BUS 1104 - Learning Journal 4 PDF

| Title | BUS 1104 - Learning Journal 4 |

|---|---|

| Course | Macroeconomics |

| Institution | University of the People |

| Pages | 5 |

| File Size | 178 KB |

| File Type | |

| Total Downloads | 89 |

| Total Views | 237 |

Summary

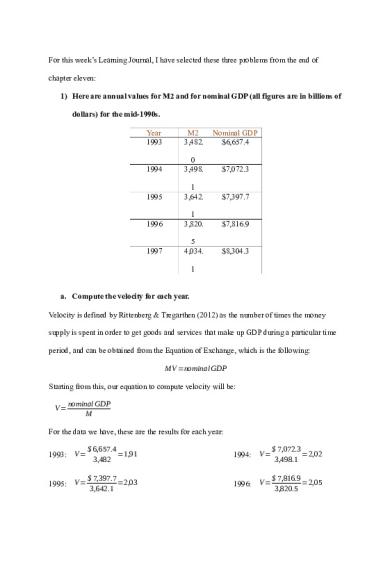

For this week’s Learning Journal, I have selected these three problems from the end of chapter eleven: 1) Here are annual values for M2 and for nominal GDP (all figures are in billions of dollars) for the mid-1990s. Year M2 Nominal GDP 1993 3,482. 0$6,657.1994 3,498.1$7,072.1995 3,642.1$7,397.1996 3...

Description

For this week’s Learning Journal, I have selected these three problems from the end of chapter eleven: 1) Here are annual values for M2 and for nominal GDP (all figures are in billions of dollars) for the mid-1990s. Year 1993

M2 3,482.

Nominal GDP $6,657.4

1994

0 3,498.

$7,072.3

1995

1 3,642.

$7,397.7

1996

1 3,820.

$7,816.9

1997

5 4,034.

$8,304.3

1

a. Compute the velocity for each year. Velocity is defined by Rittenberg & Tregarthen (2012) as the number of times the money supply is spent in order to get goods and services that make up GDP during a particular time period, and can be obtained from the Equation of Exchange, which is the following: MV =nominal GDP Starting from this, our equation to compute velocity will be: V=

nominal GDP M

For the data we have, these are the results for each year: 1993: V =

$ 6,657.4 =1,91 3,482

1994: V =

$ 7,072.3 =2,02 3,498.1

1995: V =

$ 7,397.7 =2,03 3,642.1

1996: V =

$ 7,816.9 =2,05 3,820.5

1997: V =

$ 8,304.3 =2,06 4,034.1

b. Compute the fraction of nominal GDP that was being held as money. 1993 =

1 =0.52 3 1.91

1994 =

1 =0.495 2.02

1995 =

1 =0.492 2.03

1996 =

1 =0.488 2.05

1997 =

1 =0.485 2.06

c. What is your conclusion about the stability of velocity in this five-year period?

The Velocity of M2, 1993-1997 2.1 2.05 2 1.95 1.9 1.85 1.8 1993

1994

1995 Annual Velocity

1996

1997

Average Velocity

I believe that the velocity has been stable in this five-year period, increasing of 0,15, with an average velocity of 2,014. 2) Here are annual values for M2 and for nominal GDP (all figures are in billions of dollars) for the mid-2000s. Year 2003

M2 6,055.

Nominal GDP $10,960.8

2004

5 6,400.

$11,685.9

2005

7 6,659.

$12,421.9

2006

7 7,012.

$13,178.4

2007

3 7,404.

$13,807.5

3

a. Compute the velocity for each year As before, I will use the formula V =

nominal GDP M

;

2003: V =

$ 10,960.8 =1,81 6,055.5

2004:

V=

$ 11,685.9 =1,82 6,400.7

2005: V =

$ 12,421.9 =1,86 6,659.7

2006:

V=

$ 13,178.4 =1,88 7,012.3

2007: V =

$ 13,807.5 =1,86 7,404.3

b. Compute the fraction of nominal GDP that was being held as money. 2003 =

1 =0.55 2 1.81

2004 =

1 =0.54 9 1.82

2007 =

1 =0.537 1.86

2005 =

1 =0.537 1.86 2006 =

1 =0.532 1.88

c. What is your conclusion about the stability of velocity in this five-year period?

The Velocity of M2, 2003-2007 1.9 1.88 1.86 1.84 1.82 1.8 1.78 1.76 2003

2004

2005

2006

Annual Velocity

2007

Average Velocity

I believe that the velocity of money has not been stable in this five-year period, as it increased from 2003 to 2006, and then it decreased from 2006 to 2007; the average velocity has been 1,846.

3) Here are annual values for M2 and for nominal GDP (all figures are in billions of dollars) for the years 1993 to 1997. Year 1993

M1 1,129.

Nominal GDP $6,657.4

1994

6 1,150.

$7,072.3

1995

7 1,127.

$7,397.7

1996

4 1,081.

$7,816.9

1997

3 1,072.

$8,304.3

5

a. Compute the M1 velocity for these years.

As before, I will use the formula V =

1993: V =

$ 6,657.4 =5,90 1,129.6

1995: V =

$ 7,397.7 =6,56 3 1,127.4

1997: V =

$ 8,304.3 =7,74 1,072.5

nominal GDP M1

; 1994: V =

1996:

V=

$ 7,072.3 =6,14 1,150.7

$ 7,816.9 =7,23 1,081.3

b. If you were going to use a money target, would M1 or M2 have been preferable during the 1990s? Explain your reasoning. If I were going to use a money target, I would have used M1 instead of M2. In my opinion, M1 seems to be more liquid than M2. In fact, in the case of M1 selected as Money target, we can see that the velocity of capital has been steadily rising over time. This means that individuals are keeping less of their GDP as currency compared to M2, so expanding the money supply will intensify inflationary pressures rather than stimulate the economy. Word Count: 534

References Rittenberg, L., & Tregarthen, T. D. (2012). Principles of Macroeconomics v. 2.0. Creative Commons License. https://my.uopeople.edu/mod/resource/view.php?id=240135...

Similar Free PDFs

BUS 1104 - Learning Journal 4

- 5 Pages

BUS 1104 Learning Journal Unit 4

- 2 Pages

BUS 1104 Learning Journal Unit 3

- 6 Pages

BUS 1104 WA Unit 4

- 5 Pages

BUS Learning Journal W3

- 3 Pages

BUS 1103 Learning Journal Unit 4

- 4 Pages

BUS 2201 - Learning Journal 7

- 2 Pages

Week 4 Learning Journal

- 2 Pages

Learning journal unit 4

- 3 Pages

Learning journal unit-4

- 2 Pages

Learning Journal Unit 4

- 1 Pages

Learning Journal Week 4

- 3 Pages

Learning Journal Unit 4

- 2 Pages

Learning Journal Unit 4

- 1 Pages

Learning journal week 4

- 1 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu