FCF & Multiples Tutorial PDF

| Title | FCF & Multiples Tutorial |

|---|---|

| Course | Financial Accounting Theory |

| Institution | University of Melbourne |

| Pages | 6 |

| File Size | 244.7 KB |

| File Type | |

| Total Downloads | 50 |

| Total Views | 117 |

Summary

Tutorial for Week 7 on Valuation with Free Cash Flows and Multiples...

Description

Tutorial Seven beginning 26th April 2021 TOPIC: Free cash flow and Multiples Q1 A Discounted Cash Flow Valuation: General Mills, Inc. At the beginning of its fiscal year 2006, an analyst made the following forecast for General Mills, Inc., the consumer foods company, for 2006-2009 (in millions of dollars): 2006 $2,014 $300

Cash flow from operations Cash investment in operations

2007 $2,057 $380

2008 $2,095 $442

2009 $2,107 $470

General Mills reported $6,192 million in short-term and long-term debt at the end of 2005 but very little in interest-bearing debt assets. Use a required return of 9 percent to calculate both the enterprise value and equity value for General Mills at the beginning of 2006 under two forecasts for long-run cash flows: a.

Free cash flow will remain at 2009 levels after 2009.

b.

Free cash flow will grow at 3 percent per year after 2009.

General Mills had 369 million shares outstanding at the end of 2005, trading at $47 per share. Calculate value per share under both scenarios. Solution a. The exercise involves calculating free cash flows, discounting them to present value, then adding the present value of a continuing value. For part (a) of the question, the continuing value has no growth:

Cash flow from operations less Cash investment in operations Free cash flow (FCF) Discount rate Present value of FCF Total of PV to 2009 Continuing value (CV) PV of CV Enterprise value Net debt Equity value

2006 2,014

2007 2,057

2008 2,095

2009 2,107

300 1,714 1.09 1,572

380 1,677 1.1881 1,411

442 1,653 1.2950 1,276

470 1,637 1.4116 1,160

5,419 18,189 12,885 18,304 6,192 12,112

Value per share on 369 million shares = $32.82

1,637 = 18,189 0.09 18,189 PV of CV = = 12,885 1.4116

CV (no growth) =

b. With growth of 3% after 2009, the continuing value is: CV =

1,637 1.03 = $28,102 1.09 − 1.03

The present value of the continuing value is $28,102/1.4116 = $19,908. Do the valuation is as follows:

Total of PV to 2009 Continuing value (CV) PV of CV Enterprise value Net debt Equity value

5,419 28,102 19,908 25,327 6,192 19,135

Value per share on 369 million shares = $51.86.

Q2 A Discounted Free Cash Flow Valuation At the end of 2012, you forecast the following cash flows (in millions) for a firm with net debt of $759 million:

Cash flow from operations Cash investment

2013 $1,450 1,020

2014 $1 ,576 1,124

2015 $1,718 1,200

You forecast that free cash flow will grow at a rate of 4 percent per year after 2015. Use a required return of 10 percent in answering the following questions. a.

Calculate the firm's enterprise value at the end of 2012.

b.

Calculate the value of the equity at the end of 2012.

Solution 2012

2013

2014

2015

Cash flow from operations Cash investment Free cash flow Discount rate (1.10)t PV of cash flows Total PV to 2015 Continuing value* PV of CV a. Enterprise value Net debt b. Value of equity

* Continuing value =

$1,450 $1,020 $ 430

1,576 1,124 452

1,718 1,200 518

1.21 374

1.331 389

1.10 391 $1,154

8,979 6,746 $7,900 million 759 $7,141 million

518 1.04 = 8,979 1.10 − 1.04

Q3 Calculating a Price from Comparables (easy) A firm trading with a total equity market value of $100 million reported earnings of $5 million. This firm is used as a comparable to price an IPO firm with earnings per share of $2.50. What per-share IPO price does the comparable firm imply? Solution P/E for the comparable firm = 100/5 = 20 Price for target, from earnings = $2.50 × 20 = $50 per share Q4 Why do trailing P/E ratios vary with dividend payout? Share price drops when a firm pays dividends because value is taken out of the firm. But current earnings are not affected by dividends (paid at the end of the year). Future earnings will be affected because there are less assets in the firm to earn, but current earnings will not. A trailing P/E ratio that does not adjust for dividends, prices earnings incorrectly. A P/E ratio that adjusts for the dividend is: Price per share + Annual Dps Adjusted trailing P/E = Eps

Q5 Value Harvey Norman as at April 2021 using the method of P/E method comparables using JB Hi-Fi as a benchmark. Use the forward P/E which can be obtained from https://www.reuters.com/companies/JBH.AX/profile The current share price of Harvey Norman is $5.70. Explain some limitations of this approach to valuation. Solution Forward PE = current stock price / predicted next annual earnings period. For instance, if the stock price for Apple is 600 dollars and the predicted EPS was 45, the predicted forward P/E would be 13.3. Valuation of Harvey Norman = Forward PE for JB Hi-Fi * Forward Earnings for Harvey Norman

Step One. Get Forward P/E for JB Hi-Fi This will be available at most finance web-sites such as Reuters, Google finance, Yahoo finance etc https://www.reuters.com/companies/JBH.AX/profile The forward looking P/E for JB Hi-Fi as at April 2021 is $12.95. Step Two. Get Forward EPS for Harvey Norman This is the analysts forecasts for Harvey Norman annual earnings for the year ended 30 June 2021. This will sometime be available at some finance web-sites such as Reuters, Google finance, Yahoo finance etc. Reuters do not provide analyst forecasts of annual earnings however they have provided the forward P/E for Harvey Norman which equals 10.35 ( see screen short below). Therefore as we know the current share price of Harvey Norman which equals $5.70 we can reverse engineer the analysts forecast of annual earnings. Forecast Annual Earnings = Share Price/Forward PE = $5.70/10.35 = 0.55

The estimate value of Harvey Norman is 12.95 * 0.55 = $7.12. This compares to a current valuation of $5.70. Two significant limitations of this approach to valuation is identifying a comparable company and the assumption that the market is efficient. In regard to the first limitation, it is necessary that the two firms have similar risk, expected growth, dividend payout policy and accounting. In this regard JB Hi-Fi could be a good comparison firm for Harvey Norman, as the two firms sell a similar range of products. In fact, JB Hi-Fi has recently become more like Harvey Norman following its

acquisition of The Good Guys, a direct competitor of Harvey Norman. However, there are important differences between the two companies which could give rise to differences in either risk and expected growth. Such as: HVN has a large investment property portfolio; both companies operate in New Zealand in addition to Australia, but HVN also has operations in number of other countries; JBH is in the process of digesting The Good Guys, which was a large acquisition for the company; HVN has franchise stores, whereas JBH appears to operate all its own stores. The second, limitation is that we are assuming the market pricing of JB Hi-Fi is efficient. We will be discussing in two weeks the evidence in regard to whether the market is efficient....

Similar Free PDFs

FCF & Multiples Tutorial

- 6 Pages

Exodoncias multiples

- 8 Pages

Multiples personalidades

- 21 Pages

Integrales multiples

- 35 Pages

Reacciones Multiples

- 12 Pages

Ejercicio 7 FCF

- 2 Pages

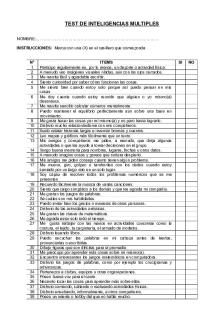

Test de Inteligencias Multiples

- 5 Pages

LAS Inteligencias Multiples 5TO

- 3 Pages

Test Inteligencias Multiples

- 3 Pages

Alelos Letales Y Multiples

- 4 Pages

ANA2C 2015 06 Integrales multiples

- 33 Pages

FCF-EBIT-EBT - Notes de cours 1

- 2 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu