Exam 2019, questions and answers PDF

| Title | Exam 2019, questions and answers |

|---|---|

| Course | Financial Management |

| Institution | University of the Cordilleras |

| Pages | 21 |

| File Size | 231.2 KB |

| File Type | |

| Total Downloads | 29 |

| Total Views | 191 |

Summary

Download Exam 2019, questions and answers PDF

Description

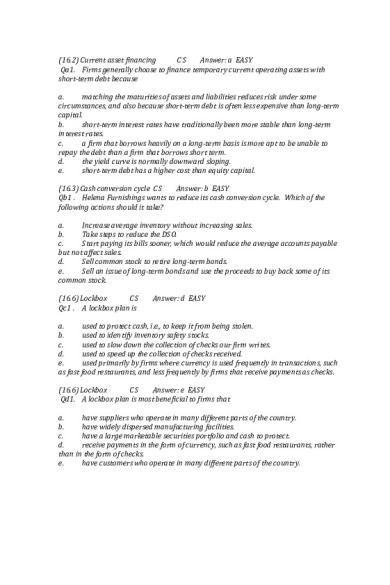

(16.2) Current asset financing CS Answer: a EASY Qa1. Firms generally choose to finance temporary current operating assets with short-term debt because a. matching the maturities of assets and liabilities reduces risk under some circumstances, and also because short-term debt is often less expensive than long-term capital. b. short-term interest rates have traditionally been more stable than long-term interest rates. c. a firm that borrows heavily on a long-term basis is more apt to be unable to repay the debt than a firm that borrows short term. d. the yield curve is normally downward sloping. e. short-term debt has a higher cost than equity capital. (16.3) Cash conversion cycle C S Answer: b EASY Qb1 . Helena Furnishings wants to reduce its cash conversion cycle. Which of the following actions should it take? a. Increase average inventory without increasing sales. b. Take steps to reduce the DSO. c. Start paying its bills sooner, which would reduce the average accounts payable but not affect sales. d. Sell common stock to retire long-term bonds. e. Sell an issue of long-term bonds and use the proceeds to buy back some of its common stock. (16.6) Lockbox CS Qc1 . A lockbox plan is

Answer: d EASY

a. used to protect cash, i.e., to keep it from being stolen. b. used to identify inventory safety stocks. c. used to slow down the collection of checks our firm writes. d. used to speed up the collection of checks received. e. used primarily by firms where currency is used frequently in transactions, such as fast food restaurants, and less frequently by firms that receive payments as checks. (16.6) Lockbox CS Answer: e EASY Qd1. A lockbox plan is most beneficial to firms that a. have suppliers who operate in many different parts of the country. b. have widely dispersed manufacturing facilities. c. have a large marketable securities portfolio and cash to protect. d. receive payments in the form of currency, such as fast food restaurants, rather than in the form of checks. e. have customers who operate in many different parts of the country.

(16.8) Credit policy C S Answer: e EASY Qe1 . Which of the following is NOT commonly regarded as being a credit policy variable? a. b. c. d. e.

Credit period. Collection policy. Credit standards. Cash discounts. Payments deferral period.

(16.2) Current asset financing CS Answer: c MEDIUM qf1. Swim Suits Unlimited is in a highly seasonal business, and the following summary balance sheet data show its assets and liabilities at peak and off-peak seasons (in thousands of dollars): Peak Off-Peak Cash $ 50 $ 30 Marketable securities0 20 Accounts receivable 40 20 Inventories 100 50 Net fixed assets 500 500 Total assets $690 $620 Payables and accruals $ 30 Short-term bank debt50 0 Long-term debt 300 300 Common equity 310 310 Total claims $690 $620

$ 10

From this data we may conclude that a. Swim Suits' current asset financing policy calls for exactly matching asset and liability maturities. b. Swim Suits' current asset financing policy is relatively aggressive; that is, the company finances some of its permanent assets with short-term discretionary debt. c. Swim Suits follows a relatively conservative approach to current asset financing; that is, some of its short-term needs are met by permanent capital. d. Without income statement data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy. e. Without cash flow data, we cannot determine the aggressiveness or conservatism of the company's current asset financing policy.

(16.2) Current asset financing CS Answer: b MEDIUM qg1. Which of the following statements is CORRECT? a. Net working capital is defined as current assets minus the sum of payables and accruals, and any increase in the current ratio automatically indicates that net working capital has increased. b. Although short-term interest rates have historically averaged less than longterm rates, the heavy use of short-term debt is considered to be an aggressive strategy because of the inherent risks associated with using short-term financing. c. If a company follows a policy of "matching maturities," this means that it matches its use of common stock with its use of long-term debt as opposed to shortterm debt. d. Net working capital is defined as current assets minus the sum of payables and accruals, and any decrease in the current ratio automatically indicates that net working capital has decreased. e. If a company follows a policy of "matching maturities," this means that it matches its use of short-term debt with its use of long-term debt. (16.3) Cash conversion cycle C S Answer: d MEDIUM qa2 . Other things held constant, which of the following would tend to reduce the cash conversion cycle? a. b. c. d. e.

Carry a constant amount of receivables as sales decline. Place larger orders for raw materials to take advantage of price breaks. Take all discounts that are offered. Continue to take all discounts that are offered and pay on the net date. Offer longer payment terms to customers.

(16.3) Cash conversion cycle C S Answer: a MEDIUM qb2 . Which of the following actions would be likely to shorten the cash conversion cycle?

a. Adopt a new manufacturing process that speeds up the conversion of raw materials to finished goods from 20 days to 10 days. b. Change the credit terms offered to customers from 3/10 net 30 to 1/10 net 50. c. Begin to take discounts on inventory purchases; we buy on terms of 2/10 net 30. d. Adopt a new manufacturing process that saves some labor costs but slows down the conversion of raw materials to finished goods from 10 days to 20 days. e. Change the credit terms offered to customers from 2/10 net 30 to 1/10 net 60. Qc2(16.8) Receivables management C S Answer: b MEDIUM . Which of the following statements is CORRECT? a. A firm that makes 90% of its sales on credit and 10% for cash is growing at a constant rate of 10% annually. Such a firm will be able to keep its accounts receivable at the current level, since the 10% cash sales can be used to finance the 10% growth rate. b. In managing a firm's accounts receivable, it is possible to increase credit sales per day yet still keep accounts receivable fairly steady, provided the firm can shorten the length of its collection period (its DSO) sufficiently. c. Because of the costs of granting credit, it is not possible for credit sales to be more profitable than cash sales. d. Since receivables and payables both result from sales transactions, a firm with a high receivables-to-sales ratio must also have a high payables-to-sales ratio. e. Other things held constant, if a firm can shorten its DSO, this will lead to a higher current ratio. Qd2(16.8) Days sales outstanding (DSO) C S Answer: c MEDIUM . Which of the following statements is CORRECT? a. Other things held constant, the higher a firm's days sales outstanding (DSO), the better its credit department. b. If a firm that sells on terms of net 30 changes its policy to 2/10 net 30, and if no change in sales volume occurs, then the firm's DSO will probably increase. c. If a firm sells on terms of 2/10 net 30, and its DSO is 30 days, then the firm probably has some past-due accounts. d. If a firm sells on terms of net 60, and if its sales are highly seasonal, with a sharp peak in December, then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in January than in July. e. If a firm changed the credit terms offered to its customers from 2/10 net 30 to 2/10 net 60, then its sales should increase, and this should lead to an increase in sales per day, and that should lead to a decrease in the DSO. Qe2(16.10) Marketable securities C S Answer: c MEDIUM . Which of the following is NOT a situation that might lead a firm to increase its holdings of short-term marketable securities?

a. The firm must make a known future payment, such as paying for a new plant that is under construction. b. The firm is going from its peak sales season to its slack season, so its receivables and inventories will experience a seasonal decline. c. The firm is going from its slack season to its peak sales season, so its receivables and inventories will experience seasonal increases. d. The firm has just sold long-term securities and has not yet invested the proceeds in operating assets. e. The firm just won a product liability suit one of its customers had brought against it (16.10) Marketable securities CS Answer: d MEDIUM qf2 . Which of the following statement completions is CORRECT? If the yield curve is upward sloping, then the marketable securities held in a firm's portfolio, assumed to be held for emergencies, should a. consist mainly of long-term securities because they pay higher rates. b. consist mainly of short-term securities because they pay higher rates. c. consist mainly of U.S. Treasury securities to minimize interest rate risk. d. consist mainly of short-term securities to minimize interest rate risk. e. be balanced between long- and short-term securities to minimize the adverse effects of either an upward or a downward trend in interest rates. (Comp.) Current asset financing CS Answer: b MEDIUM qg2 . Which of the following statements is CORRECT? a. Trade credit is provided only to relatively large, strong firms. b. Commercial paper is a form of short-term financing that is primarily used by large, strong, financially stable companies. c. Short-term debt is favored by firms because, while it is generally more expensive than long-term debt, it exposes the borrowing firm to less risk than longterm debt. d. Commercial paper can be issued by virtually any firm so long as it is willing to pay the going interest rate. e. Commercial paper is typically offered at a long-term maturity of at least five years. Qa3(Comp.) Current asset financing C S Answer: a MEDIUM . Which of the following statements is NOT CORRECT? a. Commercial paper can be issued by virtually any firm so long as it is willing to pay the going interest rate. b. Accruals are "free" in the sense that no explicit interest is paid on these funds. c. A conservative approach to working capital management will result in most if not all permanent current operating assets being financed with long-term capital.

d. The risk to a firm that borrows with short-term credit is usually greater than if it borrowed using long-term debt. This added risk stems from the greater variability of interest costs on short-term debt and possible difficulties with rolling over short-term debt. e. Bank loans generally carry a higher interest rate than commercial paper.

Qb3(Comp.) Short-term financing C S Answer: a MEDIUM . Which of the following statements is CORRECT? a. Under normal conditions, a firm's expected ROE would probably be higher if it financed with short-term rather than with long-term debt, but using short-term debt would probably increase the firm's risk. b. Conservative firms generally use no short-term debt and thus have zero current liabilities. c. A short-term loan can usually be obtained more quickly than a long-term loan, but the cost of short-term debt is normally higher than that of long-term debt. d. If a firm that can borrow from its bank at a 6% interest rate buys materials on terms of 2/10 net 30, and if it must pay by Day 30 or else be cut off, then we would expect to see zero accounts payable on its balance sheet. e. If one of your firm's customers is "stretching" its accounts payable, this may be a nuisance but it will not have an adverse financial impact on your firm if the customer periodically pays off its entire balance. Qc3(Comp.) Working capital policy C S Answer: d MEDIUM . Which of the following statements is NOT CORRECT? a. A company may hold a relatively large amount of cash and marketable securities if it is uncertain about its volume of sales, profits, and cash flows during the coming year. b. Credit policy has an impact on working capital because it influences both sales and the time before receivables are collected. c. The cash budget is useful to help estimate future financing needs, especially the need for short-term working capital loans. d. If a firm wants to generate more cash flow from operations in the next month or two, it could change its credit policy from 2/10 net 30 to net 60. e. Managing working capital is important because it influences financing decisions and the firm's profitability. Qd3. (Comp.) Working capital concepts CS Answer: b MEDIUM . Which of the following statements is CORRECT? a. Depreciation is included in the estimate of cash flows (Cash flow = Net income + Depreciation), hence depreciation is set forth on a separate line in the cash budget.

b. If cash inflows from collections occur in equal daily amounts but most payments must be made on the 10th of each month, then a regular monthly cash budget will be misleading. The problem can be corrected by using a daily cash budget. c. Sound working capital policy is designed to maximize the time between cash expenditures on materials and the collection of cash on sales. d. If a firm wants to generate more cash flow from operations in the next month or two, it could change its credit policy from 2/10 net 30 to net 60. e. If a firm sells on terms of net 90, and if its sales are highly seasonal, with 80% of its sales in September, then its DSO as it is typically calculated (with sales per day = Sales for past 12 months/365) would probably be lower in October than in August. Qe3(Comp.) Working capital concepts CS Answer: c MEDIUM . Which of the following statements is CORRECT? a. Accruals are an expensive but commonly used way to finance working capital. b. A conservative financing policy is one where the firm finances part of its fixed assets with short-term capital and all of its net working capital with short-term funds. c. If a company receives trade credit under terms of 2/10 net 30, this implies that the company has 10 days of free trade credit. d. One cannot tell if a firm has a conservative, aggressive, or moderate current asset financing policy without an examination of its cash budget. e. If a firm has a relatively aggressive current asset financing policy vis-à-vis other firms in its industry, then its current ratio will probably be relatively high. qf3 (16.3) Cash conversion cycle CS Answer: d EASY . Cass & Company has the following data. What is the firm's cash conversion cycle? Inventory conversion period = 50 days Average collection period = 17 days Payables deferral period = 25 days a. b. c. d. e.

31 days 34 days 38 days 42 days 46 days

qg3 (16.3) Cash conversion cycle CS Answer: b EASY . Romano Inc. has the following data. What is the firm's cash conversion cycle? Inventory conversion period = 38 days Average collection period = 19 days Payables deferral period = 20 days

a. b. c. d. e.

33 days 37 days 41 days 45 days 49 days

qa4(16.3) Cash conversion cycle CS Answer: b EASY . Whittington Inc. has the following data. What is the firm's cash conversion cycle? Inventory conversion period = 41 days Average collection period = 31 days Payables deferral period = 38 days a. b. c. d. e.

31 days 34 days 37 days 41 days 45 days

qb4 (16.3) Cash conversion cycle CS Answer: d EASY . Inmoo Company’s average age of accounts receivable is 45 days, the average age of accounts payable is 40 days, and the average age of inventory is 69 days. Assuming a 365-day year, what is the length of its cash conversion cycle? a. b. c. d. e.

63 days 67 days 70 days 74 days 78 days

qc4 (16.1) ROE and WC policy CS Answer: c MEDIUM . Edwards Enterprises follows a moderate current asset investment policy, but it is now considering a change, perhaps to a restricted or maybe to a relaxed policy. The firm’s annual sales are $400,000; its fixed assets are $100,000; its target capital structure calls for 50% debt and 50% equity; its EBIT is $35,000; the interest rate on its debt is 10%; and its tax rate is 40%. With a restricted policy, current assets will be 15% of sales, while under a relaxed policy they will be 25% of sales. What is the difference in the projected ROEs between the restricted and relaxed policies? a. b. c. d.

4.25% 4.73% 5.25% 5.78%

e.

6.35%

. (16.1) ROE and WC policy C S Answer: c MEDIUM Sales $400,000 Debt ratio 50% Interest rate 10% Fixed assets $100,000 EBIT $35,000 Tax rate 40% CA/Sales, restricted 15% CA/Sales, relaxed 25% Restricted Relaxed CA $ 60,000 $100,000 FA 100,000 100,000 Total assets $160,000 $200,000 Debt $ 80,000 $100,000 Equity 80,000 100,000 Total liab. & capital $160,000

$200,000

EBIT $ 35,000 $ 35,000 Interest 8,000 10,000 EBT $ 27,000 $ 25,000 Taxes 10,800 10,000 NI $ 16,200 $ 15,000 ROE

20.25%

15.00%

Difference in ROE = 5.25% Qd4. Data on Shick Inc. for 2008 are shown below, along with the days sales outstanding of the firms against which it benchmarks. The firm's new CFO believes that the company could reduce its receivables enough to reduce its DSO to the benchmarks’ average. If this were done, by how much would receivables decline? Use a 365-day year. Sales $110,000 Accounts receivable $16,000 Days sales outstanding (DSO) 53.09 Benchmark days sales outstanding (DSO) 20.00 a. b. c. d. e.

$ 8,078 $ 8,975 $ 9,973 $10,970 $12,067

Original Data Related ICP Benchmark Level

Benchmark ICP

ICP at

Cost of goods sold $85,000 Inventory and ICP $20,000 85.88 New inventory = ICP × (COGS/365) = Reduction in inventories = Original Inv. – New Inv. = $11,151

38.00 $8,849

Alternative solution: (Change in ICP/Original ICP) × Orig. Inv. Qe4 . Data on Wentz Inc. for 2008 are shown below, along with the payables deferral period (PDP) for the firms against which it benchmarks. The firm's new CFO believes that the company could delay payments enough to increase its PDP to the benchmarks’ average. If this were done, by how much would payables increase? Use a 365-day year. Cost of goods sold = $75,000 Payables = $5,000 Payables deferral period (PDP) = 24.33 Benchmark payables deferral period = 30.00 a. b. c. d. e.

$ 764 $ 849 $ 943 $1,048 $1,164

Original

Benchmark Payables

at Data Related PDP Benchmark Level Cost of goods sold $75,000 Inventory and PDP $5,000 24.33 New payables = PDP × (COGS/365) = Increase in payables = New Payables – Original Payables = $1,164

PDP

30.00 $6,164

Alternative solution: (Change in PDP/Original PDP) × Orig. Payables = $1,164 Qf4. Your consulting firm was recently hired to improve the performance of ShinSoenen Inc, which is highly profitable but has been experiencing cash shortages due to its high growth rate. As one part of your analysis, you want to determine the firm’s cash conversion cycle. Using the following information and a 365-day year, what is the firm’s present cash conversion cycle?

Average inventory = $75,000 Annual sales =$600,000 Annual cost of goods sold = $360,000 Average accounts receivable = $160,000 Average accounts payable = $25,000 a. b. c. d. e.

120.6 days 126.9 days 133.6 days 140.6 days 148.0 days

Avg. inventory = Avg. receivables = Avg. payables =

$75,000 $160,000 $25,000

Annual sales =$600,000 Annual COGS = $360,000 Days in year = 365

Inv. conv. period = Inv./(COGS/365) 76.0 + DSO = Receivables/(Sales/365) 97.3 – Payables deferral = Payables/(COGS/365) Cash conversion cycle (CCC) 148.0

-25.3

Qg4. Dewey Corporation has the following data, in thousands. Assuming a 365-day year, what is the firm's cash conversion cycle? Annual sales =$45,000 Annual cost of goods sold = $31,500 Inventory = $4,000 Accounts receivable =$2,000 Accounts payable = $2,400 a. b. c. d. e.

25 days 28 days 31 days 35 days 38 days

Annual sales Annual cost of goods sold (COGS) Inventory Accounts receivable Accounts payable Days in year Sales per day =

Similar Free PDFs

Exam 2019, questions and answers

- 4 Pages

Exam 2019, questions and answers

- 3 Pages

Exam 2019, questions and answers

- 21 Pages

Exam 2019, questions and answers

- 21 Pages

Exam 2019, questions and answers

- 8 Pages

Exam 2019, questions and answers

- 41 Pages

Exam 2019, questions and answers

- 17 Pages

Exam 2019, questions and answers

- 30 Pages

Exam 2019, questions and answers

- 3 Pages

Exam 2019, questions and answers

- 8 Pages

Exam 2019, questions and answers

- 11 Pages

Exam 2019, questions and answers

- 18 Pages

Exam 2019, questions and answers

- 1 Pages

Exam 2019, questions and answers

- 95 Pages

Exam 2019, questions and answers

- 9 Pages

Exam 2019, questions and answers

- 40 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu