Cost control analysis PDF

| Title | Cost control analysis |

|---|---|

| Course | Financing Enterprises |

| Institution | Western Sydney University |

| Pages | 2 |

| File Size | 59.9 KB |

| File Type | |

| Total Downloads | 4 |

| Total Views | 140 |

Summary

question 3 group asssignment about cost control analysis...

Description

Cost control analysis is important to determine the ability of a firm to manage their expenses and earn a reasonable profit margin, which can be done by calculating its gross profit margin (GPM), operating profit margin (OPM), and net profit margin (NPM). GPM measures the ability of a firm’s management to regulate its expenses to make profits (Western Sydney University, 2021). Moreover, Bloomenthal explains that change in GPM could indicate the lack of management’s ability to control its production cost, but can also be validated when a firm changes its business model which should cause no long term issue (Bloomenthal, 2021). According to the data in Appendix 3, Boral limited (BDL) GPM decreases from 33.70% in 2019 to 30.09% in 2020. The decrease in GPM indicates BDL’s operation efficiency is low. An increase in cost of goods sold (COGS), which can be caused by rise in supply’s prices, can influence a decrease in revenue, which can lead to GPM to drop. BDL has an increase to its COGS from $3,845,000 to $3,965,000 between 2019 and 2020, which could explain the influence it has had on the GPM drop (Morningstar DatAnalysis Premium 2021). In comparison, FFI Holdings Limited (FFI) GPM is increasing from 24.29% in 2019 to 26.44% in 2020 (Appendix 3). A higher percentage of GPM suggests that FFI has better operation efficiency. FFI managed to reduce its COGS from $29,827,026 to $25,767,000, which resulted in a rise in its revenue, which led to the GPM to increase (Morningstar DatAnalysis Premium 2021). OPM measures the firm’s ability to make profits after deducting COGS and operating expenses (Western Sydney University, 2021). Besides its GPM, BDL OPM is also decreasing from 11.37% in 2019 to 5.94% in 2020 (Appendix 3). Similarly to GPM, a drop in OPM suggests a firm’s ability to control its cost is poor due to its higher COGS and operating expenses, compared to the profit it makes on each sale. There is a slight increase in BDL COGS and operating expenses between 2019 and 2020, which influence the profit it makes on each sale, hence the drop in its OPM (Morningstar DatAnalysis Premium 2021). On the other hand, FFI has better management of their COGS and operating expenses, as its OPM rises from 10.51% in 2019 to 12.82% in 2020. Based on the data collected from Morningstar DatAnalysis Premium in 2021, FFI has a lower COGS and operating expenses between 2019 and 2020, which results in a rise in its profit and boosting its OPM. NPM measures the profit a firm’s make from each sale after deducting all its expenses (Western Sydney University, 2021). Murphy explains that NPM can also be used to analyse different businesses’ profitability whether they have the same size or not (Murphy, 2021). In 2019, BDL NPM dropped almost by half from 7.59% to 3.22% in 2020 (Appendix 3). This significant drop of NPM could be caused by a few things, such as poor management, large expenses, and poor planning for pricing (CFI, 2021). In contrast to BDL, FFI has a slight increase on its NPM from 8.37% in 2019 to 9.81% in 2020 (Appendix). A rise in NPM is due to the ability to manage, low expenses, and good planning for pricing (CFI, 2021). Even though the FFI NPM number seems smaller compared to BBL due to the different size of both businesses, FFI shows the ability to manage their cost better and makes more profit from each of its sale compared to BBL.

413 word1137...

Similar Free PDFs

Cost control analysis

- 2 Pages

Cost accounting and Control

- 5 Pages

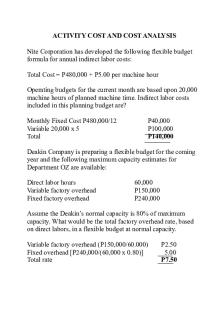

Activity COST AND COST Analysis

- 5 Pages

Cost control and reduction

- 15 Pages

COST A Ccounting and Control

- 12 Pages

Tb ch03-cost-analysis

- 11 Pages

Cost volume profit analysis

- 11 Pages

Cost Analysis Template for PDF

- 5 Pages

M7 Cost-Volume-Profit Analysis

- 2 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu