Illustrative Problem for analyses of business transactions PDF

| Title | Illustrative Problem for analyses of business transactions |

|---|---|

| Author | Zamora, Mariah Niña C. |

| Course | Accounting Technology |

| Institution | University of Cebu |

| Pages | 6 |

| File Size | 110.9 KB |

| File Type | |

| Total Downloads | 453 |

| Total Views | 857 |

Summary

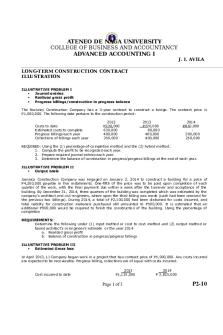

ILLUSTRATIVE PROBLEM for analyses of business transactions:The narrative transactions taken from Susan Chung Management Consultancy Services for the Month of January, 2020 follows:Jan. 5 Invested P100,000 cash for the management consultancy service.10 Purchased supplies inventory of P15,000. Paid ca...

Description

ILLUSTRATIVE PROBLEM for analyses of business transactions: The narrative transactions taken from Susan Chung Management Consultancy Services for the Month of January, 2020 follows: Jan. 5

Invested P100,000 cash for the management consultancy service.

10

Purchased supplies inventory of P15,000. Paid cash , P10,000 and made an oral promise to pay for the balance.

15

Received P35,000 cash from a client for services rendered.

20

Purchased an equipment costing P40,000. Paid cash of P30,000 and the balance on credit.

22

Withdrew cash of P15,000 for personal use.

26

Paid taxes and licenses, P7,000.

27

Paid salaries, P15,000.

30

Rendered consultancy service on credit, P20,000.

Required: 1. Determine the value received or debit and the value parted with or credit. 2. Prepare a transaction analyses worksheet with the following accounts: Cash, Accounts Receivable, Supplies Inventory, Equipment, Accounts Payable and Susan Chung, Capital. 3. With the aid of T-accounts, record the transactions listed above. 4. Prepare a trial balance.

Requirement 1:

DATE 2020 Jan. 5

VALUE RECEIVED

Cash

AMOUN T

VALUE PARTED WITH

AMOUN T

P100,000

S. Chung, Capital

P100,000

10

Supplies Inventory

15,000

Cash Accounts Payable

10,000 5,000

15

Cash

35,000

Service Income

35,000

20

Equipment

40,000

Cash Accounts Payable

30,000 10,000

22

S. Chung, Drawing

15,000

Cash

15,000

26

Taxes & Licenses

7,000

Cash

7,000

27

Salaries Expense

15,000

Cash

15,000

30

Accounts Receivable TOTAL

20,000 P247,000

Service Income

20,000 P247,000

Requirement2:

P 58,000 + P 20,000 + P15,000 + P 40,000 = P 15,000 + P 118,000 P 133,000 = P 133,000 Requirement 3: CASH DR. 2020 JAN. 5 15

CR. P 100,000 35,000

JAN. 10 20 22 26 27

P 10,000 30,000 15,000 7,000 15,000 ________ P 77,000

__________ P 135,000 58,000

ACCOUNTS RECEIVABLE DR. JAN. 30

CR. P 20,000

SUPPLIES INVENTORY DR. JAN. 10

CR. P 15,000 EQUIPMENT

DR. JAN. 20

CR. P 40,000

ACCOUNTS PAYABLE DR.

CR. JAN. 10 20

P 5,000 10,000 P 15,000

S. CHUNG, CAPITAL DR.

CR. JAN. 5

P 100,000

S. CHUNG, DRAWING DR. JAN. 22

CR. P 15,000

SERVICE REVENUE DR.

CR. JAN. 15 30

P 35,000 20,000 P 55,000

TAXES AND LICENSES DR.

CR.

JAN. 26

P 7,000

SALARIES EXPENSE DR.

CR.

JAN. 27

P 15,000

Requirement 4: Susan Chung Management Consultancy Services Trial Balance January 31, 2020

Cash Accounts Receivable Supplies Inventory Equipment Accounts Payable S. Chung, Capital S. Chung, Drawing Service Revenue Taxes and Licenses Salaries Expense TOTAL

DR. P 58,000 20,000 15,000 40,000

CR.

P 15,000 100,000 15,000 55,000 7,000 15,000 P 170,000

________ P 170,000...

Similar Free PDFs

Illustrative Problem

- 1 Pages

02-Illustrative Problem

- 3 Pages

Analysis of Business Transactions

- 21 Pages

IP in business transactions

- 4 Pages

Analysing Business Transactions

- 4 Pages

Recording Business Transactions

- 3 Pages

ACCOUNTING FOR SPECIAL TRANSACTIONS

- 27 Pages

Recording of Transactions

- 1 Pages

BDO IFRS Illustrative FS

- 238 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu