Chapter 28 - Investment Policy and the Framework of the CFA Institute PDF

| Title | Chapter 28 - Investment Policy and the Framework of the CFA Institute |

|---|---|

| Course | Investment Analysis and Portfolio Management |

| Institution | University of Canterbury |

| Pages | 65 |

| File Size | 694.3 KB |

| File Type | |

| Total Downloads | 11 |

| Total Views | 157 |

Summary

Download Chapter 28 - Investment Policy and the Framework of the CFA Institute PDF

Description

Chapter 28 - Investment Policy and the Framework of the CFA Institute

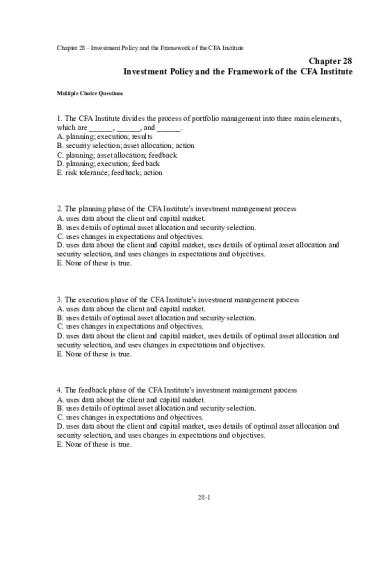

Chapter 28 Investment Policy and the Framework of the CFA Institute Multiple Choice Questions

1. The CFA Institute divides the process of portfolio management into three main elements, which are ______, ______, and ______. A. planning; execution; results B. security selection; asset allocation; action C. planning; asset allocation; feedback D. planning; execution; feedback E. risk tolerance; feedback; action

2. The planning phase of the CFA Institute's investment management process A. uses data about the client and capital market. B. uses details of optimal asset allocation and security selection. C. uses changes in expectations and objectives. D. uses data about the client and capital market, uses details of optimal asset allocation and security selection, and uses changes in expectations and objectives. E. None of these is true.

3. The execution phase of the CFA Institute's investment management process A. uses data about the client and capital market. B. uses details of optimal asset allocation and security selection. C. uses changes in expectations and objectives. D. uses data about the client and capital market, uses details of optimal asset allocation and security selection, and uses changes in expectations and objectives. E. None of these is true.

4. The feedback phase of the CFA Institute's investment management process A. uses data about the client and capital market. B. uses details of optimal asset allocation and security selection. C. uses changes in expectations and objectives. D. uses data about the client and capital market, uses details of optimal asset allocation and security selection, and uses changes in expectations and objectives. E. None of these is true.

28-1

Chapter 28 - Investment Policy and the Framework of the CFA Institute

5. __________ refer to strategies aimed at attaining the established rate of return requirements while meeting expressed risk tolerance and applicable constraints. A. Investment constraints B. Investment objectives C. Investment policies D. All of these are true. E. None of these is true.

6. One incorrect belief that is often cited as a reason for fully-funded pension funds to invest in equities is A. stocks have higher risk. B. bonds have lower returns. C. stocks provide a hedge against inflation. D. stocks have higher returns. E. All of these are incorrect beliefs that are often cited.

7. __________ in the process of asset allocation. A. Deriving the efficient portfolio frontier is a step B. Specifying asset classes to be included in the portfolio is a step C. Specifying the capital market expectations is a step D. Deriving the efficient portfolio frontier is a step, specifying asset classes to be included in the portfolio is a step, and specifying the capital market expectations is a step E. None of these is true.

8. Questionnaires and attitude surveys suggest that risk tolerance A. increases with age. B. decreases with age. C. stays constant over the life cycle for most investors. D. cannot be assessed. E. None of these is true.

28-2

Chapter 28 - Investment Policy and the Framework of the CFA Institute

9. __________ can be used to create a perfect inflation hedge A. Gold B. Real estate C. CPI-linked bonds D. The S&P 500 index E. None of these is true.

10. A fully-funded pension plan can invest surplus assets in equities provided it reduces the proportion in equities when the value of the fund drops near the accumulated benefit obligation. This strategy is referred to as A. immunization. B. hedging. C. diversification. D. contingent immunization. E. overfunding.

11. Workers who change jobs may wind up with lower pension benefits at retirement than otherwise identical workers who stay with the same employer, even if the employers have defined benefit plans with the same final-pay benefit formula. This is referred to as A. an accumulated benefit obligation. B. an unfunded liability. C. immunization. D. indexation. E. the portability problem.

12. The __________ the proportion of total return that is in the form of price appreciation, the __________ will be the value of the tax-deferral option for taxable investors. A. greater; greater B. greater; lower C. lower; greater D. Cannot tell from the information given. E. None of these is true.

28-3

Chapter 28 - Investment Policy and the Framework of the CFA Institute

13. An important benefit of Keogh plans is that A. they are not taxable until funds are withdrawn as benefits. B. they are protected against inflation. C. they are automatically insured by the Federal government. D. they are not taxable until funds are withdrawn as benefits and they are protected against inflation. E. they are not taxable until funds are withdrawn as benefits and they are automatically insured by the Federal government.

14. Variable life insurance A. combines life insurance with a tax-deferred annuity. B. provides a minimum death benefit that increases subject to investment performance. C. can be converted to a stream of income. D. All of these are true. E. None of these is true.

15. Endowment funds are held by __________. A. charitable organizations B. educational institutions C. for profit firms D. charitable organizations and educational institutions E. educational institutions and for profit firms

16. __________ center on the trade-off between the return the investor wants and how much risk the investor is willing to assume. A. Investment constraints B. Investment objectives C. Investment policies D. All of these are true. E. None of these is true.

28-4

Chapter 28 - Investment Policy and the Framework of the CFA Institute

17. The stage an individual is in his/her life cycle will affect his/her __________. A. return requirements B. risk tolerance C. asset allocation D. return requirements and risk tolerance E. return requirements, risk tolerance, and asset allocation

18. A remainderman is __________. A. a stockbroker who remained working on Wall Street after the 1987 crash B. an employee of a trustee C. one who receives interest and dividend income from a trust during their lifetime D. one who receives the principal of a trust when it is dissolved E. None of these is true.

19. __________ are boundaries that investors place on their choice of investment assets. A. Investment constraints B. Investment objectives C. Investment policies D. All of these are true. E. None of these is true.

20. The investment horizon is: A. the investor's expected age at death. B. the starting date for establishing investment constraints. C. based on the investor's risk tolerance. D. the date at which the portfolio is expected to be fully or partially liquidated. E. None of these is true.

21. Liquidity is A. the ease with which an asset can be sold. B. the ability to sell an asset for a fair price. C. the degree of inflation protection an asset provides. D. All of these are true. E. the ease with which an asset can be sold and the ability to sell an asset for a fair price.

28-5

Chapter 28 - Investment Policy and the Framework of the CFA Institute

22. The objectives of personal trusts normally are __________ in scope than those of individual investors and personal trust managers typically are __________ than individual investors. A. broader; more risk averse B. broader; less risk averse C. more limited; more risk averse D. more limited; less risk averse E. None of these is true.

23. When a company sets up a defined contribution pension plan, the __________ bears all the risk and the __________ receives all the return from the plan's assets. A. employee; employee B. employee; employer C. employer; employee D. employer; employer E. cannot tell; Depends on the economic environment.

24. Suppose that the pre-tax holding period returns on two stocks are the same. Stock A has a high dividend payout policy and stock B has a low dividend payout policy. If you are an individual in a high marginal tax bracket and do not intend to sell the stocks during the holding period, __________. A. stock A will have a higher after-tax holding period return than stock B B. the after-tax holding period returns on stocks A and B will be the same C. stock B will have a higher after-tax holding period return than stock A D. It is impossible to determine which stock will have a higher after-tax holding period return given the information available. E. None of these is true.

28-6

Chapter 28 - Investment Policy and the Framework of the CFA Institute

25. The prudent investor rule requires __________. A. executives of companies to avoid investing in options of companies by which they are employed B. executives of companies to disclose their transactions in stocks of companies by which they are employed C. professional investors who manage money for others to avoid all risky investments D. professional investors who manage money for others to constrain their investments to those that would have been approved by the prudent investor E. None of these is true.

26. The longest time horizons are likely to be set by A. banks. B. property and casualty insurance companies. C. pension funds. D. banks and pension funds. E. property and casualty insurance companies and pension funds.

27. The longest time horizons are likely to be set by A. banks. B. property and casualty insurance companies. C. endowment funds. D. banks and endowment funds. E. property and casualty insurance companies and endowment funds.

28. The shortest time horizons are likely to be set by A. banks. B. property and casualty insurance companies. C. pension funds. D. banks and property and casualty insurance companies. E. property and casualty insurance companies and pension funds.

28-7

Chapter 28 - Investment Policy and the Framework of the CFA Institute

29. U. S. mutual funds are restricted to holding no more than __________ of any publicly traded corporation. A. 1% B. 5% C. 10% D. 25% E. There is no restriction on percentage ownership.

30. Institutional investors will rarely invest in which of these asset classes? A. Bonds B. Stocks C. Cash D. Real estate E. Precious metals

31. For an individual investor, the value of home ownership is likely to be viewed A. as a hedge against increases in rental rates. B. as a guarantee of availability of a particular residence. C. as a hedge against inflation. D. as a hedge against increases in rental rates and as a guarantee of availability of a particular residence. E. All of these are true.

32. Assume that at retirement you have accumulated $500,000 in a variable annuity contract. The assumed investment return is 6% and your life expectancy is 15 years. What is the hypothetical constant benefit payment? A. $30,000.00 B. $33,333.33 C. $51,481.38 D. $52,452.73. E. Cannot tell without additional information.

28-8

Chapter 28 - Investment Policy and the Framework of the CFA Institute

33. Assume that at retirement you have accumulated $500,000 in a variable annuity contract. The assumed investment return is 6% and your life expectancy is 15 years. If the first year's actual investment return is 8%, what is the starting benefit payment? A. $30,000.00 B. $33,333.33 C. $51,481.38 D. $52,452.73 E. Cannot tell without additional information.

34. The first step a pension fund should take before beginning to invest is to __________. A. establish investment objectives B. develop a list of investment managers with superior records to interview C. establish asset allocation guidelines D. decide between active and passive management E. None of these is true.

35. General pension funds typically invest __________ of their funds in equity securities. A. none B. 5–10% C. 15–35% D. 40–60% E. more than 60%

36. The optimal portfolio on the efficient frontier for a given investor depends on A. the investor's degree of risk tolerance. B. the coefficient, A, which is a measure of risk aversion. C. the investor's required rate of return. D. the investor's degree of risk tolerance and the investor's required rate of return. E. the investor's degree of risk tolerance and the coefficient, A, which is a measure of risk aversion.

28-9

Chapter 28 - Investment Policy and the Framework of the CFA Institute

37. The optimal portfolio on the efficient frontier for a given investor does not depend on A. the investor's degree of risk tolerance. B. the coefficient, A, which is a measure of risk aversion. C. the investor's required rate of return. D. the investor's degree of risk tolerance and the investor's required rate of return. E. the investor's degree of risk tolerance and the coefficient, A, which is a measure of risk aversion.

38. Target-date retirement funds are not A. funds of funds diversified across stocks and bonds. B. designed to change their asset allocation as time passes. C. a simple but useful strategy. D. designed to function much like hedge funds. E. funds of funds diversified across stocks and bonds, designed to change their asset allocation as time passes, and a simple but useful strategy.

39. A ___________ is established when an individual confers legal title to property to another person or institution to manage the property for one or more beneficiaries. A. tax shelter B. defined contribution plan C. personal trust D. fixed annuity E. Keogh plan

40. Professional financial planners should A. assess their client's risk and return requirements on a one-time basis. B. explain the investment plan to the client. C. inform the client about the outcome of the plan. D. assess their client's risk and return requirements on a one-time basis, explain the investment plan to the client, and inform the client about the outcome of the plan. E. explain the investment plan to the client and inform the client about the outcome of the plan.

28-10

Chapter 28 - Investment Policy and the Framework of the CFA Institute

41. Deferral of capital gains tax I) means that the investor doesn't need to pay taxes until the investment is sold. II) allows the investment to grow at a faster rate. III) means that you might escape the capital gains tax if you live long enough. IV) provides a tax shelter for investors. A. II and III B. I, II, IV C. I, III, and V D. II, III, and IV

42. Deferral of capital gains tax does not I) mean that the investor doesn't need to pay taxes until the investment is sold. II) allow the investment to grow at a faster rate. III) mean that you might escape the capital gains tax if you live long enough. IV) provide a tax shelter for investors. A. III B. II C. I, II, and V D. II, III, and IV

43. Which of the following investments does not allow the investor to choose how to allocate assets? A. Variable Life insurance policies B. Keogh plans C. Personal funds D. Tax qualified defined contribution plans E. Universal Life policies

44. Which of the following investments allows the investor to choose how to allocate assets? A. Variable Life insurance policies B. Keogh plans C. Personal funds D. Tax qualified defined contribution plans E. All of these are true.

28-11

Chapter 28 - Investment Policy and the Framework of the CFA Institute

45. Pension funds I) accept contributions from employers, which are tax-deductible. II) pay distributions that are taxed as ordinary income. III) pay benefits only from the income component of the fund. IV) accept contributions from employees, which are not tax-deductible. A. I and IV B. II and III C. I and II D. I, II, and IV E. I, II, III, and IV

46. Pension funds do not I) accept contributions from employers, which are tax-deductible. II) pay distributions that are taxed as ordinary income. III) pay benefits only from the income component of the fund. IV) accept contributions from employees, which are not tax-deductible. A. III and IV B. II and III C. I and II D. I, II, and IV E. I, II, III, and IV

Stephanie Watson is 23 years old and has accumulated $4,000 in her self-directed defined contribution pension plan. Each year she contributes $2,000 to the plan and her employer contributes an equal amount. Stephanie thinks she will retire at age 67 and figures she will live to age 81. The plan allows for two types of investments. One offers a 3.5% risk-free real rate of return. The other offers an expected return of 10% and has a standard deviation of 23%. Stephanie now has 5% of her money in the risk-free investment and 95% in the risky investment. She plans to continue saving at the same rate and keep the same proportions invested in each of the investments. Her salary will grow at the same rate as inflation.

28-12

Chapter 28 - Investment Policy and the Framework of the CFA Institute

47. How much does Stephanie currently have in the safe account; how much in the risky account? A. $3,800; $200 B. $2,000; $2,000 C. $200; $3,800 D. $2,500; $1,500 E. $1,500; $2,500

48. Of the total amount of new funds that will be invested by Stephanie and by her employer on her behalf, how much will she put into the safe account each year; how much into the risky account? A. $3,800; $200 B. $2,000; $2,000 C. $200; $3,800 D. $2,500; $1,500 E. $1,500; $2,500

49. How much can Stephanie be sure of having in the safe account at retirement? A. $37,221 B. $16,423 C. $11,856 D. $21,156. E. $49,219

50. How much can Stephanie expect to have in her risky account at retirement? A. $2,731,838 B. $2,915,415 C. $1,425,316 D. $224,651 E. $3,545,886

28-13

Chapter 28 - Investment Policy and the Framework of the CFA Institute

Genny Webb is 27 years old and has accumulated $7,500 in her self-directed defined contribution pension plan. Each year she contributes $2,000 to the plan and her employer contributes an equal amount. Genny thinks she will retire at age 63 and figures she will live to age 90. The plan allows for two types of investments. One offers a 3% risk-free real rate of return. The other offers an expected return of 12% and has a standard deviation of 39%. Genny now has 20% of her money in the risk-free investment and 80% in the risky investment. She plans to continue saving at the same rate and keep the same proportions invested in each of the investments. Her salary will grow at the same rate as inflation.

51. How much does Genny currently have in the safe account; how much in the risky account? A. $1,500; $6,000 B. $3,000; $4,500 C. $2,000; $5,500 D. $4,800; $2,700 E. $3,500; $3,500

52. Of the total amount of new funds that will be invested by Genny and by her employer on her behalf, how much will Genny put into the safe account each year; how much into the risky account? A. $1,500; $2,500 B. $1,200; $1,800 C. $800; $3,200 D. $1,250; $2,750 E. $1,400; $1,600

53. How much can Genny be sure of having in the safe account at retirement? A. $45,473 B. $62,557 C. $78,943 D. $54,968 E. $74,643

28-14

Chapter 28 - Investment Policy and the Framework of the CFA Institute

54. How much can Genny expect to have in her risky account at retirement? A. $1,800,326 B. $1,905,095 C. $1,743,781 D. $1,224,651 E. $345,886

Alex Goh is 39 years old and has accumulated $128,000 in his self-directed defined contribution pension plan. Each year he contributes $2,500 to the plan and his employer contributes an equal amount. Alex thinks he will retire at age 62 and figures he will live to age 86. The plan allows for two types of investments. One offers a 4% risk-free real rate of return. The other offers an expected return of 11% and has a standard ...

Similar Free PDFs

Chapter 28 The Reproductive System

- 11 Pages

Investment policy statement

- 4 Pages

The Conceptual Framework Project

- 55 Pages

The National Development Policy

- 2 Pages

The Diamond-E Framework

- 3 Pages

THE Business Policy GAME

- 233 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu