Activity 3 4 - Labor and Overhead cost PDF

| Title | Activity 3 4 - Labor and Overhead cost |

|---|---|

| Author | angelica jane ortega |

| Course | BS Accountancy |

| Institution | Lyceum of the Philippines University |

| Pages | 14 |

| File Size | 456.8 KB |

| File Type | |

| Total Downloads | 89 |

| Total Views | 756 |

Summary

Activity 3 - Accounting for LaborDue Wednesday, September 16, 2020, 1:00 PMTime remaining: 6 days 21 hoursSubmit your answers via PDF file with e-signature included. In case ofmanual answering, take a picture of your answers and compile it intoone PDF file only.Problem 1:The following employee chang...

Description

Activity 3 - Accounting for Labor Due Wednesday, September 16, 2020, 1:00 PM Time remaining: 6 days 21 hours Submit your answers via PDF file with e-signature included. In case of manual answering, take a picture of your answers and compile it into one PDF file only.

Problem 1: The following employee changes in BSA Mfg. Inc. for 2019 are as follows:

Employees at the beginning of 2019

1,050

Employees recruited (of which 50 of them replaced those leavers discharged by the management of BSA, while the remainder are due to expansion plans to be made by BSA for future years)

150

Employees left during the year (including the abovementioned employees replaced)

250

Employees at the end of 2019

950

Assume that there is no other information as to the changes in employees, determine the labor turnover based on the following methods (round off your answers to two decimal places expressed in percent): 1. Separation method 2. Replacement method

3. Flux method

Problem 2: BSA Factory provides for an incentive scheme for its factory workers which features a combined minimum guaranteed wage and a piece rate. Each worker is paid P11.25 per piece with a minimum guaranteed wage of P875 per week. Production report for the week show:

Employee

Units Produced

Krista

67

Jose

78

Sophiya

80

Crisia

82

Maye

72

Angelo

75

Determine the amount of the following: 1. Direct labor 2. Factory overhead

Problem 3: Cedy is an employee of NPP Incorporated. He is earning a salary (gross) of P50,000 a month. The following deductions and contributions pertaining to him and his employer are as follows:

Employee

Employer

P6,304

-

SSS contributions

P800

P1,600

PhilHealth contributions

P550

P550

HDMF contributions

P100

P100

-

P30

Withholding tax on compensation

EC contribution

Assume that Cedy is a mechanical engineer who operates the machine used in production, prepare journal entries for the following: 1. Distribution of payroll (no need to set up payroll fund, assume paid) 2. Accruals of employer’s contribution

Problem 4: The following information of a manufacturing company as regards to additional compensation to its 48 employees are as follows: Number of working weeks

48

Vacation weeks

4

Holidays

10

Annual bonus (for all 48 employees)

P592,560

Daily salary per employee

P600

The company is entitling all employees with bonus, vacation and holiday pays. Assume that the regular working days per week are 5 days, calculate the following (on a weekly basis): 1. Vacation pay 2. Bonus pay 3. Holiday pay

Problem 5: BSA Homes produces a variety of household products. The firm operates 24 hours per day with three daily work shifts. The first-shift workers receive “regular pay.” The second shift receives an 8 percent pay premium, and the third shift receives a 12 percent pay premium. In addition, when production is scheduled on weekends, the firm pays an overtime premium of 50 percent (based on the pay rate for firstshift employees). Labor premiums are included in overhead. The October 2019 factory payroll is as follows:

Total wages for October for 32,000 hours

P435,600

Normal hourly wage for first-shift employees

P12

Total regular hours worked, split evenly among the three 27,000 shifts

Answer the following: 1. How much of the total labor cost should be charged to direct labor? 2. How much of the total labor cost should be charged to overhead? 3. Calculate the breakdown of overhead cost as to: a. Second shift premiums b. Third shift premiums c. Overtime premiums

Activity 4 - Accounting for Overhead Due Wednesday, September 16, 2020, 1:00 PM Time remaining: 6 days 21 hours Submit your answers via PDF file with e-signature included. In case of manual answering, take a picture of your answers and compile it into one PDF file only.

Problem 1: The following information about Chachi Company’s budgeted overhead are as follows:

Variable overhead @ 2,000 direct labor hours $150,000 Fixed overhead @ 2,000 direct labor hours $100,000

Chachi uses normal costing in accounting for the factory overhead with a predetermined rate based on direct labor hours. They use the flexible budgets in order to calculate the predetermined rate. Actual labor hours worked during the current period is 1,700 hours. The following information pertains to the costs actually incurred by Chachi during the current period: Depreciation expense, machine Depreciation expense, factory Direct materials Indirect labor Indirect materials Marketing manager’s salary, net of 15% part-time salary in factory supervision Utilities expense, 70% of which is related to factory Office supplies Miscellaneous factory expense Administrative salaries, 5% are related to part-timers in quality inspection

$40,000 $10,000 $100,000 $60,000 $20,000

$85,000 $50,000 $15,000 $35,000

$120,000

Required: ·

How much is the applied overhead?

·

How much is the actual overhead incurred?

·

How much is the under- or overrapplied overhead during the current period?

Problem 2: Alberton Electronics makes inexpensive GPS navigation devices and uses a normal costing system that applies overhead based on machine hours. The following 2016 budgeted data are available:

Variable FOH at 100,000 machine hours

$1,250,000

Variable FOH at 150,000 machine hours

1,875,000

Fixed FOH at all levels between 10,000 and 180,000 machine hours

1,440,000

Practical capacity is 180,000 hours; expected capacity is two-thirds of practical.

Required: ·

What is Alberton’s predetermined variable OH rate?

·

What is the predetermined fixed OH rate using practical capacity?

·

What is the predetermined fixed OH rate using expected capacity?

· During 2016, the firm records 110,000 machine hours and $2,710,000 of overhead costs. o How much variable overhead is applied? o How much fixed overhead is applied using the rates found in parts (b) and (c)? o Compute for the under- or overapplied overhead for 2016 using both fixed OH rates.

Problem 3: The following data related to Jenel Company’s utility costs for the past 6 months are as follows (based on kilowatt hours (kWh)):

kWhs

Total cost ($)

120

4,000

200

6,500

150

4,750

180

5,600

220

7,200

175

5,350

Required: · Using high low method, determine the cost formula for utility costs of the company. Determine the variable component per hour and the total fixed cost associated to it. · Using your answers on the first requirement, compute for the expected total cost of the company if they projected their kilowatt hours used at 135 hours. · Using your answers on the first requirement, how many kWhs will the company expect to use if they budgeted their next month’s utility costs at $5,280? · Compute the variable and fixed component of the utility costs of Jenel using least squares analysis and derive the cost formula based on your computations.

Problem 4: Geo-trig Inc. has three producing departments (Sine, Cosine, and Tangent) and two service departments (Rhombus and Triangle). Data that summarize overhead activity for January are:

Producing Departments Sine

Cosine

Service Departments

Tangent

Rhombus

Triangle

Total overhead before service department allocations.......... $20,000

$50,000

$80,000

$30,000

$40,000

Square footage occupied...................................... 3,000 Number of employees.......................... 50

4,000 30

3,000 20

1,000 25

2,500 10

Rhombus costs are distributed on the basis of square footage occupied, while Triangle costs are distributed on the basis of number of employees.

Required: · Compute the factory overhead of each producing departments after allocation of service department costs using: o Direct method o Step method, using Triangle as the first to be distributed o Simultaneous method

Problem 5: Eaglehorn Company had the following overhead costs for the month of October 2019:

Budgeted (Based on 4,000 machine hours)

Actual (based on 5,000 machine hours)

Variable overhead

$12,000

$14,560

Fixed overhead

16,000

17,890

The company determined that their normal operating capacity is 4,000 machine hours.

Required: Calculate the following: ·

Variable overhead spending variance

·

Fixed overhead spending variance

·

Idle capacity variance

·

Total overhead variance

1. Av er ageNumberofwr ok er sDur i ng2019=1050+950/ 2= 1000 Seper at i onMet hod

Tot alEmpl oy eedLef tDur i ngt heYear = 250 Repal cedonManegmentDeci s i on = 50 Empl oy eesSeper at edwi t houtr epl acement =25050=200 LabourTur nov er= No.ofwor ker sl ef torsepar at ed dur i ng a per i od/ Av er age numberofwor k er s on r ol e dur i ng t hatper i odx100 =( 200/ 1000) * 100 20% Repl acementMet hod LabourTur nov er=No.ofwor k er sr epl aceddur i ngaper i od/Av er agenumberofwor k er sonr ol e dur i ngt hatper i odx100 =( 50/ 1000) * 100 5% Fl uxMet hod LabourTur nov er= ( No. ofwor k er ssepar at edi naper i od+No.ofwor k er sr epl acedi nt hes ameper i od)/Av er age numberofwor k er sonr ol edur i ngt hatper i odx100 =( 250/ 1000) * 100 25% 2. Pi eceRat e 11. 25 Mi ni mum 875 Empl oy ee Uni t sPr oduced Kr i st a67753. 75121. 25 Jos e78877. 50 Sophi y a80 900. 00 Cr i si a82922. 50 May e72810. 0065. 00 Angel o75843. 7531. 25 Tot al5107. 50217. 50 Di r ectLabor 5107. 50 Fact or yOH 217. 50

Pi eceRat eAmountOH( 825PRAmount )

5.

2....

Similar Free PDFs

Factory Overhead Cost Variance

- 2 Pages

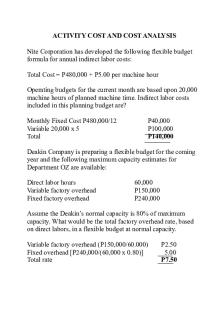

Activity COST AND COST Analysis

- 5 Pages

SAP - Overhead Cost Orders

- 199 Pages

Accounting For Labor Cost

- 18 Pages

Activity 3 AND 4 Aileen Quitain

- 4 Pages

Cost Accounting Basic Activity

- 11 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu