Outline Agency PDF

| Title | Outline Agency |

|---|---|

| Course | Agency Law |

| Institution | Pace University |

| Pages | 40 |

| File Size | 734.5 KB |

| File Type | |

| Total Downloads | 44 |

| Total Views | 154 |

Summary

Agency Law course notes summary...

Description

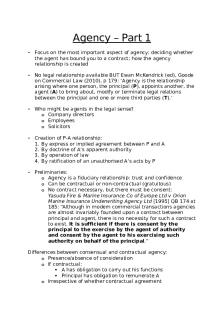

AGENCY LAW Relationship where one person acts for another. § 194-195: Restatement of Agency Requirements to find a principal-agent relationship are (1) mutual consent; (2) one is acting on behalf of the other; and (3) one is acting under the authority of the other. Liability of the Agent: If the Principal is undisclosed (you do not know about him) the agent is fully liable. If the Principal is partially disclosed (the agent is acting on behalf of another but the plaintiff did not know who that person was) the agent is not liable. 1.) Gorton v. Doty a. High school teacher gives her car to football coach who crashes the car. b. Court: To find and Agency relationship there must be a manifestation of consent by the principal that the agent is going to act for the principal and be subject to principal’s control and c. By this reasoning, by her telling him that he had to drive the car, he was acting as her agent. d. Although this reasoning might be a little over reaching because it says anyone who drives your car can be found to be your agent, it is upheld for a good policy reason, that b/c of insurance purposes, she should be held liable. e. Important because it states you do not need a contract to create an agent-principal relationship. If you give explicit directions on how to act you can create that relationship. 2.) A Gay Jensen Farms Co. v. Cargill (Lender as Principal) Farm (P) v. Grain Dealer (D) a. Cargill financed all Warren’s purchases of grain and operating expenses who becomes insolvent and can’t pay farmers for grain they have already delivered. Can Cargill be liable for the debt as a Principle of Cargill? b. Court examines the level of control Cargill has over Warren. Lists nine factors (including constant recommendations to Warren, right of first refusal of grain, Warren’s inability to enter into mortgages, to purchase stock or pay dividends w/o Cargill’s approval) not to be read independently and concludes that Warren was an agent of Cargill. c. Important because it analyzes how much control is necessary to create a P-A relationship. It takes a lot. AUTHORITY Restatement Of Agency § 7: Authority § 26: Agent’s Authority to Do an Act § 144: Principal’s Liability for Agents Actions (Disclosed or Partially Disclosed Principle) § 145: Authorized Representations § 186: Principal is bound by contracts made by his account by an agent acting within authority, except for contracts that are negotiable or those that don’t include him. 1.) Actual Authority a. Express b. Implied i. If it is reasonable in the express authority to do something or to authorize someone else to do something, an Agent has Implied authority. Ex: A corporation 1

2.)

3.)

4.)

5.)

6.)

7.)

authorizes one of its officers to sell a piece of real estate, they tell Sylvia to do it and Sylvia hires a broker. No Actual Authority a. Apparent Authority i. § 8: Apparent Authority ii. § 27: Creation of Apparent Authority iii. § 159: Principal is liable for actions of agent with apparent authority. iv. § 160: Even if Agent Violates Secret Instructions, Principal is Liable v. Where the P puts the A in a position where others would reasonably believe the A has the authority to act. Ex: If building manager hires a plumber who the principal told her not to hire. b. Inherent Agency Power i. § 8A/B: Inherent agency Power ii. § 161: Unauthorized act of Inherent Agency iii. § 194: If done in scope of powers, principal is liable for unauthorized agents action. iv. § 195: Same as 194 but for a manager of a business. v. Where A in a position, regardless of where the principal puts him, where a reasonable person would believe that they have authority. Ex: If building manager orders a basket of fruit for the tenants and the Fruit Dude sues the principal. Mill Street Church a. Guy is hired to paint church, he hires his brother who hurts himself. Is church liable? b. Court holds that there was implied authority based on painter’s need and past experience. It was reasonable for him to believe he could hire a helper. c. Importance: Implied authority falls on whether the agent had reason to believe that they could act in that capacity. It doesn’t fall on the principle or the hired help’s belief. Lind v. Schenley Employee (P) v. Employer (D) a. Lind gets a promotion and VP tells him that he will be working for Kaufman. Kaufman promises Lind a 1% commission on all sales made by those under him. b. Issue: Does Kaufman have authority? c. Court: Has apparent authority. It was reasonable for Lind to believe that Kaufman had authority. d. Analysis: If VP had apparent authority, he granted apparent authority to Kaufman. e. Dissent said that it was not reasonable for P to believe this b/c it would have tripled his salary. Three Seventy Leasing v. Ampex a. Contract that purchased computer space affirmed by an employee in a letter of confirmation. Did the employee have agency? b. Court rules yes. Kays had apparent authority. c. Question arises of whether it was reasonable for others to believe that employee (Kayes) would have the authority to authorize 450K in credit. Watteau v. Fenwick a. Undisclosed principals own a bar. Old owner still runs it, his name is still on building. He must, however, purchase only what they tell him to purchase. Old owner bought something unauthorized and didn’t pay for it. Owners claim that they are not liable b/c they told him not to buy that. b. Court holds that there is inherent agency power. c. § 194: Agent is responsible for acts of agents if usual or necessary albeit forbidden. Kidd v. Thomas Edison 2

a. Edison company has recitals for advertisements. Agent who books singers signed people on for further engagements after the commercials. b. Apparent authority. It was reasonable for her to believe that he could sign her on to an additional engagement. Even if an agent disregards a principles instruction the principle is still liable for those actions, so long as they are within the scope of employment. LIABILITY OF PRINCIPLE TO 3RD PARTIES IN TORTS § 102: Master – Servant Relationship: Exists when servant (1) Acts on behalf of the master; and (2) is subject to master’s control or right to control in manner in which job is done. § 219: When Master is Liable for Servants Torts § 220: Definition of Servant 1.) Humble Oil Refining v. Martin a. Humble oil leases gas station and sells oil and tires to Schneider. Car rolls into father and children. Who is liable? b. Does a Cargill like analysis: Court found that it was an employee after seeing that it was responsible for the operation of the station because Schneider had to clear everything with Humble. c. Because of the control, found liable as a principle. 2.) Hoover v. Sun Oil a. Held opposite of Humble. b. Looked at the element of control again but found for D. c. This might be b/c Hoover was decided by a Delaware court and Humble by a Texas court. Delaware might deal more favorably to corporations. 3.) In determining independent contractor vs. servant a. Did the company create an appearance that it was responsible? b. Who has the financial interest? c. Who could more easily prevent the harm or risk? Scope of Employment § 228: When conduct of servant is within the scope of employment § 229: Kind of Conduct within Scope § 230: Even a forbidden act may be done within scope of employment § 231: An act may be within the scope even if criminal or tortious. 1.) Three tests for scope of employment a. § 228 of Restatement of Agency: whether the servant was attempting to act at least in part by a purpose to serve the master. b. Policy: Find the master liable in order to give it incentives to take steps to prevent it from happening again. c. Fairness: A deeply rooted sentiment that a business enterprise cannot justly disclaim responsibility for accidents that fit within its scope. 2.) Bushey and Sons v. United States a. Drunk coast guard crew member turns some knobs and floods the dry dock, destroying it. b. Court finds that the US govt is responsible, b/c the sailor wouldn’t be there had it not been for the Govt, and no matter how strange he felt h was acting in the scope of his employment. c. Court leans towards the third test for scope of employment. Problem: is getting drunk within the scope of the govt’s responsibility? 3

d. Impossible to make the case that it is in the scope of someone’s duty to sink a ship. Judge brings up the rule, but gets around it by saying that the coast guard negotiated for the right for the sailors to be on the ship, reasonably foreseeable that sailors were drunk. 3.) Red Sox Ball Case a. Court finds that an employer is liable if it can be shown that the assault perpetrated was in response to plaintiff’s conduct which interfered with pitcher’s ability to perform his job, that is, to pitch. ____________________________________________________________________________________

PARTNERSHIPS § 6: Partnership defined § 7: Rules for determining the existence of partnership. Advantages over a corporation Taxes: Gains and losses of the company are taxed individually. The partnership is not taxed for the gains like a corporation is. A partnership has to file a return but doesn’t have to pay taxes. It “passes through” to the individual returns with the IRS. Formation: You can create a partnership by acting like a partnership. Limited Liability: Partners in a partnership are personally liable for partnership’s debts. Duration: Ends when a partner dies or leaves the agreement. Centralized Management: Partnership theoretically has equal say amongst partners. Expenses: More costly with a partnership Flexibility: Allows participants a great deal of flexibility in setting up arrangements. A partnership can be shown by circumstantial evidence. Partners Compared With Employees 1.) Fenwick v. Unemployment Compensation Committee a. P owns a beauty salon, and his employee wants more money. He devises an agreement where she will have a set salary and can share in the profits f the salon, if any at the end of the year. b. § 4 OPA: A receipt of the share of profits is prima facie evidence that they are a partner, but not if (c): Profits are received as wages of an employee. c. (1) Intention of parties; (2) right to share in profits and losses; (3)ownership and control of property; (4) power in administration/management; (5) language of agreement; (6) conduct towards thirds people; (7) rights upon dissolution. d. Court reasons that there is no partnership b/c share in profits is the only thing that might lead someone to believe it was a partnership. This factor is not a per se determining factor of a partnership. Fenwick didn’t grant her a share of profits to make her a partner, he did it to accomidate her needs with what he was able to give. 4

e. Unusual because here P saying it is a partnership and the court says it isn’t. Generally the other way around. Partners Compared with Lenders 2.) Martin v. Peyton a. Third party creditor loans company 2.5 million, with a few terms. (1) KNK (Company receiving the loan) had to turn over a large number of their own securities); (2) Lender was to receive 40% of profits of KNK until loan was repaid (not exceeding 500K and no less than 100K). Also created trustees of the lenders, not allowing KN to do anything with the loaned money without their consent. b. Court finds that this was all done to insure an investment in a highly speculative company. However, it was not enough control to make them a partner. c. Similar to Cargill case, but held the other way. 3.) Putnam v. Shoaf a. Putnam owned 50% in a partnership and sells it to the Shoafs. After sale of her interest, the partnership is credited 68K. Putnam wants her share of the 68K. b. Court says that once she sold her share of the partnership she is no longer entitled to any gains. After selling her shares, she was not entitled to anything else. You can only convey an undivided interest in a property. Cows. c. UP A§ 201: A Partnership is a legal entity, not just an aggregate of assets. Partnership Dissolution § 2 9 : Di s s ol ut i onDe fine d § 3 0 : Pa r t ne r s hi pnott e r mi na t e dbydi s s ol ut i on § 31: Causes of Dissolution § 32: Dissolution by decree § 33: Effect of Dissolution § 35: Power of Partner to Bind Partnership to Third Persons after Dissolution § 38 (2) (c) (2): A partner who has wrongfully caused a dissolution is entitled to his share of partnership assets, not including Good Will (Value of business as a going concern above and beyond the value of the assets of a business.) Partnership Agreements: (1) Without a partnership agreement, it is an at-will partnership. (2) Partners owe each other a fiduciary duty, you cannot dissolve a partnership in bad faith. (3) A term may be implied (by outstanding debt). (4) Partners are entitled to share control, but that may be modified by agreement. (5) When a partner deprives another of participation, it constitutes a violation of the partnership. 1.) Owen v. Cohen a. Partners in a bowling alley, one is the money the other is the management. Manager causes problems, money guy files to force a dissolution. b. Cohen decides to bring it to court b/c if he filed for an automatic dissolution, Owen might have been able to sue for breach of contract. Cohen could take a position that partnership has an implied term lasting until he gets his money back. However, he is relying on Owen’s misconduct, which entitles him to get out even though there Is that implied term. c. Court Order Dissolution

5

d. What could happen next is to (1) put the business up for sale, sell off and pay assets: Liquidate; (2) continue to run the business as a going concern. Even when a partnership dissolves, the business does not necessarily end immediately. 2.) Collins v. Lewis a. Cafeteria, similar setup to above. P puts up over 600K in the business, and D has to pay 30K first year and 60K each year after. Business isn’t going well, he refuses to put in more money and wants to dissolve the business. b. Court: Lewis did nothing wrong, unlike case above, and Collins has to continue to put up money per their partnership agreement. c. What happens next: An attorney could tell Collins to sell his interest to Lewis. Lewis was looking to buy out anyway. d. The court is saying to figure it out amongst yourselves. They are not going to dissolve by decree a partnership that is unsuccessful just because of its lack of success. e. The buying partner can set his price. Is it a breach of fiduciary duty to set a higher price? 3.) Page v. Page a. Partnership in a linen company. After a hard start there was minimal profits and one party decided to terminate. P sued saying the partnership was for a term rather than at will. b. Court makes point that a partnership is at will if there is no partnership agreement to the contrary. Without an agreement, a partner can dissolve a partnership upon express notice to other party. If there is bad faith or breach of fiduciary duty shown, then the dissolution would be wrongful and the plaintiff would be liable. c. Duration of the partnership was the term reasonably needed to pay back the money. Here they weren’t able to show that it was more than the hope of being profitable. 4.) Pav-Saver Case a. Two parties to a partnership. (1) Dale: Owns trademarks and patents in a technology. (2) Meersman, attorney who runs the business. Form a partnership agreement, granting Meersman exclusive license over the patents and trademarks. After several years Dale decides to terminate partnership. Meersman takes over and says under §38 (2) he is entitled to run the business. b. Court says Dale is not entitled to his patents and trademarks, that he wrongfully dissolved the partnership, and Meersman may continue to he business. Dale is entitled to, under § 38 his share of partnership assets minus any damages caused by the breach of the agreement. The partnership agreement was “permanent”. c. This puts Dale in a bad position, because he was not allowed to keep his patents and the value of his share in the company was almost zero because his only asset of the company was the patents, which the court said was worth nothing. LIMITED PARTNERSHIP Different from partnership because (1) You cannot form a limited partnership inadvertently, must file papers with Secretary of State; (2) limited partnership has to have at least one general partner and at least one limited partner. Limited Partners: Have to be passive participants. They are not liable for debts of participants. Same liability as a shareholder in the corporation. If a limited partner participates in the control of the partnership, then he loses his limited status.

6

§ 303: If a creditor reasonably believes that someone is a general partner, then that comes into account. They had to (1) believe that they were general partners and (2) belief had to be reasonable. This also lists a range of activities a limited partner can engage in and still be limited. 1.) Holzman v. Escamilla a. A partnership where there are general and limited partners. b. Court finds the limited partners were actually general partners due to “the manner of withdrawing money from the bank accounts.” The men had absolute power to withdraw funds without the GP’s knowledge. They could take control of the business by refusing to sign checks, they required him to resign as manager and selected his successor, and they were active in dictating the crops to be planted, some against the will of Escamilla. ____________________________________________________________________________________

FIDUCIARY DUTY AGENTS § 3 7 9 : Dut yofCar ea ndSki l l § 3 8 0 : Dut yofGoodConduc t § 381: Duty To Disclose § 385: Duty to Obey § 387: Duty of loyalty § 388: Secret Profits § 393: Duty of non-competing § 395: Using or disclosing confidential information § 396: Using Confidential Information after Termination Policy: Constant tension of (1) fair competition, the ability of employees to leave and employ their skills elsewhere and (2) protection of the work product, companies are entitled to their trade secrets. 1.) General Automotive v. Singer a. Singer is specialist. He works 5 ½ days a week, render exclusive services, and in return receive a salary plus 3% of profits. On jobs he didn’t feel plaintiff was equipped to handle he would farm off the work to another shop and take some money off the top. Doesn’t tell P, when P finds out he sues to recover damages. b. Court rules that Singer is liable. Although Singer is not engaged in fraud, it doesn’t matter. A breach of fiduciary duty doesn’t have to be fraudulent nor does it have to cause harm to the company. The law protects Singer from his own temptation. c. Importance here is that the remedy is different in a fiduciary duty case. Instead of damages, P is entitled to all the money Singer made. If it was a breach of contract case, P would only be entitled to the damages he could prove he incurred. d. Much harder to prove a breach of contract case than a breach of fiduciary duty case. 2.) Town and Country a. P compiled a list of housewives who didn’t want to do cleaning, and made a cleaning service to clean for them. D worked for P and quit, started his own business and took customers away from P. b. Court holds that even if the actions were not fraudulent, P was still entitled to protect it’s list of clients from outside competition. It is the product of years of efforts to solicit these consumers. This is almost like a trade secret. 7

c. Town and country could have written a non-compete clause limiting the time and geography for exiting employees. A court will enforce an agreement like that if it is limited. d. Interesting point: Here the fiduciary duty outlives the employment. 3.) Law Firms a. Generally speaking, a lawyer who wants to leave a firm can bring their clients with them. b. In light of T&C, the difference is that a law firm, like a doctor, brings up more sensitive issues that aren’t considered in T&C. PARTNERSHIPS § 19: Partnership Books § 20: Duty of partners to render ingormation § 21: Partner accountability as fiduciary § 22: Right to an account § 404: If a partner is presented with a partnership opportunity, he holds it as a trustee for the other partners. Also must refrain fro...

Similar Free PDFs

Outline Agency

- 40 Pages

Agency Partnership - Outline

- 7 Pages

MH Agency Outline 2016

- 17 Pages

Agency

- 20 Pages

Agency definizione

- 2 Pages

Agency Paras

- 20 Pages

Termination of agency pdf

- 15 Pages

Chapter 35 + 36 - agency

- 8 Pages

LAW ON Agency - RFTB

- 9 Pages

Travel-agency-business-plan

- 39 Pages

Agency - Dr Luke Butler

- 24 Pages

LINE Agency Department

- 6 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu