More on Costs - Cost and cost PDF

| Title | More on Costs - Cost and cost |

|---|---|

| Course | Managerial Accounting |

| Institution | Gonzaga University |

| Pages | 10 |

| File Size | 157.3 KB |

| File Type | |

| Total Downloads | 88 |

| Total Views | 161 |

Summary

Cost and cost...

Description

Companies, usually assign costs to their products and services for two main reasons. 1. It helps them fulfill their planning, controlling and decision making responsibilities. a. EX: a company may use product cost information to better understand each product’s profitability to go establish product’s selling price. 2. It helps them determine the value of ending inventories and costs of goods sold for external reporting purposes. The costs attached to products that have not been sold are included in ending inventories on the balance sheet, where as the costs attached to units that have been sold are included in costs of goods sold in the income statement. It is very common for external financial reporting requirements to heavily influence how companies assess costs to their products and services. Because most countries (including USA) require some form of absorption costing for external financial reports, many companies use some form of absorption costing for product costing purposes In absorption costing all manufacturing costs, both fixed and variable are assigned to units of product units are said to fully absorb manufacturing costs. Conversely all non manufacturing costs are treated as period costs and they are not assigned to units of product. This chapter and the next explain a common type of absorption costing system known as job order costing. JOB ORDER COSTING- AN OVERVIEW: Job order costing is used in situations where many different products, each with individual and unique features, are produced each period. EX: A levi strauss clothing factory would typically make many different types of jeans for both men and women during a month. In a job order costing system, costs are traced and allocated to jobs and the costs of the jobs are divided by the number of units in the job to arrive at an average cost per unit. This order of jobs is called a job. The average cost per unit is also referred to as the unit product cost.

JOB ORDER COSTING AN EXAMPLE: To introduce job order costing we will follow a specific job as it progresses through the manufacturing process. This job consist of two experimental couplings that yeast precision machining has agreed to produce for loops united, a manufacturer of roller coasters. Couplings connect the cars on the roller coaster and are a critical component in the performance and safety of the ride Companies generally classify manufacturing costs into three broad categories. 1. Direct materials 2. Direct labor 3. Manufacturing overhead As we study the operation of a job order costing system we wills e how each of these three types of products costs is assigned to jobs for purposes of computing unit product costs. MEASURING DIRECT MATERIALS COST: This is a custom product that is being made for the first time, but if this were ocne of the company’s standard products, it would have an established bill of materials. A bill of materials is a document that lists the quantity of each type of direct material needed to complete a unit of product. When an agreement has been reached with the customer concerning the quantities, price and shipment dates for the order, a production order is issued. The production department then prepares a material requisition form similar to the form in exhibit 2-1 The materials requisition form is a document that specifies the type and quantity of materials to be drawn from the storeroom and identifies the job that will be charged for the cost of the materials. The form is used to control the flow of materials into production and also for making journal entries in the accounting records. JOB COST SHEET: After a production order has been issued, the accounting department’s job order costing software system automatically generates a job cost sheet like the one presented in exhibit 2-2 A job cost sheet record the materials, labor and manufacturing overhead costs in charge to that job.

After direct materials are issued the cost of these materials are automatically recorded on the job cost sheet. MEASURING DIRECT LABOR COST: -Direct labor consists of labor changes that are easily traced to a particular job. - Labor changes that cannot be easily traced to specific job are treated as part of manufacturing overhead. - As discussed in the previous chapter, this later category of labor costs is called indirect labor and includes task such as maintenance, supervision and cleanup. - Most companies rely on computerized systems to maintain employee time tickets. - A completed time ticket is an hour by hour summary of the employee’s activities throughout the day. - one computerized approach to creating time tickets uses barcodes to capture data. - each employees and each job has a unique barcode. When beginning work on a job, the employees scans three bar codes using a handheld device much like the bar code readers at grocery store checkout stands. The first bar code indicates that a task is being started; the second is the unique bar code on the employee’s identity badge; and the third is the unique bar code of the job itself. This information is fed automatically via an electronic network to a computer that notes the time and records all of the data. When the talk is completed the employee scan a barcode indicating the task it complete, the barcode on his or identity badge and the barcode attached to the job. This information is relayed to the computer that again notes the time, and a time ticket such as the one shown in exhibit 2-3 is automatically prepared. This information is relayed to the computer that again notes the time, and a time ticket such as the other one shown in exhibit 2-3 is automatically prepared. Because all of the source data is already in the computer files, the labor costs can be automatically posted to job cost sheets. The indirect labor cost related to performing maintenance is treated as part of manufacturing overhead and does not get posted on a job cost sheet. COMPUTING PREDETERMINED OVERHEAD RATES: -

Recall that in absorption costing, product costs include manufacturing overhead as well as direct material and direct labor.

-

Therefore, manufacturing overhead are the one needs to be recorded on the job cost sheet. - However, assigning manufacturing overhead to a specific job is complicated by three circumstances: 1. Manufacturing overhead is an indirect cost. This means that it is either impossible or difficult to trace these costs to a particular product or job. 2. Manufacturing overhead consists of many different types of costs ranging from the grease used in machines to the annual salary of the production manager. Some of these costs are variable overhead costs because they vary in direct proportion to changes in the shelves of production (e.g indirect materials, supplies and power) and some are fixed overhead costs because they remain constant as the level of production fluctuates (e.g heat and light, property taxes and insurance) 3. Many companies have large amounts of fixed manufacturing overhead. Therefore, their total manufacturing overhead costs continue to remain relatively constant from one period to the next even though the number of units that they have produced can fluctuate widely. -Consequently, the average cost per unit will vary from one period to the next. -Given these circumstances, allocation is used to assign overhead costs to products. - Allocation is accomplished by selecting an allocation base that is common to all of the company’s products and services - An allocation base is a mauser such as direct labor hours (DLH) or machine hours (MH) that is used to assign overhead costs to products and services - The most widely used allocation base in manufacturing are direct labor hours, direct labor costs, machine hours and ( where a company has only a single product ) unit of production. - manufacturing overhead is commonly assigned to products using a predetermined overhead rate. - The predetermined overhead rate is computed by dividing the total estimated manufacturing overhead cost for the period by the estimated total amount of the allocation base as follows: - predetermined overhead rate= (estimated total manufacturing overhead cost)/ estimated total amount of the allocation base. The predetermined overhead rate is computed before the period begins using a four step process: 1. The first step is to estimate the total amount of the allocation base (the denominator) that will be required for next period’s estimated level of production. 2. The second step is to estimate the total fixed manufacturing overhead cost for te coming period and the variable manufacturing overhead cost per unit of the allocation base. 3. The third step is to use the cost formula shown below to estimate the total manufacturing overhead ( the numerator) for the coming period: 4. The fourth step is to compute the predetermined overhead rate

Notice the estimated amount of the allocation base is determined before estimating the total manufacturing overhead cost. This needs to be done because total manufacturing overhead cost includes variable overhead costs that depend on the amount of the allocation base. APPLYING MANUFACTURING OVERHEAD: -apply overhead costs to jobs using a predetermined overhead rate. - to repeat the predetermined overhead rate is computed before the period begins. - the predetermined overhead rates is then used to apply overhead cost to jobs throughout the period. - the process of assigning overhead cost to jobs is called overhead application. - the formula for determining the amount of overhead cost to apply a particular job is overhead applied to a particular job= predetermined overhead rate x amount of the allocation base incurred by the job. For example, if the predetermined overhead rate is $20 per direct labor hour, then 20 dollars hour of overhead cost is applied to a job for a direct labor hour incurred on the job. When the allocation base is direct labor hours, the formula becomes: Overhead applied to a particular job= predetermined overhead rate x actual direct labor hours worked on the job Note that the amount of overhead applied to a particular job is not the actual amount of overhead caused by the job. Actual overhead costs are not assigned to jobs- if they could be done, the costs would be direct costs, not overhead. The overhead assigned to the job is simply a share of the total overhead that was estimated at the beginning of the year This approach to overhead application is known as normal costing A normal cost system applies overhead costs to jobs by multiplying a predetermined overhead rate by the actual amount of the allocation base incurred by the jobs. THE NEED FOR A PREDETERMINED RATE: -

Instead of using a predetermined rate based on estimates why not base the overhead rate on the actual total manufacturing overhead cost and the actual total amount of the allocation base incurred on a monthly, quarterly or annual basis?

-

If an actual rate is computed monthly or quarterly, seasonal costs in overhead costs or in the allocation base can produce fluctuation in the overhead rate.

For example, the costs of heating and cooling a factory in Illinois will be highest in the winter and summer months or each quarter based on actual costs and activity, the overhead rate would go up in the winter and summer and go down in the spring and fall. As a result, two identical jobs, one completed in the winter and one completed in the spring would be assigned different manufacturing overhead costs. Many managers believe that such fluctuations in product cost serve no useful purpose. TO avoid such fluctuations, actual overhead rates could be computed on an annual or less frequent basis. However, if the overhead rate is computed annually based on the actual costs and activity for the year, the manufacturing overhead assigned to any particular job would not be known until the end of the year. For example, the cost of Job 2B47 at cost precision machining would not be known until the end of the year; even though the job will completed and shipped to the customer in March. For these reasons, most companies use predetermined overhead rates than actual overhead rates in their costing accounting systems. COMPUTATION OF TOTAL JOB COSTS AND UNIT PRODUCT COSTS: ( compute the total cost and the unit product cost of a job using a plantwide predetermined overhead rate) As indicated earlier- this unit product cost is an average cost and should not be interpreted as the cost that would actually be incurred if another unit were produced. The incremental cost of an addition unit something less than the average unit cost of 1195 dollars because much of the actual overhead costs would not change if another until were produced. JOB ORDER COSTING- A MANAGERIAL PERSPECTIVE: - Managers use job cost information to establish plans and make decisions For example: managers may use job profitability reports to develop sales and production plans for next year. -

If certain types of jobs such as low volume engineering intensive jobs, appear to be highly profitable, managers may decide to dedicate future advertising expenditures to growing sale of these types of jobs.

-

-

Conversely if other types of jobs such as high volume labor intensive jobs appear to be unprofitable-- managers may take actions to reduce the projected sales and production of these types of jobs. Managers may also use job cost information to make pricing decisions.

For example if a job A has a total manufacturing cost of 100 dollars, managers often use a predefined markup percentage say 50 percent to establish a markup of 50 dollars (100 dollars x by 50 percent) and a selling price of 150 dollars. 100 plus 50 dollars Under this approach, known as ( cost plus pricing) the managers establish a markup percentage that they believe will generate enough revenue to cover all of a kob’s manufacturing costs and a profit for the company’s nonmanufacturing costs while generating some residual profit. If a company’s job order costing system does not accurately assign manufacturing costs to kobs, it will adversely influence the types of planning and decision making scenario just described. In other words, distorted job cost data may cause managers to use additional advertising dollars to purse certain types of jobs that they believe are profitable, but in actuality are not. Similarly, inaccurate job costs may cause managers to establish selling prices that are too high or too low relative to the prices established by more savvy competitors. At this point, you may be wondering how can this happen? How can a job order costing system inaccurately assign costs to jobs? The key to answering this question is to focus on indirect manufacturing costs, also called manufacturing overhead costs. While job order costing systems can accurately trace direct materials and direct labor costs to jobs, they often fail to accurately allocate the manufacturing overhead costs used during the production process to their respective jobs. The root cause of the problem often relates to the choice of an allocation base. CHOOSING AN ALLOCATION BASE- A key to job cost accuracy To improve job accuracy, the allocation base in the predetermined overhead rate should drive the overhead cost. A cost driver is a factor such as machines hours, beds occupied, computer time or flight hours that causes overhead costs

If the base in the predetermined overhead rate does not “drive” overhead costs, it will not accurately measure the cost of overhead resource used by each job. Many companies use job order costing systems that assume direct labor hours (or direct labor cost) is the only manufacturing overhead cost driver. They use a single predetermined overhead rate, or what is called a plantwide overhead rate to allocate all manufacturing overhead costs to jobs based on the usage of the direct labor hours. However, while direct labour hours may indeed drive some of a company’s manufacturing overhead costs, it is often overly simplistic and incorrect to assume that direct labour hours is a company’s only manufacturing overhead cost drive. -

When companies can identify more than one overhead cost driver they can improve job to accuracy by using multiple predetermined overhead rates.

JOB ORDER COSTING USING MULTIPLE PREDETERMINED OVERHEAD RATES: (compute the total cost and the unit product cost of a job using multiplied predetermined overhead rates) A cost system with multiple predetermined overhead rates use more than one overhead rate to apply overhead costs to jobs. EX: a company may choose to use a predetermined overhead rate for each of its production departments. Such a system, while more complex is more accurate because it reflects differences across departments in terms of how jobs consumed overhead costs. EX: in departments that are relatively labor intensive their overhead costs might be applied to jobs based on direct labour hours and in departments that are relatively machine invented their overhead costs might be applied to jobs based on machine hours. MULTIPLE PREDETERMINED OVERHEAD RATES- a departmental approach -It is important to emphasize that using a departmental approach to overhead application results in a different selling price for job 407 than would have been derived using a plantwide overhead rate based used on either direct labor hours or machine hours. - The appeal of using a predetermined departmental overhead rates is that they presumably provide a more accurate accounting of the costs caused by jobs, which in turn should appeal of using predetermined departmental overhead rates is that they presumably provide a more

accurate accounting of the costs cause by jobs, which in turn should change management planning and decision making. MULTIPLY PREDETERMINED OVERHEAD RATES- an activity based approach: -

Using departmental overhead rates is one approach to creating a job order costing system that includes multiple predetermined overhead rates.

-

Another approach is to create overhead rates related to the activities performed within departments. This approach usually results in more overhead rates than a departmental approach because each department may perform more than one activity. When a company creates overhead rates based on the activities that it performs, it is employing an approach called activity based costing. For now our goal is to simply introduce you to the idea of availability based costing an alternative approach to developing multiple predetermined overhead rates. Managers use activity based costing systems to more accurately measure the demands that jobs, products, customers and other cost objects make on overhead resources.

-

JOB ORDER COSTING AN EXTERNAL REPORTING PERSPECTIVE: -

This chapter focuses on using job order costing systems to compute unit product costs for internal management purposes. However, job order costing systems are also often used to create a balance sheet and income statement for external parties, such as shareholders and lenders. While the next chapter will provide a detailed explanation of how job order costing systems facilitate external financial reporting, we’d like to take a moment to highlight two important points related to overhead application and subsidiary ledgers, that in some see context this chapter to the next.

OVERHEAD APPLICATION AND THE INCOME STATEMENT: - When a company uses predetermined overhead rates to apply overhead costs to jobs, it is almost a certainty that the amount of overhead applied to all jobs during a period will diff from the actual amount of the overhead cost incurred during the period. -

When a company applies less overhead to production than it actually incurs, it creates what is known as underapplied overhead. When it applies more overhead to production than it actually incurs, its results is overapplied overhead.

The existence of underapplied or overapplied overhead has implications for how a company prepares its financial statements.

For example: the cost of goods sold (COGS) reported on a company’s income statement must be adjusted to ref...

Similar Free PDFs

More on Costs - Cost and cost

- 10 Pages

More on Cost - More on Cost

- 5 Pages

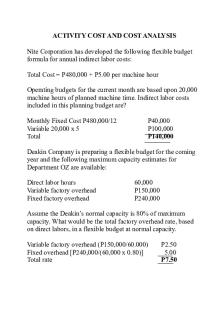

Activity COST AND COST Analysis

- 5 Pages

FULL COST :: Direct COST

- 1 Pages

Cost Behavior - Cost Accounting

- 78 Pages

COST Acctg 2 - cost

- 1 Pages

Cost Behavior and Cost Volume Profit

- 18 Pages

Cost hw - Cost accounting homework

- 18 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu