Historical cost PDF

| Title | Historical cost |

|---|---|

| Course | Accounting Theory and Accountability |

| Institution | Murdoch University |

| Pages | 3 |

| File Size | 118.7 KB |

| File Type | |

| Total Downloads | 32 |

| Total Views | 151 |

Summary

Download Historical cost PDF

Description

1

Historical cost Chapter 6 (Godfrey) -Explain the arguments for and against using historical cost as a measurement base. Key arguments for historical cost include:

Most objective measurement approach - amounts are determined based on actual transactions. Clear audit trail – amounts can usually be proven by documentation.

Key arguments against historical cost include:

Amounts determined may not be relevant to current decision making if there is a long time span since the transaction occurred. Historical cost does not take into account changes in the value of money over time. In other words, it ignores price inflation. The amount paid for an item or received for an item may not necessarily be indicative of its value. Judgement involved in determining depreciation rates can create inconsistencies and opportunity for manipulation. Inability to determine the cost of some items. Items may be donated with no actual cost to the entity. Items may be internally generated rather than purchased.

-According to the historical cost system, what is the objective of accounting and the role of profit? What criticisms are made of profit calculated under the historical cost system? Stewardship is emphasised as the objective of accounting in traditional historical theory — enunciated by Paton and Littleton. Accountability to equity holders is primary. Owners and creditors are considered to be especially interested in what the firm (management) has done with the funds they have entrusted to it. Therefore, information should be provided to give an accounting of the performance of the firm in using the funds from a creditors point of view. Hence conservatism is required in valuation. Determining ‘net worth’ to owners is not of primary importance. Critics say that stewardship is too narrow an interpretation of the objective of accounting. The stewardship emphasis causes a preoccupation with the past. Users want information for decision making, which calls for a ‘forward looking’ position. This is now the principles based approach championed by the IASB for international accounting standards. Because accountability and stewardship is emphasised, the belief is that equity holders are primarily interested in the results of the use of their funds. Thus an emphasis on flows and hence to earnings as the primary statement; the statement of financial performance is more important than the statement of financial position. After all, the objective of the firm is to make a profit a concept that is embedded in business. The balance sheet (now statement of financial position) is a link between two statements of financial performance. It is a repository (dumping ground?) of unamortised historical costs. 1

2

Critics charge that we claim the balance sheet is a statement of financial position; but, in effect, historical theory downplays this interpretation. We should be more serious about making the statement of financial position a meaningful statement, one that fits the claims we make about it. Useful information for decision making implies that the statement of financial position items should be as important as the income statement items. Current values would be more relevant. -Explain the difference between financial capital and physical capital. The financial capital concept is the traditional view. It keeps track of capital in terms of the dollar amount invested in the company. A return on financial capital means that there is an excess of the dollar amount of capital at the end compared with the dollar amount of capital at the beginning, excluding the effect of transactions with owners. In other words, there has been an increase in the value of money capital. The physical capital concept looks at capital in terms of its physical aspect, and then translates it into dollars. Usually, the physical aspect relates to the firm’s producing capacity. A return on physical capital results only if the physical productive capacity at the end of the period exceeds the physical productive capacity at the beginning of the period, excluding effects of transactions with owners. For example, if at the beginning of the year, X has the capability of producing 10 000 units of product, then profit occurs only after the current dollar amount of that capability at the end of the year is maintained. The capability to produce 10 000 units may be expressed in terms of plant and equipment. Only current cost (or replacement cost) is relevant for a physical capital view. The main difference between the two is the placement of price changes of non-monetary assets and long-term debt during the period. Under the financial capital view, these price changes are included in profit as holding gains/losses. Under the physical capital view, these are placed directly into shareholders’ equity as a capital maintenance adjustment. -The following questions relate to the apparent divergence in view between the standard setters and the private sector, with respect to the need to shift from historical cost to current value accounting: (a) In your opinion, why do standard setters moving away from traditional historical cost accounting? (b) Why do think that the business community and the public accounting firms are so strongly opposed to a move away from historical cost accounting? (c) Measurement principles are fundamental to any accounting system. Why does the Framework lack fully developed measurement concepts? The answer to these questions relies on the students’ perspectives. These questions can be used to facilitate debate on moving from historical cost to market/current-value approaches. (a) Standard setters (in Australia) do not share agreement on the move to market-value-based standards. However, the recent trend with SAC 5 and AAS 25 and AAS 26 indicates a growing acceptance by the AASB to alternatives to historical cost. This is largely a function of international trends and the increasing number of standards dealing with specific reporting and measurement issues. This is also consistent with the adoption of 2

3

the conceptual framework, developed as a guide to appropriate reporting and measurement outcomes, which focuses on the most appropriate solution and which is outside the traditional constraints of the historical cost system. (b) Reasons for the opposition to move away from historical cost include: the potential risk associated with auditing reports based on alternative measurement systems costs associated with changing knowledge and audit techniques costs associated with current-value systems potential to reduce reported profits and in some cases asset values significant changes which may be required to reporting systems. (c) This is subjective and a matter of perspective. Students should discuss this from the perspective of each key group, including management, shareholders, the Australian Securities & Investments Commission and the accounting profession.

https://daftsex.com/watch/-181565694_456239271

3...

Similar Free PDFs

Historical cost

- 3 Pages

Historical Background

- 29 Pages

FULL COST :: Direct COST

- 1 Pages

Cost Behavior - Cost Accounting

- 78 Pages

COST Acctg 2 - cost

- 1 Pages

Historical Lenses Discussion

- 1 Pages

The Historical Jurisprudence

- 9 Pages

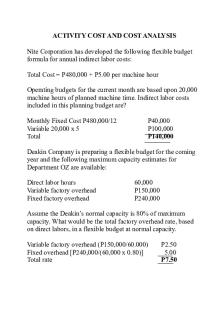

Activity COST AND COST Analysis

- 5 Pages

Historical Analysis Final Paper

- 7 Pages

Final Project - Historical Essay

- 13 Pages

Historical Tourism open course

- 188 Pages

Historical Investigation Year 11

- 10 Pages

Historical Journal - Lecture

- 3 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu