Intermediate Accounting Chapter 16 PDF

| Title | Intermediate Accounting Chapter 16 |

|---|---|

| Course | intermediate accounting |

| Institution | Universitas Pelita Harapan |

| Pages | 3 |

| File Size | 82.6 KB |

| File Type | |

| Total Downloads | 92 |

| Total Views | 162 |

Summary

Download Intermediate Accounting Chapter 16 PDF

Description

Nama Lengkap NIM Jurusan

: Terumi Angstetra : 01012190019 : Akuntansi – A Tugas Intermediate Accounting Chapter 16

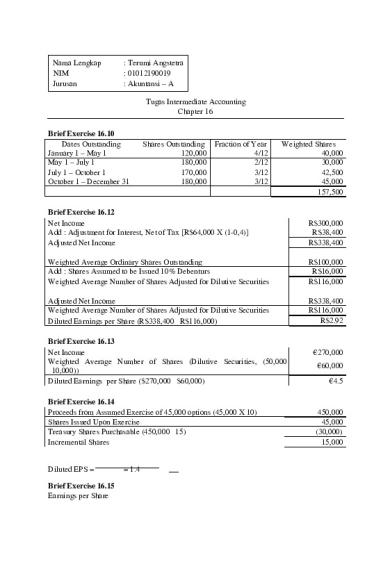

Brief Exercise 16.10 Dates Outstanding January 1 – May 1 May 1 – July 1 July 1 – October 1 October 1 – December 31

Shares Outstanding Fraction of Year 120,000 4/12 180,000 2/12 170,000 3/12 180,000 3/12

Weighted Shares 40,000 30,000 42,500 45,000 157,500

Brief Exercise 16.12 Net Income Add : Adjustment for Interest, Net of Tax [R$64,000 X (1-0,4)] Adjusted Net Income

R$300,000 R$38,400 R$338,400

Weighted Average Ordinary Shares Outstanding Add : Shares Assumed to be Issued 10% Debenturs Weighted Average Number of Shares Adjusted for Dilutive Securities

R$100,000 R$16,000 R$116,000

Adjusted Net Income Weighted Average Number of Shares Adjusted for Dilutive Securities Diluted Earnings per Share (R$338,400 R$116,000)

R$338,400 R$116,000 R$2.92

Brief Exercise 16.13 Net Income Weighted Average Number of Shares (Dilutive Securities, (50,000 10,000)) Diluted Earnings per Share ($270,000 $60,000) Brief Exercise 16.14 Proceeds from Assumed Exercise of 45,000 options (45,000 X 10) Shares Issued Upon Exercise Treasury Shares Purchasable (450,000 15) Incremental Shares

Diluted EPS = Brief Exercise 16.15 Earnings per Share

= 1.4

€270,000 €60,000 €4.5

450,000 45,000 (30,000) 15,000

Income Before Extraordinary Loss ((€480,000 + €120,000) €100,000) Extraordinary Loss (€120,000 €100,000) Net Income (€480,000 €100,000)

€6 €1.2 €4.8

Brief Exercise 16.16 2012 (5,000 SARs X $4) X 50% = $10,000 2013 (5,000 SARs X $9) - $10,000 = $35,000 Exercise 16.17 a. Dates Shares Restatement Outstanding Outstanding Jan 1 – Feb 1 480,000 1.2 X 3 Feb 1 – Mar 1 600,000 1.2 X 3 Mar 1 – May 1 720,000 3 May 1 – Jun 1 620,000 3 Jun 1 – Oct 1 1,860,000 Oct 1 – Dec 31 1,920,000 Weighted-Average Number of Shares Outstanding b. Earnings Per Share =

Fraction of Year

Weighted Shares

1/12 1/12 2/12 1/12 4/12 3/12

144,000 180,000 360,000 155,000 620,000 480,000 1,939,000

= ¥1,679.22

c. Earnings Per Share =

= ¥1,678.75

d. Earnings Per Share Continuing Operation = 3,688,000,000 / 1,939,000 = ¥1,902.01 Earnings Per Share Discontinued Operation = 432,000,000 / 1,939,000 = ¥222.80 Net Income Add : Loss from Discontinued Operation Income from Continuing Operation Income from Continuing Operation Loss from Discontinued Operation Net Income Exercise 16.23 a. Revenues Expenses : Other than Interest Bond Interest (75 X 950 X 10%)

¥3,256,000,000 ¥432,000,000 ¥3,688,000,000 ¥1,902.01 (¥222.80) ¥1,679.21

17,500 8,400 7,125

(15,525)

Income before Income Taxes Income Taxes (40%) Net Income

1,975 (790) 1,185

Diluted Earnings per Shares =

= 0.57

b. Revenues Expenses : Other than Interest Bond Interest (75 X 950 X 10% X 4/12) Income before Income Taxes Income Taxes (40%) Net Income Diluted Earnings per Shares =

17,500 8,400 2,375

= 1.21

c. Revenues Expenses : Other than Interest Bond Interest (75 X 950 X 10% X 1/12) Bond Interest (25 X 950 X 10% X 1/12) Income before Income Taxes Income Taxes (40%) Net Income Diluted Earnings per Shares =

(10,775) 6,725 (2,690) 4,035

(

)

17,500 8,400 3,563 2,375

= 0.57

(14,338) 3,162 (1,265) 1,897...

Similar Free PDFs

Cost Accounting Chapter 16

- 9 Pages

Intermediate- Accounting

- 6 Pages

Intermediate accounting

- 3 Pages

Intermediate accounting

- 84 Pages

Intermediate Accounting

- 7 Pages

Intermediate Accounting

- 12 Pages

Chapter 16 - Accounting for Leases

- 34 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu