Pdfcoffee. Accounting problems PDF

| Title | Pdfcoffee. Accounting problems |

|---|---|

| Course | Accountancy |

| Institution | University of Southern Mindanao |

| Pages | 16 |

| File Size | 249.9 KB |

| File Type | |

| Total Downloads | 192 |

| Total Views | 709 |

Summary

Problem 1MARVEL Trading Corporation ( MARVEL ) was incorporated 3 years ago as a trading company engaged in the sale and distribution of hardware and electrical supplies.You were given by your client’s controller a copy of the unadjusted trial balance as of December 31, 2019.The Company maintains it...

Description

Auditing Problems by Adrianne Paul I. Fajatin, CPA 2019 Problem 1 MARVEL Trading Corporation ( MARVEL) was incorporated 3 years ago as a trading company engaged in the sale and distribution of hardware and electrical supplies. You were given by your client’s controller a copy of the unadjusted trial balance as of December 31, 2019. The Company maintains its bank account with Secured Bank. Your review of the bank reconciliation statement disclosed the following information: 1. On December 22, 2019, the bank erroneously credited the account of MARVEL for P195,000 representing deposit for the account of another company. 2. Postdated checks totaling P37,900 were included in the deposits in transit. These represent collections of accounts receivable from customers. The checks were actually deposited on January 5, 2020. 3. On December 28, 2019, the Company issued checks to creditors totaling P115,000. These checks were released on January 5, 2020. 4. A check dated December 12, 2019, in payment of accounts payable was recorded as P12,000. Upon examination of the checks returned by the bank, the actual amount was P21,000. 5. A check for P4,750 in payment of a minor repair of office equipment was not recorded on the Company books. 6. Transfer of fund of P59,300 to Secured Bank current account of DBS Securities was not recorded. This pertains to purchase of 5,000 shares of William Lines to be held as trading securities. Based on quoted price as of December 31, 2019, the market value per share is P8.20. 7. Interest earned amounting to P5,720 was not recorded. 8. Deposits in transit and outstanding checks at December 31, 2019, amounted to P89,200 and P132,000, respectively. 9. The cash in bank balance per book on December 31, 2019, is P681,200. The petty cash fund of P35,000 maintained on an imprest basis was counted on January 2, 2020. Unreplenished expenses include petty cash vouchers for various expenses totaling P19,300 and employees’ advances for P5,800 all dated December 2019.

1|Page

Auditing Problems by Adrianne Paul I. Fajatin, CPA 2019 MARVEL purchased several non-trading equity securities during 2019. The company has elected irrevocably to present changes in fair value in other comprehensive income. At December 31, 2019, the company had the investments in equity securities listed below. None was held at the last reporting date. San Miguel “A” Seniority Bank Multivit Total

No. of Shares 2,000 2,000 5,000

Cost P150,000 110,000 54,600 P314,600

Market Value per Share P58.50 49.25 9.10

Your physical count of stock certificates disclosed that stock dividend of the following issues were not yet recorded. Issue Seniority Bank Multivit

No. of Shares 500 200

The unadjusted trial balance of the company at December 31, 2019, included the following accounts:

Accounts receivable Allowance for doubtful accounts Sales

Debit P1,452,700

Credit P 10,200 4,820,000

Your review of the Accounts receivable schedule disclosed that various collections totaling P17,350 were not recorded in the books but already reflected in the subsidiary ledgers. You also noted the following information: 1. A customer’s deposit of P38,000 for goods to be delivered in January 2020 was deducted from accounts receivable. 2. A cash advance to an officer of P75,000 was included as part of accounts receivable. 3. Goods sold on account and delivered on December 21, 2019, amounting to P31,810 were not recorded. 4. Collection of P15,275 on October 31, 2019, from Cathay Trading was credited to the account of Supreme Mercantile. 5. A promissory note was issued by a customer to MARVEL for goods purchased worth P168,000. The said note carries an interest of 12% per annum with a term of 60 days, value dated November 15, 2019. This was reflected as part of accounts receivable. No interest was accrued as of year-end. 6. Bad debts are provided based on 2% outstanding accounts receivable at the end of the year.

2|Page

Auditing Problems by Adrianne Paul I. Fajatin, CPA 2019 A physical count of merchandise on hand was made on December 30 and 31, 2019, which reflected a balance of P3,873,000. Your review of the inventory list disclosed the following: 1. Goods costing P148,000 shipped FOB shipping point on December 30, 2019, by a supplier to MARVEL was received on January 3, 2020. The purchase was recorded on December 30, 2019. 2. Goods costing P195,000, shipped FOB destination by the supplier on December 28, 2019, were recorded and received on January 5, 2020. 3. Goods purchased in cash for P41,700 were returned to the supplier on December 22, 2019. These goods were still included in the inventory schedule and the refund was received and recorded on January 10, 2020. 4. Goods consigned to MARVEL totaling P89,500 were included in the physical count. 5. Included in the physical count were goods sold to a customer on FOB shipping point on December 27, 2019. These goods with a selling price of P52,830 and a cost of P35,600 were already recorded as sales on account but were shipped only on January 5, 2020.

Prepayments consist of: Prepaid advertising Prepaid rent Unused office and store supplies Total

P144,000 165,000 129,000 P438,000

Prepaid advertising consists of payment to an advertising agency for the design of newspaper ad which will run for a period of one year from July 31, 2019. MARVEL renewed its 5-year lease contract on the office building which expired on October 31, 2019. Total advance rental for 3 months was made amounting to P165,000 was booked as prepaid rent. The Company books purchased office supplies as inventory. The expense is normally taken up after the physical count is made at year-end. On July 9, 2019, a total of P38,450 worth of supplies was bought and included in the inventory. As of year-end, unused supplies inventory per physical count amounted to P53,200. No entry to set up the expense was recorded. MARVEL’s property, plant and equipment consist of the following:

Furniture and equipment Delivery equipment Leasehold improvements Total Accumulated depreciation Net book value 3|Page

₱1,045,00 0 1,637,000 363,000 ₱3,045,00 0 -936,500 ₱2,108,50 0

Auditing Problems by Adrianne Paul I. Fajatin, CPA 2019 The building under lease was renovated at a cost of 363,000 which was booked as leasehold improvements on September 30, 2019. These improvements will be amortized over 5 years. No amortization was recorded as at December 31, 2019. On May 31, 2019, the Company bought new computers totaling P325,000. In addition to the cost, it paid additional charges which were taken up as repairs expense. These are delivery charges – P12,500; installation cost – P11,300; and testing cost – P6,520. The estimated useful life of these computers is 4 years. No depreciation was provided on the equipment as of December 31, 2019. MARVEL opened additional stores in nearby localities. To service more deliveries, additional 3 units of delivery equipment were bought on installment basis on December 29, 2019. The installment price was P1,200,000 but the cash price was P1,000,000. The terms are P200,000 down payment and the balance payable in four equal quarterly installments. A non-interest bearing promissory note was issued for the unpaid portion on December 30, 2019. The down payment of P200,000 was recorded as a debit to Delivery equipment and a credit to Cash. Included in the Company’s unadjusted trial balance on December 31, 2019, are Accounts payable and Accrued expenses of P523,100 and P63,100, respectively. Upon verification, the following information was discovered: 1. On December 26, 2019, the Company purchased on account goods worth P215,000, but no entry was made in the books. The goods were already included in the year-end physical count. 2. The following items were erroneously included in accounts payable:

Accrued expenses totaling P37,450 A cash advance from the President of MARVEL amounting to P350,000 to be used as working capital. This will be repaid within 6 months without interest. A debit balance of P87,250 representing advance payment for goods ordered to be shipped by the supplier on January 12, 2020.

3. Your review of subsequent payments from January 2-15, 2020, revealed that no accrual was made on December 31, 2019, for the following:

Light and water for Nov. and Dec. 2019 Telephone bills for Dec. 2019 Representation expenses for Dec. 2019 Minor repair of a delivery car on Dec. 26, 2019 Transportation expenses for 2020 Total

4|Page

₱21,20 0 18,150 11,990 3,180 2,560 ₱57,08 0

Auditing Problems by Adrianne Paul I. Fajatin, CPA 2019 MARVEL was granted a credit limit of up to P5,000,000 by Secured Bank. As of year-end, availments are as follows: Value Date Due Date July 1, 2019 Feb. 1, 2020 Sep. 15, 2019 Mar. 16, 2020 Dec. 5, 2019 Apr. 4, 2020

Principal Interest Rate Maturity Value ₱500,000 13.13% ₱539,193 2,300,000 14.38% 2,467,149 1,800,000 15.50% 1,893,000 ₱4,600,00 0 ₱4,899,342

Interests are paid on scheduled maturity dates. No accrual was made as of year-end. The Company issued P1,200,000 face value of 12% bonds at par on July 1, 2019, maturing on July 1, 2024, and paying interest semi-annually on January 1 and July 1. 1. The cash balance per bank statement on December 31, 2019 is a. P946,120 b. P988,770 c. P984,020 d. P993,020 2. The adjusted Cash in bank balance at December 31, 2019, is a. P708,320 b. P746,220 c. P726,320 d. P702,600 3. The adjusted Petty cash fund balance at December 31, 2019, is a. P15,700 b. P29,200 c. P35,000 d. P 9,900 4. What is the carrying value of the investment in William Lines on December 31, 2019? a. P 41,000 b. P 59,300 c. P156,312 d. Nil 5. What amount of unrealized loss should be shown in the 2019 statement of comprehensive income as component of other comprehensive income? a. P27,155 b. P 8,855 c. P45,555 d. Nil 6. The Accounts receivable balance at December 31, 2019, should be a. P1,300,060 b. P1,247,230 c. P1,262,160 5|Page

Auditing Problems by Adrianne Paul I. Fajatin, CPA 2019 d. P1,209,330 7. What is the year-end adjustment to the Allowance for doubtful accounts? a. P14,745 b. P15,801 c. P35,145 d. P15,043 8. What is the adjusted Inventory on December 31, 2019? a. P3,979,300 b. P3,854,200 c. P3,889,800 d. P4,084,800 9. How much Sales should be reported in the 2019 income statement? a. P4,820,000 b. P4,798,980 c. P4,709,480 d. P4,816,210 10. The total Prepayments at December 31, 2019, should be a. P153,750 b. P252,200 c. P247,200 d. P192,200 11. The total cost of the Company’s Property, plant and equipment at December 31, 2019, is a. P3,868,800 b. P4,075,320 c. P4,238,320 d. P3,875,320 12. What is the net book value of the Company’s Property, plant and equipment at December 31, 2019? a. P2,862,332 b. P2,868,852 c. P3,231,852 d. P2,938,820 13. The adjusted balance of Accounts payable at December 31, 2019, is a. P437,900 b. P543,900 c. P395,900 d. P738,900 14. The adjusted balance of Accrued expenses on December 31, 2019, is a. P157,630 b. P 54,520 c. P155,070 d. P 57,080

6|Page

Auditing Problems by Adrianne Paul I. Fajatin, CPA 2019 15. The Interest payable at December 31, 2019, should be a. P151,778 b. P249,342 c. P321,342 d. P223,778

Problem 2 You have been asked by a client to review the records of IRONMAN Co., a small manufacturer of precision tools and machines. Your client is interested in buying the business, and arrangements have been made for you to review the accounting records. Your examination reveals the following: a. IRONMAN commenced business on April 1, 2019, and has been reporting on a fiscal year ending March 31. The Company has never been audited, but the annual statements prepared by the bookkeeper reflect the following income before closing and before deducting income taxes: Year Ended March 31 2020 2021 2022

Income before Taxes ₱143,200 222,800 207,160

b. A relatively small number of machines have been shipped on consignment. These transactions have been recorded as ordinary sales and billed as such. On March 31 of each year, machines billed and in the hands of consignees amounted to: 2020 2021 2022

₱13,000 None 11,180

Sales price was determined by adding 30% to cost. Assume the consigned machines are sold the following year. c. On March 30, 2021, two machines were shipped to a customer on a COD basis. The sale was not entered until April 5, 2021, when the cash was received for P12,200. The machines were not included in the inventory at March 31, 2021. (Title passed on March 31, 2021)

7|Page

Auditing Problems by Adrianne Paul I. Fajatin, CPA 2019 d. All machines are sold subject to a five-year warranty. It is estimated that the expense ultimately to be incurred in connection with the warranty will amount to ½ of 1% of sales. The Company has charged an expense account for warranty costs incurred. Sales per books and warranty costs were: Warranty Expense for Sales Made in: Year Ended March 31 Sales 2020 2021 2022 Total 2020 ₱1,880,000 ₱1,520 ₱1,520 2021 2,020,000 720 ₱2,620 3340 2022 3,590,000 640 3,240 ₱3,820 7700 e. Bad debts have been recorded on a direct write-off basis. Experience of similar enterprises indicates that losses will approximate ¼ of 1% of sales. Bad debts written off were: Bad Debts Incurred on Sales Made In 2020 202 0 202 1 202 2 f.

2021

2022

₱1,500

Total ₱1,500

1,600

₱1,040

700

3,600

2,640 ₱3,400

7,700

Commissions on sales have been entered when paid. Commissions payable on March 31 of each year were: 2020 ₱2,800 2021 1,600 2022 2,240

g. A review of the corporate minutes reveals the manager is entitled to a bonus of ½ of 1% of the income before deducting income taxes and the bonus. The bonuses have never been recorded or paid.

Based on the preceding information, calculate the following: 1. Correct sales for the year ended March 31, 2021 a. P2,035,200 b. P2,032,200 c. P2,042,200 d. P2,045,200 2. Correct sales for the year ended March 31, 2022 a. P3,569,200 b. P3,566,620 c. P3,578,820 d. P3,590,000 8|Page

Auditing Problems by Adrianne Paul I. Fajatin, CPA 2019

3. Additional warranty expense for the year ended March 31, 2022 a. P10,133 b. P24,834 c. P 6,886 d. P17,833 4. Additional bad debt expense for the year ended March 31, 2021 a. P2,473 b. P1,217 c. P8,917 d. P6,858 5. Allowance for bad debts at March 31, 2022 a. P8,917 b. P7,700 c. P6,858 d. P4,668 6. Additional commission expense for the year ended March 31, 2022 a. P1,600 b. P2,240 c. P4,640 d. P 640 7. Manager’s bonus expense for the year ended March 31, 2022 a. P 902 b. P1,781 c. P2,683 d. P1,149 8. Correct income before income taxes for the year ended March 31, 2020 a. P229,841 b. P228,692 c. P125,785 d. P126,417 9. Correct income before income taxes for the year ended March 31, 2021 a. P228,692 b. P179,488 c. P125,785 d. P126,417 10. Correct income before income taxes for the year ended March 31, 2022 a. P179,488 b. P229,841 c. P180,390 d. P126,417 9|Page

Auditing Problems by Adrianne Paul I. Fajatin, CPA 2019

10 | P a g e

Auditing Problems by Adrianne Paul I. Fajatin, CPA 2019 Problem 3 Presented below are THOR Company’s comparative statements of financial position and income statements: THOR Company COMPARATIVE STATEMENTS OF FINANCIAL POSITION December 31, 2019 and 2018 Assets Current assets: Cash Accounts receivable Inventory Prepaid expenses Total current assets Non-trading equity securities Property, plant and equipment Accumulated depreciation Total noncurrent assets Total assets Liabilities and Shareholders’ Equity Current liabilities: Accounts payable Accrued expenses Dividends payable Total current liabilities Notes payable - due 2020 Total liabilities Shareholders' equity: Ordinary share capital Retained earnings Total shareholders' equity Total liabilities and shareholders’ equity

11 | P a g e

2019

2018

₱119,000 312,000 278,000 35,000 744,000 59,000 536,000 -76,000 519,000 ₱1,263,000

₱98,000 254,000 239,000 21,000 612,000 0 409,000 -53,000 356,000 ₱968,000

₱212,000 98,000 40,000 350,000 125,000 475,000

₱198,000 76,000 0 274,000 0 274,000

600,000 188,000 788,000

550,000 144,000 694,000

₱1,263,000

₱968,000

Auditing Problems by Adrianne Paul I. Fajatin, CPA 2019 THOR Company CONDENSED COMPARATIVE INCOME STATEMENTS December 31, 2019 and 2018

Net sales Cost of goods sold Gross income Expenses Net income

2019 ₱3,561,000 -2,789,000 772,000 -521,000 ₱251,000

2018 ₱3,254,000 -2,568,000 686,000 -486,000 ₱200,000

Additional information for THOR: a. All accounts receivable and accounts payable relate to trade merchandise. b. The proceeds from the notes payable were used to finance plant expansion. c. Ordinary shares were sold to provide additional working capital. Compute for the following: 1. Cash collected from accounts receivable, assuming all sales are on account a. P3,619,000 b. P3,503,000 c. P3,561,000 d. P3,249,000 2. Total purchases, assuming all purchases of inventory are on account a. P2,828,000 b. P2,789,000 c. P2,550,000 d. P2,750,000 3. Cash payments made on accounts payable to suppliers a. P2,630,000 b. P2,842,000 c. P2,828,000 d. P2,814,000 4. Dividends declared a. P 63,000 b. P207,000 c. P107,000 d. Nil 5. Cash payments for dividends a. P211,000 b. P207,000 c. P167,000 d. Nil

12 | P a g e

Auditing Problems by Adrianne Paul I. Fajatin, CPA 2019 6. Cash receipts not provided by operations a. P175,000 b. P177,000 c. P 50,000 d. P125,000 7. Cash payments for assets that were not reflected in operations a. P125,000 b. P186,000 c. P184,000 d. P127,000 8. Net cash provided by operating activities a. P689,000 b. P191,000 c. P222,000 d. P199,000 9. Net cash provided by financing activities a. P175,000 b. P 8,000 c. P125,000 d. P 42,000 10. Cash payments for expenses a. P490,000 b. P513,000 c. P506,000 d. P529,000

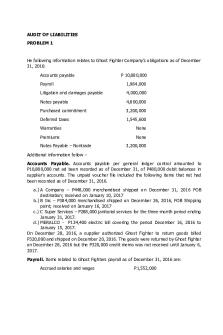

Problem 4 AMERICA Bank loaned P16,500,000 to HAWKEYE Company on January 1, 2019. The initial loan repayment terms include a 10% interest rate plus annual principal payments of P3,300,000 on January 1 each year. HAWKEYE made the required interest payment in 2019 but did not make the P3,300,000 principal payment nor the P1,650,000 interest payment for 2020. AMERICA is preparing its annual financial statements on December 31, 2020. HAWKEYE is having financial difficulty, and AMERICA has concluded that the loan is impaired. Analysis of HAWKEYE’s financial condition on December 31, 2020, indicates the principal payments will be collected, but the collection of interest is unlikely. AMERICA did not accrue the interest on December 31, 2020. The projected cash flows are: December 31, 2021 December 31, 2022 December 31, 2023

13 | P a g e

₱5,250,000 6,000,000 5,250,000 ₱16,500,000

Auditing Problems by Adrianne Paul I. Fajatin, CPA 2019 1. What is the loan impairment loss on December 31, 2020? a. P 2,824,500 b. P 1,650,000 c. P16,500,000 d. Nil 2. What is the interest income to be reported by AMERICA Bank in 2021? a. P1,504,305 b. P 979,305 c. P1,367,550 d. P1,650,000 3. What is the carrying value of the loan receivable on December 31, 2022? a. P 4,772,355 b. P 5,250,000 c. P 9,793,050 d. P13,675,500 4. What is the interest income in 2022? a. P 477,237 b. P1,650,000 c. P1,367,550 d. P 979,305 5. What is the interest income in 2023? a. P 477,645 b. P1,650,000 c. P 979,305 d. P1,367,550

Problem 5 The shareholders’ equity section of BLACKWIDOW Corporation’s balance sheet as of December 31, 2019, is as follows: Ordinary share capital, P5 par value; authorized, 2,000,000 shares; issued, 400,000 shares Share premium Retained earnings

₱2,000,000 850,000 3,000,000 ...

Similar Free PDFs

Pdfcoffee. Accounting problems

- 16 Pages

Pdfcoffee - ACCOUNTING

- 28 Pages

Pdfcoffee - problems on vat

- 29 Pages

Pdfcoffee - Cost accounting

- 3 Pages

Pdfcoffee

- 88 Pages

Accounting equation problems

- 3 Pages

Pdfcoffee

- 3 Pages

Pdfcoffee

- 11 Pages

Pdfcoffee

- 29 Pages

Pdfcoffee

- 4 Pages

Basic Accounting Problems

- 3 Pages

Accounting+Practice+problems

- 29 Pages

Popular Institutions

- Tinajero National High School - Annex

- Politeknik Caltex Riau

- Yokohama City University

- SGT University

- University of Al-Qadisiyah

- Divine Word College of Vigan

- Techniek College Rotterdam

- Universidade de Santiago

- Universiti Teknologi MARA Cawangan Johor Kampus Pasir Gudang

- Poltekkes Kemenkes Yogyakarta

- Baguio City National High School

- Colegio san marcos

- preparatoria uno

- Centro de Bachillerato Tecnológico Industrial y de Servicios No. 107

- Dalian Maritime University

- Quang Trung Secondary School

- Colegio Tecnológico en Informática

- Corporación Regional de Educación Superior

- Grupo CEDVA

- Dar Al Uloom University

- Centro de Estudios Preuniversitarios de la Universidad Nacional de Ingeniería

- 上智大学

- Aakash International School, Nuna Majara

- San Felipe Neri Catholic School

- Kang Chiao International School - New Taipei City

- Misamis Occidental National High School

- Institución Educativa Escuela Normal Juan Ladrilleros

- Kolehiyo ng Pantukan

- Batanes State College

- Instituto Continental

- Sekolah Menengah Kejuruan Kesehatan Kaltara (Tarakan)

- Colegio de La Inmaculada Concepcion - Cebu