Managerial accounting paper PDF

| Title | Managerial accounting paper |

|---|---|

| Author | Parisa Mardiha |

| Course | Managerial Accounting |

| Institution | San Francisco State University |

| Pages | 17 |

| File Size | 1.3 MB |

| File Type | |

| Total Downloads | 27 |

| Total Views | 139 |

Summary

Download Managerial accounting paper PDF

Description

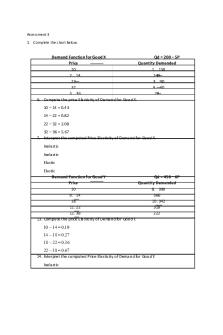

Investments Finance 6361 Professor Metghalchi Term Project 8-1-2012

Introduction Mutual funds are now the largest type of intermediary in the United States, followed by commercial banks and life insurance companies as stated in “Fundamentals of Investments” by Bradford D. Jordan, Thomas W, Miller Jr. and Steven D. Dolvin. After reading this statement many would wonder why and how mutual funds have taken such a center stage in the world of investments. To better understand this we must look at investors desires to earn above average returns on their hard earned monies. The average return in this case is measured against the S&P500. The S&P500 is a measure of the leading 500 companies in various industries in the United States. Currently the index has over $1.31 trillion in assets. Many believe that it is very difficult if not impossible to beat the S&P500’s return, which is accomplished by investing into the index and holding it for a desired period of time. However this belief has been challenged by many mutual funds that have earned returns for their investors in access of that earned by the S&P500, investors however must be careful many more mutual funds fair far worse than the S&P500. Most texts and investment specialists state that there are three primary reasons to invest in mutual funds, they are; diversification, professional management and the size of the initial investment. Diversification will mitigate risks for investors, by buying into a pool of stocks the fall of one will not destroy a portfolio as other stock remain constant or rise in value. The adage of not placing all your eggs in one basket is often used to help explain the benefits of diversification. Professional management helps investors by assuring them that experts are using the most advanced computer simulations and data to try and find way to earn them the highest possible returns. Professionals also devote much more time than the average investor in managing portfolios which is an additional benefit granted to mutual funds. Finally for new

investors or those with little disposable income the initial investment requirements for most investments are low allowing them to enter the market without incurring large risks to their savings. This leads us to the question of how and which mutual funds to invest in, which funds will turn out to be winners and which will be losers. There are a multitude of mutual funds that investors can invest in such as; balanced funds, world funds, insured funds, income funds, social conscious funds and index funds to name a few. But which one is right for you? To answer this, investors must look at what they are trying to accomplish with the fund. Are they retiring on a target date? Or are they looking for a stream of income as compared to future growth? Is the investor risk adverse or are they willing to risk it all? Does the investor want to invest in a specific industry or part of the world? After these questions are answered the field of mutual funds can be narrowed down. Next investors will look to how much a fund will cost them. What are the management fees? Who is managing the fund and what type of loads the fund carries. Additionally investors will review the funds past performance for indications of how the fund has been performing (though the historical data is no guarantee of future earnings). Finally investors will review a performance evaluation which is “an assessment of how well a money manager achieves a balance between higher returns and acceptable risk”. To do this key methodologies are employed, such methodologies include the Sharpe Ratio, Treynor Ratio, Jensen’s Alpha and Msquared. The ultimate goal of this paper is to use a few of these methodologies to determine how effective our chosen mutual funds have been at beating the S&P500. In doing so, readers will gain a better understanding of the procedure in choosing a mutual fund with clear examples of how to mathematically base their decisions.

Methodology & Data The two chosen equity funds for my project are Vanguard Consumer Staples Index Adm (VCSAX) and Hennessey Cornerstone Value (HFCVX). Some basic financial information on each equity fund is given below.

To better understand the risk and return of each of these funds we will be using the Treynor Ratio, Sharpe Ratio, Jensen’s Alpha and Modigliani risk-adjusted performance measure. Each of these financial tools is briefly discussed below. Treynor Ratio: This ratio is also known as reward to volatility ratio and is the measurement of the returns earned in excess of that which could have been earned on an investment that has no diversifiable risk such as a treasury bill as stated in Wikipedia. From the text we see that the Treynor ratio relates the excess return of a portfolio to the additional risk taken over the risk free rate. The higher the Treynor ratio the better the performance of the portfolio to which it relates. The Treynor ratio only takes systematic risk into consideration and is commonly used by investors when evaluating a specific security for inclusion into an existing portfolio.

T

=

ṝp−ṝf βp

T = Treynor Ratio ṝp = The portfolio average return over a specified time period ṝf = The average risk free rate over the same time period βp = The slope of the funds characteristic line over the same period

Sharpe Ratio:

This ratio is also known as the reward to variability ratio. In Wikipedia it states that the Sharpe Ratio is a measure of the excess return per unit of deviation in an investment asset or a trading strategy, typically referred to as risk. This ratio is used to evaluate an entire portfolio rather than its individual securities. The ratio penalizes portfolios that are not well diversified leading to higher unsystematic risk. The higher the Sharpe ratio for the portfolio the more desired the portfolio is by investors.

S=

ṝp−ṝf σp

S = Sharpe Ratio ṝp = The portfolio average return over a specified time period ṝf = The average risk free rate over the same time period σp = The standard deviation of returns of the portfolio during the same time period. Jensen’s Alpha: This ratio is used to measure the abnormal return of a portfolio over a theoretical expected return. Jensen’s Alpha is closely related to the Treynor ratio but is not in standardized form. The theoretical return most often used is calculated by the capital asset pricing model. A positive alpha is highly desired by investors.

ἀp = ṝp – [ṝf + βp(ṝm - ṝf)] ἀp = The average return over and above the predicted by CAPM (abnormal return) ṝp = The portfolio average return over a specified time period

ṝf = The average risk free rate over the same time period βp = The slope of the funds characteristic line during the same time period. Modigliani risk-adjusted performance measure (M2): This measure is derived from the Sharpe Ratio that was listed earlier. It measures the returns of the portfolio, adjusted for the deviation of the portfolio relative to that of some benchmark as stated in Wikipedia. The advantage of M2 is that it is in units of percent which makes it much easier for investors to grasp conceptually rather than like the Sharpe Ratio which is very abstract.

M2 = rp - rm M2 = Modigliani risk-adjusted performance measure rp= Adjusted portfolio rm = Market return

Empirical Results

Data and Calculations for Hennessy Cornerstone Value (HFCVX)

Data and Calculations for Vangaurd Consumer Staples Index Adm (VCSAX)

Data and Calculations for S&P500

Conclusion

The above chart illustrates the final values calculated for each of the ratios listed earlier in the paper. Analysis of the values shows the following; Sharpe Ratio: The S&P 500 indicated a Sharpe Ratio of -52.9% for the years 2007-2011, comparing this value to both HFCVX and VCSAX we see values of -31.02% and -39.1% respectively indicating that both mutual funds have outperformed the S&P 500 when all are compared to the risk free rate average for the same time span. Between both funds HFCVX performed better due to a higher Sharpe ratio value. Treynor Ratio: The Treynor Ratio indicates returns over a risk free investment, in my case I used the return on Treasury bills (3.52% which is the past 5 years average) which are considered to be completely risk free. From the data we see that when compared to the S&P 500 both funds did

not perform as well. The S&P 500 had a value of -0.071 while HFCVX was -0.1033 and VCSAX was -0.0958. From these values we see that both funds would not be desired by investors to be included in existing portfolios when compared to the S&P 500. Systematic risk is higher for my funds when compared to the S&P 500 due to the lesser degree of portfolio diversification. Jensen’s Alpha: This calculation measures how well each fund has done compared to a theoretical benchmark in my case the benchmark used is the S&P 500. From the values calculated from the two funds we can see that HFCVX has outperformed VCSAX by obtaining a value of 0.01856 compared to .0047. HFCVX has greater returns for investors than VCSAX. M-Squared: The values in the chart above indicate that HFCVX has a greater standard deviation than VCSAX however when adjusted for risk and return HFCVX has a slightly higher M2 value than VCSAX (99.77% and 99.70%) making it the more desirable investment. Overall we see that both funds have outperformed the S&P 500 while HFCVX has outperformed VCSAX. For investors this means that either fund would be more desirable than the buy and hold strategy of the S&P 500 for the past 5 years....

Similar Free PDFs

Managerial accounting paper

- 17 Pages

managerial accounting

- 34 Pages

Managerial accounting

- 7 Pages

Managerial accounting pdf

- 23 Pages

MCQ Managerial Accounting Quiz1

- 13 Pages

Managerial accounting homework

- 1 Pages

32470401 - Managerial accounting

- 8 Pages

Managerial accounting chapter 1

- 11 Pages

Managerial Accounting Final.

- 4 Pages

Managerial Accounting Formulas

- 4 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu