Law of Investments and Financial Markets Semester 1 2017 Exam Marking Guide PDF

| Title | Law of Investments and Financial Markets Semester 1 2017 Exam Marking Guide |

|---|---|

| Course | Law of Investments and Financial Markets |

| Institution | Royal Melbourne Institute of Technology |

| Pages | 4 |

| File Size | 125.8 KB |

| File Type | |

| Total Downloads | 21 |

| Total Views | 127 |

Summary

Download Law of Investments and Financial Markets Semester 1 2017 Exam Marking Guide PDF

Description

Marking Guide: Law of Investments and Financial Markets LAW2457 Semester 1 2017 QUESTION ONE

17-069MR ASIC acts against M Melbourne-based elbourne-based financial advice prov proviider for alleged contrav contraventions entions of Fov Fovea ea obligations. ASIC has commenced proceedings in the Federal Court of Australia against Wealth and Risk Management Pty Ltd (WRM), and related companies Yes FP Pty Ltd (Yes FP) and Jeca Pty Ltd (trading as Yes FS) (Yes FS), in relation to various alleged breaches of the Corporations Act 2001 and the Australian Securities and Investments Commission Act 2001, including alleged breaches of best interests obligations. ASIC is seeking injunctive relief, declarations of contraventions and financial penalties. WRM is licensed to advise retail clients about, and deal in, life risk insurance and superannuation products. WRM authorises advisers, generally employed by WRM’s corporate authorised representative Yes FP, who provide personal financial advice to retail clients referred to them by Yes FS, via the website yesfs.com.au. ASIC alleges that: on numerous occasions since December 2015, WRM Advisers have provided advice that is conflicted and in breach of the best interests obligations contained in the Corporations Act; WRM has breached s912A(1) of the Corporations Act by not: doing all things necessary to ensure that the financial services covered by its licence are provided efficiently, honestly and fairly; and has not taken reasonable steps to ensure that its representatives comply with financial services laws; Yes FS has contravened s911A and/or s911B of the Corporations Act by carrying on a financial services business without holding an AFSL; Yes FS has contravened s1041H of the Corporations Act 2001 and s12DA of the ASIC Act by engaging in misleading and deceptive conduct; and WRM, Yes FS and Yes FP contravened s12CB of the ASIC Act by engaging in unconscionable conduct in connection with the supply or possible supply of financial services. The first hearing of the matter is listed before the Federal Court of Australia at 9:30am on 31 March 2017.

REQUIRED

Discuss the legal issues arising from the above article. Refer to relevant case and/or statute law in your answer. (20 marks) Students should discuss:

FoFA obligations. Role of ASIC as the regulator. What is the purpose of these laws/regulations?

Part 7.7A of the CA was enacted as part of the “Future of Financial Advice” (FoFA) reforms which are aimed at ensuring that financial advice companies and their advisers act in the best interests of the client. ASIC alleges in this case that WRM has breached s961L. S 912A sets out the general obligations of Australian Financial Services Licensees. S911A requires any person carrying on a financial services business in Australia and providing financial product advice to hold an AFS licence or be a representative of an AFS licensee. ASIC contends that the conduct that is the subject of this action required Yes FS to have an AFS licence or be an authorised representative of an AFS licensee. What is injunctive relief? What is a declaration? What are financial penalties? What does it mean to be licensed to advise RETAIL clients? What sorts of investments are superannuation and life risk insurance? What is an authorised representative? What is personal financial advice? What is conflicted advice? What is an AFSL? Specifically discuss sections 911 A, 911B, 912A and 1041H of the CA. What is unconscionable conduct S12C of the ASIC Act?

QUESTION TWO

John, Paul, George and Ringo are the 4 directors of a music recording business called Beatles Pty Ltd. The company has created its own constitution. Clause 10 of the constitution states that: Cl10

Any loans to the company over the sum or $500 must be approved by the shareholders in general meeting.

Beatles Pty Ltd has been renting studio space in a trendy warehouse conversion in Collingwood since 2015. The rent for the warehouse is expensive at $3,000 per week and the directors consider it would make good business sense for the company to purchase a warehouse that has come up for sale next door for $3.8 million. The directors resolve at their next board meeting that: (1) Beatles Pty Ltd will purchase the Collingwood warehouse for $3.8 million. (2) George and Ringo are authorised to sign the contract of purchase under seal. John is asked by the other 3 directors to go to the ANZ bank to arrange the finance. He negotiates the terms of a $3.8 million loan. This loan is not approved by the shareholders in general meeting. Yoko a shareholder of the company finds out about this and is extremely concerned that Beatles Pty Ltd is committed to such a large loan. Advise Yoko what she can do about the loan. Use case law and relevant legislation to support your advice.

(15 marks)

Yoko is a shareholder – an internal party Her concern is enforcement of the statutory contract she has with the company s140 (1). There is no contract between directors and members. This is NOT about the authority of agents and what the 4 directors did re external parties. Does the breach by the company of not calling a meeting alter her rights as a member i.e. her RIGHT TO VOTE. Discuss Hickman v Kent and Eley v Positive Government Life. As a shareholder she cannot interfere with management issues regarding the size of the loan. Separation of powers. Borrowing the $ is a management issue- not a shareholder issue. As an investor she would be concerned about the financial implications for herself- e.g. potential loss of dividends and/or growth of shares. By borrowing too much the financial strength of the company may be compromised and the company could potentially go into receivership, VA or liquidation. Discuss whether Yoko could apply under oppression remedies S232, to wind up the company, alter the rule or sell her shares.

QUESTION THREE Sally works as a nurse. She earns $65,000 per annum. She has saved $12,000 and would like to invest that money into the share market. She does not understand the share market but is aware that it can be very volatile. She does not want to invest all the money into one company nor just in Australia.

Required: Explain to Sally what you think would be the best option to invest in for her to have exposure to the share market taking into account her concerns. In your explanation mention three advantages and three disadvantages of your choice. (15 marks)

As Sally wants to have exposure to one company then she should consider an MIS, which will spread her risk amongst different companies rather than exposure to one. Three advantages are: 1. 2. 3. 4. 5. 6.

Less exposure to one company and value falling Professional management Saves time Ability to invest small amounts locally or domestically Pooling with others to have access to greater spread Diversify

Disadvantages 1. 2. 3. 4.

Lack of control High management fees. Someone else makes the decision Fund manager manages the risk...

Similar Free PDFs

Financial Institutes and markets

- 7 Pages

Financial Institutions and Markets

- 276 Pages

Financial Markets and Institutions

- 35 Pages

Financial Markets and Institution

- 20 Pages

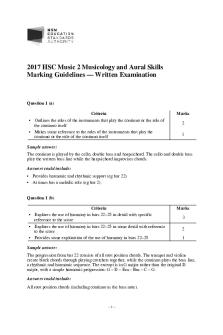

2017 hsc marking guide music 2

- 6 Pages

Money and financial markets 1 .pdf

- 208 Pages

MONEY, BANKING, AND FINANCIAL MARKETS

- 613 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu

![[CORE 2nd SEMESTER]] Money, Banking and Financial Markets Cecchetti](https://pdfedu.com/img/crop/172x258/9q6147lnyylm.jpg)