Duties of Directors - Exam Notes PDF

| Title | Duties of Directors - Exam Notes |

|---|---|

| Author | Jack Dingli |

| Course | Company Law |

| Institution | Royal Melbourne Institute of Technology |

| Pages | 3 |

| File Size | 101.2 KB |

| File Type | |

| Total Downloads | 42 |

| Total Views | 122 |

Summary

Download Duties of Directors - Exam Notes PDF

Description

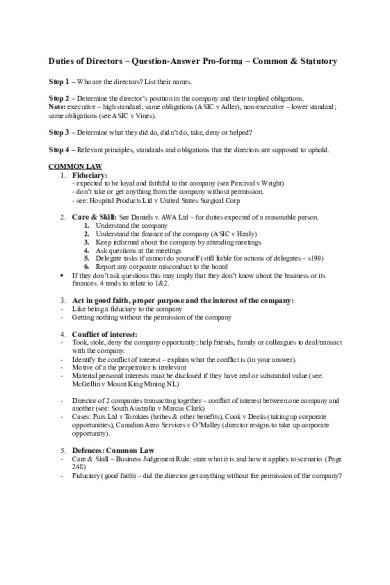

Duties of Directors – Question-Answer Pro-forma – Common & Statutory Step 1 – Who are the directors? List their names. Step 2 – Determine the director’s position in the company and their implied obligations. Note: executive – high standard; same obligations (ASIC v Adler), non-executive – lower standard; same obligations (see ASIC v Vines). Step 3 – Determine what they did do, didn’t do, take, deny or helped? Step 4 – Relevant principles, standards and obligations that the directors are supposed to uphold. COMMON LAW

1. Fiduciary: - expected to be loyal and faithful to the company (see Percival v Wright) - don’t take or get anything from the company without permission. - see: Hospital Products Ltd v United States Surgical Corp 2. Care & Skill: See Daniels v. AWA Ltd – for duties expected of a reasonable person. 1. Understand the company 2. Understand the finance of the company (ASIC v Healy) 3. Keep informed about the company by attending meetings 4. Ask questions at the meetings 5. Delegate tasks if cannot do yourself (still liable for actions of delegates – s190) 6. Report any corporate misconduct to the board If they don’t ask questions this may imply that they don’t know about the business or its finances. 4 tends to relate to 1&2.

3. Act in good faith, proper purpose and the interest of the company: -

Like being a fiduciary to the company Getting nothing without the permission of the company

4. Conflict of interest: -

-

Took, stole, deny the company opportunity; help friends, family or colleagues to deal/transact with the company. Identify the conflict of interest – explain what the conflict is (in your answer). Motive of a the perpetrator is irrelevant Material personal interests must be disclosed if they have real or substantial value (see: McGellin v Mount King Mining NL) Director of 2 companies transacting together – conflict of interest between one company and another (see: South Australia v Marcus Clark) Cases: Furs Ltd v Tomkies (bribes & other benefits), Cook v Deeks (taking up corporate opportunities), Canadian Aero Services v O’Malley (director resigns to take up corporate opportunity).

5. Defences: Common Law - Care & Skill – Business Judgement Rule: state what it is and how it applies to scenario. (Page 248) - Fiduciary (good faith) – did the director get anything without the permission of the company?

6. Consequences of breach - care & skill – pay damages or compensation to the company. - fiduciary – give back the benefits you received. - conflict of interest – if no disclosure and you acquired any benefit – this must be given to the company and any loss or profits/income must also be handed over. *DO NOT FORGET STATUTORY APPLICATIONS

STATUTORY LEGISLATION – Duties apply to officers and directors of a company. S180 – duty to act with care and diligence (Defence – s180(2) – Business Judgement Rule – must meet criteria of abcd – Page 720 (see ASIC v Rich). S181 – duty to act with good faith and proper purpose to the company (see: Mills v Mills) - Means that directors should also seek independent valuation of assets on behalf of company to ensure company is not ripped off. S182 – duty no to misuse position to gain advantage or cause detriment to the company. (see: Doyle v ASIC) – Civil penalty S183 - duty no to misuse information to gain advantage or cause detriment to the company. (see: ASIC v Vizard) – Civil penalty S184 – director or other officer is reckless or intentionally dishonest and fails to exercise powers in good faith and in the best interests of the company S588G – directors duty to prevent insolvent trading (Defences – see Page 860). S190 – directors have responsibility for the actions of their delegates. (Page 724) S191 – requires directors to disclose interests in transactions, s194 (private companies) – if meet s191, then can vote. S195 (public companies) – even if meet s191, still can’t vote. Chapter 2E – avoid party related transactions

Penalties brought against Directors & Officers by ASIC Civil Penalty -

May include fine of $200,000 (s1317G) Disqualification from being a director Damages or compensation paid to the company.

Criminal Penalty -

Fine of $220,000 Jail time

S184 – breach – fine $220,000, imprisonment for up to 5 years. S191 – fined up to $1,000 or imprisonment for 3 months. S195 – fine of $550...

Similar Free PDFs

Duties of Directors - Exam Notes

- 3 Pages

Exam Prep - Directors Duties

- 11 Pages

Directors\' duties - exam question

- 22 Pages

Notes on Directors Duties

- 7 Pages

Directors duties

- 4 Pages

Directors Duties

- 26 Pages

SU9B - Directors\' Duties 2

- 17 Pages

CH15 Directors duties remedies

- 19 Pages

Directors\' Duties PQ Structure

- 18 Pages

Directors Duties – s174

- 4 Pages

Directors duties week 4

- 6 Pages

CH15 Directors duties

- 35 Pages

Directors\' Duties Problem Essay

- 8 Pages

Directors duties final mine.

- 32 Pages

Company Law-directors duties

- 12 Pages

Directors Duties- Cheat Sheet

- 5 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu