Manufacturing Accounts practical questions for bcom PDF

| Title | Manufacturing Accounts practical questions for bcom |

|---|---|

| Author | Anonymous User |

| Course | B.COM (ACCOUNTING) |

| Institution | University of Cape Coast |

| Pages | 6 |

| File Size | 126.2 KB |

| File Type | |

| Total Downloads | 4 |

| Total Views | 198 |

Summary

Manufacturing questions practical analysis needed to solve and end up at answers...

Description

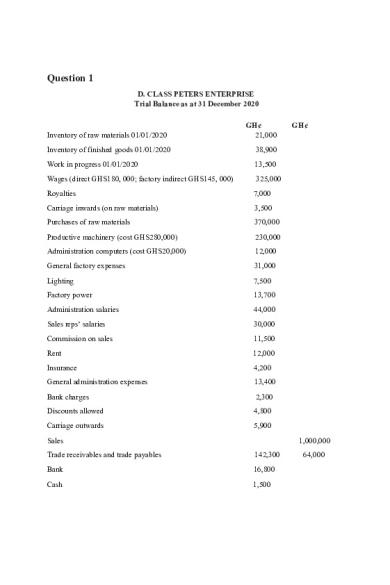

Question 1 D. CLASS PETERS ENTERPRISE Trial Balance as at 31 December 2020

Inventory of raw materials 01/01/2020

GH¢ 21,000

Inventory of finished goods 01/01/2020

38,900

Work in progress 01/01/2020

13,500

Wages (direct GHS180, 000; factory indirect GHS145, 000)

325,000

Royalties

7,000

Carriage inwards (on raw materials)

3,500

Purchases of raw materials

370,000

Productive machinery (cost GHS280,000)

230,000

Administration computers (cost GHS20,000)

12,000

General factory expenses

31,000

Lighting

7,500

Factory power

13,700

Administration salaries

44,000

Sales reps’ salaries

30,000

Commission on sales

11,500

Rent

12,000

Insurance

4,200

General administration expenses

13,400

Bank charges

2,300

Discounts allowed

4,800

Carriage outwards

5,900

Sales

GH¢

1,000,000

Trade receivables and trade payables

142,300

Bank

16,800

Cash

1,500

64,000

Drawings

60,000

Capital as at 01/01/2020

357,800 1,421,800

1,421,800

Notes at 31/12/2020: 1.

Inventory of raw materials GHS 24,000; inventory of finished goods GHS 40,000; work in progress GHS 15,000. 2. Lighting, rent and insurance are to be apportioned: factory 5/6, administration 1/6. 3. Depreciation on productive and administration computers at 10 per cent per annum on cost. Required Prepare Manufacturing, Trading and Profit and Loss Accounts D. CLASS PETERS ENTERPRISE for the year ended 31 December 2020.

QUESTION 2 Prepare manufacturing, trading and profit and loss accounts from the following balances of W Miller for the year ended 31 December 2020. Stocks at 1 January 2020:

GH¢

Raw materials

25,400

Work in progress

31,100

Finished goods

23,260

Purchases: Raw materials

91,535

Carriage on raw materials

1,960

Direct labour

84,208

Office salaries

33,419

Rent

5,200

Office lighting and heating

4,420

Depreciation: Works machinery

10,200

Office equipment

2,300

Sales

318,622

Factory fuel and power

8,120

Rent is to be apportioned: Factory 3/4; Office 1/4. Inventory at 31 December 2020 were:

Raw materials GH¢ 28,900 Work in progress GH¢ 24,600 Finished goods GH¢ 28,840.

QUESTION 3 The following relate Asumang Manufacturing enterprise as at 31 December, 2019 GHS Production cost of goods completed

720,000

Sales

1, 293,000

Inventory of finished goods at market value (01.01.2019)

170,000

Inventory of finished goods at market value (31.12.2019)

135,000

Selling and distribution expenses

144,000

Administrative expenses

122,000

Financial charges

32,000

Goods are transferred to the warehouse at cost plus 25% Required 1. Determine the amount of unrealized profit and market value of goods completed. 2. Prepare Trading, profit and loss account for the year.

QUESTION 4 The following relates to K. Agyapong Manufacturing enterprise as at 31 December, 2019. Opening inventory at market value (01.01.2019) GHS 22,000 Closing inventory at market value (31.01.2019) GHS 36,000 Goods are transferred to warehouse at cost plus 33 1/3%. Prepare the provision for unrealized profits account and indicate the amount to be taken to the profit and loss Account. QUESTION 5 Form the following information relating to the business of K. Asante Manufacturing Enterprise, you are required to prepare Manufacturing, Trading and Profit and loss Account and a Statement of Financial Position for the year ended 31 December, 2020. Dr.

Cr.

GHS

GHS

Opening Inventory Raw Materials

77,000

Work in progress

40,700

Finished Goods (market value)

49,500

Trade Receivables

104,500

Trade payables

115,500

Cash and Bank

137,500

Discounts

38,500

General Expenses

121,000

Carriage on Raw Materials

5,000

Rents and Rates

22,000

Electricity

55,000

Factory power

88,000

Insurance

7,150

Sales Commission

99,000

Direct Expenses

110,000

Factory Wages: Direct

242,000

Indirect

148,500

Office salary

82,500

Drawings

60,500

Capital

49,500

2,386,950

Buildings

1,375,000

Plant and Machinery

742,500

Delivery van

440,000

Office Equipment

125,000

Provision for Depreciation Office Equipment

25,000

Plant and machinery

148,500

Delivery van

176,000

Provision for unrealized profits

9,900

Purchases for Raw materials

1,028,500

Sales

2,288,000 5,199,350

5,199,350

Additional information 1. It is the policy of the enterprise to transfer goods to the warehouse at factory cost plus 25%. 2. Inventory on 31st December, 2020 GHS Raw materials 93,500 Work in progress 49,500 Finished goods (at market value) 60,500 3. The following expenses should be apportioned as follows: Factory Electricity 3/5 Rent and Rates 3/5 Insurance 3/5 4. Depreciation provision are applied to cost on the basis of: Plant and machinery 10% Office Equipment 10% Delivery vans 20%

office 2/5 2/5 2/5

QUESTION 6 ASARE YORK Ltd is a manufacturing company, keeping accounts to 31st December every year. The following balances were extracted from the books of the company as at 31st December, 2020. GH¢’000 Inventory as at 1st January, 2020: Raw Materials Work in Progress Finished Goods Purchases of Raw Materials

13,550 9,750 14,080 237,650

Indirect Materials

2,161

Productive Wages

63,230

Electricity

7,455

Printing and Stationery

1,264

Postage and Telephone

520

Salaries

21,400

Insurance

1,660

Office Expenses

1,680

Advertising

1,280

Royalties

11,000

Sales

398,120

Provision for unrealized profits as at 1st January 2020

1,280

The following additional information is relevant to the above accounting period: i. ii.

Finished goods manufactured during the period are transferred from the factory at a manufacturing price of cost plus 10% Stock at close the year: GH¢’000 Raw Materials 24,000 Work-in-progress

11,250

Finished Goods (market value) 19,800 iii.

Provide for depreciation as follows: Equipment and Machinery

iv.

Prepayments at 31/12/2020: Insurance

v.

160

Accruals as at 31/12/2020: Productive Wages

1,342

Electricity vi.

5,650

590

The following expenses should be split as follows: Factory

Office

Electricity

60%

40%

Salaries

60%

40%

Insurance

66 2/3%

33 1/3 %

Depreciation

80%

20%

All other expenses should be charged in full to the profit or loss account. Required: Use the information above to complete the missing figures in the manufacturing account and the income statement for the year ended 31 December 2020, as well as the statement of financial position as at 31 December 2020...

Similar Free PDFs

Accounts FOR Manufacturing Firms

- 2 Pages

Manufacturing Accounts and examples

- 17 Pages

MST 2015 - Questions for practical

- 20 Pages

Course Structure for BCOM

- 8 Pages

Lab Practical Practice Questions

- 4 Pages

Practical - practice questions

- 2 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu