CHAP 5 - tax PDF

| Title | CHAP 5 - tax |

|---|---|

| Course | Taxation |

| Institution | Mindanao State University |

| Pages | 26 |

| File Size | 475.4 KB |

| File Type | |

| Total Downloads | 116 |

| Total Views | 208 |

Summary

PERCENTAGE TAXA percentage tax is a national tax measured by a certain percentage of the gross selling price or gross value in money of goods sold or bartered; or of the gross receipts or earning derived by any person engaged in the sale of services. (CIR vs. Solid bank Corporation, G,R. No. 148191,...

Description

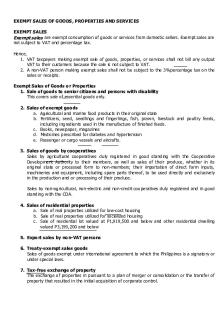

PERCENTAGE TAX A percentage tax is a national tax measured by a certain percentage of the gross selling price or gross value in money of goods sold or bartered; or of the gross receipts or earning derived by any person engaged in the sale of services. (CIR vs. Solid bank Corporation, G,R. No. 148191, November 25, 2003) THE SCOPE OF THE PERCENTAGE TAX Coverage Type of % tax Services specifically subject to Specific % tax percentage tax Sales of goods or other services General % tax not exempted Who pays percentage tax? Type of percentage Tax Specific percentage tax General percentage tax

VAT registered taxpayers YES NO

Tax rates Various tax rates 3% percentage tax

Non-VAT taxpayers YES YES

Non-VAT taxpayers are those who did not exceed the VAT threshold and who did not register as VAT taxpayers. SERVICES SPECIFICALLY SUBJECT TO PERCENTAGE TAX 1. Banks and non-bank financial intermediaries 2. International carries on their transport of cargoes, excess baggage and mails only (RA 10378) 3. Common carries on their transport of passengers by land and keepers of garage 4. Certain amusement places 5. Brokers in effecting sales of stocks through the Philippine Stock Exchange and corporations or shareholders on initial public offerings 6. Certain franchise grantees 7. Life insurance companies and agents of foreign insurance 8. Telephone companies on overseas communication 9. Jai-alai and cockpit operators on winnings Don’t forget out mnemonic BICAP FLOW.

TAX ON BANKS AND NON-BANK FINANCIAL INTERMEDIARIES PERFORMING QUASIBANKING FUNCTIONS “Banks” refers to entities engaged in the lending of fund obtained in the form of deposits. ( RA 8792. The general Banking Law of 2000) “Banks” includes commercial banks, saving banks, mortgage banks, development banks rural banks, stocks and savings associations, branches and agencies of foreign banks (RA337, The General Act). The term also includes cooperative banks, Islamic banks and other banks as determined by the monetary board of the Bangko Sentral ng Pilipinas (BSP) in the classification of banks. (RA 8791) “Non-bank financial intermediaries” refers to persons or entities whose principal function include lending investing or placement of funds or evidences of indebtedness or equity deposited with

them, acquired by them or otherwise coursed through them, either for their own account or for the account of others. This includes all entities regularly engaged in the lending of funds or purchasing of receivables or other obligations with funds obtained from the public through the issuance, endorsement or acceptance or debt instruments of any kind for their own account, or through the issuance of certificates, or of purchase agreements, whether any of these means of obtaining funds from the public is done on a regular basis or only occasionally. (Ibid) What is Quasi-Banking function? Refers to the borrowing of funds from twenty (20) or more personal or corporate lenders at any one time, through the issuance, endorsement or acceptance of debt instruments of any kind, other than deposits, for the borrower’s own account or through the issuance of certificates of assignment or similar instruments, with recourse, or repurchase agreements for purposes of relending or purchasing receivables or other similar obligations. Provided, however, that commercial, industrial and other non-financial companies, which borrows funds through any of these means for the limited purpose of financing their own needs or the needs if their agents or dealers, shall be not considered as performing quasi-banking functions. Non-banking financial intermediaries performing quasi-banking functions re commonly referred to as “Quasi-banks”. Tax Rates on Bank and Quasi-banks Source of income or receipt % Tax rate 1. Interest income, commissions and discounts from lending activities, and income from financial leasing, on the basis of remaining maturities of instruments from which basis of receipts were derived: a. Maturity period of five years or less 5% b. Maturity period of more than five years 1% 2. Dividend and equity share in the net income of subsidiaries 0% 3. On royalties, rentals of property, real or persona;, profits from exchange 7% and all other items treated as gross income under section 32 of the NIRC 4. On net trading gains within the taxable year on foreign currency, debts 7% securities, derivatives, and other similar financial instruments Note: 1. The percentage tax on banks, quasi-banks and other non-bank financial institution is commonly known as the “gross receipt tax” 2. The BSP usually makes a periodic publication of the list of quasi-banks. Non-bank financial intermediaries not performing quasi-banking functions are subject to a separate set of gross receipt tax rates. Illustration 1: Basic computation Orion Bank had the following interest receipts during the month: Source of Income Interest income from loans maturing within 2 years Interest income from loans maturing more than 2 years but within 5 years Interest income on loans maturing more than 5 years Processing fees

Total amount P2,500,000 1,000,000 1,200,000 300,000

Rent income from foreclosed properties (ROPA) Dividends income

200,000 50,000

The gross receipt tax of the bank shall be computed as follows: Tax rates

%Tax

Interest on short-term loans: Up to 2 year loans More than 2 – 5 year loans Total

P2,500,000 1,000,000 P3,500,000

5%

P175,000

Interest on long-term loans: More than 5 year maturity Dividends

P1,200,000 P50,000

1% 0%

12,000 0

P300,000 200,000 P500,000

7%

35,000 P222,000

Other items of gross income: Processing fees Rent income Total Gross receipt tax

Illustration 2: Meaning of “On the basis of remaining maturities” In 2019, East Bank had a 10 year loan with a principal amount of P1,000,000 which was issued on March 31,2014. The loan pays P20,000 monthly interest income on the last day of every month. The applicable gross receipt tax rate for the monthly interest payments on this loan in 2014 shall be: Month Remaining maturity Applicable tax rate January 31, 2019 5 years and 2 months 1% February 28, 2019 5 years and 1 month 1% March 31, 2019 Exactly 5 years 5%* April 30, 2019 4 years and 11 months 5%* *This tax rate applies on interest income for every month thereafter until maturity The monthly gross receipt tax on the interest income on this loan shall be: January February March April Interest income P20,000 P20,000 P20,000 P20,000 Gross receipt tax rate 1% 1% 5% 5% Gross receipt tax P200 P200 P1,000 P1,000 MEANING OF “GROSS INCOME” The items of gross income referred to in Section 32 of the NIRC. Include only those items of gross income subject to regular income tax. It can be argued therefore that only those items of gross income subject to the regular tax are includible as “gross receipts” for purposes of the percentage tax. Under current jurisprudence, however, the term “gross income” of banks was held to include those items of gross income subject to final tax. Furthermore, it was also held that the amount of gross

income to be included in gross receipts for purposes of the gross receipt tax shall be the amount of the income, gross of the final income tax. Illustration The United Kalinga Unibank received a total of P8,000,000 interest income from short-term deposits with other banks during the month. The interest was net of the 20% final income tax. Pursuant to the aforementioned Supreme Court rulings, the gross receipt tax of Unitel Kalinga on the interest income from deposit shall be computed as: Gross receipts (8,000,000/80%) P10,000,000 Multiply by: 7% Gross receipt tax P700,000 Note: 1. The P8,000,000 net receipt is only 80% of the actual gross receipt. Hence, it is grossed up by dividing it with 80%. 2. The applicable percentage tax rate is 7% not the 5% tax rate since the interest is earned from deposits not from loans.

Net trading within the taxable year on foreign currencies, debts, securities, derivatives and other financial instruments The tax clearly applies to the annual net gains from this category. According to RR4-2009, the figure to be reported in the monthly percentage tax return shall be cumulative total of the net trading gain loss since the start of the taxable year less the figures already reflected in the previous months of the taxable year. Net trading loss sustained from this category shall be deductible only to the gains from trading on the same category. The net trading loss shall not be deductible to other categories of receipts. If the bank has a cumulative net loss at the end of the year, the same cannot be carried over as deduction against trading gains in the following year. Illustration 1 A bank had the following income respectively in April 2016 and May 2016: April May Interest income from short-term loans P100,000 P100,000 Rentals 50,000 50,000 Net trading (loss) gain (10,000) 20,000 The percentage tax shall be computed as follows: For the month of April Gross receipt tax on interest – short-term (100,000 x 5%) Gross receipt tax on rent (P50,000 x 7%) Net trading loss Gross receipts tax Note: the loss cannot be offset against other items of gross receipts.

For the month of May –

P5,000 3,500 P8,500

Gross receipt tax on interest – short-term (100,000 x 5%) Gross receipts tax on rent (50,000 x 7%) Net trading gain (P20,000 gain – P10,000 loss) x 7% Gross receipt tax

P5,000 3,500 700 P9,200

Note: the taxable amount of the gain is the cumulative net gain to date.

Illustration 2 A bank had the following data: December 2015 Net trading gains (loss) (P10,000)

January 2016 P20,000

The gross receipt tax in December 2015 shall be nil since there is a loss. The gross receipt tax on the net trading gain for January 2016 shall be P1,400, computed as P20,000 x 7% the annual net trading loss in 2015 cannot be deducted in 2016. Note that the treatment specified by the regulation may result in the payment of monthly gross receipt tax even if there is an annual net trading loss at the end of the year. The regulation is silent on such issue. However, since the law taxes the annual net gain rather than the monthly net gain, it is understandable that any monthly gross receipt tax paid under such condition is recoverable by the taxpayer. Exemption from the gross receipt tax The gross receipt tax imposed on banks does not apply to the income of or revenue realized by the Bangko Sentral ng Pilipinas (BSP) from its transactions undertaken in pursuit of its legally mandated functions. TAX ON OTHER FINANCIAL INTERMEDIARES WITHOUT QUASI-BANKING FUNCTIONS Source of income or receipt % Tax rate 1. Interest income, commissions and discounts from lending activities, income from financial leasing, on the basis of remaining maturities of instruments from which the receipts were derived: a. Maturity period is five years or less 5% b. Maturity period is more than five years 1% 2. From all other items treated as gross income under the NIRC 5% Examples of non-bank financial intermediaries without quasi-banking functions include: 1. Pawnshop 2. Money changers Common Rules for Banks, Quasi-banks and Other Financial Institutions 1. Accounting rules 2. Finance lease and operating leases 3. Pre-termination of instruments

Accounting rules Under RR4-2009, the basis of the calculation of gross receipts shall be the generally accepted accounting principle (GAAP) prescribed by the: 1. Bangko Sentral ng Pilipinas – for banks and quasi-banks 2. Securities and Exchange Commission – for other non-bank financial intermediaries Both agencies prescribe the Philippine Financial Reporting Standards (PFRS) based upon International Accounting Standards (IAS) as GAAP. Finance and operating leases A finance lease (also known as direct financing lease) is a sale of property whereby the seller earns only interest income on the arrangement. An operation lease is not a sales and does not transfer ownership over the leased property. The taxable gross receipt on finance lease shall consist only if interest income excluding the gross rentals received. Illustration 1: The effective interest method for finance leases HIM finance Corporation imports machineries from abroad and sells them under a deferred financing scheme. On February 1, 2019, it sold a machine with an acquisition cost of P257,710 for P300,000 payable in monthly installment of 100,000 starting March 1, 2019. The loan earns 8% effective interest. The P42,290 excess the contract price over the cost (P300,000-P257,710) is an interest income to be recognized as income in pursuant to the effective interest method under GAAP. Date Feb. 1, 2019 Mar. 1, 2019 Apr. 1, 2019 May 1, 2019 Note:

Beginning Balance P257,701 257,701 178,327 92,593

Interest Income P20,617 14,266 7,407

Collection 100,000 100,000 100,000

Principal Reduction 79,383 85,734 92,593

Balance Ending P257,710 178,327 92,593 0

The interest income is computed as beginning balance of the loan x interest rate. The principal reduction is computed as collection less interest income. The ending balance is computed as beginning balance less principal reduction.

The interest income in each month is reported as gross receipt in the month realized, not entire P100,000 monthly collection because it contains recover of the principal. Illustration 2: Operating Lease Itogon Industrial Bank foreclosed a property in March. It leased the property to a commercial lease for period of 10 years. The lease pays P50,000 monthly rental on the property.

The P50,000 monthly rental shall be included in the monthly gross receipts for purposes of the gross receipt tax. Note that this rental is purely income.

Pre-termination of loans In the care of pre-termination, the maturity period shall be reckoned to end as of the date of pretermination of purposes of classifying the transaction and applying correct rate tax. Illustration On January 1, 2015, Pinoy Bank loaned P1,000,000 to a client payable within 10 years. The loan pays 10% interest payable every December 31 with the first interest payment due December 31, 2015. On June 30, 2021, the client pre-terminated the loan by repaying the principal in full. Year Remain maturity Interest Tax rate 2015 9 years P100,000 1% 2016 8 years 100,000 1% 2017 7 years 100,000 1% 2018 6 years 100,000 1% 2019 5 years 100,000 5% 2020 4 years 100,000 5% Total 6/30/2021 P50,000 ??

Amount P1,000 1,000 1,000 1,000 5,000 5,000 P14,000 ??

Upon pre-termination in June 30, 2021, the loan shall be reclassified. The remaining maturities of the loan shall be re-counted up to the date of pre-termination. The correct gross receipt tax shall be recomputed and adjustment shall be made: Year

Remaining maturity 5.5 years 4.5 years 3.5 years 2.5 years 1.5 years...

Similar Free PDFs

CHAP 5 - tax

- 26 Pages

Chap 4 - tax

- 27 Pages

Chap 5

- 4 Pages

CIVE 541 - Chap 5 - Chap 5

- 9 Pages

Chap 5 ans - IE Chap 5

- 4 Pages

Chapter 5 - tax

- 8 Pages

Chap 5 - anatomy

- 13 Pages

Chap 5 - BOOK SOLUTIONS

- 96 Pages

Chapter 5 TAX - Banggawan

- 47 Pages

ACC 440 Chap. 5

- 8 Pages

Tax Chapter 5

- 30 Pages

Pf2 chap 5 en ca - Pf2 chap 5 en ca

- 63 Pages

Chap-5 - Charlotte Bellon

- 8 Pages

Chap 5 Assess - Lecture

- 5 Pages

Chap 5 - CCA Classes

- 3 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu