Topic 12 - Intra Group Transactions - Illustrative Examples PDF

| Title | Topic 12 - Intra Group Transactions - Illustrative Examples |

|---|---|

| Author | Anonymous User |

| Course | Management Accounting |

| Institution | The University of the South Pacific |

| Pages | 4 |

| File Size | 89.4 KB |

| File Type | |

| Total Downloads | 32 |

| Total Views | 193 |

Summary

Lecture...

Description

Topic 12 – Accounting for Intra-Group Transactions

Exercise 1

Intra Group Dividends

During the year, Subsidiary: Paid an interim dividend of $10,000 on 30 June; and Declared a final dividend of $5,000 on 31 December

Required Prepare a b c

Original journal entries in the subsidiary’s books Original journal entries in the parent’s books Elimination entries for the consolidation worksheet

Exercise 2

Intra-Group Sales (no unrealised profit)

During the year, Subsidiary sells inventory to Parent for $20,000 (inventory was acquired for $12,000 last year) Parent sells all the inventory to an external customer for $30,000 Parent hasn’t paid subsidiary

Required Prepare a b c

Original journal entries in the subsidiary’s books Original journal entries in the parent’s books Elimination entries for the consolidation worksheet

Page 1 of 4

Exercise 3

Intra-Group Sales (unrealised profit)

Refer to Exercise 2, with the following changes. Inventory remains with the parent at the end of the year

Required Prepare a b c

Original journal entries in the subsidiary’s books Original journal entries in the parent’s books Elimination entries for the consolidation worksheet

Exercise 4

Intra-group Sales (partly unrealised profit)

Refer to Exercise 2 with the following changes Parent sells ¾ of the inventory to an external customer for $22,500

Required Prepare a b c

Original journal entries in the subsidiary’s books Original journal entries in the parent’s books Elimination entries for the consolidation worksheet

Page 2 of 4

Exercise 5

Unrealised Profit in Opening Inventory

Refer to Exercise 4.

Required Prepare elimination entries at the start of the next period

Exercise 6

Intra-group Sale of Non-current Assets (Gain)

On 1 January, Subsidiary sells a machine to Parent for $50,000 (it was acquired for $40,000 on 1 January last year) Subsidiary has depreciated the machine by $10,000 The machine has a remaining useful life of 4 years.

Required a b c

Calculate the gain/loss on disposal in the subsidiary’s books Calculate the depreciation in the parent’s books Prepare elimination entries

Page 3 of 4

Exercise 7

Intra-group Sale of Non-current Assets (Loss)

On 1 January, Parent sells equipment to Subsidiary for $60,000 (it was acquired for $100,000 on 1 January last year) Parent has depreciated the machine by $20,000 The machine has a remaining useful life of 5 years

Required Prepare a b c

Calculate the gain/loss on disposal in the parent’s books Calculate the depreciation in the subsidiary’s books Prepare elimination entries

Exercise 8

Intra-group Sale of Non-current Asset in prior period

Refer to Exercise 7.

Required Prepare relevant elimination entries at the end of the next period.

Page 4 of 4...

Similar Free PDFs

Point group examples

- 4 Pages

Point group examples 2

- 20 Pages

Topic 12

- 4 Pages

Topic 12

- 2 Pages

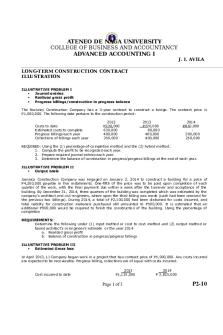

Illustrative Problem

- 1 Pages

Biochem Topic 12 Review

- 4 Pages

Topic 12 Negotiable instruments

- 24 Pages

Lesson 12 - Group Dynamics

- 3 Pages

BDO IFRS Illustrative FS

- 238 Pages

02-Illustrative Problem

- 3 Pages

MKG3300 Intra

- 32 Pages

Intra NOTE

- 29 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu