions during 2016: Sales of $4,200 on account Collected $2,500 for services to be performed in 2017 Paid $1,580 cash in salaries Purchased airline tickets for $350 in December for a trip to take place in 2017 What is Toole’s 2016 net income using accrual accounting? a. $2,370. b. $2,620. c. $4,770. d. $5,120.

29.

Toole Company had the following transactions during 2016: Sales of $4,200 on account Collected $2,600 for services to be performed in 2017 Paid $1,630 cash in salaries Purchased airline tickets for $450 in December for a trip to take place in 2017 What is Toole’s 2016 net income using cash basis accounting? a. $520. b. $970. c. $4,720. d. $5,170.

30.A law firm received $5,000 cash for legal services to be rendered in the future. The full amount was credited to the liability account Unearned Service Revenue. If the legal services have been rendered at the end of the accounting period and no adjusting entry is made, this would cause a. expenses to be overstated. b. net income to be overstated. c. liabilities to be understated. d. revenues to be understated. 31.Wallowa Company purchased supplies costing $6,000 and debited Supplies for the full amount. At the end of the accounting period, a physical count of supplies revealed $1,800 still on hand. The appropriate adjusting journal entry to be made at the end of the period would be a. Debit Supplies Expense, $1,800; Credit Supplies, $1,800. b. Debit Supplies, $4,200; Credit Supplies Expense, $4,200. c. Debit Supplies Expense, $4,200; Credit Supplies, $4,200. d. Debit Supplies, $1,800; Credit Supplies Expense, $1,800. 32.The balance in the supplies account on June 1 was $5,000, supplies purchased during June were $3,000, and the supplies on hand at June 30 were $3,500. The amount to be used for the appropriate adjusting entry is a. $4,000. b. $4,500. c. $6,500. d. $11,500. 33.Bichon Company purchased equipment for $6,720 on December 1. It is estimated that annual depreciation on the equipment will be $1,680. If financial statements are to be prepared on December 31, the company should make the following adjusting entry: a. Debit Depreciation Expense, $1,680; Credit Accumulated Depreciation, $1,680. b. Debit Depreciation Expense, $140; Credit Accumulated Depreciation, $140. c. Debit Depreciation Expense, $5,040; Credit Accumulated Depreciation, $5,040. d. Debit Equipment, $6,720; Credit Accumulated Depreciation, $7,200. 34.

Mullins Real Estate received a check for $30,000 on July 1 which represents a 6 month advance payment of rent on a building it rents to a client. Unearned Rent Revenue was credited for the full $30,000. Financial statements will be prepared on July 31. Mullins Real Estate should make the following adjusting entry on July 31: a. Debit Unearned Rent Revenue, $5,000; Credit Rent Revenue, $5,000. b. Debit Rent Revenue, $5,000; Credit Unearned Rent Revenue, $5,000. c. Debit Unearned Rent Revenue, $30,000; Credit Rent Revenue, $30,000. d. Debit Cash, $30,000; Credit Rent Revenue, $30,000.

35.At December 31, 2016, before an...

Similar Free PDFs

P1 review with ans

- 7 Pages

AMLA MCQ with ans - sfdgnb

- 9 Pages

Chapter 02 - questions with ans

- 2 Pages

Chapter 13 ans - Test bank

- 40 Pages

Chapter 14 ans - Test bank

- 44 Pages

409514968 COMP131 TEST docx

- 85 Pages

Docx - M/C with answers

- 28 Pages

215 BMS Workshop with ans (2)

- 6 Pages

MTH166 Question CA2 - MCQ with ANS

- 10 Pages

Docx - M/C with answers

- 19 Pages

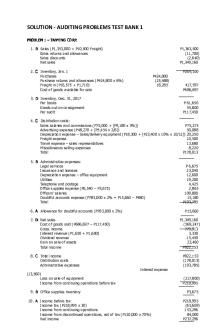

Auditing Problem Test Bank 1 ANS

- 8 Pages

ACL Quiz 2 Ans codie Test

- 8 Pages

Correction of Errors docx

- 120 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu